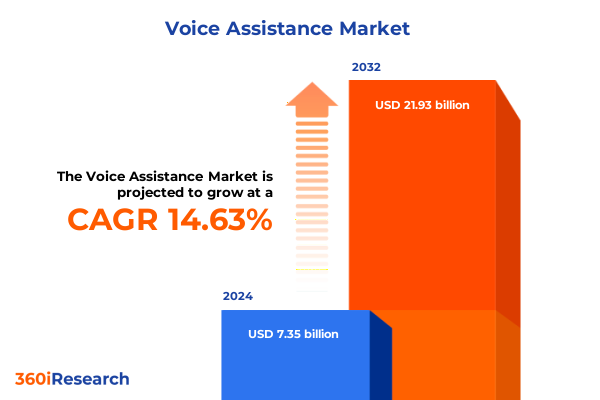

The Voice Assistance Market size was estimated at USD 8.34 billion in 2025 and expected to reach USD 9.46 billion in 2026, at a CAGR of 14.80% to reach USD 21.93 billion by 2032.

Unveiling the Transformative Potential of Voice Assistance Technologies to Shape Tomorrow’s Customer Engagement and Operational Efficiency

Voice assistance technologies have evolved from simple command-and-control interfaces into sophisticated conversational platforms that redefine how individuals and organizations interact with digital ecosystems. The proliferation of smart devices, coupled with leaps in artificial intelligence, has accelerated adoption across consumer, commercial, and industrial environments. As user expectations for natural, seamless experiences grow, enterprises are compelled to rethink engagement strategies, optimize operational workflows, and harness voice-driven insights to maintain relevance and drive differentiation.

This executive summary distills critical trends, transformative shifts, and strategic imperatives unfolding in the voice assistance landscape. It presents an integrated view of regulatory influences such as trade tariffs, comprehensive segmentation perspectives spanning hardware, software, and services, and a multi-regional analysis that captures the distinct growth drivers shaping adoption. Senior decision-makers will benefit from actionable recommendations, competitive benchmarking, and a transparent methodology, all designed to support informed investment decisions and sustainable innovation.

How Pioneering Advances in Artificial Intelligence and Edge Processing Are Redefining the Voice Assistance Landscape for Next-Generation Applications

In recent years, foundational breakthroughs in machine learning and natural language processing have propelled voice assistants from rudimentary virtual agents to context-aware companions capable of nuanced understanding and predictive interactions. These advances, coupled with powerful edge computing architectures, have enabled real-time speech recognition and intent analysis directly on devices, reducing latency and bolstering user privacy. As a result, organizations now deploy voice interfaces that seamlessly integrate with Internet of Things networks, transforming homes, vehicles, and workspaces into intelligent, interactive environments.

Simultaneously, growing regulatory scrutiny around data protection has reshaped platform design, prompting developers to embed robust security and compliance measures from the outset. This shift has fueled demand for on-premises and hybrid deployment models that satisfy stringent enterprise and government requirements. Moreover, the rise of multilingual and emotion-aware conversational engines has expanded the global addressable market, enabling culturally tailored experiences. Together, these converging trends are redefining use cases, from hands-free customer service to voice-enabled asset management, heralding a new era of immersive, voice-first engagement.

Assessing the Strategic Consequences of Escalating United States Tariffs on Component Sourcing and Device Manufacturing for Voice Assistance Solutions

The United States has steadily increased tariffs on imported electronic components and finished devices since 2018 to address trade imbalances and encourage domestic manufacturing. These measures have escalated costs for voice assistant hardware, particularly for AI and voice processing chips sourced from major global foundries. In response, device manufacturers have reconfigured supply chains by diversifying supplier bases, engaging in strategic nearshoring, and negotiating volume agreements that offset incremental duties.

This cumulative tariff environment has also influenced software and service providers to optimize development roadmaps, aligning release cycles with anticipated duty fluctuations to manage total cost of ownership. While higher component costs have marginally raised entry barriers for new market entrants, established enterprises leverage scale and long-term contracts to preserve price competitiveness. Moreover, the tariff-driven imperative to localize production has catalyzed partnerships between chipset designers and regional manufacturing hubs, ultimately fortifying supply chain resilience and fostering innovation in domestically assembled voice-enabled devices.

Decoding Comprehensive Segmentation Dynamics to Illuminate Distinct Component, Technology, Device, Deployment, and Industry Perspectives in Voice Assistance

Voice assistance market dynamics are shaped by a nuanced breakdown across component categories, where hardware-including specialized AI and voice processing chips and advanced microphones for audio capture-coexists with robust software platforms and a spectrum of managed and professional services that support deployment and integration. These interrelated segments collectively drive innovation trajectories and define competitive positioning.

Equally important is the underlying technology segmentation that spans machine learning frameworks that power predictive analytics, natural language processing engines that decode semantic intent, and speech recognition systems that enable accurate transcription and comprehension. Each technological pillar contributes essential capabilities that elevate user experiences and expand the scope of practical applications.

The diversity of device types further underscores the ecosystem’s breadth, encompassing automotive infotainment systems that offer hands-free navigation and vehicle diagnostics, smart speakers that function as home control hubs, intelligent televisions and connected appliances that respond to vocal commands, mobile devices such as smartphones and tablets that deliver on-the-go assistance, and wearable platforms that extend voice interfaces into new form factors.

Deployment mode also plays a critical role, as cloud-based architectures facilitate rapid scalability and continuous updates, while on-premises solutions address the needs of regulated industries that require strict data sovereignty. This dichotomy ensures a comprehensive range of implementation options that align with varying security, performance, and integration requirements.

Finally, the end-user landscape spans established verticals such as automotive, banking, financial services, and insurance, where secure interactions and transaction processing are vital, as well as healthcare and hospitality, where patient engagement and guest experiences are enhanced through voice. Information technology and telecommunications providers leverage voice to streamline support workflows, while retail and e-commerce platforms integrate conversational interfaces for personalized shopping, and smart homes and IoT applications unify home automation under voice-driven control.

This comprehensive research report categorizes the Voice Assistance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Device Type

- Deployment Mode

- End-User Industry

Exploring Regional Adoption Patterns and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets for Voice Assistance

Regional adoption of voice assistance exhibits unique contours across global markets. In the Americas, early leadership stems from mature digital infrastructure and extensive developer ecosystems, where household penetration of voice-enabled speakers and smart displays continues to grow. Enterprise adoption in North America is bolstered by strong cloud-native capabilities and progressive data privacy frameworks, which foster experimentation in voice-driven customer service and operational automation.

Across Europe, Middle East & Africa, regulatory diversity and varying levels of market maturity create a mosaic of opportunity and challenge. Western European markets prioritize data protection and localization, driving interest in on-premises and hybrid deployment models, while emerging economies in the Middle East and Africa are leapfrogging traditional channels by adopting voice interfaces for banking and utility services to overcome infrastructure constraints.

The Asia-Pacific region stands out for its rapid urbanization and consumer appetite for smart devices. Local technology champions and government initiatives promoting domestic manufacturing have accelerated innovation in multilingual voice assistants tailored to regional dialects. Moreover, cross-border collaborations among technology providers and telecommunication operators are extending voice services into retail, healthcare, and public sector applications, leveraging mobile penetration to democratize access.

This comprehensive research report examines key regions that drive the evolution of the Voice Assistance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Competitive Strategies and Innovation Imperatives Shaping Leading Enterprises in the Global Voice Assistance Ecosystem

The competitive landscape of the voice assistance ecosystem is shaped by a blend of global technology titans and specialized innovators. Major platform providers differentiate through comprehensive ecosystems that integrate voice functionality with broader cloud, analytics, and device portfolios, enabling seamless cross-channel experiences. At the same time, software vendors focus on vertical-specific solutions that address compliance, localization, and domain expertise, carving out niches in industries such as healthcare, finance, and automotive.

Chipset manufacturers and hardware designers are intensifying efforts to deliver high-performance, energy-efficient AI inference engines and premium audio capture modules, fostering closer collaboration with device assemblers and audio specialists. Partnerships and strategic alliances have become pivotal, as companies seek to combine strengths-such as edge processing capabilities with advanced conversational AI-to accelerate time-to-market and enhance differentiation.

Meanwhile, dynamic new entrants and open-source communities continue to drive democratization of voice technologies, offering flexible development kits and runtime frameworks that lower barriers for innovation. As these players mature, they present both opportunities for collaborative adoption and challenges for incumbent brands striving to maintain market share in a rapidly evolving competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Voice Assistance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Apple, Inc.

- AT&T Inc. by SBC Communications

- Avaamo, Inc.

- Bose Corporation

- Cisco Systems, Inc.

- Creative Virtual Ltd.

- ELSA Corp.

- Google, LLC by Alphabet Inc.

- Hewlett-Packard Development Company, L.P.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- International Business Machines Corporation

- Lenovo Group Limited,

- Let’s Nurture Infotech Pvt Ltd.

- Meta Platforms, Inc.

- Microsoft Corporation

- NEC Corporation

- Nokia Corporation

- NVIDIA Corporation

- Oracle Corporation

- Orange S.A.

- Qualcomm Incorporated

- Salesforce, Inc.

- Samsung Electronics Co., Ltd.

- SAP SE

- Sonos, Inc.

- Uniphore Technologies Inc.

- Verint Systems, Inc.

- ZAION SAS

- Zoho Corporation

Charting Actionable Strategic Pathways to Enhance Scalability, Resilience, and Customer-Centric Innovation for Voice Assistance Market Leaders

To navigate the complexities of the voice assistance market, industry leaders should prioritize the deployment of edge computing frameworks that reduce latency, enhance privacy, and enable offline functionality. Complementing this, diversifying supply chains and engaging with alternative component sources will mitigate exposure to geopolitical and tariff-driven risks, ensuring continuity in hardware availability.

Concurrently, organizations must embed privacy-by-design principles into platform architecture, establishing transparent data governance and consent mechanisms to build consumer trust. Localizing voice models to accommodate regional dialects and cultural nuances will unlock new demographic segments, while strategic alliances with telecommunications carriers and IoT integrators will broaden distribution channels and streamline go-to-market initiatives.

Investing in sustainable hardware design and circular economy practices will resonate with environmentally conscious customers and align with global regulatory trends. Finally, fostering cross-industry collaborations-between automotive, retail, and healthcare sectors, for instance-will drive the co-creation of specialized voice use cases, accelerating adoption and solidifying voice assistance as a cornerstone of the broader digital transformation agenda.

Detailing a Rigorous Research Methodology Combining Primary Insights, Secondary Intelligence, and Data Triangulation to Ensure Analytical Robustness

This research draws upon a rigorous methodology that integrates primary qualitative and quantitative data collection with extensive secondary intelligence gathering. Primary research included in-depth interviews with C-level executives, product managers, and technical architects from leading technology vendors, service providers, and end-user organizations to capture firsthand perspectives on adoption drivers and challenges.

Secondary research involved a comprehensive review of industry publications, white papers, regulatory filings, and technology roadmaps, providing contextual background and corroborating emerging trends. Data triangulation techniques were employed to validate insights, cross-referencing multiple sources such as vendor press releases, patent filings, and public financial disclosures.

Further analytical robustness was achieved through vendor briefings and advisory board consultations, enabling iterative verification of key findings and ensuring that the final synthesis reflects both market reality and forward-looking projections. This multi-tiered approach guarantees that stakeholders can rely on the report’s conclusions to inform strategic decision-making and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Voice Assistance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Voice Assistance Market, by Component

- Voice Assistance Market, by Technology

- Voice Assistance Market, by Device Type

- Voice Assistance Market, by Deployment Mode

- Voice Assistance Market, by End-User Industry

- Voice Assistance Market, by Region

- Voice Assistance Market, by Group

- Voice Assistance Market, by Country

- United States Voice Assistance Market

- China Voice Assistance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Insights and Strategic Themes to Illuminate the Future Trajectory of Voice Assistance Technologies and Industry Evolution

The convergence of advanced machine learning, natural language processing, and edge computing has irrevocably altered the voice assistance landscape, expanding possibilities for intuitive human-machine interaction. As companies contend with regulatory dynamics, tariff pressures, and an increasingly complex vendor ecosystem, strategic alignment of technology, supply chain, and market approach becomes paramount.

Key insights from this summary underscore the importance of comprehensive segmentation analysis, revealing that differentiated hardware-performance, software sophistication, and deployment flexibility are critical to capturing diverse end-user demands. Regional nuances further highlight the need to tailor strategies to local regulatory and cultural contexts, while competitive analysis points to the value of ecosystem partnerships and domain specialization.

In essence, organizations that embrace a holistic vision-balancing innovation with operational resilience and customer-centric design-will be positioned to lead the next wave of voice-enabled transformation across consumer and enterprise domains.

Empowering Your Strategic Decisions with In-Depth Voice Assistance Market Analysis and Direct Engagement Opportunities with Our Associate Director

Empowering strategic decision-making with a comprehensive and actionable market research offering, readers are encouraged to secure the full report through direct consultation. To access granular insights, detailed vendor evaluations, and tailored strategic guidance, we invite you to reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise and deep understanding of voice assistance technologies will ensure that you obtain the information most relevant to your organization’s unique objectives and challenges.

By connecting with Ketan Rohom, you will gain personalized support, priority access to the latest data updates, and bespoke advisory that aligns with your strategic roadmap. This direct engagement pathway facilitates a seamless experience, enabling you to derive maximum value from the methodology, findings, and recommendations outlined in this summary for immediate and sustained competitive advantage.

- How big is the Voice Assistance Market?

- What is the Voice Assistance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?