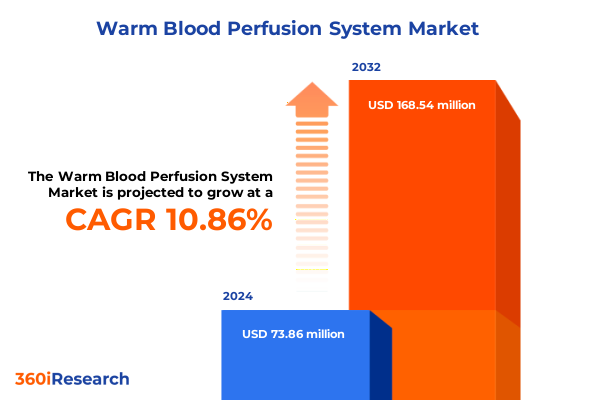

The Warm Blood Perfusion System Market size was estimated at USD 81.75 million in 2025 and expected to reach USD 90.21 million in 2026, at a CAGR of 10.88% to reach USD 168.54 million by 2032.

Exploring Breakthrough Advances in Warm Blood Perfusion Systems Transforming Organ Preservation Through Improved Viability, Functionality, and Transplant Success Rates

Warm blood perfusion systems represent a pivotal advancement in the field of organ preservation, shifting paradigms away from static cold storage toward dynamic ex vivo support. By continuously delivering nutrient-rich, oxygenated blood at physiological temperatures, these systems extend the functional viability of donor organs and enable real-time assessment of organ health. This breakthrough approach not only reduces ischemic injury but also opens new avenues for organ rehabilitation and quality enhancement prior to transplantation. As the demand for donor organs continues to outpace supply, warm blood perfusion has emerged as a critical technology to optimize utilization rates and improve post-transplant outcomes.

In recent years, clinical adoption has accelerated alongside compelling evidence demonstrating reduced incidence of primary graft dysfunction and improved short-term survival across multiple organ types. Continued research efforts into perfusate formulations, microcirculatory dynamics, and biomarker-driven monitoring are further refining system capabilities. Moreover, the shift toward personalized perfusion protocols tailored to donor and recipient profiles underscores the potential for even greater improvements in transplant success. Against this backdrop, stakeholders across clinical, research, and commercial domains are converging to drive broader access and integration of warm blood perfusion into standard transplant pathways.

Accelerating Technological and Clinical Breakthroughs Are Driving Unprecedented Growth and Innovation in Warm Blood Perfusion Systems Worldwide and Across Care Settings

The landscape of warm blood perfusion systems has undergone transformative shifts driven by technological, clinical, and regulatory milestones. Artificial intelligence–enabled monitoring platforms now integrate multi-parameter data streams from perfusate analysis and tissue oxygenation sensors, allowing predictive algorithms to forecast graft performance. This convergence of AI and perfusion has expanded the window for safe organ transportation and facilitated remote expert oversight when distance or scarce specialist availability might otherwise preclude use.

Regulatory agencies have also embraced this innovation with expedited designations and guidance frameworks that streamline clinical trials and device approvals. As a result, manufacturers are investing heavily in next-generation perfusion platforms that combine modular hardware with cloud-based analytics and telemedicine interfaces. Concurrently, the research community has deepened its focus on immunomodulatory perfusates and novel microvascular therapies, reinforcing the role of warm perfusion as not merely a preservation tool but as an active intervention to rehabilitate marginal donors.

Furthermore, patient advocacy groups and professional societies have elevated awareness of organ shortages, pressuring institutions to adopt advanced preservation to maximize donor organ use. These converging forces have generated robust investment flows, strategic partnerships, and cross-industry collaboration, marking a new era in which warm blood perfusion transitions from experimental to essential in modern transplantation practice.

Analyzing the Compound Effects of Newly Finalized Section 301 Tariffs on Cost Structures, Supply Chains, and Competitiveness of Warm Blood Perfusion Systems in the United States

In 2025, the United States Trade Representative finalized significant amendments to Section 301 tariffs that encompass a broad array of medical devices, including dynamic organ perfusion machinery. Imports originating from China classified under critical subheadings now incur additional duties of 25% on new entries effective January 1, 2025, with escalations to 50% scheduled for 2026. Moreover, this tariff regime applies to both complete systems and key components, such as perfusion pumps and oxygenators, thereby elevating landed costs for non-domestic suppliers and pressuring profit margins across the supply chain.

The cumulative impact of these duties has driven manufacturers and distributors to reevaluate sourcing strategies. Many companies are shifting production to allied markets in Europe and Southeast Asia to mitigate cost escalation and supply disruptions. At the same time, domestic production of perfusion equipment has gained momentum, fueled by government incentives aimed at strengthening critical healthcare infrastructure. This redirection has, however, introduced complexities related to quality standard alignment and regulatory compliance between divergent manufacturing locales. Consequently, original equipment manufacturers are increasingly adopting dual-sourcing models and regional hubs to balance tariff exposure with logistical efficiency and quality assurance.

Deep Dive Into Market Segmentation Based on Type, Technology, and End User Reveals Critical Opportunities and Adoption Dynamics in Warm Blood Perfusion Systems

Understanding market segmentation reveals nuanced demand patterns that inform strategic priorities for device developers and service providers. From a type perspective, systems designed for hypothermic preservation maintain organs at reduced temperatures, offering cost efficiencies and logistical simplicity, whereas normothermic solutions employ warm blood perfusion to actively sustain organ metabolism, driving adoption in high-volume transplant centers seeking superior post-transplant outcomes. These distinct modalities cater to divergent clinical protocols and budget frameworks, with many institutions deploying both to optimize case-specific needs.

Technology selection further delineates market potential: disposable cartridges simplify workflow and minimize cross-contamination risks, appealing to facilities prioritizing sterility and ease of use. In contrast, reusable systems provide lower long-term operating costs and enhanced customization for research-focused users, prompting many academic institutions and biotech firms to invest in robust, modular platforms that support experimental studies and protocol development. End user profiles also shape demand dynamics. Large hospitals leverage integrated perfusion services to support extensive transplant programs, while specialized transplant centers focus on high-acuity cases, often requiring full-service solutions encompassing equipment, training, and logistics. Research institutes, in turn, adopt both disposable and reusable perfusion technologies to advance preclinical investigations, driving innovation in perfusate composition and immunological assays.

This comprehensive research report categorizes the Warm Blood Perfusion System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- End User

Comparative Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia Pacific Highlight Varied Adoption Rates and Growth Drivers in Warm Blood Perfusion Systems

Regional dynamics in the Warm Blood Perfusion System market reflect varying healthcare infrastructures, policy environments, and clinical priorities. In the Americas, the United States leads adoption with record‐setting transplant volumes-48,149 procedures in 2024-underpinned by a mature reimbursement framework, robust organ donation network, and significant R&D investment in preservation technologies. Canada’s centralized procurement model and growing transplant capacity also contribute to rising demand, while Latin American nations focus on foundational deployments supported by international partnerships.

Europe, Middle East & Africa illustrates a heterogeneous mix of regions where regulatory harmonization across the European Union has facilitated cross‐border clinical trials and device approvals, thereby expanding market access. Eurotransplant’s allocation of 7,150 organs in 2024 exemplifies collaborative procurement initiatives that drive system uptake in member states. In Middle Eastern markets, significant government funding for healthcare modernization and the emergence of specialized transplant centers are catalyzing technology adoption, whereas many African countries concentrate on capacity-building through training programs and public–private collaborations.

The Asia‐Pacific region presents rapid growth powered by surging transplant volumes and policy reforms. China recorded 24,684 transplant surgeries in 2024, alongside 6,744 deceased organ donors, reflecting year-on-year increases of 3.3% and 4.5%, respectively, in its national commemoration event report. Meanwhile, Australia and Japan leverage advanced clinical infrastructure and regulatory support to integrate warm perfusion into emerging organ care networks. Across Asia, increasing awareness of organ shortage challenges is accelerating adoption of cutting-edge preservation solutions to improve access and outcomes.

This comprehensive research report examines key regions that drive the evolution of the Warm Blood Perfusion System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Analysis of Leading Industry Players Unveils Strategies, Collaborations, and Technological Innovations Shaping the Warm Blood Perfusion System Market

A review of leading players reveals that innovation, strategic partnerships, and targeted investments are shaping competitive positioning. TransMedics, known for its Organ Care System platform, has secured FDA approvals for heart, lung, and liver applications and expanded its National OCS Program to provide turnkey organ retrieval and logistics services. Its patented perfusion technology and integrated data analytics differentiate it as a full-service provider. XVIVO Perfusion, with a heritage in ex vivo lung preservation, continues to innovate perfusate formulations and has established global service networks through partnerships with top transplant centers.

OrganOx focuses on liver perfusion, commercializing the metra® platform to extend preservation times and restore marginal graft function. Strategic collaborations with pharmaceutical and biotech firms enable exploration of immunomodulatory perfusates and cell therapy integration. Medtronic’s entry into the perfusion market leverages its extensive distribution channels and regulatory expertise, accelerating the availability of disposable cartridges and modular perfusion units. Meanwhile, emerging startups in the United States and Europe are advancing niche solutions-such as portable microfluidic perfusion devices and specialized monitoring sensors-that promise to redefine operational flexibility and cost structures. Collectively, these companies are driving both consolidation of service offerings and diversification of technology options to meet the complex needs of modern transplant programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Warm Blood Perfusion System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Medical Co Ltd

- Bridge to Life Ltd

- EBERS Medical Technology SL

- Fresenius SE & Co KGaA

- Getinge AB

- Harvard Bioscience Inc

- LivaNova PLC

- Medtronic PLC

- Merck KGaA

- Nipro Corporation

- Organ Assist BV

- Organ Recovery Systems Inc

- OrganOx Limited

- Paragonix Technologies Inc

- Preservation Solutions Inc

- Repligen Corporation

- Sartorius AG

- Shenzhen Lifotronic Technology Co Ltd

- Spectrum Medical

- Terumo Corporation

- TransMedics Inc

- Water Medical System LLC

- XVIVO Perfusion AB

Strategic Imperatives and Best Practices for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Position in Warm Blood Perfusion Systems

To capitalize on evolving opportunities, industry leaders must adopt multifaceted strategies that align innovation with operational resilience. First, manufacturers should diversify production footprints by establishing regional manufacturing hubs to mitigate tariff exposure and supply chain volatility. Collaborative ventures with local partners can expedite market entry while ensuring compliance with regional regulatory requirements. Second, leveraging digital health platforms and AI-driven analytics will enhance system differentiation, enabling predictive perfusion management and remote support services that reduce clinical risk and strengthen value propositions.

Moreover, engaging proactively with policymakers and advocacy groups to shape reimbursement frameworks and clinical guidelines will be critical. Demonstrating clinical and economic value through real-world evidence and health economics outcomes research can accelerate payer approvals and foster broader adoption. Strategic alliances with organ procurement organizations and transplant networks will also facilitate integrated service models, combining device provision with specialized training, data management, and logistics coordination. Finally, committing resources to translational research-especially in perfusate optimization and immunomodulation-will reinforce leadership in next-generation perfusion therapies and expand indications beyond standard heart, lung, and liver applications.

Robust Research Methodology Integrating Primary Expert Interviews, Secondary Data Analysis, and Rigorous Validation Procedures Underpins Market Insights

This research integrates primary and secondary data sources to ensure comprehensive and validated market insights. Primary research commenced with in-depth interviews of key opinion leaders, including transplant surgeons, perfusion scientists, and procurement organization executives, to capture real-world use cases and technology requirements. These expert inputs informed the design of subsequent surveys targeting hospital administrators, research institute directors, and transplant center managers to quantify adoption drivers and barriers.

Secondary research leveraged authoritative databases, peer-reviewed publications, and regulatory filings to map technology trends, clinical outcomes, and policy evolutions. Trade association reports, clinical trial registries, and patent filings were analyzed to assess innovation pipelines and competitive landscapes. Data triangulation methods were employed to reconcile discrepancies between sources, enhancing the robustness of market estimates and segmentation breakdowns. Additionally, periodic consultations with an advisory panel comprising industry, clinical, and academic stakeholders ensured alignment with evolving market realities and emerging clinical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Warm Blood Perfusion System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Warm Blood Perfusion System Market, by Type

- Warm Blood Perfusion System Market, by Technology

- Warm Blood Perfusion System Market, by End User

- Warm Blood Perfusion System Market, by Region

- Warm Blood Perfusion System Market, by Group

- Warm Blood Perfusion System Market, by Country

- United States Warm Blood Perfusion System Market

- China Warm Blood Perfusion System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Converging Technological, Regulatory, and Market Forces Are Set to Propel Warm Blood Perfusion Systems Into a New Era of Organ Transplantation Excellence

The intersection of advanced engineering, clinical science, and regulatory support has positioned warm blood perfusion systems as a transformative cornerstone in the future of organ transplantation. By enabling active metabolic maintenance, real-time viability assessment, and potential organ rehabilitation, these platforms offer a paradigm shift from passive preservation to dynamic care. The rising transplant volumes, coupled with persistent organ shortages, underscore the imperative for technologies that maximize graft utilization and improve patient outcomes.

As global healthcare systems embrace AI integration, cross-border collaboration, and patient-centered value metrics, warm perfusion devices will continue evolving toward seamless, data-driven solutions. Stakeholders who actively engage in regulatory discourse, prioritize interoperable digital ecosystems, and invest in translational studies will shape the next wave of innovation. With strategic foresight and concerted industry collaboration, the promise of expanding transplant access and enhancing long-term graft survival can be realized, heralding a new standard of care in organ preservation.

Drive Strategic Growth and Secure Competitive Advantage by Consulting With Sales & Marketing Leader Ketan Rohom to Acquire the Comprehensive Market Research Report

To unlock the full depth of market intelligence, competitive benchmarking, and tailored strategies for your organization, schedule a consultation with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise spans in-depth understanding of clinical, regulatory, and commercial dynamics driving the Warm Blood Perfusion System market. By engaging with Ketan, you will gain personalized guidance on how to leverage this research to enhance your product positioning, optimize market entry tactics, and accelerate growth. Don’t miss the opportunity to access proprietary data, trend analyses, and actionable roadmaps designed to help you stay ahead in this rapidly evolving landscape. Reach out to Ketan today to purchase the comprehensive report and begin shaping the future of organ preservation technology with confidence.

- How big is the Warm Blood Perfusion System Market?

- What is the Warm Blood Perfusion System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?