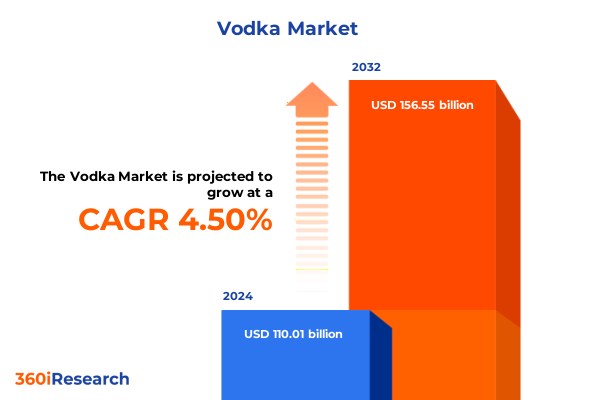

The Vodka Market size was estimated at USD 115.08 billion in 2025 and expected to reach USD 119.74 billion in 2026, at a CAGR of 4.49% to reach USD 156.55 billion by 2032.

Introducing the 2025 Vodka Market Landscape with an In-Depth Overview of Consumer Preferences, Innovation Pathways, and Competitive Forces

The global vodka category is experiencing an unprecedented resurgence, transitioning from its image as the undifferentiated spirit of choice to an arena of artisanal craftsmanship and experimental innovation. Once derided for its neutrality, vodka has emerged as a canvas for distillers seeking to imbue their products with distinctive flavor profiles and regional authenticity. In the United States and across Europe, producers are reimagining traditional formulas by leveraging local ingredients, from estate-grown potatoes to heritage grains, forging vodkas that resonate with a growing consumer appetite for provenance and storytelling. This renaissance underscores a broader industry shift toward spirits that offer both sensory depth and narrative richness.

Moreover, the premiumization of vodka has gained remarkable momentum, driven by the premium+ segment’s robust performance and sustained consumer willingness to trade up. Total spirits volumes grew by 2 percent in 2022, with the premium+ category outpacing the broader market with a 13 percent increase in volume. Within the flavored vodka segment, natural and authentic infusions-ranging from spice and herb extracts to citrus and vegetable notes-have captured substantial market share, supported by an anticipated growth rate of 4.5 percent. These trends reflect an evolving demographic profile, as health-conscious millennials and Gen Z consumers prioritize quality, transparency, and unique sensory experiences when selecting spirits.

In parallel, the proliferation of online retail channels and ready-to-drink formats has fueled vodka’s accessibility and cocktail versatility. Flavored offerings such as limited-edition seasonal infusions have become staples both on e-commerce platforms and in on-premise venues, extending the category’s reach beyond traditional liquor stores. Notably, Constellation Brands’ rollout of the Tea Spritz canned vodka line demonstrates the potential for spirit-based hard seltzers that blend real tea, sparkling water, and natural fruit flavors. This innovation not only taps into the ready-to-drink trend but also responds to consumer demands for convenience and differentiated taste profiles.

Navigating the Transformative Shifts Shaping Premium Vodka Innovations, Sustainability Trends, Digital Distribution Strategies, and Global Market Realignment

The vodka industry’s landscape is being redefined by a convergence of transformative forces, paramount among which is the premiumization wave reshaping consumer expectations. Modern spirit enthusiasts are moving away from commoditized offerings, prioritizing vodkas that showcase superior distillation techniques, organic or gluten-free credentials, and elevated packaging aesthetics. This shift is evident across multiple markets, with brands leveraging innovation to secure differentiation and command higher price points. Furthermore, flavor innovation remains a cornerstone of competitive strategy, as consumers continue to seek adventurous infusions-botanical, fruit-based, and spice-driven-that elevate the classic vodka profile from neutral base to flavor-forward ingredient.

Simultaneously, sustainability and digital transformation have emerged as critical imperatives for brand relevancy and operational resilience. Distillers are investing in zero-waste distillation processes, renewable energy sources, and locally sourced feedstocks to reduce environmental footprints and align with evolving regulatory standards. At the same time, the embrace of digital-first distribution models, data-driven marketing, and AI-enabled production planning is enabling companies to anticipate demand fluctuations, optimize supply chains, and engage consumers through personalized offerings. These dual strategies of green innovation and technological integration are not ancillary but central to the vodka sector’s competitive playbook.

In addition, the acceleration of e-commerce adoption and omnichannel retailing has expanded market access and consumer touchpoints. Vodka brands are increasingly forming direct-to-consumer relationships via subscription services, virtual tastings, and exclusive online releases, bypassing traditional distribution bottlenecks. This democratization of market entry is empowering smaller craft distillers to carve out niches, while larger incumbents pursue scale through partnerships with major e-commerce platforms. The interplay of sustainability, digitalization, and omnichannel expansion is driving a structural realignment in how vodka is produced, marketed, and distributed globally.

Evaluating the Cumulative Impact of 2025 United States Trade Tariffs on Vodka Import Dynamics and Industry Supply Chains

In 2025, United States trade policy has introduced formidable headwinds for imported alcoholic beverages, recalibrating the competitive balance in the vodka category. The administration’s imposition of a 25 percent levy on beer imports, combined with threats of up to 200 percent tariffs on European wines, champagnes, and spirits, has elevated supply chain costs and injected uncertainty across the on- and off-premise channels. Industry stakeholders warn that elevated import duties will translate into higher consumer prices, menu rationalizations in bars and restaurants, and potential market exits for niche labels unable to absorb the added expense. Such policy shifts reflect a broader tit-for-tat escalation, as the European Union simultaneously retaliates against U.S. aluminum and steel tariffs, underscoring how trade disputes can swiftly reverberate through global beverage markets.

Analytical projections illustrate that vodka imports into the United States are expected to decline despite the absence of a direct tariff on vodka itself. Complementary relationships with other spirits categories, particularly tequila and whiskey, mean that reduced trade volumes and elevated price points for these products have indirectly dampened vodka demand. Specifically, projected vodka import losses amount to approximately $140 million, representing a 10.5 percent contraction relative to recent averages. This spillover effect highlights the interconnected nature of distilled spirits consumption and the broader sensitivity of category performance to trade policy interventions.

Moreover, the ripple effects of tariffs have prompted global supply chain reconfiguration and localization strategies. Distillers and distributors are exploring alternative sourcing arrangements, including the establishment of transshipment hubs in non-tariff regions and the development of flexible contracting models with co-packing partners. Some multinational enterprises are even considering localized production facilities within key consumer markets to circumvent import duties altogether. While these measures bolster supply chain resilience, they also impose additional capital expenditures and operational complexity, underscoring the intense strategic trade-offs that companies must navigate amid evolving trade frameworks.

Key Segmentation Insights Revealing How Product Types, Alcohol Strengths, and Distribution Channels Drive Vodka Market Dynamics

An in-depth examination of vodka market performance reveals that product type segmentation is central to understanding category momentum. The distinction between flavored and unflavored vodkas captures the divergence between consumers seeking classic, neutral spirits and those drawn to novel taste experiences. Within the flavored segment, manufacturers are extending beyond simple fruit infusions to develop cream-based, spiced, and multi-component expressions that appeal to cross-category drinkers. This layering of sub-segments underscores how consumer demand for differentiation drives portfolio breadth and innovation pipelines.

Alcohol content emerges as another pivotal segmentation axis, distinguishing high-strength vodkas from standard-strength offerings. High-strength variants have gained traction among enthusiasts and cocktail professionals who prize the heightened aromatic complexity and textural mouthfeel that elevated ethanol levels afford. In contrast, standard-strength vodkas maintain broad appeal across casual and on-premise settings, benefitting from ease of mixing and generally more accessible pricing.

Distribution channel segmentation further illuminates market nuances. Offline channels remain influential due to established relationships with convenience stores, liquor stores, and supermarket chains, which cater to a wide range of consumer occasions. Meanwhile, online channels are rapidly expanding, with direct-to-consumer websites and third-party e-commerce platforms offering targeted digital campaigns and personalized shopping experiences. The online ecosystem’s scalability and data-rich capabilities have encouraged both legacy brands and emerging craft distillers to prioritize digital shelf space and invest in omnichannel fulfillment solutions.

This comprehensive research report categorizes the Vodka market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Alcohol Content

- Distribution Channel

Uncovering Regional Variations Across Americas, Europe Middle East Africa, and Asia Pacific Impacting Global Vodka Consumption Patterns and Growth Drivers

Regional performance in the vodka industry reflects distinct consumer behaviors, regulatory environments, and supply chain configurations. The Americas continue to dominate in terms of both consumption volume and premiumization, driven by strong spirits culture in the United States and Canada, as well as burgeoning middle-class demand in Latin American markets. North American consumers’ willingness to explore flavored and ultra-premium vodkas has reinforced the region’s position as a critical growth engine for leading brands and emerging entrants alike.

In Europe, the Middle East, and Africa, market dynamics are shaped by a complex interplay of tradition and innovation. Established vodka-producing nations such as Poland, Russia, and Sweden maintain cultural cachet for heritage expressions, while younger demographics in Western Europe embrace craft and flavored renditions. The Middle East presents both challenges and opportunities, with regulatory restrictions in certain markets offset by growth prospects in liberalizing economies. Africa’s nascent premium spirits segment offers long-term potential, as distribution networks evolve and consumers trade up amid rising disposable incomes.

The Asia-Pacific region stands out for its rapid adoption of novel spirit formats and digital distribution models. Markets in China, India, and Southeast Asia have witnessed accelerated demand for ready-to-drink and flavored vodkas, propelled by urbanization and the proliferation of online grocery and alcohol platforms. Meanwhile, Australia and Japan exemplify mature consumer bases with sophisticated palates, where craft and regionally inspired vodkas-utilizing indigenous ingredients-are commanding increased attention. These diverse regional trajectories underscore the necessity for tailored strategies that resonate with local preferences and channel structures.

This comprehensive research report examines key regions that drive the evolution of the Vodka market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Vodka Industry Participants and Their Strategic Initiatives Fueling Brand Value, Innovation, and Market Resilience

Leading participants in the vodka sector are leveraging differentiated strategies to enhance brand equity and fortify market positions. Diageo, for instance, continues to pioneer flavor innovation through its Smirnoff and Cîroc portfolios, having introduced variants such as Smirnoff Spicy Tamarind and Cîroc Honey Melon to capture consumer interest in exotic and fruit-driven profiles. These launches underscore how large-scale producers utilize robust R&D pipelines and marketing muscle to sustain consumer engagement in a crowded landscape.

Constellation Brands has demonstrated agility by entering the spirit-based ready-to-drink arena with the Tea Spritz line under its Svedka brand. This product marries real tea extracts with natural fruit flavors and sparkling water, signaling a broader industry pivot toward lighter, convenient, and flavor-focused offerings. By capitalizing on consumer enthusiasm for hard seltzers and RTD cocktails, Constellation is positioning its vodka assets to thrive in on- and off-premise channels alike.

Allied Blenders and Distillers Ltd. exemplifies the integration of backward integration and premiumization by expanding its capacity for extra neutral alcohol, malt production, and packaging operations. The company’s recent foray into premium vodka offerings, including the introduction of Russian Standard Vodka alongside its diversified spirits portfolio, highlights how regional players can leverage scale and local production to compete effectively in both domestic and international markets. This localized approach enhances supply chain efficiency and aligns with consumer demand for authenticity and value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vodka market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bacardi Limited

- Becle SAB de CV

- Beluga Group

- Brown-Forman Corporation

- Campari Group

- Constellation Brands Inc.

- Diageo plc

- E. & J. Gallo Winery

- Gruppo Campari

- Heaven Hill Brands

- LVMH Moët Hennessy Louis Vuitton SE

- Moscow Distillery Cristall

- Pernod Ricard SA

- Phillips Distilling Company

- Piccadily Agro Industries Ltd.

- Proximo Spirits

- Radico Khaitan Limited

- Roust Corporation

- Sazerac Company

- Stock Spirits Group

- Stoli Group

- Suntory Global Spirits Inc.

- Tilaknagar Industries Ltd.

- William Grant & Sons Ltd.

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Vodka Trends, Enhance Competitive Positioning, and Drive Sustainable Growth

Industry leaders should prioritize a dual focus on portfolio differentiation and channel innovation to capture emerging opportunities in the evolving vodka landscape. First, expanding premium and flavored offerings can satisfy the advanced palates of discerning consumers while enabling higher margin realization. Distillers should invest in R&D collaborations, harnessing both traditional craft expertise and cutting-edge flavor extraction technologies to develop standout expressions.

Second, harnessing digital capabilities to enhance consumer engagement and streamline distribution will be critical. Brands must refine their e-commerce presence, leveraging data analytics to tailor promotional campaigns, optimize assortment, and deliver personalized experiences. Partnerships with leading online retailers and direct-to-consumer platforms will amplify reach and unlock new customer segments.

Finally, resilience in supply chain and trade policy navigation will differentiate successful players. Companies should evaluate localized production or co-packing arrangements in strategic markets to mitigate tariff exposure, while pursuing sustainable sourcing and packaging programs to align with regulatory trends and consumer ethics. By embedding flexibility into procurement and distribution models, brands can maintain operational continuity and respond swiftly to geopolitical shifts, ensuring long-term growth and market stability.

Comprehensive Research Methodology Detailing Data Collection, Analytical Techniques, and Validation Processes Underpinning the Vodka Market Study

This study employed a rigorous, multi-stage research design anchored in both secondary and primary data sources. Initially, comprehensive secondary research was conducted, drawing upon trade publications, regulatory filings, industry publications, and reputable news outlets. This foundation informed the identification of key market trends, regulatory developments, and competitive activities.

Subsequently, primary research was undertaken through structured interviews with distillery executives, distributors, and on-premise operators, complemented by surveys of key consumer segments. These qualitative and quantitative insights were triangulated with secondary findings to validate market drivers and elucidate consumer preferences.

Analytical frameworks such as Porter’s Five Forces and SWOT analyses were applied to assess competitive dynamics and strategic positioning. Data accuracy was ensured through iterative validation with industry experts and cross-referencing of multiple sources. The result is a robust, transparent methodology that underpins the insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vodka market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vodka Market, by Product Type

- Vodka Market, by Alcohol Content

- Vodka Market, by Distribution Channel

- Vodka Market, by Region

- Vodka Market, by Group

- Vodka Market, by Country

- United States Vodka Market

- China Vodka Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Concluding Reflections on Vodka Market Evolution, Strategic Imperatives for Stakeholders, and Pathways for Future Innovation

The evolution of the vodka market reflects a dynamic interplay of consumer-centric innovation, shifting trade landscapes, and strategic adaptation by industry incumbents. From the resurgence of craft and flavored expressions to the transformative impact of new tariff regimes, stakeholders are navigating a complex environment that demands agility and foresight.

Successful brands will be those that seamlessly integrate premiumization strategies with digital-first engagement models and resilient supply chains. By aligning product portfolios with evolving taste preferences, embracing omnichannel distribution, and preemptively addressing trade policy risks, companies can secure competitive advantage and drive sustainable growth.

Ultimately, the vodka category’s trajectory will be shaped by the capacity of producers to marry heritage authenticity with modern consumer demands, reinforcing vodka’s status as a versatile and continually reinvigorated spirit.

Secure Your Competitive Edge by Partnering with Ketan Rohom to Access the Definitive 2025 Vodka Market Research Report Today

Elevate your strategic decision-making by gaining direct access to the comprehensive research, granular data, and expert insights contained in the definitive 2025 Vodka Market Research Report. Connect with Ketan Rohom, our Associate Director of Sales & Marketing, to discuss how this report can be tailored to your organization’s needs and empower you to chart a clear course in an increasingly competitive market. Secure exclusive intelligence on consumer behaviors, competitive landscapes, and emerging opportunities to ensure your brand remains at the forefront of innovation. Reach out today to unlock the full potential of your vodka portfolio and drive growth with confidence.

- How big is the Vodka Market?

- What is the Vodka Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?