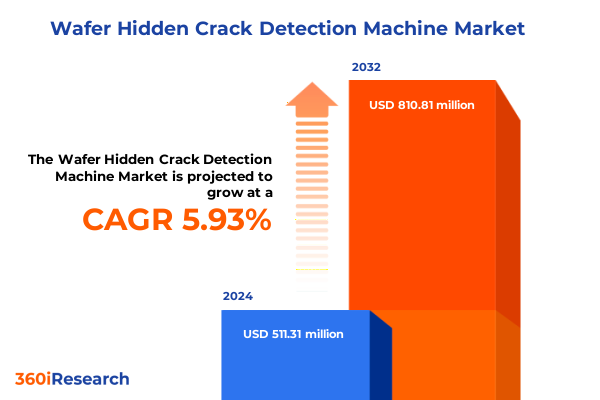

The Wafer Hidden Crack Detection Machine Market size was estimated at USD 543.23 million in 2025 and expected to reach USD 578.15 million in 2026, at a CAGR of 5.88% to reach USD 810.81 million by 2032.

Defining the Critical Role of Hidden Crack Detection in Wafers and Its Impact on Enhancing Semiconductor Manufacturing Yield, Reliability, and Quality Assurance

Hidden cracks within semiconductor wafers pose a silent but significant threat to chip performance, reliability, and overall yield. Even the most advanced fabrication facilities can suffer yield losses if micro-cracks remain undetected until final stages of production. Understanding the fundamental role of crack detection technologies is therefore critical for semiconductor manufacturers seeking to maintain rigorous quality standards while pushing the boundaries of device miniaturization and performance.

Over time, crack formation has become more challenging to detect as wafer geometries shrink and materials diversify. The transition to compound semiconductor wafers like gallium arsenide and silicon carbide, alongside emerging specialty substrates, introduces new complexities in crack initiation and propagation. Consequently, manufacturers require inspection solutions that not only identify surface defects but also reveal hidden subsurface fissures that traditional optical methods may overlook.

This report sets the stage by exploring the evolution of hidden crack detection systems-from fixed point measurement tools to high-throughput scanning platforms. By integrating advanced sensors, signal processors, and display units, modern systems deliver rapid feedback and actionable insights during wafer processing and in-line monitoring. As we delve deeper, these foundational concepts will frame the transformative advances and strategic imperatives guiding the semiconductor industry’s approach to wafer integrity assurance.

Emerging Technologies and Automation Driving Transformative Shifts in Wafer Hidden Crack Detection and Inspection Processes Across the Industry

The landscape of wafer hidden crack detection is experiencing a period of profound transformation driven by technological integration and process innovation. Artificial intelligence and machine learning algorithms are now embedded within inspection platforms, enabling dynamic defect classification and predictive analytics. These capabilities allow inspection systems to learn from vast imaging datasets, improving sensitivity and reducing false positives over time, which is essential for high-volume fabs targeting advanced nodes below five nanometers.

Simultaneously, automation and robotics have emerged as indispensable components of modern inspection workflows. Automated wafer handling dramatically increases throughput and ensures consistent positioning for both fixed point measurement and full-wafer scanning processes. This shift not only enhances operational efficiency but also minimizes human-induced variability, a critical factor in meeting the stringent quality demands of semiconductor manufacturing.

Furthermore, a new generation of imaging technologies, including acoustic microscopy, laser vibrometry, and multispectral infrared systems, offers multidimensional defect detection. By capturing defects across different physical phenomena-such as acoustic impedance variations or infrared absorption signatures-manufacturers can uncover subsurface cracks and contamination spots that evade conventional optical inspection. As these technologies converge, wafer inspection systems are positioned to deliver unparalleled resolution and diagnostic depth, setting a new benchmark for yield enhancement.

Assessing How the 2025 United States Tariffs on Semiconductor Equipment Are Reconfiguring Supply Chains, Costs, and Strategic Sourcing in Crack Detection Solutions

In 2025, the imposition of higher tariffs on semiconductor equipment by the United States has reshaped procurement strategies and cost structures for wafer crack detection machine manufacturers and end users alike. The extension of blanket levy proposals, reaching levels up to 25 percent on certain finished semiconductor tools, has introduced added complexity into cross-border sourcing decisions.

These increased duties have prompted device makers to reevaluate supplier relationships, balancing the imperative for cutting-edge inspection capabilities against the need for cost containment. Equipment costs have risen across the board, driving some manufacturers to consider strategic stockpiling of critical components while exploring alternative production partners in tariff-exempt jurisdictions. At the same time, domestic equipment vendors have benefited from these shifts, gaining traction as companies look to mitigate exposure to heightened import costs.

The longer-term impact of these tariffs extends beyond immediate price adjustments. Elevated input costs for inspection tools feed into wafer processing budgets, potentially slowing the adoption of next-generation platforms. Moreover, ongoing uncertainty around tariff revisions has underscored the need for more resilient supply chains, emphasizing regional diversification and localized manufacturing to shield future investments from further trade policy volatility.

Uncovering Deep Segmentation Insights Spanning Machine Types, Components, Technologies, Detection Methods, Wafer Variants, Sizes, Applications, and Sales Channels

The market for wafer crack detection machines can be understood through a multifaceted segmentation framework that reveals diverse needs and opportunities. Based on machine type, fixed point measurement systems provide rapid spot checks for known critical locations, while full-wafer scanning platforms deliver comprehensive surface and subsurface imaging at scale. Component-based analysis highlights the role of detectors, sensors, and signal processors working in concert with display units to translate raw imaging data into actionable defect maps.

Technological differentiation emerges when considering ultrasonic techniques, which harness high-frequency acoustic waves to reveal internal fissures, alongside optical methods like infrared imaging and laser vibrometry that detect surface irregularities. Destructive testing approaches offer in-depth material characterization at the expense of wafer loss, whereas non-destructive testing, whether automated or manual, maintains production integrity by inspecting without damaging substrates. The choice between these methods hinges on production priorities and acceptable trade-offs between cost, throughput, and risk.

Wafer variety further drives segmentation. Silicon wafers remain the industry stalwart, while compound semiconductor wafers-gallium arsenide and silicon carbide-cater to power electronics and RF applications. Specialty wafers such as epitaxial or SOI substrates address niche demands in advanced logic and MEMS devices. Sizing conventions, including the now ubiquitous 300 mm platforms and emerging 450 mm trials, shape equipment design to balance resolution requirements with throughput potential.

Lastly, the application landscape spans aerospace and automotive safety systems, consumer and industrial electronics, energy sector power modules, and medical device fabrication. End users range from semiconductor foundries and electronics assembly plants to research institutions driving next-generation materials science. Sales channels oscillate between direct offline relationships and growing online procurement portals, reflecting a broader industry shift toward digital supply chain integration.

This comprehensive research report categorizes the Wafer Hidden Crack Detection Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Component

- Technology Type

- Detection Method

- Wafer Type

- Wafer Size

- Application

- End User Industry

- Sales Channel

Analyzing Regional Dynamics Influencing Wafer Crack Detection Adoption and Innovation Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics profoundly influence the adoption and innovation of wafer crack detection solutions. In the Americas, a robust ecosystem of semiconductor fabs supported by governmental incentives and advanced R&D centers drives demand for high-precision inspection tools customized for both legacy and emerging nodes. Collaborative efforts among U.S. national laboratories and private industry frequently result in pilot programs that accelerate technology maturation, particularly for compound semiconductor materials.

Europe, Middle East, and Africa collectively form a diverse landscape where regulatory frameworks and sustainability mandates shape equipment uptake. Western European governments often incentivize domestic manufacturing through subsidies aimed at reducing reliance on Asian supply chains, while Middle Eastern investments focus on establishing foundry capacities that leverage renewable energy resources. As a result, inspection system providers engage in strategic partnerships to address localized standards and environmental requirements.

Asia-Pacific dominates in volume, with large-scale production facilities in China, Taiwan, South Korea, and Japan leading global wafer fabrication. Here, the drive toward smaller nodes and higher yields has accelerated the deployment of AI-enabled automated inspection platforms. Local equipment manufacturers also play a growing role by tailoring solutions to regional manufacturing practices and supply chain ecosystems. This combination of scale, innovation, and governmental support cements the region’s position as the primary engine of wafer crack detection technology advancement.

This comprehensive research report examines key regions that drive the evolution of the Wafer Hidden Crack Detection Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping the Future of Wafer Hidden Crack Detection Through Innovation, Partnerships, and Strategic Collaborations

A cadre of specialized equipment providers and technology innovators has come to define the competitive landscape of wafer hidden crack detection. KLA Corporation maintains a leading position with its broad portfolio of optical and electron beam inspection platforms, integrating advanced AI-driven analytics and high-throughput capabilities to support sub-5 nm process nodes. Hitachi High-Tech Corporation complements this with its dark field and multi-beam electron systems, offering enhanced precision for patterned wafer analysis and subsurface defect identification, alongside significant throughput gains in high-volume manufacturing environments.

Innovators such as Onto Innovation deliver non-destructive metrology tools optimized for rapid detection of micro-cracks across a range of wafer materials, helping foundries minimize yield losses. Lasertec Corporation leads in utilizing deep ultraviolet and near-infrared imaging to uncover both surface and hidden defects on specialized wafers like silicon carbide, catering to power electronics and RF application markets. Camtek Ltd. further augments the ecosystem with automated optical inspection solutions that efficiently identify micro-scratches and particle contamination in advanced packaging contexts.

In addition to these global players, regional vendors and emerging startups are gaining traction by focusing on niche applications, such as acoustic microscopy for MEMS devices or multispectral hyperspectral imaging modules tailored for compound semiconductor substrates. These strategic collaborations and acquisitions underscore an industry-wide recognition that innovation in inspection technology is critical for sustaining competitive advantage in semiconductor manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wafer Hidden Crack Detection Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applied Materials, Inc.

- Camtek Ltd.

- Cohu, Inc.

- Hitachi High-Tech Corporation

- ISRA VISION GmbH by Atlas Copco AB

- JEOL Ltd.

- KLA Corporation

- Lasertec Corporation

- Leica Microsystems by Danaher Corporation

- Magkraft Integrated Private Limited

- Microtronic Inc.

- Nanotronics Imaging, Inc.

- Nikon Corporation

- Nordson Corporation

- Onto Innovation Inc.

- SCREEN Semiconductor Solutions Co., Ltd.

- Semiconductor Technologies & Instruments Group

- Thermo Fisher Scientific Inc.

- Toray Engineering Co., Ltd.

- Zeiss Semiconductor Manufacturing Technology

Forging a Path Forward with Actionable Recommendations to Drive Innovation, Collaboration, and Resilient Supply Chains in Crack Detection Technologies

To navigate the evolving landscape of wafer crack detection, industry leaders should prioritize the integration of AI-driven analytics with real-time process control systems. By deploying machine learning models trained on diverse defect libraries, manufacturing facilities can achieve higher detection accuracy and faster root cause analysis. Companies should also invest in collaborative development efforts with equipment partners to co-innovate sensor arrays and algorithms customized for next-generation wafer materials.

Supply chain resilience must be fortified through diversified sourcing strategies that balance domestic production with reliable international partnerships. Establishing localized service hubs and spare parts inventories can reduce downtime and mitigate the risks posed by fluctuating tariffs and trade policies. Executives should further explore modular equipment designs that accommodate rapid upgrades, enabling seamless integration of new imaging technologies and detection methods as they emerge.

Finally, forging strategic alliances across the semiconductor ecosystem-from materials suppliers to fab operators and research institutions-will accelerate the adoption of advanced crack detection solutions. Joint pilot programs and knowledge-sharing consortia can harmonize best practices, expedite standardization efforts, and drive continuous improvements in yield, quality, and sustainability metrics within wafer manufacturing operations.

Outline of Rigorous Research Methodology Employing Multisource Data Collection, Expert Interviews, and Cutting Edge Analysis Techniques for Report Accuracy

This research employed a multi-pronged methodology to ensure comprehensive coverage and analytical rigor. Primary data was collected through in-depth interviews with over two dozen industry experts, including equipment engineers, fab operations managers, and senior R&D personnel at leading semiconductor firms. These interviews provided qualitative insights into emerging challenges, technology adoption drivers, and strategic priorities.

Secondary research encompassed an extensive review of company literature, patent filings, and peer-reviewed journal articles to map technological advancements and competitive positioning. Publicly available financial disclosures and regulatory filings were scrutinized to verify market activities, partnerships, and investment trends. Additionally, major trade association reports and government publications were evaluated to identify policy influences and incentive structures shaping regional market dynamics.

Data triangulation techniques, combining quantitative shipment statistics with qualitative interview findings, underpinned our analysis of segmentation and regional trends. Rigorous cross-validation processes, including peer reviews by subject matter experts and iterative feedback cycles with industry stakeholders, ensured the accuracy and relevance of key insights. This methodological framework has delivered a robust foundation for actionable intelligence on wafer hidden crack detection systems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wafer Hidden Crack Detection Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wafer Hidden Crack Detection Machine Market, by Machine Type

- Wafer Hidden Crack Detection Machine Market, by Component

- Wafer Hidden Crack Detection Machine Market, by Technology Type

- Wafer Hidden Crack Detection Machine Market, by Detection Method

- Wafer Hidden Crack Detection Machine Market, by Wafer Type

- Wafer Hidden Crack Detection Machine Market, by Wafer Size

- Wafer Hidden Crack Detection Machine Market, by Application

- Wafer Hidden Crack Detection Machine Market, by End User Industry

- Wafer Hidden Crack Detection Machine Market, by Sales Channel

- Wafer Hidden Crack Detection Machine Market, by Region

- Wafer Hidden Crack Detection Machine Market, by Group

- Wafer Hidden Crack Detection Machine Market, by Country

- United States Wafer Hidden Crack Detection Machine Market

- China Wafer Hidden Crack Detection Machine Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2226 ]

Concluding Reflections Emphasizing the Strategic Importance of Hidden Crack Detection Solutions for Semiconductor Manufacturing Competitiveness and Sustainability

As semiconductor manufacturers continue to push the frontiers of device performance and miniaturization, the ability to detect and mitigate hidden cracks within wafers becomes a strategic imperative. The convergence of AI, automation, and advanced imaging modalities marks a turning point in inspection capabilities, enabling higher yields and stronger reliability in critical applications ranging from automotive safety systems to next-generation data centers.

Global supply chain shifts and evolving trade policies underscore the importance of adaptive procurement strategies and resilient equipment ecosystems. Regional dynamics have highlighted the value of localized manufacturing and service networks, while segmentation analyses reveal the nuanced requirements of diverse wafer types, sizes, and application domains. Leading technology providers and emerging innovators are collaboratively defining the roadmap for future inspection platforms.

Ultimately, the insights presented in this report aim to guide executives toward informed decisions that safeguard production integrity and foster sustainable growth. By aligning technology investments with strategic partnerships, and embedding continuous improvement practices into operational workflows, industry stakeholders can realize the full potential of hidden crack detection solutions and maintain a competitive advantage in an increasingly complex semiconductor landscape.

Take the Next Step Toward Enhanced Yield and Quality with a Comprehensive Wafer Hidden Crack Detection Market Research Report Featuring Ketan Rohom’s Expert Guidance

Are you ready to elevate your semiconductor manufacturing processes through unparalleled insights and expert guidance? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report on wafer hidden crack detection machines. This report offers a deep dive into emerging technologies, regional dynamics, and strategic recommendations tailored for decision-makers aiming to enhance yield and quality assurance. Contact Ketan today to discover how this research can empower your organization’s next innovation cycle and maintain competitive advantage in a rapidly evolving landscape

- How big is the Wafer Hidden Crack Detection Machine Market?

- What is the Wafer Hidden Crack Detection Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?