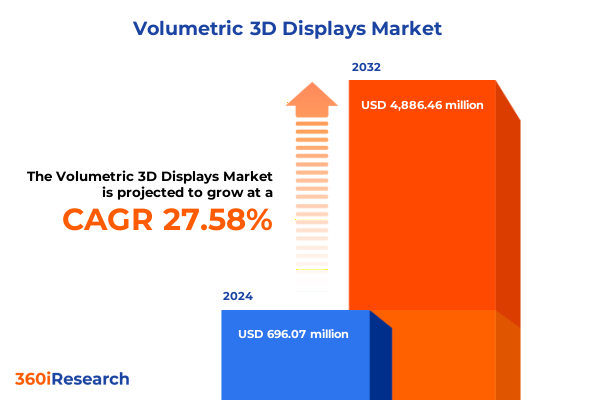

The Volumetric 3D Displays Market size was estimated at USD 890.39 million in 2025 and expected to reach USD 1,107.19 million in 2026, at a CAGR of 27.53% to reach USD 4,886.46 million by 2032.

Exploring How Volumetric 3D Display Technology Is Redefining Immersive Visualization and Driving Innovation Across Industries Globally

Volumetric 3D display technology represents a groundbreaking evolution in the way visual information is rendered, viewed, and interacted with. Unlike conventional flat-panel or stereoscopic displays, volumetric solutions generate images in three-dimensional space, enabling observers to perceive depth without the need for specialized eyewear. This innovation leverages advanced optics, precise projection systems, and sophisticated rendering engines to create realistic visualizations that hover in midair or occupy defined volumes. As a result, industries spanning from entertainment and gaming to healthcare and aerospace are reimagining user experiences with heightened realism and intuitive interaction.

In recent years, surging interest in immersive visualization has catalyzed substantial investment in volumetric 3D displays. Stakeholders recognize that the ability to deliver true three-dimensional content unlocks new applications such as surgical planning with life-like anatomic models, digital marketing experiences that engage audiences in physical spaces, and training simulations where spatial orientation is critical. Concurrent advancements in computing power and content creation pipelines have alleviated previous barriers around rendering complexity, paving the way for more widespread adoption.

Moreover, the convergence of artificial intelligence with volumetric imaging has introduced dynamic real-time rendering capabilities, allowing systems to adapt visuals based on user perspective or environmental conditions. Consequently, organizations across multiple sectors are actively evaluating how to integrate volumetric displays into existing workflows, signage networks, and simulation platforms. As this report unfolds, readers will gain an in-depth understanding of transformative shifts, tariff influences, segmentation insights, and targeted recommendations to navigate the rapidly evolving volumetric 3D display landscape.

Unveiling Pivotal Technological Developments and Shifting Market Dynamics That Are Catalyzing the Evolution of Volumetric 3D Displays

Over the past few years, volumetric 3D displays have undergone remarkable transformations driven by parallel advancements in hardware miniaturization and rendering algorithms. High-precision sensors now capture user movements and environmental cues with negligible latency, enabling fluid perspective changes and interactive holographic experiences. Concurrently, rendering engines have evolved to support complex light field and voxel-based imaging formats, producing crisp visuals that maintain fidelity from multiple vantage points.

Furthermore, the integration of hybrid computational architectures-blending edge processing with cloud-native rendering-has enabled more scalable deployment models. By offloading compute-intensive tasks to edge nodes, vendors can deliver real-time volumetric content without compromising on performance or introducing network bottlenecks. This shift towards distributed computing has also supported the emergence of on-premise and multi-cloud deployment strategies, providing enterprises with flexible options that align with data sovereignty and latency requirements.

In addition, the proliferation of modular optics and compact projection systems has lowered the entry threshold for volumetric solutions. Manufacturers are engineering interchangeable components, thereby accelerating time-to-market and facilitating easier upgrades. As these trends converge, the landscape of volumetric visualization is poised to reshape user expectations around depth perception and interactivity, signaling a new era of immersive display experiences that blend seamlessly into both consumer and industrial environments.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Supply Chains Cost Structures and Market Adoption of Volumetric 3D Display Solutions

In 2025, the United States implemented targeted tariffs on key display components, including certain optoelectronic sensors, projection module parts, and specialized semiconductors essential to volumetric imaging systems. These measures, introduced under specific trade policy provisions, were aimed at recalibrating domestic manufacturing incentives and addressing perceived trade imbalances. However, they have also introduced cost pressures and logistical complexities for global supply chains supporting high-precision display technologies.

Suppliers reliant on international fabrication facilities have faced increased lead times as customs inspections and tariff classifications extend transit durations. These delays, in turn, have compelled original equipment manufacturers to reexamine inventory strategies and supplier diversification plans. Some vendors have mitigated exposure by sourcing components from tariff-exempt regions or by redesigning modules to utilize alternative materials that fall outside the imposed tariff categories.

As a result, a number of system integrators have accelerated partnerships with domestic optics and sensor producers, fostering closer collaboration on co-development and localized assembly. While these initiatives help stabilize production schedules, they also require significant capital investment and recalibration of product roadmaps. Looking ahead, industry players must balance cost optimization against the imperative to maintain innovation velocity and uphold rigorous performance standards in volumetric 3D display deployments.

Deriving Strategic Insights from Multidimensional Segmentation Spanning Applications Technologies Components and Deployment Models in Volumetric 3D Displays

Segmenting the volumetric 3D display landscape across multiple dimensions reveals nuanced opportunities and challenges. From an application perspective, immersive displays are transforming digital signage by delivering holographic advertisements that capture consumer attention, while experiential marketing initiatives deploy floating visuals at events to create memorable brand experiences. In aerospace and defense, volumetric systems enhance pilot and operator training through high-fidelity simulations and advanced mission visualization modules. Automotive integration focuses on next-generation heads-up displays and navigation overlays that project critical information directly into the driver’s line of sight.

Educational institutions leverage volumetric platforms to deliver immersive training simulations that reinforce spatial learning, and virtual classrooms where 3D content deepens comprehension in STEM subjects. In entertainment venues such as cinemas, museums, and theme parks, lifelike holographic exhibits captivate audiences, while gaming applications span from console-driven volumetric contests to PC-based esports and VR hybrids. Healthcare providers deploy these displays for medical imaging review, surgical visualization assistance, and hands-on procedural training. Meanwhile, industrial users apply holographic guides for maintenance tasks and virtual prototyping, and retailers introduce in-store volumetric showcases and interactive virtual try-on experiences that bridge digital and physical shopping environments.

On the technology front, the market encompasses volumetric solutions based on fog displays-both high-density and low-density fog layers-as well as holographic systems utilizing reflective or transmissive optical paths. Light field implementations vary between coherent laser arrays and incoherent LED matrices, while swept volume designs include laser-driven and LED-driven variants that rotate or oscillate planar images to form volumetric illusions. Volumetric video further divides into layer-based sequences and true voxel-mapped capture methods.

Component analysis highlights hardware segments such as display units, precision optics, projection modules, and environmental sensors, complemented by software layers focusing on content management systems and real-time rendering engines. Deployment considerations range from fully cloud-native services to hybrid configurations with edge integration and multi-cloud orchestration, as well as traditional on-premise installations where data control and low latency remain paramount.

This comprehensive research report categorizes the Volumetric 3D Displays market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Technology

- Component

- Deployment

Uncovering Regional Variances in Adoption Challenges and Growth Drivers for Volumetric 3D Display Technology Across the Americas EMEA and Asia Pacific

Regional dynamics significantly influence how volumetric 3D displays are adopted and monetized. In the Americas, North American organizations benefit from robust technology ecosystems and well-established enterprise IT infrastructure. Private sector innovators and government research programs both drive demand for immersive visualization tools, while a favorable venture capital environment accelerates commercialization. However, regulatory frameworks around data residency and import control influence deployment models, prompting many enterprises to favor hybrid or on-premise solutions that align with compliance requirements.

Within Europe, Middle East, and Africa, a diverse mix of mature markets and emerging economies creates differentiated adoption patterns. Western European nations are advancing pilot projects in smart cities and cultural institutions, deploying volumetric exhibitions as part of digital transformation roadmaps. Regulatory considerations around environmental safety of projection materials and energy consumption have prompted manufacturers to innovate with low-power fog and light field configurations. In contrast, select Middle Eastern hubs are investing heavily in tourism infrastructure, integrating volumetric installations into theme parks and public spaces, while African markets are at an earlier stage of adoption but show growing interest in educational and industrial use cases.

Asia-Pacific emerges as a manufacturing powerhouse and a rapidly growing consumer market. Leading electronics firms in East Asia have developed proprietary volumetric display modules, while research institutes collaborate with global system integrators on next-generation holographic imaging. Countries such as China, Japan, and South Korea pilot interactive retail showcases and advanced gaming arcades, and regulatory incentives for domestic manufacturing support localized supply chain development. As network infrastructure and 5G coverage expand, the region’s appetite for real-time, cloud-augmented volumetric content is expected to intensify.

This comprehensive research report examines key regions that drive the evolution of the Volumetric 3D Displays market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Their Strategies Innovations and Strategic Collaborations Shaping the Competitive Volumetric 3D Display Market Landscape

A handful of pioneering companies are defining the competitive contours of the volumetric 3D display market through differentiated product roadmaps and strategic alliances. Light Field Lab has introduced scalable holographic modules tailored for both enterprise signage and immersive environments, partnering with major technology integrators to co-develop turnkey solutions. Looking Glass Factory continues to refine its flagship volumetric workstations, collaborating with creative agencies to extend content creation pipelines into new verticals such as product design and interactive art installations.

RealView Imaging focuses on medical applications, offering holographic displays that enable surgeons to visualize patient-specific anatomy in three dimensions. By forming alliances with leading hospital systems and academic research centers, the company accelerates clinical validation and regulatory approval processes. Hypervsn, specializing in high-density fog and LED oscillation systems, has secured landmark deals with retail chains and event organizers, demonstrating the versatility of swept volume approaches in high-traffic environments.

Software providers like Eon Reality are integrating volumetric content management platforms with advanced rendering engines, ensuring seamless deployment across hybrid cloud environments and on-premise installations. Additionally, sensor and optics specialists are forging co-development agreements to optimize hardware-software interoperability and streamline assembly processes. These collaborative efforts underscore a broader industry trend toward ecosystem partnerships that combine hardware innovation, software sophistication, and content creation expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Volumetric 3D Displays market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alioscopy

- CREAL SA

- Deepsky Corporation

- Holografika Kft

- Holoxica Limited

- Jiangmen Seekway Technology Ltd.

- Leia Inc

- LightSpace Technologies Inc

- Looking Glass Factory Inc

- Magic Leap Inc.

- Microsoft Corporation

- Panasonic Holdings Corporation

- RealView Imaging Ltd.

- SeeReal Technologies S.A.

- Sony Group Corporation

- The Coretec Group Inc

- VIRTUAL ON LTD

- VividQ Ltd

- Volucap GmbH

- Voxon Photonics

- WayRay AG

- Zebra Imaging

Outlining Actionable Strategies for Industry Leaders to Accelerate Adoption Leverage Emerging Technologies and Navigate Regulatory Tariff Impacts Effectively

To capitalize on emerging opportunities in volumetric 3D displays, industry leaders should prioritize investment in modular hardware architectures that facilitate rapid upgrades and customization. By adopting open standards and ensuring interoperability across sensor arrays and projection modules, organizations can reduce integration complexity and accelerate deployment timelines. Furthermore, fostering partnerships with content studios and software developers will expand the ecosystem of compatible applications, enriching the value proposition for end users.

Additionally, executives must address cost variabilities introduced by tariff policies and supply chain disruptions. Engaging with alternative suppliers, co-investing in localized manufacturing capabilities, and redesigning display modules for component flexibility can mitigate financial risks and stabilize production flow. Equally important is the development of training programs that equip engineering and operations teams with the skills needed to deploy volumetric installations safely and efficiently, particularly in regulated environments such as healthcare and aerospace.

Finally, stakeholders should engage proactively with standards bodies and regulatory agencies to shape guidelines around volumetric emissions, data privacy in interactive displays, and cross-border content distribution. By contributing to the formation of industry benchmarks, organizations can influence market norms and ensure that emerging technologies align with compliance imperatives. Taken together, these actionable strategies will enable companies to navigate complexity, drive innovation, and capture the full potential of volumetric 3D display technology.

Detailing Rigorous Research Methodology Including Primary and Secondary Approaches Expert Interviews and Data Validation Techniques Ensuring Robust Analysis

This analysis is grounded in a rigorous, multi-stage research approach that blends qualitative and quantitative methodologies. Primary research involved in-depth interviews with senior executives, product managers, and academic researchers who specialize in volumetric imaging, optics, and interactive display systems. These conversations provided firsthand perspectives on technological pain points, adoption barriers, and strategic imperatives.

Complementing these insights, secondary research encompassed a comprehensive review of patent filings, technical whitepapers, trade association publications, and developer forums. Publicly available reports from custom hardware vendors and cloud service providers were triangulated with import-export data to track tariff classifications and supply chain trends. Wherever possible, company press releases and financial disclosures were analyzed to validate partnership announcements, product launches, and R&D investments.

Data validation techniques included cross-referencing supplier directories, geospatial mapping of manufacturing clusters, and benchmarking performance claims against independent test labs. Segmentation schemas were refined through iterative feedback loops with industry stakeholders, ensuring that application categories, technology classifications, and deployment models accurately reflect market realities. This robust methodology underpins the strategic insights and recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Volumetric 3D Displays market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Volumetric 3D Displays Market, by Application

- Volumetric 3D Displays Market, by Technology

- Volumetric 3D Displays Market, by Component

- Volumetric 3D Displays Market, by Deployment

- Volumetric 3D Displays Market, by Region

- Volumetric 3D Displays Market, by Group

- Volumetric 3D Displays Market, by Country

- United States Volumetric 3D Displays Market

- China Volumetric 3D Displays Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

Summarizing Critical Findings Underscoring Strategic Imperatives and Envisioning Emerging Trends for the Next Phase of Volumetric 3D Display Adoption

Drawing together the critical findings, it is clear that volumetric 3D display technology has reached an inflection point, driven by converging advances in sensor fidelity, rendering engines, and modular hardware design. The 2025 tariff landscape has introduced cost and sourcing complexities, yet also accelerated localized manufacturing efforts and supplier diversification. Through nuanced segmentation, stakeholders can pinpoint high-impact applications-ranging from holographic advertising to surgical visualization-and tailor value propositions to specific industry needs.

Regional insights reveal that North America benefits from a mature innovation ecosystem, while Europe, Middle East, and Africa exhibit a patchwork of pilot deployments and regulatory considerations. Asia-Pacific stands out as both a consumer and manufacturing hub, championing volumetric showcases in retail and entertainment. Leading companies are forging ecosystem partnerships to integrate hardware, software, and content expertise, laying the groundwork for scalable volumetric experiences.

Looking ahead, organizations that embrace open standards, invest in content creation partnerships, and engage proactively with regulatory bodies will be best positioned to sustain competitive advantage. By leveraging the strategic recommendations outlined in this executive summary, decision makers can navigate the evolving landscape with confidence and unlock the transformative potential of volumetric 3D displays.

Driving Your Strategic Decisions with In-Depth Volumetric 3D Display Insights Contact Ketan Rohom to Secure Your Comprehensive Market Research Report Today

To explore the strategic implications of volumetric 3D display technology and secure a comprehensive research dossier, reach out today to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in bridging market insights with actionable strategies ensures that your organization will gain unparalleled clarity on developing trends, competitive dynamics, and regional nuances.

Partnering with Ketan Rohom grants you access to in-depth analysis across technological innovations, segmentation breakdowns, tariff impact assessments, and company profiles. Whether you aim to refine product roadmaps, evaluate strategic partnerships, or align investment priorities, his tailored support will accelerate decision making and drive successful implementation of volumetric 3D display initiatives.

- How big is the Volumetric 3D Displays Market?

- What is the Volumetric 3D Displays Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?