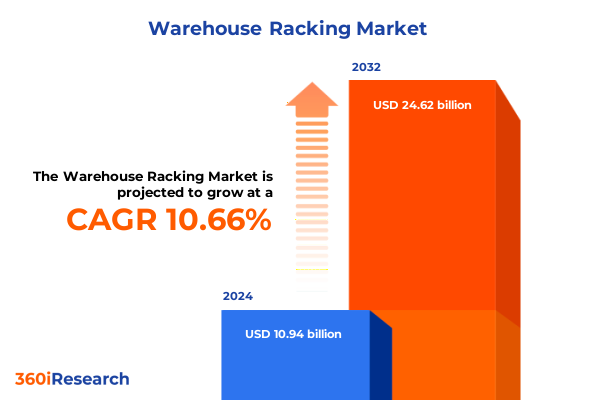

The Warehouse Racking Market size was estimated at USD 12.06 billion in 2025 and expected to reach USD 13.29 billion in 2026, at a CAGR of 10.73% to reach USD 24.62 billion by 2032.

Exploring the Critical Role of Warehouse Racking Systems in Enhancing Operational Efficiency and Supply Chain Resilience Across Industries

Warehouse racking systems serve as the backbone of modern supply chain operations, providing essential support for storage optimization, inventory management, and spatial efficiency. Over the past decade, rising e-commerce demand and omnichannel fulfillment imperatives have intensified the pressure on distribution centers to maximize throughput while maintaining safety and compliance. Consequently, racking solutions have evolved beyond simple shelving to become sophisticated frameworks that integrate automation, real-time data gathering, and modular adaptability. This shift underscores the critical importance of selecting systems that not only accommodate current throughput requirements but also anticipate future scalability needs.

Moreover, workforce dynamics have placed renewed emphasis on ergonomic design and operational safety. As labor shortages persist, facilities are challenged to streamline material handling processes and minimize manual interventions. Warehouse automation technologies-ranging from automated storage and retrieval systems (AS/RS) to robotic picking-are driving demand for racking architectures capable of interfacing seamlessly with advanced equipment. In response, manufacturers are engineering racks with reinforced load-bearing components, embedded sensors for preventive maintenance, and configurable layouts that support mixed-load environments without compromising structural integrity.

Revolutionary Technological, Environmental, and Fulfillment-Driven Shifts Redefining Warehouse Racking System Design and Functionality

The warehouse racking landscape has undergone transformative shifts driven by digitalization, sustainability imperatives, and evolving fulfillment models. Real-time inventory tracking, powered by IoT-enabled load sensors and RFID technology, is revolutionizing how storage capacity is planned and utilized. Facilities are transitioning from static rack configurations to dynamic systems that can self-optimize based on demand patterns, reducing pick times and idle inventory. At the same time, sustainability considerations are gaining prominence; recycled steel and eco-friendly coatings are becoming standard offerings as companies strive to meet corporate social responsibility targets and reduce carbon footprints.

Concurrently, omnichannel distribution strategies are reshaping racking design principles. Retailers and third-party logistics providers must now accommodate a wider array of SKU sizes and handling methods, prompting the adoption of push-back and pallet-flow systems for high-density deployment alongside selective pallet racks for quick-access zones. In parallel, the integration of collaborative mobile robots and automated guided vehicles (AGVs) demands racks with adaptable aisle widths and modular uprights that can be adjusted on the fly. These technological, environmental, and operational currents have collectively redefined the parameters of warehouse design, compelling stakeholders to invest in future-proof racking infrastructures.

Assessing the Long-Term Consequences of Evolving United States Steel and Component Tariffs on Warehouse Racking Supply Chains

Since the initial imposition of Section 232 steel and aluminum tariffs, followed by Section 301 actions targeting specific imported components, the cumulative impact on warehouse racking economics has been substantial. Raw material costs for steel profiles have increased, prompting manufacturers to source domestically or diversify supply chains to mitigate volatility. Over time, these measures have accelerated the adoption of alternative materials in non-load-bearing rack components and spurred collaborative negotiations with mill partners to secure favorable pricing terms.

Moreover, end users have responded by embracing design efficiencies that require less raw steel per storage unit without sacrificing load capacity. Innovative cross-bracing patterns and optimized beam geometries have emerged as engineering responses to tariff-driven cost pressures. Concurrently, lead times have fluctuated in line with trade policy adjustments, necessitating more robust inventory buffer strategies. In response, many logistics operators have redeployed capital to expand local warehousing footprints and pre-order critical rack components, reducing exposure to sudden price escalations. This strategic recalibration underscores how policy interventions have reshaped procurement behavior and driven the pursuit of resilient supply chain solutions.

Unveiling In-Depth System Type, End-Use, Distribution Channel, and Service-Driven Insights Shaping Warehouse Racking Demand Dynamics

Warehouse racking demand is shaped by a diverse array of system types each tailored to specific storage profiles. Cantilever racking, designed for heavy, light, and medium loads, excels in handling long, irregular items and supports industries with bulky inventory needs. Drive-in and drive-through racks optimize cubic space by enabling forklift entry within the rack structure, making them ideal for high-density applications. Push-back systems, available in two-depth, three-depth, and four-depth configurations, offer improved storage density for uniform pallet flows, while pallet-flow solutions deliver first-in, first-out capabilities critical for perishables. Selective pallet racking, whether single-deep or double-deep, remains the most versatile and widely deployed option across mixed-SKU operations.

A further layer of segmentation emerges through end-use contexts that span automotive aftermarket and OEM, cold and dry food and beverage storage, cold logistics and express courier networks, automotive OEM and pharmaceutical manufacturing, and diverse retail environments including department stores, e-commerce fulfillment centers, and supermarket distribution nodes. Each vertical exhibits unique throughput rates, safety and compliance standards, and environmental controls, driving specialized feature requirements.

Distribution channels also influence market dynamics, with direct sales models catering to multinational enterprises, national and regional distributor networks serving mid-tier operators, and online platforms offering flexibility through company websites and third-party marketplaces. Service offerings-consulting in design and engineering, project management, installation expertise, as well as preventive and corrective maintenance programs-round out the value chain, ensuring that system lifecycles are fully supported and performance benchmarks are consistently met.

This comprehensive research report categorizes the Warehouse Racking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Racking Type

- Service

- End Use

- Distribution Channel

Capturing the Diverse Regional Forces Driving Warehouse Racking Innovation and Adoption Across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in warehouse racking adoption, reflecting divergent growth trajectories and regulatory landscapes. In the Americas, robust investment in e-commerce infrastructure, coupled with stringent safety and fire code regulations, has elevated demand for high-clearance selective pallet systems and automated interfacing equipment. North American markets prioritize rapid deployment and scalability, incentivizing modular racking designs that can be expanded without major facility overhauls.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of market conditions. Western Europe leans toward sustainability-focused rack manufacturing and energy-efficient facility designs, while the Middle East is witnessing large-scale warehouse developments driven by government-led logistics hubs. African warehousing remains nascent but is gradually embracing imported racking solutions to support burgeoning retail and manufacturing sectors, despite challenges related to infrastructure and skilled labor.

Asia-Pacific stands out as the region with the most accelerated growth, fueled by government initiatives to enhance cold chain capabilities and expand domestic manufacturing. Facilities across China, India, Southeast Asia, and Australia are integrating smart racking with advanced automation, reflecting a broader digital transformation agenda. These regional distinctions underscore the necessity of tailoring racking strategies to local regulatory requirements, capital availability, and technological adoption rates.

This comprehensive research report examines key regions that drive the evolution of the Warehouse Racking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Leading Manufacturers and Technology Integrators Are Enhancing Warehouse Racking Systems Through Innovation and Collaboration

Leading suppliers in the warehouse racking arena are advancing system durability, automation compatibility, and service excellence to capture market opportunities. Interlake Mecalux has distinguished itself through innovative cantilever load-bearing components and advanced pallet-flow track assemblies designed for high-throughput operations. SSI Schaefer continues to push the envelope on integrated software-driven storage management platforms, enabling seamless orchestration of racking, conveyors, and picking robotics.

Daifuku Group focuses on turnkey solutions, blending AS/RS configurations with dynamic racking modules, while Jungheinrich delivers comprehensive maintenance and repair offerings that extend system lifecycles and ensure uptime. Voestalpine and EPE International emphasize material science advancements, leveraging corrosion-resistant coatings and high-strength steel formulations to meet demanding environmental and load conditions. Across the competitive landscape, vendors are forging strategic partnerships with system integrators and technology providers to offer end-to-end solutions that address the full spectrum of design, installation, and ongoing support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Warehouse Racking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advance Storage Products, Inc.

- AR Racking S.A.

- Constructor Group AS

- Daifuku Co., Ltd.

- Dexion GmbH

- Elite Storage Solutions, Inc.

- Frazier Industrial Company

- Hannibal Industries, Inc.

- Interroll Holding AG

- Jungheinrich AG

- Kardex Holding AG

- Konstant Products, Inc.

- Mecalux S.A.

- Ridg-U-Rak, Inc.

- Schaefer Systems International, Inc.

- Spacesaver Corporation

- SSI Schäfer Gruppe

- Steel King Industries, Inc.

- UNARCO Industries LLC

Delivering a Comprehensive Set of Strategic Tactics to Optimize Warehouse Racking Flexibility, Resilience, and Sustainability

To thrive amid escalating operational complexity and policy uncertainty, industry leaders must adopt a multifaceted strategy. Prioritizing modular racking architectures allows rapid reconfiguration in response to fluctuating SKU profiles and throughput demands. Early adoption of IoT-enabled load sensors fosters predictive maintenance, minimizing unplanned downtime and extending system lifecycles. Furthermore, investing in workforce training programs ensures that staff can safely and efficiently operate sophisticated automated equipment and interpret real-time analytics dashboards.

Additionally, supply chain resilience hinges on diversifying procurement sources and establishing strategic material agreements with domestic and international steel mills. Engaging with third-party logistics partners on co-investment models can alleviate capital expenditure burdens while expanding network reach. Sustainability goals should be met by specifying recycled and locally sourced materials, complemented by energy-efficient lighting and climate control integration. Finally, proactive engagement with policymakers and trade associations can help anticipate regulatory shifts and secure advantageous positions in emerging free trade agreements, thereby mitigating tariff-related cost fluctuations.

Outlining a Robust Hybrid Primary and Secondary Research Design Ensuring Precise, Validated Insights into Warehouse Racking Trends

This research framework combines rigorous primary and secondary methodologies to ensure comprehensive market intelligence. Primary insights were gathered through structured interviews with senior logistics and facilities managers across key verticals, supplemented by in-depth discussions with racking system OEMs, distributors, and service providers. On-site facility visits provided context for system performance benchmarks, while expert panels reviewed preliminary findings to validate emerging trends.

Secondary analysis incorporated trade publications, industry white papers, and regulatory filings to map tariff evolutions and technological advancements. Proprietary databases were leveraged to track patent filings, supplier catalogs, and historical procurement patterns. Data triangulation methods cross-verified quantitative observations with qualitative expert feedback, ensuring robustness. Finally, a continuous feedback loop involving scheduled updates and client reviews maintains relevance amid rapidly changing supply chain conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Warehouse Racking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Warehouse Racking Market, by Racking Type

- Warehouse Racking Market, by Service

- Warehouse Racking Market, by End Use

- Warehouse Racking Market, by Distribution Channel

- Warehouse Racking Market, by Region

- Warehouse Racking Market, by Group

- Warehouse Racking Market, by Country

- United States Warehouse Racking Market

- China Warehouse Racking Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Reaffirming How Adaptive, Data-Driven, and Regionally Tailored Racking Strategies Propel Supply Chain Agility and Long-Term Resilience

In conclusion, warehouse racking systems have transcended their traditional roles to become dynamic enablers of supply chain excellence. The intersection of digitalization, sustainability, and policy shifts demands racking infrastructures that are modular, data-driven, and cost-effective. Segmentation by system type, end use, distribution channel, and service offering reveals nuanced requirements that must be addressed through tailored solutions.

Regional insights illuminate the diverse factors influencing adoption, from e-commerce proliferation in the Americas to smart racking integration in Asia-Pacific. Competitive analysis underscores the importance of innovation partnerships and emerging material technologies in securing market leadership. Ultimately, organizations that embrace transformative racking strategies will realize improved operational agility, reduced total cost of ownership, and strengthened resilience against external shocks.

Unlock Strategic Warehouse Racking Intelligence with Direct Access to Expert Associate Director Insights for Accelerated Growth

Embarking on the path to strategic growth and operational excellence in warehouse racking demands expert guidance and insight. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to gain an in-depth understanding of current market dynamics, technological innovations, and tariff influences shaping the industry. By securing access to the comprehensive market research report, stakeholders can make informed investment decisions, drive competitive advantage, and accelerate return on capital.

Ketan’s extensive experience in sales, marketing, and market intelligence ensures personalized consultation tailored to your organization’s unique challenges. Whether you are evaluating racking system upgrades, exploring new regional markets, or assessing supplier partnerships, this report is your definitive tool for mastering complexity and unlocking growth potential.

Connect today to transform warehouse storage strategies and stay ahead of evolving supply chain demands. Engage Ketan Rohom to discuss pricing options, customized research solutions, and timely delivery schedules designed to align with your strategic roadmap. Take this crucial step toward operational resilience and market leadership in the warehouse racking sector.

- How big is the Warehouse Racking Market?

- What is the Warehouse Racking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?