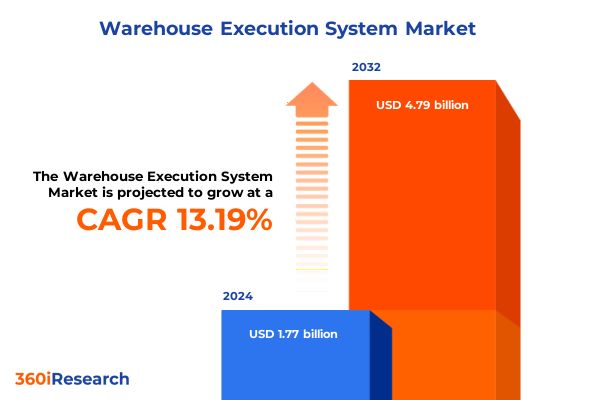

The Warehouse Execution System Market size was estimated at USD 2.00 billion in 2025 and expected to reach USD 2.25 billion in 2026, at a CAGR of 13.27% to reach USD 4.79 billion by 2032.

Discover the Foundational Role of Warehouse Execution Systems in Revolutionizing Supply Chain Efficiency and Operational Control through Real-Time Orchestration and Data-Driven Insights

Warehouse execution systems have emerged as pivotal enablers of supply chain agility, orchestrating real-time operations across order fulfillment, labor allocation, and inventory flows. As organizations face escalating consumer demands for speed and accuracy, these platforms bridge the gap between strategic warehouse management and tactical control layers. By integrating seamlessly with warehouse management systems and enterprise resource planning suites, they offer a unified framework that aligns people, processes, and machines toward common performance objectives.

The proliferation of omnichannel retail and just-in-time manufacturing models has intensified pressure on distribution networks to deliver precise, on-demand services. Consequently, stakeholders are looking beyond siloed automation islands to holistic execution platforms capable of dynamic task orchestration. Through advanced data analytics and event-driven workflows, warehouse execution systems not only optimize throughput but also facilitate predictive decision-making, ultimately reducing manual interventions and elevating service levels. As enterprises chart their digital transformation journeys, understanding the foundational role of these solutions is critical to achieving both operational resilience and competitive differentiation.

Explore the Transformative Shifts Redefining Warehouse Execution with Advanced Automation, Artificial Intelligence, and Integration Architectures Driving Next-Gen Operations

The past few years have witnessed a profound evolution in warehouse execution solutions, driven by the convergence of automation technologies, artificial intelligence, and open integration frameworks. Intelligent orchestration engines now leverage machine learning to adapt task sequences in response to fluctuating order profiles, while computer vision and sensor networks feed continuous performance feedback. This shift from static rule-based configurations toward self-learning systems enables warehouses to adjust in real time to unexpected disruptions, from sudden order surges to equipment downtime.

Furthermore, the rise of microservices architectures and API-first design philosophies has accelerated interoperability between execution platforms and adjacent systems such as robotics controllers, order management applications, and advanced analytics dashboards. As a result, enterprises can deploy modular capabilities-be it labor management modules or task assignment engines-without the risk of vendor lock-in or extensive customization. Ultimately, this combination of embedded intelligence, cloud-native scalability, and open integration sets the stage for next-generation warehouse operations that are both adaptive and future-proof.

Understand the Cumulative Impact of United States Tariffs through 2025 on Warehouse Execution System Adoption Costs, Supplier Strategies, and Global Sourcing Decisions

Since the enactment of Section 232 tariffs on steel and aluminum in 2018 and subsequent Section 301 measures targeting imported goods, warehouse execution system providers have navigated a landscape marked by increased input costs and supply chain realignment. The cumulative impact of these policies through 2025 has materialized in sharper capital expenditure scrutiny, compelling hardware manufacturers to explore domestic production or regional assembly to mitigate duty exposure. Software licensing fees have also borne the weight of cost inflation, leading some vendors to adopt subscription-based pricing models that distribute investment over longer timelines.

In response to elevated procurement expenses, organizations have accelerated diversification of their supplier base, engaging local integrators and systems houses to curtail logistics overheads. Moreover, tariff-driven uncertainties have underscored the importance of modular, upgradable execution architectures, enabling companies to phase in capabilities as budget windows allow. By reorienting sourcing strategies and embedding agility into deployment roadmaps, stakeholders are finding ways to maintain momentum in warehouse modernization despite the headwinds posed by sustained tariff regimes.

Unveil Key Segmentation Insights into Component Offerings, Application Focus, Form Factors, Deployment Modes, and End User Verticals Shaping the Warehouse Execution Landscape

The warehouse execution system landscape encompasses two primary components: services and software. Services, which include consulting, implementation, and ongoing support and maintenance, represent a critical investment for organizations seeking to tailor solutions to their unique operational challenges. Software offerings, meanwhile, range from core orchestration modules to specialized labor management and task optimization suites that drive productivity improvements.

Applications of these systems span inventory management, labor management, order fulfillment optimization, and task management-each delivering targeted benefits such as reduced picking errors, balanced workloads, and accelerated throughput. Execution solutions are packaged in two distinct forms: fully automated configurations that integrate robotics and conveyor controls, as well as manual systems designed for operations reliant on human-centric processes. Deployment modalities further diversify the market, with cloud-based implementations-whether hybrid, private, or public-providing scalability and remote management, alongside traditional on-premise installations favored for their control and data sovereignty attributes.

End users across automotive, food and beverage, healthcare, logistics and transportation, manufacturing, and retail and e-commerce verticals are harnessing execution platforms to address sector-specific demands. From strict regulatory compliance in pharmaceutical distribution to high-velocity order flows in online retail, segmentation insights reveal varying priorities in customization, integration, and support models that vendors must accommodate to succeed in a heterogeneous market.

This comprehensive research report categorizes the Warehouse Execution System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Form

- Deployment Mode

- End User

Gain Key Regional Insights Highlighting Diverse Adoption Patterns, Regulatory Influences, and Growth Drivers across Americas, EMEA, and Asia-Pacific Markets

In the Americas, adoption of warehouse execution technologies is driven by large e-commerce players and third-party logistics providers seeking to differentiate service levels. Regulatory stability and robust IT infrastructure support rapid deployment of cloud-native execution platforms, while tariff considerations have prompted near-shoring strategies that enhance responsiveness across North America and Latin America distribution hubs.

Europe, the Middle East, and Africa present a mosaic of regulatory requirements and digital maturity levels. Western European markets lead in integrating AI-enabled orchestration with sustainability initiatives, emphasizing energy-efficient operations. In contrast, emerging economies in the Middle East and Africa are prioritizing modular, scalable solutions that accommodate phased investments as infrastructure and capital availability evolve over time.

Asia-Pacific remains the most dynamic region, characterized by high volume throughput centers, sprawling manufacturing ecosystems, and government-sponsored smart logistics initiatives. Market participants are capitalizing on this momentum by offering localized support, multilingual interfaces, and integration with region-specific hardware standards. Collectively, these regional dynamics underscore the necessity for vendors to tailor go-to-market strategies and deployment architectures to diverse operating environments and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Warehouse Execution System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine Key Companies Insights Revealing Strategic Investments, Competitive Differentiation, and Collaboration Trends among Leading Warehouse Execution System Vendors

Leading warehouse execution system vendors are pursuing differentiated strategies to capture market share and expand their solution portfolios. Some have concentrated on strategic partnerships, integrating best-of-breed labor management and robotics control modules to present a unified orchestration platform. Others have executed targeted acquisitions of niche software providers to strengthen their AI and machine-learning capabilities, enhancing predictive task assignment and dynamic resource allocation.

R&D investments are channelled into advancing intuitive user interfaces and mobile-first applications that empower warehouse staff with real-time insights and task instructions. Concurrently, cloud-specialist entrants are carving out niches by offering rapid, subscription-based access to execution functionalities without the need for extensive on-premise infrastructure. Competitive pricing models now frequently bundle software updates and premium support services, reflecting a shift toward value-added offerings and customer success frameworks.

To maintain relevance, vendors are fostering developer ecosystems and open APIs, enabling system integrators to craft bespoke modules that extend core execution capabilities. This communal approach accelerates innovation cycles and mitigates integration risks, ensuring that end users can seamlessly adopt emerging technologies such as autonomous mobile robots and digital twin simulations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Warehouse Execution System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&D Company, Limited

- Adam Equipment Company, LLC

- Addverb Technologies Limited

- AutoStore AS

- Avery Weigh-Tronix Limited

- Bastian Solutions, LLC by Toyota Industries Corporation

- Cardinal Scale Manufacturing Company

- Conveyco Technologies

- Fairbanks Scales, Inc.

- Fortna Inc.

- HighJump Software Inc. by Körber AG

- Honeywell International Inc.

- Hy-Tek LLC

- Inyxa LLC

- Kern & Sohn GmbH

- KION Group

- Locad

- Lucas Systems, Inc.

- Manhattan Associates, Inc.

- Matthews International Corporation

- Mettler-Toledo International Inc.

- Microsoft Corporation

- Minebea Intec GmbH

- Numina Group, Incorporated

- OHAUS Corporation

- Oracle Corporation

- Panasonic Corporation

- PTC Inc.

- Rice Lake Weighing Systems, Inc.

- Softeon Inc.

- SSI SCHAEFER Group

- Swisslog Holding AG

- Tecsys Inc.

- Toshiba Corporation

- Vargo

- Westfalia Technologies, Inc.

- WOW Logistics Company

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Technologies, Optimize Integration Approaches, and Future-Proof Warehouse Operations

Industry leaders should prioritize the development of modular execution architectures that allow incremental capability expansion aligned with evolving operational requirements. By adopting open integration standards and RESTful APIs, they can accelerate time to value and streamline interoperability with warehouse management systems, robotics controllers, and analytics platforms. Additionally, embedding AI-driven orchestration engines will enable real-time adaptation to order variability, equipment availability, and labor capacity fluctuations.

Investing in cloud-native deployment options, including hybrid and private cloud models, will provide the scalability necessary to support fluctuating throughput demands while preserving data security and compliance. To address the cumulative cost impacts of tariffs, organizations should explore strategic supplier diversification, leveraging regional integrators and hardware assemblers to localize key components and mitigate duty exposure. Workforce training initiatives, guided by interactive digital tools and augmented reality modules, can further boost adoption rates and reduce change management friction.

Finally, establishing cross-functional governance frameworks that unite IT, operations, and supply chain stakeholders will ensure alignment on performance metrics and continuous improvement objectives. By balancing technological innovation with robust change management, industry leaders can future-proof warehouse operations and sustain competitive advantage.

Research Methodology Overview Detailing Rigorous Data Collection, Multi-Source Verification, and Analytical Frameworks Underpinning the Warehouse Execution System Report

This research integrates a multi-stage approach, commencing with comprehensive secondary research that encompasses trade publications, regulatory filings, vendor white papers, and industry consortium reports. To complement these insights, primary research was conducted through in-depth interviews with supply chain executives, warehouse managers, solution architects, and system integrators, ensuring a balanced perspective on market challenges and adoption drivers.

Quantitative data was validated through triangulation across multiple sources, with qualitative findings enriched by case studies and best-practice examples. Vendor briefings and product demonstrations provided firsthand exposure to technology roadmaps and feature differentiation strategies. An advisory board of industry experts reviewed preliminary conclusions, offering critical feedback that refined the analytical framework and ensured alignment with current operational realities.

The methodology emphasizes transparency and reproducibility, outlining key assumptions, data limitations, and validation protocols. By combining robust primary intelligence with rigorous secondary analysis and expert validation, the study delivers actionable insights and a credible foundation for strategic decision-making in the warehouse execution system landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Warehouse Execution System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Warehouse Execution System Market, by Component

- Warehouse Execution System Market, by Application

- Warehouse Execution System Market, by Form

- Warehouse Execution System Market, by Deployment Mode

- Warehouse Execution System Market, by End User

- Warehouse Execution System Market, by Region

- Warehouse Execution System Market, by Group

- Warehouse Execution System Market, by Country

- United States Warehouse Execution System Market

- China Warehouse Execution System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Perspectives Summarizing Strategic Implications, Market Dynamics, and Core Themes for Stakeholder Decision-Making in Warehouse Execution

Warehouse execution systems stand at the nexus of evolving supply chain imperatives, integrating advanced automation, AI-driven orchestration, and modular deployment models to meet the demands of modern distribution networks. Through segmentation insights, it becomes clear that solution components, application focus areas, form factors, deployment modalities, and end-user requirements each present unique considerations for technology selection and implementation.

Regional analyses underscore the importance of adapting to diverse market dynamics-from regulatory nuances and digital maturity in EMEA to high-volume execution centers in Asia-Pacific and tariff-influenced sourcing strategies in the Americas. Key vendor strategies, including strategic partnerships, niche acquisitions, and open integration ecosystems, illustrate the competitive pathways to delivering comprehensive execution solutions. Concurrently, tariff regimes through 2025 have driven supplier diversification and flexible pricing models that preserve modernization momentum.

By synthesizing these insights, stakeholders can formulate deployment roadmaps that balance technological investment, cost management, and operational agility. This holistic perspective culminates in actionable recommendations designed to guide industry leaders toward sustainable performance improvements and robust strategic positioning in the warehouse execution system market.

Engage with Associate Director Ketan Rohom to Secure the Comprehensive Warehouse Execution System Market Research Report and Accelerate Strategic Planning

Engaging with industry experts like Ketan Rohom, Associate Director of Sales & Marketing, unlocks direct access to the comprehensive warehouse execution system market research report tailored to your strategic needs. By securing this in-depth analysis, your organization gains unparalleled visibility into the latest technological breakthroughs, competitive dynamics, and regional growth patterns. This collaboration empowers decision-makers to benchmark against leading practices, anticipate shifts driven by tariff policies, and refine deployment roadmaps with confidence.

Take advantage of the opportunity to align your investment decisions with actionable insights crafted through rigorous methodology and validated by primary interviews with sector leaders. Partnering with Ketan Rohom ensures personalized guidance on leveraging the report’s findings-whether optimizing automation architectures, diversifying supplier networks in response to cumulative tariff impacts, or tailoring solutions to end-user requirements across automotive, healthcare, and e-commerce sectors. Reach out today to transform data into strategic advantage and accelerate your journey toward operational excellence.

- How big is the Warehouse Execution System Market?

- What is the Warehouse Execution System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?