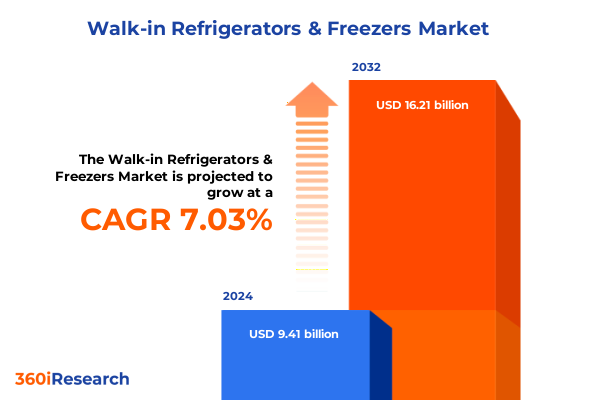

The Walk-in Refrigerators & Freezers Market size was estimated at USD 9.99 billion in 2025 and expected to reach USD 10.61 billion in 2026, at a CAGR of 7.15% to reach USD 16.21 billion by 2032.

Illuminating the Critical Role of Walk-in Refrigeration and Freezing Solutions in Modern Cold Chain Ecosystems and Business Operational Excellence

Walk-in refrigerators and freezers serve as indispensable pillars within contemporary cold chain architectures, underpinning the storage and preservation of temperature-sensitive goods across diverse industries. From large-scale food service operations to complex pharmaceutical workflows, these units ensure product integrity and compliance with stringent safety regulations. In an era marked by heightened consumer expectations for freshness and transparency, businesses are compelled to prioritize robust cold storage strategies in order to maintain competitive advantage and operational continuity.

As organizations grapple with evolving demands, the landscape of cold storage solutions has grown increasingly sophisticated. Stakeholders now evaluate options ranging from field-erected custom installations to factory-configured modular panels, each offering distinct benefits in terms of installation speed, scalability, and lifecycle costs. Facilities managers and procurement leaders weigh factors such as energy performance, spatial footprint, and long-term serviceability when selecting optimal configurations. Consequently, the selection of a tailored walk-in system emerges as a strategic decision with direct implications for bottom-line performance and customer satisfaction.

Looking ahead, the interplay between regulatory mandates, technological innovation, and sustainability imperatives will continue to shape investment priorities within the walk-in refrigeration and freezer segment. Pressure to reduce carbon emissions, transition to eco-friendly refrigerants, and integrate real-time monitoring platforms is gaining momentum. Accordingly, businesses that adopt forward-looking cold storage solutions stand to unlock new efficiencies, reinforce compliance, and anticipate future market requirements. This executive summary synthesizes these foundational drivers and dynamics to provide actionable insights for decision-makers navigating this evolving domain.

Exploring the Radical Technological, Environmental, and Supply Chain Innovations Redefining the Walk-in Refrigerator and Freezer Sector

Rapid advancements in sensor technology and connectivity have ushered in a new era of smart cold storage, empowering operators with granular visibility into temperature fluctuations, energy consumption, and equipment health. Real-time data streaming from integrated IoT platforms enables predictive maintenance schedules, minimizing unplanned downtime and extending asset lifecycles. Consequently, organizations are shifting from reactive to proactive management paradigms, leveraging analytics dashboards and automated alerts to ensure uninterrupted cold chain performance and reduce operational risk.

Meanwhile, environmental stewardship has emerged as a defining force reshaping product development and regulatory standards. The global phase-down of hydrofluorocarbon refrigerants, combined with tightening energy efficiency mandates, is driving manufacturers to innovate next-generation equipment. Variable-speed compressors, enhanced insulation materials, and low-global-warming-potential refrigerants now anchor new model releases. As a result, capital investments increasingly target systems that deliver quantifiable reductions in carbon footprint while meeting stringent compliance requirements.

In tandem with technological and regulatory drivers, supply chain resilience is undergoing a transformative shift. Stakeholders are reevaluating sourcing strategies, prioritizing regional manufacturing hubs and modular prefabrication techniques to mitigate logistical disruptions. Panel-based modular assemblies are gaining traction for their rapid deployment and consistent quality control, allowing operators to scale cold storage capacity with minimal onsite labor. This modular approach also accelerates retrofitting initiatives and supports phased expansions, enhancing agility in response to fluctuating demand.

Collectively, these innovations are redefining the walk-in refrigeration and freezer sector, compelling industry participants to adopt integrated, sustainable, and flexible solutions. As digitalization converges with environmental and logistical considerations, market leaders must remain vigilant in embracing these transformative shifts to secure operational excellence and long-term growth.

Assessing the Far-Reaching Consequences of United States Tariff Policies on 2025 Walk-in Refrigeration and Freezer Procurement Dynamics

The imposition of tariff measures within the United States has exerted a profound influence on the procurement and cost structures associated with walk-in refrigeration and freezer equipment. By escalating import duties on critical components and finished assemblies, policymakers aimed to incentivize domestic manufacturing and address trade imbalances. However, the resulting headwinds have rippled through procurement channels, prompting buyers to reassess supplier relationships, negotiate pricing terms, and explore alternative sourcing destinations beyond traditional import markets.

From a strategic standpoint, the cumulative tariff burden has translated into elevated landed costs for key equipment categories, compelling end-users to absorb higher upfront capital expenditures or pass through incremental expenses to final customers. In response, some manufacturers have accelerated investments in Mexican and domestic assembly operations to circumvent punitive duty structures. Concurrently, contract manufacturers in cost-competitive regions have pursued tariff engineering tactics, reconfiguring product designs to localize high-value subcomponents and reduce tariff exposure.

Despite these adaptive measures, the broader ripple effects extend to supply chain lead times, inventory buffering strategies, and working capital management. Organizations now allocate additional planning buffers to accommodate potential policy revisions, while logistics teams prioritize bonded warehouses and tariff deferral programs to streamline cash flow. As the tariff landscape remains in flux, businesses that cultivate multifaceted procurement frameworks and maintain open dialogue with policy advisors are better positioned to navigate ongoing uncertainties and safeguard operational continuity.

Unveiling Key Market Segmentation Insights Highlighting Catering to Diverse Construction Types, Door Configurations, Product Offerings, and Application Verticals

A nuanced understanding of market segmentation reveals how distinct customer requirements shape the adoption of walk-in refrigeration and freezer solutions. The construction type dimension distinguishes between proudly bespoke field-erected or site-built custom installations and the swiftly deployable panel modular or factory-pre-assembled configurations. Savvy operators weigh the benefits of on-site craftsmanship and design flexibility against the accelerated deployment and repeatable quality offered by modular systems. Each approach attracts specific project profiles, whether large-scale distribution centers favor modular consistency or hospitality venues prefer custom aesthetics.

Door type preferences further underscore functional and ergonomic considerations. Double-door arrangements deliver expansive access corridors for high-volume operations, while single-door models optimize floor space in compact environments. Sliding-door variants, prized for frictionless operation and enhanced thermal retention, have found strong resonance within pharmaceutical and high-frequency service settings. By aligning door configurations with throughput requirements and energy conservation targets, end-users refine overall system performance and user experience.

Divergence in product type-freezers versus refrigerators-mirrors distinct temperature regimes and storage durations. Freezer installations accommodate long-term preservation and rapid-freeze applications, whereas refrigerators excel in short-term chilling and product rotation. Decision-makers calibrate system selection based on product life cycles, inventory turnover rates, and ambient loading conditions, balancing capital intensity against operational flexibility.

Application verticals span from robust food service environments, including cafeteria kitchens, hotel banquettes, quick-service chains, and full-service restaurants, to critical healthcare settings such as clinics and hospital storage units. The pharmaceutical domain demands specialized arrangements for cold chain logistics and secure pharma storage, while retail outlets leverage convenience stores and supermarket formats to showcase chilled and frozen offerings. Each vertical imposes unique compliance, hygiene, and performance specifications, highlighting the imperative for suppliers to tailor solutions that resonate with targeted end-user profiles.

This comprehensive research report categorizes the Walk-in Refrigerators & Freezers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Construction Type

- Door Type

- Product Type

- Application

Analyzing Regional Dynamics and Growth Potential across the Americas, Europe Middle East Africa, and Asia-Pacific Walk-in Refrigerator and Freezer Markets

Regional analysis underscores distinct growth trajectories and market characteristics across the three principal territories. In the Americas, maturity in the United States combines with rising modernization efforts in Canada and targeted expansions in Latin American hubs. Here, the emphasis remains on upgrading existing infrastructure to achieve energy efficiency goals and comply with evolving environmental standards. Stakeholders increasingly integrate smart monitoring systems to streamline maintenance and reduce lifecycle costs, while North American distribution centers leverage modular expansions to meet surging e-commerce demands.

Moving into Europe, the Middle East, and Africa, stringent European Union regulations on refrigerant GWP values drive rapid adoption of next-generation eco-friendly cold storage technologies. Simultaneously, Middle Eastern retail and hospitality chains fuel demand for turnkey modular installations, capitalizing on panel-based solutions to deliver uniform quality across geographically dispersed outlets. In regions of Africa with emerging food processing industries, cold chain investments are nascent but gaining traction as infrastructure projects receive governmental and private funding support.

Across the Asia-Pacific landscape, robust industrialization and healthcare infrastructure growth underpin the highest compound uplift in cold storage adoption. In China and India, rapid hospital construction and pharmaceutical manufacturing expansions necessitate both custom-built and modular refrigeration systems. Southeast Asian markets, grappling with post-harvest losses in agriculture, emphasize cold chain logistics facilities for perishable produce. As stakeholders prioritize investment in rural distribution centers, modular cold rooms offer a cost-effective path to enhance food security and reduce waste.

Collectively, these regional insights illuminate the strategic imperatives that guide capital allocations and technology adoption. By synthesizing cross-regional contrasts, industry participants can identify high-potential markets, align product roadmaps with localized requirements, and forge partnerships that drive sustainable growth.

This comprehensive research report examines key regions that drive the evolution of the Walk-in Refrigerators & Freezers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deciphering the Competitive Landscape with Profiled Industry Leaders Driving Innovation, Strategic Alliances, and Service Excellence in Cold Storage Solutions

An intricate competitive landscape features established refrigeration solution providers alongside innovative challengers pursuing market share through differentiation. Leading original equipment manufacturers are doubling down on research and development efforts to deliver whisper-quiet compressors, advanced insulation composites, and integrated management software. Concurrently, nimble upstarts leverage digital platforms to offer subscription-based monitoring and maintenance packages, reshaping traditional service models into value-added partnerships.

Strategic alliances and joint ventures have become common levers for accelerating product development and expanding geographic reach. Collaborations between component specialists and systems integrators yield turnkey cold storage solutions that streamline procurement and installation processes. At the same time, acquisition activity has intensified in adjacent segments such as refrigeration controls and energy management analytics, enabling larger players to assemble end-to-end ecosystems that span equipment, software, and professional services.

Service excellence has emerged as a key differentiator, with top firms enhancing field-service networks and training certification protocols to minimize downtime for end-users. Extended warranty packages, predictive maintenance platforms, and remote diagnostic capabilities underpin comprehensive aftermarket support strategies. By coupling high-performance hardware with robust service offerings, these market leaders reinforce customer loyalty and create recurring revenue streams.

In this environment, companies that blend deep product expertise with agile operational models are best positioned to capture emerging opportunities. Whether through sustainable innovation, digital transformation, or strategic partnerships, the ability to anticipate shifting end-user preferences and regulatory imperatives will define the next wave of competitive advantage within the walk-in refrigeration and freezer sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Walk-in Refrigerators & Freezers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ali Group S.r.l.

- American Panel Corporation

- Arneg S.p.A.

- Emerson Electric Co.

- Hillphoenix, L.P.

- Hussmann Corporation

- Kolpak, Inc.

- Kysor Warren, Inc.

- Liebherr Group

- Master-Bilt Products, Inc.

- Nor-Lake, Inc.

- True Manufacturing Co., Inc.

- Turbo Air Inc.

Strategic Imperatives and Actionable Recommendations to Navigate Market Disruptions, Regulatory Shifts, and Technological Advances in Cold Storage

Industry leaders should prioritize investments in energy-efficient technologies, including variable-speed drives, enhanced thermal insulation, and eco-friendly refrigerants, in order to align with tightening regulatory standards and reduce operational expenditures. By integrating intelligent control systems, decision-makers can optimize temperature management, anticipate maintenance needs, and leverage data analytics to drive continuous improvement. Consequently, smart refrigeration solutions will emerge as core enablers of operational resilience and cost containment.

To mitigate supply chain disruptions and tariff volatility, organizations must cultivate diversified sourcing networks. Establishing regional assembly hubs and forging partnerships with local fabricators can reduce dependency on distant manufacturing centers. Furthermore, adopting modular panel and pre-assembled approaches enables rapid deployment and minimizes exposure to fluctuating logistics costs. As a result, procurement agility will become a critical strategic asset in a dynamic policy environment.

Collaboration with adjacent industries such as pharmaceuticals, healthcare, and food processing can unlock co-innovation opportunities. Joint pilots for specialized cold chain configurations, shared R&D initiatives on antimicrobial insulation surfaces, and integration of remote monitoring solutions can enhance product portfolios. By forging these cross-sector alliances, providers will access new markets and reinforce their value proposition through tailored, industry-specific offerings.

Finally, investing in workforce development and service excellence will fortify long-term customer relationships. Developing certified training programs for technicians, establishing global spare-parts networks, and deploying augmented reality tools for remote troubleshooting will differentiate service delivery models. In sum, a holistic approach combining technological innovation, supply chain diversification, strategic partnerships, and talent development will equip industry participants to navigate disruption and drive sustained growth.

Detailing the Comprehensive Research Methodology Combining Qualitative and Quantitative Approaches for Robust Market Intelligence and Validation

This research leverages a multi-tiered methodology, beginning with an extensive suite of in-depth interviews and surveys conducted with equipment manufacturers, facility operators, regulatory bodies, and end-users. Through qualitative discussions, insights into purchasing criteria, performance expectations, and emerging pain points were uncovered. These primary inputs provided a contextual foundation that guided subsequent analyses of technology trends, policy influences, and competitive strategies.

Secondary research encompassed a rigorous review of industry publications, technical standards, regulatory filings, and published white papers. Data from equipment certifications, refrigerant licensing records, and capital expenditure disclosures were systematically extracted to validate thematic findings. Market signals were further triangulated through satellite imagery insights on construction trends, trade data on component imports, and patent filings on refrigeration innovations.

Quantitative modeling techniques underpinned the segmentation and regional analyses, employing statistical cross-tabulations and cluster analysis to identify high-potential market pockets. Validity checks were performed through cross-referencing multiple data sources, while expert panels convened at key junctures to challenge assumptions and refine conclusions. This iterative process ensured robustness and minimized bias.

Finally, a comprehensive validation phase synthesized feedback from stakeholder workshops, calibrating insights against real-world operational parameters. The integrated approach, blending qualitative depth with quantitative rigor, delivers a holistic view of the walk-in refrigeration and freezer market, equipping decision-makers with reliable intelligence to support strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Walk-in Refrigerators & Freezers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Walk-in Refrigerators & Freezers Market, by Construction Type

- Walk-in Refrigerators & Freezers Market, by Door Type

- Walk-in Refrigerators & Freezers Market, by Product Type

- Walk-in Refrigerators & Freezers Market, by Application

- Walk-in Refrigerators & Freezers Market, by Region

- Walk-in Refrigerators & Freezers Market, by Group

- Walk-in Refrigerators & Freezers Market, by Country

- United States Walk-in Refrigerators & Freezers Market

- China Walk-in Refrigerators & Freezers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Reflection on Market Evolution Emphasizing Strategic Adaptation, Technological Integration, and Regulatory Compliance for Future Success

In summary, the walk-in refrigeration and freezer market stands at a pivotal juncture shaped by converging forces of sustainability, digital transformation, and geopolitical policy. Evolving environmental regulations have accelerated the shift toward low-GWP refrigerants and highly efficient system architectures, while advanced connectivity solutions have enabled unprecedented operational oversight. Concurrently, tariff measures and supply chain realignments continue to influence procurement dynamics, prompting organizations to adopt diversified sourcing and modular deployment strategies.

Segmentation insights reveal that choices around construction type, door configuration, and application vertical are more critical than ever in tailoring solutions that optimize performance and total cost of ownership. Regional analyses highlight nuanced market trajectories, with each territory offering unique opportunities driven by regulatory stringency, infrastructural investments, and end-user priorities. Meanwhile, competitive intensity has spurred a wave of strategic alliances, digital service offerings, and customer-centric support models that redefine market positioning.

As the industry evolves, decision-makers must embrace a proactive posture, integrating advanced technologies, sustainable practices, and resilient supply chains to maintain a competitive edge. By leveraging comprehensive research insights, stakeholders can anticipate market shifts, align product roadmaps with emerging demands, and execute strategic initiatives with confidence.

Ultimately, success in the walk-in refrigeration and freezer sector will hinge on the ability to harmonize innovation with operational practicality, ensuring that every investment delivers measurable value and fosters long-term growth.

Empowering Industry Leaders to Secure Tailored Walk-in Refrigeration Market Insights by Connecting with Associate Director Sales and Marketing Ketan Rohom

Engaging directly with Ketan Rohom, the Associate Director of Sales and Marketing, unlocks an opportunity to gain immediate access to an in-depth market research report tailored to your strategic objectives. With extensive expertise in guiding leading organizations through complex decision-making processes, Ketan ensures that you receive a comprehensive briefing that aligns with your unique operational challenges and growth ambitions. By initiating a consultation, you will benefit from a customized demonstration of key insights, interactive Q&A sessions, and practical recommendations designed to enhance your understanding of the walk-in refrigeration and freezer landscape.

Whether you seek clarity on tariff implications, segmentation strategies, or emerging regional trends, Ketan’s collaborative approach guarantees that every question is addressed with precision and depth. His proven track record in translating rich data into actionable strategies enables stakeholders to anticipate market shifts, optimize procurement, and strengthen supply chain resilience. Bridging the gap between high-level analysis and on-the-ground applications, this engagement fosters alignment between your organizational priorities and the cutting-edge intelligence provided in the report.

To secure your copy of the full report and schedule a personalized briefing, reach out to Ketan Rohom today. By partnering with a knowledgeable industry expert, you empower your team to make informed, strategic investments in cold storage infrastructure. Act now to drive operational excellence and capture emerging opportunities in the walk-in refrigerator and freezer market.

- How big is the Walk-in Refrigerators & Freezers Market?

- What is the Walk-in Refrigerators & Freezers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?