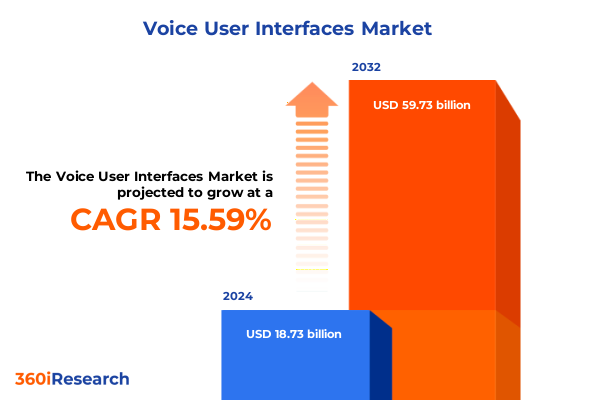

The Voice User Interfaces Market size was estimated at USD 21.83 billion in 2025 and expected to reach USD 25.32 billion in 2026, at a CAGR of 15.46% to reach USD 59.73 billion by 2032.

Exploring the Transformative Emergence of Voice User Interfaces as a Fundamental Bridge Enabling Seamless Human-Computer Communication in the Digital Era

Voice user interfaces have rapidly evolved from niche curiosities into critical components of modern digital interaction. Enabled by breakthroughs in machine learning and natural language processing, VUIs now facilitate hands-free control, conversational commerce, and immersive user experiences that were once confined to the realm of science fiction. As consumers grow accustomed to issuing voice commands to manage tasks, control devices, and access information, businesses are seizing the opportunity to redefine touchpoints and streamline processes.

The introduction of cross-device conversational platforms has accelerated this shift, enabling consistent experiences across smartphones, smart speakers, and automotive systems. Meanwhile, enterprises are integrating voice interfaces into customer service workflows, creating hybrid human–machine support channels that reduce service resolution times and enhance user satisfaction. As voice-enabled solutions become increasingly embedded in everyday life, organizations must grasp the foundational principles of VUI design, understand the underlying technology stack, and anticipate evolving user expectations. This executive summary provides an essential orientation for stakeholders seeking to leverage voice modalities as a core element of digital strategy and competitive differentiation.

Unveiling the Paradigm Shifts in Conversational AI and Multimodal Voice Interfaces Driving Next-Generation User Experiences

Over the past five years, voice interfaces have transcended simple command recognition to embrace rich conversational paradigms and multimodal interactions. AI-driven language models now power more nuanced understanding of intent, context, and sentiment, allowing virtual assistants to offer tailored recommendations and proactive engagement. Concurrently, the proliferation of edge computing has enabled real-time processing of voice data on-device, reducing latency and preserving user privacy by limiting cloud dependencies.

As augmented audio interfaces converge with visual and haptic feedback, the landscape has shifted from isolated voice commands to orchestrated, multisensory journeys. Enterprises are harnessing multimodal capabilities to enhance accessibility and inclusivity, enabling users with diverse abilities to interact seamlessly with digital services. Furthermore, the integration of voice biometrics and emotion detection augments security and personalization, paving the way for trust-based conversational commerce. These transformative shifts are redefining user expectations, compelling organizations to adopt holistic design frameworks that orchestrate voice across the full spectrum of customer experiences.

Examining the Cumulative Effects of 2025 United States Tariff Measures on Costs and Supply Chain Strategies for Voice Technology Solutions

In 2025, a new wave of tariffs imposed on critical technology components and cross-border service provisions has reshaped the cost structure and deployment strategies for voice-enabled products and platforms. Hardware manufacturers face heightened duties on semiconductor modules used in smart speakers and embedded automotive systems, prompting a reevaluation of global sourcing strategies. Cloud service providers, which host conversational AI engines and support real-time analytics, are grappling with increased import levies on data center equipment, leading to incremental operational expenses that cascade throughout the value chain.

These tariff-induced pressures have encouraged vendors to localize manufacturing closer to end markets to mitigate duty impacts, stimulating regional partnerships and joint ventures. Moreover, software providers are accelerating the adoption of open-source frameworks and modular architectures to reduce reliance on imported proprietary toolkits. This recalibration has, in turn, influenced pricing models, contract structures, and service-level commitments. As a result, enterprises exploring voice adoption must incorporate tariff considerations into total cost of ownership analyses and seek collaborative approaches with suppliers to sustain innovation while preserving budgetary targets.

Diving Deep into Multi-Dimensional Segmentation Frameworks Revealing Nuanced Demand Patterns Across Products, Interactions, Deployments, Applications, and Verticals

The voice user interface market can be dissected through multiple lenses to reveal differentiated opportunity spaces. When viewed through the prism of product offerings, service components such as consulting, implementation and integration, alongside ongoing support and maintenance, integrate closely with software elements like APIs, SDKs, natural language processing platforms, text-to-speech engines and voice recognition engines to deliver end-to-end solutions. Taking interaction modality into account highlights distinct requirements for command-based paradigms versus more fluid conversational exchanges and advanced multimodal interfaces. Deployment preferences add another dimension, with organizations balancing cloud-based delivery for rapid scalability against on-premise installations for data sovereignty and reduced latency.

Application scenarios further diversify the landscape: interactive voice response systems maintain roles in legacy contact centers, while smart speakers and voice-controlled devices redefine home automation. Increasingly, smartphones and tablets incorporate robust VUI layers for hands-free navigation and accessibility. Finally, industry vertical analysis demonstrates differentiated adoption curves across automotive and transportation, where in-vehicle assistants enhance driver safety; banking, financial services and insurance sectors leverage voice for secure transactions; consumer electronics prioritize seamless user experiences; education drives interactive learning; healthcare and life sciences optimize patient engagement; retail and e-commerce enable voice shopping; and travel and hospitality curate personalized itineraries. This multifaceted segmentation framework illuminates not only current deployment patterns but also untapped niches awaiting tailored innovation.

This comprehensive research report categorizes the Voice User Interfaces market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Interaction Type

- Deployment Mode

- Application

- Industry Vertical

Analytical Overview of Regional Adoption Trajectories and Regulatory Dynamics Shaping Voice Interface Integration Across Global Markets

Geographically, voices interfaces are maturing at varied rates, each region reflecting unique adoption drivers and regulatory landscapes. In the Americas, widespread consumer familiarity with virtual assistants and robust cloud infrastructure underpin steady integration into smart home ecosystems, contact centers, and in-car infotainment. Leading technology hubs in North America continue to cultivate AI talent, fostering rapid innovation cycles and pilot deployments across industries.

Within Europe, the Middle East and Africa, data privacy regulations and language diversity shape the pace and nature of VUI rollouts. Companies navigate stringent compliance regimes to tailor voice solutions that respect local dialects and cultural nuances. Collaborative consortiums between public sector bodies and private enterprises are accelerating voice-enabled e-government and multilingual assistance services. Across Asia-Pacific, rapid smartphone penetration and digitally native consumer segments drive experimentation with voice in retail, hospitality and education sectors. Regional manufacturing ecosystems facilitate cost-effective hardware production, bolstered by supportive government initiatives targeting AI and IoT integration. Each region’s distinct maturity profile offers a mosaic of strategic entry points and partnership models for vendors seeking global scale with localized relevance.

This comprehensive research report examines key regions that drive the evolution of the Voice User Interfaces market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Strategic Movements and Collaborative Partnerships Driving Competitive Differentiation Among Voice Technology Providers

Leading organizations are charting the course for voice interface innovation through strategic investments, acquisitions and partnerships. Major cloud platforms continue to enhance their conversational AI portfolios, integrating advanced contextual understanding and developer tools to lower entry barriers. Technology giants collaborate with telecom operators and automotive OEMs to embed voice capabilities at the network edge, ensuring deterministic performance for latency-sensitive applications.

Meanwhile, specialized vendors focusing on industry-specific solutions are differentiating through deep domain expertise. Companies delivering voice biometrics and security layers partner with financial institutions to enable secure voice transactions. Providers of multilingual NLP engines are teaming up with travel and hospitality brands to support real-time translation and concierge services. Cross-sector alliances between consumer electronics manufacturers and software firms are fostering novel form factors, blending voice with wearables and smart appliances. Startups are securing venture capital to pioneer emotion-aware voice assistants, pushing the frontier of empathy-driven interactions. Collectively, these movements reflect a dynamic ecosystem where ecosystem orchestration and interoperable architectures define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Voice User Interfaces market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alan AI Inc.

- Amazon Web Services, Inc.

- Apple Inc.

- Baidu, Inc.

- Brainasoft

- Charles River Analytics, Inc.

- Fluent.ai Inc.

- Google LLC by Alphabet Inc.

- Intelligo Technology Inc.

- International Business Machines Corporation

- Kardome Technology LTD.

- Kasisto, Inc.

- Meta Platform, Inc.

- Microsoft Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co.Ltd.

- Sensory Inc.

- Sonos Inc.

- SoundHound AI Inc.

- Speechly by Roblox Corporation

- ZAION SAS

Actionable Strategic Recommendations for Orchestrating Robust, Secure, and Seamless Voice Interface Deployments Across Enterprise Ecosystems

Industry leaders must adopt an integrated strategy that aligns technology roadmaps, organizational workflows and user-centric design to harness the full potential of voice interfaces. Establishing robust governance frameworks for voice data management and privacy compliance will build stakeholder trust and reduce regulatory friction. Prioritizing open standards and interoperability will foster ecosystem connectivity, enabling seamless handoffs between voice, visual and tactile modalities.

To drive engagement, organizations should invest in continuous optimization of conversational flows, leveraging user analytics to refine intents, entities and response variations. Embedding voice capabilities into existing digital platforms such as customer portals and enterprise resource planning systems will amplify adoption and streamline training overhead. Strengthening partnerships with hardware manufacturers and telecom carriers will ensure end-to-end performance guarantees, particularly for embedded and edge deployments. Moreover, cultivating interdisciplinary teams of linguists, UX designers and AI engineers will accelerate experimentation with emerging capabilities like emotion detection and domain-specific knowledge graphs. By executing these recommendations, leaders can advance from pilot phases to scalable voice solutions that deliver measurable operational efficiencies and enhanced customer experiences.

Detailed Explanation of the Hybrid Research Approach Integrating Secondary Analytics, Primary Stakeholder Interviews, and Expert Validation Procedures

This research synthesis is grounded in a rigorous, hybrid methodology that integrates secondary data analysis, primary research interviews, and expert validation. Initially, a comprehensive review of academic publications, patent filings and regulatory filings established the technological foundation and intellectual property trends. Complementing this, in-depth interviews were conducted with C-level executives, product managers and technical architects who are architects and adopters of voice solutions, yielding firsthand perspectives on pain points, success factors and deployment roadmaps.

Data triangulation was employed to reconcile divergent viewpoints and ensure consistency across sources. Quantitative insights were enriched through case study analysis of representative deployments in key verticals. A multi-stage validation process, involving subject matter experts in AI ethics and human-computer interaction, underpins the credibility of conclusions. Finally, iterative peer review within the research team ensured methodological rigor, transparency and reproducibility. This approach delivers a balanced, actionable understanding of the voice interface landscape, attuned to both emerging innovations and practical adoption challenges.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Voice User Interfaces market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Voice User Interfaces Market, by Product

- Voice User Interfaces Market, by Interaction Type

- Voice User Interfaces Market, by Deployment Mode

- Voice User Interfaces Market, by Application

- Voice User Interfaces Market, by Industry Vertical

- Voice User Interfaces Market, by Region

- Voice User Interfaces Market, by Group

- Voice User Interfaces Market, by Country

- United States Voice User Interfaces Market

- China Voice User Interfaces Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Key Insights Highlighting the Strategic Imperatives and Transformative Potential of Voice Interfaces in Modern Digital Ecosystems

Voice user interfaces are catalyzing a paradigm shift in how individuals and organizations interact with technology, redefining expectations for immediacy, personalization and accessibility. The convergence of advanced natural language understanding, robust deployment frameworks and cross-disciplinary innovation has propelled VUI from experimental pilots to mission-critical applications. As enterprises navigate evolving tariff landscapes, regulatory frameworks and regional nuances, the imperative to adopt voice-enabled strategies grows ever more pressing.

This executive summary has outlined the core transformative forces, segmentation insights, regional dynamics, competitive movements, and strategic imperatives that shape the VUI domain. By harnessing these insights, decision-makers can chart informed roadmaps, prioritize high-impact use cases and forge partnerships that yield sustainable, user-centric solutions. Ultimately, voice interfaces represent not just a new interaction channel, but a foundational shift in the digital experience landscape, one that promises to unlock unprecedented efficiencies and engagement levels.

Secure Exclusive Access to the Full-Scale Voice User Interface Market Report by Connecting Directly with Our Sales and Marketing Leadership

To delve deeper into this comprehensive examination of voice user interface advancements and how they can transform customer engagement and operational efficiencies, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By contacting him, you gain direct access to exclusive insights, detailed use cases, and strategic guidance tailored to your organization’s needs. Secure your copy of the full market research report today and empower your decision-making with the latest intelligence on voice technology innovations and competitive benchmarks. Engage with Ketan Rohom now to unlock the full potential of vocal engagement strategies and drive transformative growth.

- How big is the Voice User Interfaces Market?

- What is the Voice User Interfaces Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?