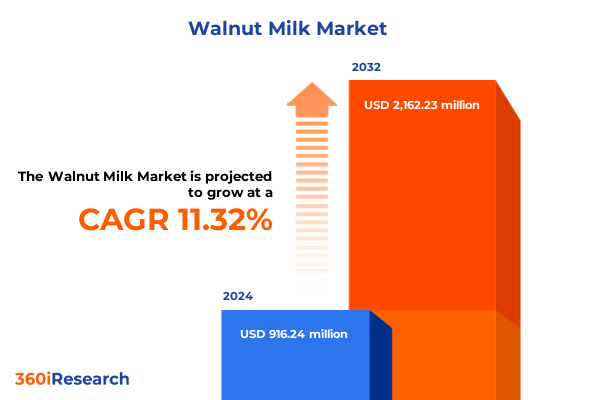

The Walnut Milk Market size was estimated at USD 1.01 billion in 2025 and expected to reach USD 1.12 billion in 2026, at a CAGR of 11.41% to reach USD 2.16 billion by 2032.

Exploring the Ascendance of Walnut Milk as a Premium, Nutritive Alternative Fueling Consumer Demand Through Health Consciousness and Culinary Innovation

Walnut milk has rapidly emerged as a distinguished contender in the plant-based dairy alternative space, appealing to consumers who seek both nutritive value and culinary versatility. With its naturally rich profile of essential fatty acids, antioxidants, and a subtly nutty flavor, walnut milk resonates with health-conscious individuals looking beyond the more established almond and oat offerings. As dietary patterns evolve, the appeal of walnut milk is amplified by its ability to complement diverse applications-from morning smoothies and gourmet coffee beverages to savory sauces and baked goods-making it a truly multifunctional ingredient for both at-home cooks and high-end foodservice operators.

Moreover, sustainability considerations are driving consumer interest in alternative milk sources that impose lower environmental burdens. Walnut trees require less water than many other nut varieties, and recent advances in cold-press extraction and ultrafiltration technologies have further improved yield efficiency and product stability. These innovations, coupled with targeted marketing campaigns emphasizing clean-label credentials and transparent supply chains, have positioned walnut milk as not only a premium health product but also an eco-responsible choice. Consequently, manufacturers and ingredient innovators have intensified their focus on walnut-centric formulations, aiming to capture market share by leveraging this unique blend of nutritional benefits and sustainability narratives.

Key Disruptive Trends Shaping the Walnut Milk Landscape Through Sustainability, Supply Chain Innovation and Shifting Consumer Preferences

The walnut milk landscape is undergoing a series of transformative shifts, propelled by a confluence of consumer, technological, and regulatory forces. Health consciousness continues to intensify, with a growing emphasis on plant-based proteins and functional nutrients. Against this backdrop, walnut milk is carving out a differentiated position by highlighting its naturally occurring omega-3 fatty acids and polyphenolic antioxidants, attributes that resonate with consumers seeking cognitive and cardiovascular benefits.

At the same time, the supply chain is being redefined by digital traceability solutions, enabling brands to demonstrate provenance and ethical sourcing. Blockchain-enabled platforms and farm-to-shelf tracking systems are not only enhancing transparency but also fostering deeper engagement with artisanal producers in key growing regions. Concurrently, manufacturing innovation-such as high-pressure processing and enzymatic treatment-has reduced waste and optimized texture, resulting in a creamier mouthfeel that rivals conventional dairy. These combined dynamics are elevating consumer expectations and pressuring incumbents to invest in continuous process improvement.

Finally, regulatory landscapes are adapting to accommodate novel plant-based dairy designations, while nutritional labeling guidelines are being refined to underscore health claims. As legislation evolves, stakeholders across the walnut milk value chain are collaborating with advocacy groups and standards organizations to ensure compliance and to influence policy formulation, thereby safeguarding market access and facilitating international trade.

Analyzing the Compound Effects of 2025 United States Tariffs on Walnut Milk Imports, Production Costs and Market Dynamics Amid Global Trade Shifts

In 2025, the imposition of new United States tariffs on selected nut imports has reverberated across the walnut milk sector, altering cost structures and sourcing strategies. While the intention was to protect domestic growers, producers of walnut milk have encountered elevated raw material expenses that have necessitated reevaluations of supplier portfolios. Many manufacturers are now exploring diversified orchards in lower-tariff jurisdictions or forging strategic partnerships with cooperatives to mitigate price volatility and ensure continuity of supply.

Moreover, heightened duties have prompted innovations in ingredient optimization, with formulators experimenting with concentrated walnut protein isolates and blended nut matrices to preserve product quality while offsetting cost increases. These efforts are complemented by incremental adjustments in retail pricing and promotional programming, as brands seek to maintain affordability. In parallel, some forward-thinking companies have initiated vertical integration efforts-investing directly in walnut grove operations-to secure long-term feedstock resilience and to exert greater control over quality and sustainability metrics.

Looking ahead, the cumulative impact of these tariffs is expected to accelerate regional sourcing diversification, drive product reformulation initiatives, and stimulate collaborative advocacy for trade policy revisions. Stakeholders who proactively adapt their procurement and pricing strategies today will be best positioned to navigate the evolving trade environment and to capture expanding consumer demand in the post-tariff era.

Unveiling Segmentation Dynamics in Walnut Milk Markets Highlighting Consumer Behavior Across Product Types, Sources, Packaging, End Users and Distribution Channels

A detailed segmentation analysis reveals nuanced patterns in consumer preferences and purchasing channels within the walnut milk market. From a product-type perspective, unsweetened formulations continue to attract purists who value unadulterated flavor profiles, while sweetened walnut milk appeals to those seeking a milder taste. Within the flavored subsegment, chocolate remains the frontrunner among indulgent options, with vanilla carving out its own niche for versatility in recipes, and strawberry gaining traction among younger demographics seeking fruit-infused dairy alternatives.

Shoppers are also increasingly discerning about the origin of their walnut milk, causing organic variants to register faster growth than their conventional counterparts. Organic certification not only caters to health-focused audiences but also aligns with broader ethical consumption trends, underpinning premium pricing strategies. On the packaging front, the majority of products are housed in recyclable cartons, although a subset of artisanal brands is experimenting with glass bottles to reinforce a premium positioning. Metal cans, while less common, are emerging in select markets due to their robust shelf stability and convenience for on-the-go consumption.

Consideration of end-user segmentation further refines market understanding, as household buyers account for the bulk of volume but foodservice and institutional channels are unlocking significant incremental opportunities. Cafés and bistros are integrating walnut milk into specialty coffee menus, and educational institutions are piloting nut-based dairy programs to diversify menu offerings. Finally, distribution channel dynamics underscore the importance of omni-channel readiness: while offline specialty stores and supermarket chains remain vital for mass reach, online sales-via brand websites and third-party eCommerce platforms-are accelerating, driven by subscription models, targeted digital marketing, and the convenience of home delivery.

This comprehensive research report categorizes the Walnut Milk market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Packaging Type

- End Users

- Distribution Channel

Deciphering Regional Nuances in Walnut Milk Consumption and Distribution Patterns Across Americas, Europe, Middle East & Africa and Asia-Pacific Markets

Regional consumption and distribution patterns for walnut milk exhibit distinct characteristics across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, particularly in the United States and Canada, wellness-oriented consumers are driving widespread adoption of walnut milk in both retail and foodservice settings, supported by a dense network of specialty cafés and health food retailers. Moreover, North American supply chains are increasingly agile, leveraging domestic walnut orchards and established cold-chain logistics to meet year-round demand.

Conversely, in Europe, Middle East & Africa, the market is more fragmented, with northern and western European countries leading adoption on the back of robust plant-based trends and favorable regulatory frameworks. Meanwhile, in regions of the Middle East & Africa, consumer awareness is growing more slowly, although premium resorts and urban centers are introducing walnut-infused menu options to attract affluent and expatriate demographics. Import dependency remains a significant factor here, with tariff and phytosanitary requirements shaping sourcing choices.

Asia-Pacific represents a dual-track opportunity, where mature markets like Japan and Australia embrace walnut milk as part of broader functional beverage portfolios, while emerging markets in Southeast Asia are beginning to explore nut milk varieties as disposable incomes rise and westernized eating patterns diffuse. Local partnerships and co-manufacturing agreements are instrumental in scaling production cost-effectively, and eCommerce penetration is amplifying reach beyond metropolitan hubs, thereby democratizing access to walnut-based dairy alternatives.

This comprehensive research report examines key regions that drive the evolution of the Walnut Milk market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Walnut Milk Innovators and Established Brands Driving Product Innovation, Strategic Partnerships and Market Expansion Trajectories Worldwide

The competitive landscape of walnut milk is characterized by a mix of dedicated innovators and established plant-based dairy leaders. Niche startups are carving out narrow positioning through single-origin sourcing and artisanal cold-press techniques, offering small-batch walnut milk that commands a premium among connoisseur consumers. At the same time, larger food and beverage companies are integrating walnut milk into broader portfolios, leveraging existing manufacturing infrastructure and distribution networks to accelerate time-to-market and achieve scale economies.

Strategic collaborations between ingredient suppliers and end-brand processors are also gaining prominence, as firms seek to co-develop proprietary walnut protein concentrates and stabilize emulsions for enhanced shelf life. Brand alliances with coffee chains, fast-casual restaurants, and even boutique fitness studios are providing critical visibility, embedding walnut milk in everyday consumption occasions. Private equity investors and venture capital funds have begun allocating more resources to the nut-based dairy space, spotlighting walnut milk as a high-potential avenue for portfolio diversification within the broader alternative proteins sector.

Taken together, these competitive and collaborative activities are accelerating innovation cycles, expanding retail footprints, and intensifying the push toward international roll-outs. Market leaders who balance premium positioning with operational excellence are emerging as benchmarks for how to translate walnut milk’s unique value proposition into sustainable growth trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Walnut Milk market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al Naturale

- ALPINE PACIFIC NUT CO

- Alt-Milk

- EAST PACIFIC FOODS LLC by Dan On Foods Corporation

- Elmhurst 1925, Inc.

- GROWER DIRECT NUT CO. INC.

- Hain Celestial Group, Inc.

- Läderach (Österreich) GmbH

- Mariani Nut Company, Inc.

- Moses and Co.

- Pure Tropic

- RITA Food & Drink Co.,Ltd.

- Tan Do Refreshing Water Company Limited

- The Australian Walnut Company Pty Ltd

Strategic Roadmap for Industry Leaders to Enhance Competitiveness Through Product Diversification, Supply Chain Resilience and Channel Optimization in Walnut Milk Sector

To thrive in the dynamic walnut milk market, industry leaders must adopt a multifaceted strategic playbook. First, there is a pressing need to broaden product portfolios by introducing differentiated flavor extensions and fortification options, such as calcium and probiotic enrichments, to address emerging health trends and dietary concerns. Equally critical is to deepen commitments to sustainability by securing certified organic and regenerative agriculture inputs, thereby reinforcing brand authenticity and commanding accessibility among eco-conscious consumers.

Second, supply chain resilience must be strengthened through diversification of sourcing regions and the establishment of integrated procurement arrangements. By investing in backward integration or long-term cooperative partnerships, companies can shield themselves from tariff fluctuations and potential supply disruptions. Simultaneously, embracing advanced manufacturing techniques-including high-pressure processing and enzymatic extraction-will optimize yield and maintain consistent sensory profiles at scale.

Finally, channel optimization should prioritize an omnichannel ecosystem that marries offline experiential engagements with seamless digital commerce. This means forging alliances with specialty cafés and foodservice operators for targeted product trials, while also leveraging subscription models and AI-driven personalization within eCommerce platforms to drive repeat purchase and consumer loyalty. Organizations that execute these initiatives in concert will establish robust competitive moats and set new benchmarks for growth in the walnut milk sector.

Comprehensive Overview of Research Methodologies and Data Collection Approaches Underpinning the Walnut Milk Market Analysis and Insights

This analysis is underpinned by a rigorous, multi-method research framework designed to capture both qualitative and quantitative dimensions of the walnut milk market. Primary research initiatives included in-depth interviews with senior executives across ingredient suppliers, brand manufacturers, and distribution partners, as well as structured consultation sessions with regulatory experts to assess the impact of tariffs and labeling guidelines. In parallel, consumer surveys were conducted via online panels in key geographic regions to gauge preferences, purchase triggers, and willingness to pay for various walnut milk formulations.

Secondary research efforts entailed extensive review of industry publications, trade journals, patent filings, and sustainability reports to identify emerging technological advancements and novel processing methods. Market dynamics were further enriched through supply chain mapping exercises that traced walnut sourcing routes, cost structures, and distribution channels from grove to retail shelf. The data collected were triangulated using statistical tools and cross-validated with publicly available accelerator program reports and investor presentations to ensure consistency and reliability.

Collectively, this robust methodological approach guarantees that the insights presented are both comprehensive and actionable, providing stakeholders with a clear line of sight into consumer trends, competitive dynamics, and regulatory influences shaping the walnut milk sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Walnut Milk market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Walnut Milk Market, by Product Type

- Walnut Milk Market, by Source

- Walnut Milk Market, by Packaging Type

- Walnut Milk Market, by End Users

- Walnut Milk Market, by Distribution Channel

- Walnut Milk Market, by Region

- Walnut Milk Market, by Group

- Walnut Milk Market, by Country

- United States Walnut Milk Market

- China Walnut Milk Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Critical Insights and Forward-Looking Perspectives on Walnut Milk Evolution Amid Health Trends, Regulatory Developments and Consumer Expectations

The trajectory of walnut milk reflects a broader consumer shift toward nutritionally enriched, ethically sourced, and multifunctional beverage alternatives. As detailed in this summary, the convergence of heightened health awareness, evolving regulatory frameworks, and innovative supply chain solutions has catalyzed an environment ripe for continued growth. Segmentations by product type, source, packaging, end use, and distribution channel reveal diverse avenues for differentiation, while regional nuances underscore the importance of tailored market development strategies.

Key players have demonstrated that strategic collaboration-whether through ingredient co-development or targeted channel partnerships-can expedite market penetration and reinforce brand credibility. At the same time, the current tariff landscape presents both challenges and opportunities for those who proactively diversify sourcing and optimize cost structures. Taken together, these insights paint a picture of a market in transformation, where agility, authenticity, and innovation will determine winners and shape the future of plant-based dairy alternatives.

Going forward, stakeholders should maintain vigilant monitoring of policy changes, evolving consumer health priorities, and technological breakthroughs in processing. By aligning strategic investments with the emergent drivers outlined in this report, companies can position themselves to capture the next wave of demand and to define the walnut milk category in the global plant-based ecosystem.

Unlock Your Access to the Definitive Walnut Milk Market Research Report by Connecting with Ketan Rohom for Tailored Insights and Acquisition Details

Are you ready to gain unparalleled insights into a rapidly evolving segment of the plant-based dairy market? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your access to the comprehensive walnut milk market research report. He will guide you through bespoke packages tailored to your organization’s intelligence needs, ensuring you are equipped with the strategic information necessary to capitalize on emerging consumer trends, regulatory shifts, and competitive dynamics. Elevate your decision-making with precise, data-driven analysis – contact Ketan today to unlock your copy and transform your market positioning.

- How big is the Walnut Milk Market?

- What is the Walnut Milk Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?