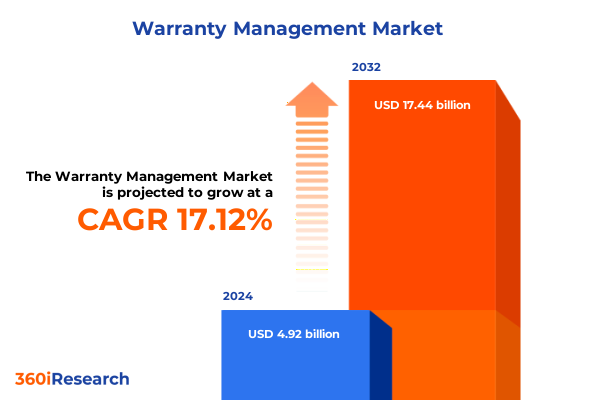

The Warranty Management Market size was estimated at USD 5.78 billion in 2025 and expected to reach USD 6.67 billion in 2026, at a CAGR of 17.07% to reach USD 17.44 billion by 2032.

Unveiling the Current Dynamics of Warranty Management with a Strategic Overview of Key Drivers Disruptions and Growth Imperatives

In an era defined by accelerating product complexity and rapidly shifting customer expectations, warranty management emerges as a critical linchpin in sustaining brand reputation and driving post-sales profitability. The contemporary warranty environment demands a seamless orchestration of technology platforms, service models, and compliance frameworks to address both evolving regulatory landscapes and heightened consumer demands for transparency and rapid resolution. By understanding the imperatives of end-to-end warranty administration-from initial claim intake to reverse logistics optimization-business leaders can leverage warranty processes as a strategic differentiator rather than a cost center. As customer lifetime value takes center stage, integrating advanced analytics and agile processes enables organizations to preemptively address failure patterns and tailor service offerings, ultimately forging deeper customer loyalty and unlocking latent revenue streams.

Moreover, technological advancements in artificial intelligence and the Internet of Things are catalyzing a paradigm shift in warranty oversight, transforming reactive claim handling into proactive risk mitigation. This transition underscores the necessity for enterprises to adopt integrated platforms capable of ingesting real-time field data, automating claim adjudication, and facilitating dynamic policy adjustments. Accordingly, stakeholders must align internal capabilities-spanning operations, IT, and customer care-to capitalize on this transformative wave. The ensuing sections delve into the critical drivers, structural shifts, and actionable frameworks that collectively chart the future of warranty management.

Examining the Fundamental Evolutionary Shifts Redefining Warranty Management Practices Across Technology Policy and Customer Experience Frontiers

The warranty management landscape is undergoing fundamental recalibration driven by disruptive technological, regulatory, and customer-centric forces. As enterprises confront mounting pressures to enhance operational efficiency and deliver exceptional user experiences, digital platforms are swiftly replacing manual processes. Seamless integration of cloud-native architectures and scalable microservices now underpins modern warranty ecosystems, enabling real-time visibility into asset performance and claim statuses. In parallel, the proliferation of connected devices within the Industrial Internet of Things ecosystem has amplified the volume and velocity of data, compelling organizations to invest in robust analytics capabilities and machine learning algorithms. These investments facilitate predictive maintenance, automated decision-making, and continuous improvement loops that enhance both cost efficiency and customer satisfaction.

In addition to technological evolution, regulatory shifts are reshaping warranty obligations and reporting requirements across geographies. Stricter consumer protection statutes and enhanced warranty disclosure mandates necessitate agile compliance frameworks that can adapt to region-specific guidelines. Consequently, firms are reevaluating policy structures and streamlining documentation workflows to mitigate legal exposure while preserving service quality. Customer expectations further intensify these imperatives as buyers increasingly demand omnichannel support, transparent claim processes, and value-added service extensions. As a result, organizations are forging strategic partnerships with specialized service providers and technology vendors to deliver end-to-end warranty solutions that are both scalable and resilient to future disruptions. Through this multifaceted transformation, warranty management is evolving from a back-office function into a dynamic, growth-oriented discipline poised to drive competitive advantage.

Assessing the Compounded Effects of United States 2025 Tariff Measures on Warranty Management Cost Structures Supply Chains and Compliance Strategies

The introduction of new tariff measures by the United States in 2025 exerts a cascading impact on warranty management operations across multiple dimensions. Elevated import duties on critical components drive up procurement costs and introduce volatility into supply chain planning, compelling organizations to reassess supplier contracts and develop contingency sourcing strategies. As these cost pressures mount, businesses face the dual challenge of preserving service levels while absorbing or passing through additional expenses. This dynamic influences warranty reserve calculations and underscores the importance of real-time financial modeling within claims management platforms.

Furthermore, the tariffs amplify the strategic significance of localized sourcing and near-shoring initiatives. Enterprises are increasingly scrutinizing regional supplier ecosystems to reduce exposure to trade policy fluctuations and minimize lead times. This shift not only bolsters supply chain resilience but also affects repair and replacement logistics, as parts availability and transit windows become more predictable. The emerging emphasis on supply chain diversification necessitates tighter collaboration between procurement, operations, and warranty teams to synchronize inventory management, claim fulfillment, and reverse logistics processes.

From a compliance perspective, the new tariff regime heightens the complexity of cross-border warranty obligations. Differing regional tax treatment, customs documentation, and duty exemptions for warranty replacements demand enhanced data integration between enterprise resource planning systems and warranty management platforms. Organizations that fail to adapt risk escalated administrative burdens and prolonged claim turnaround times. Accordingly, forward-thinking firms are embedding tariff tracking modules and automated duty calculations into their warranty workflows. By doing so, they can safeguard margin integrity while ensuring regulatory adherence and maintaining a superior customer experience amidst an increasingly complex trade environment.

Discerning Critical Segmentation Insights to Illuminate Service Software Deployment Organization Warranty and Industry Dimensions Shaping Market Dynamics

Deeper insights emerge when the warranty management market is dissected across the lenses of solution, deployment, organizational scale, warranty type, end-user vertical, and distribution channel. Within solution frameworks, professional services encompass consulting initiatives that define warranty policy and integration engagements that link systems, alongside support offerings that sustain ongoing operations. Parallel software components deliver advanced analytics for claim trend identification, claims management modules that automate adjudication workflows, and contract management capabilities that ensure policy compliance and audit readiness. Transitioning to deployment considerations, cloud-hosted solutions provide elastic scalability and rapid updates, whereas on-premise implementations-available under both perpetual licensing models and subscription-based agreements-offer tighter data control and tailored customization.

Organization size significantly influences solution adoption and complexity thresholds, with large enterprises typically demanding multi-tiered, global warranty platforms capable of supporting high transaction volumes and diverse regulatory requirements. In contrast, small and midsized businesses prioritize cost-effective configurations that streamline workflows and improve time-to-value. Warranty type segmentation reveals distinct service requirements for extended warranties that augment initial coverage, manufacturer warranties that bear direct brand responsibility, and retailer warranties that function as third-party service extensions. End-user industries further refine demand patterns: the automotive sector emphasizes uptime management and telematics-driven warranty orchestration, electronics and semiconductor players seek rapid replacement cycles to mitigate product obsolescence, healthcare providers require strict quality assurance protocols for mission-critical equipment, and industrial end users demand comprehensive performance analytics to optimize asset utilization. Distribution channels shape delivery strategies as well, with direct engagements fostering brand controlled experiences and indirect pathways leveraging dealer networks, authorized service centers, and partner ecosystems to maximize reach.

This comprehensive research report categorizes the Warranty Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution

- Deployment

- Organization Size

- Warranty Type

- End User Industry

Analyzing Regional Variations to Highlight Distinct Warranty Management Trends Opportunities and Challenges Across Americas EMEA and Asia Pacific

Regional landscapes exhibit pronounced differences affecting warranty management strategies and investment priorities. In the Americas, mature markets prioritize digital transformation investments in integrated cloud platforms and advanced analytics engines to handle high claim volumes and unified regulatory frameworks. North American enterprises, in particular, drive innovation through cross-industry collaborations and shared service models, whereas Latin American players focus on fundamental system upgrades and dealer network optimization to improve service availability.

Europe, Middle East and Africa regions present a mosaic of regulations and consumer protections, prompting multinational corporations to deploy modular warranty solutions that can adapt to country-specific rules. Western European markets emphasize sustainability and circular economy principles, integrating reverse logistics and refurbished parts programs into warranty operations. Meanwhile, Gulf Cooperation Council countries explore warranty extensions tied to rapid digital onboarding initiatives, and African markets concentrate on improving service infrastructure through strategic partnerships with local providers.

Asia-Pacific dynamics vary from advanced economies implementing predictive maintenance solutions based on IoT data to emerging markets prioritizing cost-efficient claim processing systems capable of operating in low-bandwidth environments. Japan and South Korea lead in robotic automation for repair centers, Australia invests heavily in cloud security and data privacy within warranty platforms, and Southeast Asian players leverage hybrid deployment models to balance regulatory compliance with technological agility. These regional distinctions guide solution providers as they tailor offerings, investment roadmaps, and partnership strategies to local market nuances.

This comprehensive research report examines key regions that drive the evolution of the Warranty Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Approaches and Competitive Positioning of Leading Solution Providers Driving Innovation in Warranty Management Technology and Services

Competitive positioning among leading warranty management vendors revolves around technological differentiation, end-to-end service portfolios, and strategic alliances. Established enterprise software firms continue to expand their footprint by acquiring niche analytics startups and integrating claim automation engines, thereby strengthening the depth and breadth of their solution suites. Concurrently, specialist service providers differentiate through highly customized consulting engagements, delivering rapid implementation and local support capabilities that resonate with clients seeking hands-on guidance.

Furthermore, emerging technology entrants are harnessing artificial intelligence and machine learning to introduce autonomous claim adjudication, anomaly detection, and natural language processing features that streamline customer interactions and reduce operational costs. Strategic partnerships between hardware manufacturers and software vendors also gain prominence, as they enable seamless data flow from field devices into warranty platforms, fostering real-time monitoring and proactive risk mitigation. In addition, vendor ecosystems are increasingly adopting open architecture principles, facilitating third-party integrations with enterprise resource planning, customer relationship management, and supply chain systems to deliver holistic value propositions.

End-user feedback loops drive continuous improvement among top players, with regular product updates, user forums, and benchmark studies informing roadmap priorities. This ongoing dialogue not only accelerates feature innovation but also fosters trust and long-term collaboration. As competition intensifies, leading companies invest in global delivery centers, multilingual support teams, and regional compliance expertise to solidify market share and cultivate differentiated customer experiences across diverse industry segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Warranty Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-1 Enterprise, Inc.

- Capterra

- Evia Information Systems Pvt. Ltd

- Holostik Group India

- IFS AG

- Industrial and Financial Systems (IFS) AB

- Infosys Limited

- InsightPro

- Intellinet Systems

- International Business Machines Corporation

- iWarranty

- ManageEngine by ZOHO Corp.

- NeuroWarranty

- OnPoint Warranty Solutions, LLC

- Optimum Info

- Pegasystems Inc.

- Porch Group, Inc.

- PTC Inc.

- SAP SE

- SiteOne Services Inc.

- Syncron Holding AB

- Tata Consultancy Services Limited

- Tavant Technologies, Inc.

- Tech Mahindra Limited

- Wipro Limited

Formulating Strategic Roadmaps with Targeted Actionable Recommendations to Optimize Warranty Management Operations and Strengthen Market Leadership

To convert insights into tangible outcomes, industry leaders should prioritize a phased modernization roadmap that aligns key stakeholders and allocates resources against high-impact initiatives. Initially, executives must secure cross-functional buy-in by articulating the total economic value of warranty optimization, reinforcing how enhanced claim accuracy, reduced processing times, and improved reverse logistics deliver measurable ROI. Subsequently, a proof-of-concept deployment focusing on predictive analytics can validate data readiness and identify anomalies before full-scale implementation.

Next, organizations should establish governance frameworks that assign clear accountability for data stewardship, process compliance, and performance metrics. This approach ensures continuous monitoring and alignment with evolving regulatory mandates. Parallel investments in talent development-through specialized training programs and center-of-excellence formations-will cultivate the requisite skills to manage advanced warranty platforms and interpret analytic outputs effectively. In addition, forging strategic supplier partnerships and entering collaborative innovation forums can expedite technology adoption and surface new use cases, such as telematics-enabled service orchestration or blockchain-backed contract management.

Ultimately, decision-makers must adopt an iterative mindset that incorporates ongoing performance reviews and agile course corrections. By embedding warranty insights into broader digital transformation agendas-encompassing customer experience, product design, and supply chain resilience-organizations can unlock sustainable competitive advantage and position warranty management as a strategic growth lever rather than a reactive burden.

Detailing the Rigorous Research Methodology Employed to Ensure Robust Data Integrity Comprehensive Analysis and Industry Validation in This Study

This study employs a robust mixed-methods research design to ensure comprehensive coverage and data integrity. Primary research encompasses in-depth interviews with senior executives, warranty program managers, and technology architects across multiple industries, providing firsthand perspectives on emerging trends, operational challenges, and technology adoption drivers. These qualitative insights are complemented by structured surveys targeting a statistically significant sample of mid- to large-sized enterprises, capturing quantitative data on process efficiencies, technology budgets, and service level performance metrics.

Secondary research leverages publicly available corporate documents, industry white papers, regulatory filings, and patent databases to triangulate findings and validate market developments. In addition, solution provider collateral and case studies inform best practices and implementation benchmarks. The research team applies rigorous data normalization and trend-validation techniques, supported by iterative workshop sessions with external subject-matter experts to identify potential gaps and refine analytical assumptions. Finally, a multi-stage review process involving internal quality control and external peer validation ensures that the final deliverables meet the highest standards of accuracy, relevance, and actionable insight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Warranty Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Warranty Management Market, by Solution

- Warranty Management Market, by Deployment

- Warranty Management Market, by Organization Size

- Warranty Management Market, by Warranty Type

- Warranty Management Market, by End User Industry

- Warranty Management Market, by Region

- Warranty Management Market, by Group

- Warranty Management Market, by Country

- United States Warranty Management Market

- China Warranty Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Findings and Strategic Implications to Provide a Clear Path Forward for Stakeholders in the Warranty Management Ecosystem

By synthesizing the critical drivers, structural transformations, and actionable frameworks outlined in this executive summary, stakeholders gain a holistic understanding of warranty management’s evolving role in the enterprise value chain. Embracing digital platforms and advanced analytics enables organizations to shift from reactive claim processing to proactive maintenance and risk mitigation, unlocking new tiers of customer satisfaction and financial performance. The deep dive into segmentation reveals the nuanced requirements of different solution categories, deployment models, organizational scales, warranty types, end markets, and distribution channels, ensuring that decision-makers adopt strategies finely tuned to their specific operational context.

Moreover, the analysis of regional dynamics and corporate strategies underscores the importance of localized solution design, strategic partnerships, and continuous innovation to sustain competitive differentiation. The recommended roadmap provides clear guidance on stakeholder alignment, governance structures, and capability building, setting a course for successful modernization and growth. Ultimately, this executive summary serves as a strategic compass, equipping industry leaders with the insights and recommendations needed to transform warranty management from a cost center into a strategic asset that underpins product excellence, customer loyalty, and long-term business resilience.

Engage Expert Sales Leadership for Comprehensive Market Insights and Partnership Opportunities to Unlock Next Generation Warranty Management Solutions

To secure unparalleled access to in-depth insights and strategic guidance in the warranty management domain, reach out to Ketan Rohom Associate Director, Sales & Marketing at 360iResearch for personalized consultation and report procurement. Engage with expert sales leadership to explore tailored licensing options, custom research add-ons, and bulk acquisition packages designed to align with your organizational objectives. Connect today to unlock actionable data, comparative vendor benchmarks, and forward-looking scenario analyses that will empower your teams to develop resilient warranty programs and sustain competitive advantage.

- How big is the Warranty Management Market?

- What is the Warranty Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?