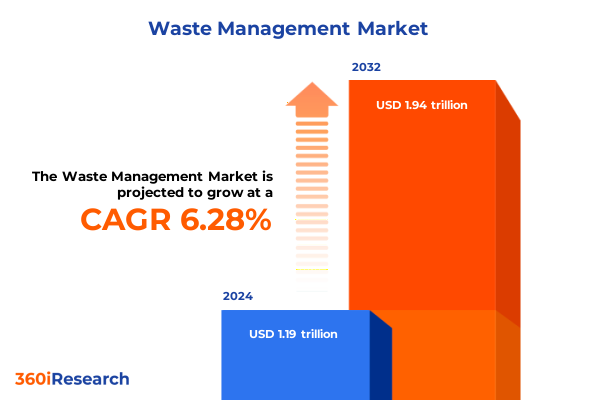

The Waste Management Market size was estimated at USD 1.27 trillion in 2025 and expected to reach USD 1.34 trillion in 2026, at a CAGR of 6.27% to reach USD 1.94 trillion by 2032.

Navigating the Dynamic Waste Management Market: Emerging Drivers, Regulatory Shifts, and Sustainability Imperatives Shaping Industry Transformation

The waste management industry is experiencing an unprecedented convergence of challenges and opportunities, propelled by escalating urban populations and intensifying regulatory demands. Across emerging and mature markets alike, stakeholders are grappling with surging waste volumes-reaching 263 million tons in regions such as the Gulf Cooperation Council-while striving to maintain system integrity and environmental compliance. Simultaneously, technological advances in artificial intelligence, including robotic sorting and machine learning for predictive maintenance, are redefining operational paradigms and unlocking efficiency gains of up to 55% in some municipalities.

Against this backdrop, the rise of circular economy principles has shifted the industry focus from end-of-pipe disposal to closed-loop resource recovery. Extended Producer Responsibility mandates and growing consumer demand for transparent recycling streams are driving service providers to integrate material reuse schemes and to collaborate closely with manufacturers on eco-design initiatives. Moreover, the deployment of Internet of Things solutions for real-time bin monitoring and route optimization is reducing operational costs by 20% in select urban centers, underscoring the transformative power of data-driven decision-making.

In light of these forces, cross-sector partnerships are emerging as a crucial vector for growth and resilience. Technology innovators, logistics specialists, and waste treatment operators are forging alliances to develop advanced sorting facilities, waste-to-energy plants, and decentralized processing hubs that bridge urban demand with rural resource streams. As the industry enters this era of converging drivers-sustainability, digitalization, and regulatory complexity-it is imperative for decision-makers to understand foundational shifts, anticipate policy impacts, and craft strategies that embrace both environmental stewardship and commercial viability.

From Linear to Circular: Digitalization, Circular Economy and Collaborative Ecosystems Transforming Waste Management Operations at Scale

The waste management sector is undergoing fundamental transformations driven by the integration of cutting-edge technologies and evolving stakeholder expectations. Artificial intelligence applications, from computer vision–enabled robotic sorters to predictive maintenance algorithms, are enhancing material recovery rates and operational uptime across material recovery facilities. Concurrently, Internet of Things networks of smart bins equipped with ultrasonic sensors are delivering real-time fill-level data, streamlining collection schedules, and cutting fuel consumption, thus aligning environmental targets with cost reduction goals.

In parallel, circular economy initiatives have gained unprecedented momentum, pushing waste and recycling companies to transition from service contractors to strategic data partners in closed-loop systems. Stakeholders are implementing modular product designs to facilitate easier disassembly and recycling, while waste-to-energy advancements are converting post-recycling residuals into renewable power sources, amplifying both resource efficiency and revenue diversification. Regulatory landscapes are also intensifying, with Extended Producer Responsibility frameworks compelling manufacturers to assume a greater share of end-of-life treatment costs, thereby fueling deeper collaborations between brands and recycling operators.

These shifts are further accentuated by the rise of multi-stakeholder alliances that transcend traditional industry boundaries. Logistics providers, software developers, and environmental service firms are co-investing in regional composting networks, anaerobic digestion complexes, and decentralized processing hubs that enable scalable resource recovery. As waste management ecosystems embrace digital platforms, smart infrastructure, and circularity principles, industry leaders must recalibrate business models to harness synergies, optimize material flows, and secure long-term competitive advantage.

Assessing the Ripple Effects of 2025 United States Tariffs on Waste Streams, Recycling Economics, and Cross-Border Trade Dynamics

In 2025, the United States implemented a series of tariffs aimed at bolstering domestic manufacturing by imposing a 25% levy on steel and aluminum imports and a 10% charge on select goods from China. These measures have elevated domestic aluminum premiums to record highs, driving recyclers to aggressively compete for rising scrap volumes, which surged more than 30% in early 2025 compared to the prior year. At the same time, the Recycled Materials Association has warned that such tariffs risk undermining recycling operations, noting that 25% duties on Canadian and Mexican recyclables and 10% on Chinese materials could disrupt manufacturing inputs and threaten 500,000 jobs supported by the sector.

Cross-border waste flows, an integral component of North American recycling, have encountered mounting friction as equipment and disposal costs escalate. Proposed increases in landfill tipping fees from $0.36 to $5.00 per ton in Michigan, combined with tariff-driven spikes in recycling machinery prices, are creating budgetary strains for Canadian operators relying on U.S. infrastructure. These dynamics are prompting industry stakeholders to reassess supply chains, lobbying for tariff exemptions on recycled materials and equipment components to preserve the economic viability of sustainability programs.

Moreover, volatility in global recycling markets is intensifying price swings across key streams. Paper and cardboard, where North American imports account for nearly one-third of supply, face potential cost rebounds as tariffs on neighboring suppliers threaten established trade flows. Metals, which constitute 40% of U.S. scrap exports, could see domestic oversupply and depressed prices if trading partners retaliate, while plastics tariffs may further erode competitiveness of recycled resin against lower-cost virgin alternatives. These cumulative effects underscore the urgent need for policy clarity, infrastructure investments, and collaborative trade solutions that balance industrial objectives with environmental ambitions.

Unveiling Critical Market Segments: Service, Waste Streams, Users, and Disposal Techniques Driving Tailored Solutions in Waste Management

Insights into service-based segmentation reveal that traditional collection models, encompassing curbside pickup and drop-off hubs, remain foundational to urban and suburban waste strategies. While curbside services continue to capture the majority of residential waste volumes, the rise of community-based drop-off stations is enabling targeted resource recovery, especially for materials that require specialized handling. In recycling operations, distinct streams for glass, metal, paper, and plastic underscore material-specific value chains, with PET and HDPE plastics experiencing the most rapid adoption of closed-loop processing due to stable commodity pricing and robust end-market demand. Concurrently, treatment and disposal infrastructures-including anaerobic digestion, composting, incineration, and engineered landfills-are increasingly integrated into holistic service offerings that optimize environmental outcomes and regulatory compliance.

When examining waste typologies, electronic waste from consumer electronics and electrical equipment is driving investment in safe handling and precious metal recovery, while hazardous streams-comprising biomedical and chemical wastes-demand stringent protocols and licensed facilities. Industrial waste, spanning agricultural residues, chemical by-products, and construction and demolition debris, is fueling demand for customized processing solutions that reconcile volume efficiencies with environmental safeguards. The medical waste segment’s focus on pathological, pharmaceutical, and sharps disposal underscores the interplay between public health imperatives and operational risk management for service providers.

End-user segmentation across commercial, industrial, infrastructure, and residential markets is shaping tailored service delivery models. Healthcare facilities, hospitality venues, and retail centers require high-frequency pickups and specialized recycling programs, whereas automotive, manufacturing, and pharmaceutical industries emphasize hazardous management, circular material recovery, and energy-from-waste solutions. Infrastructure clients, including rail, road, and utilities, demand large-scale logistics and asset management, while residential services must balance multi–family housing units’ bulk collection needs with single-family curbside expectations. Disposal technique categorizations-ranging from anaerobic digestion and composting (aerobic and vermicomposting) to incineration methods such as mass burn and refuse-derived fuel, as well as landfill capacity and emerging pyrolysis technologies-enable precise alignment of client requirements with environmental performance targets.

This comprehensive research report categorizes the Waste Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Waste Type

- Disposal Technique

- End User

Key Regional Dynamics Shaping Waste Management Growth and Innovation Across the Americas, EMEA, and Asia-Pacific Markets

In the Americas, market maturity is characterized by advanced regulatory frameworks, high recycling penetration, and expanding waste-to-energy infrastructures. The United States leads in landfill gas–to–renewable natural gas projects, exemplified by San Antonio’s initiative converting methane into fuel for over 400 transit buses, reducing CO₂ emissions by up to 85% and demonstrating scalable energy partnerships. Canada’s robust cross-border trade with U.S. landfills and treatment centers further illustrates the region’s interconnected waste ecosystem, though rising tariffication and infrastructure costs are compelling operators to explore domestic processing enhancements.

Europe, the Middle East, and Africa (EMEA) reflect a diverse spectrum of waste management maturity and regulatory environments. The European Union’s circular economy package and Basel Convention alignment are driving stringent waste export controls and ambitious landfill diversion goals, prompting heightened surveillance of scrap metal trades to secure domestic supplies amid global tariffs. Middle Eastern nations are investing in large-scale waste-to-energy and recycling infrastructures, while African markets are prioritizing municipal solid waste collection expansion and informal sector integration to address rapid urban population growth.

Asia-Pacific markets, spanning mature economies and emerging hubs, are witnessing accelerated adoption of Extended Producer Responsibility schemes and digital waste tracking platforms. Japan’s Circular Society framework and 3Rs legislation have achieved recycling rates approaching 80%, yet require further innovation to meet 2030 targets, while South Korea’s systemic, technology-driven EPR approaches are strengthening plastics circularity. In Southeast Asia, countries such as Singapore, Vietnam, and Indonesia are implementing EPR regulations and deposit return schemes to bolster collection rates and enhance material recovery, signaling a region-wide pivot toward sustainability.

This comprehensive research report examines key regions that drive the evolution of the Waste Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating Competitive Terrain: In-depth Perspectives on Key Waste Management Industry Players’ Strategies, Innovations, and Performance

Waste Management Inc. continues to lead through automation and renewable energy investments, planning to eliminate 5,000 jobs by 2026 while deploying automated side loaders and robotics to improve safety and reduce attrition in its fleet operations. Concurrently, the company is allocating $3 billion through 2026 to expand landfill gas capture facilities and build next-generation recycling plants, reinforcing its position at the nexus of waste disposal and energy generation.

Republic Services is distinguishing itself through circular innovations, from landfill-derived RNG fueling San Antonio’s public transit to the rollout of “Thor” composting systems at commercial venues in California’s Otay Sustainability Park, effectively diverting organics from landfills and meeting state-mandated methane-reduction targets. Its strategic investments in polymer centers for advanced plastics recycling and an aggressive M&A pipeline are furthering its goal of expanding recovery volumes by 40% by 2030, while electrification and RNG integration bolster its sustainability credentials.

Veolia’s "GreenUp" strategic program for 2024–2027 is accelerating ecological transformation with €4 billion in growth investments, prioritizing decarbonization, water technologies, and hazardous waste treatment as core boosters. Its landmark biogas upgrading contract in San Francisco exemplifies a circular approach-converting wastewater byproducts into pipeline-quality RNG sufficient to power 3,800 homes-while digital solutions underpin predictive maintenance and operational optimization across its global asset base.

SUEZ is advancing circular solutions through significant R&D and digital innovation, doubling budgets for waste recovery research and scaling AI-driven sortation platforms that have increased sorting performance by 20% at pilot facilities. Its investments in Digelis®+ compact anaerobic digesters and Qualiwaste AI characterisation tools underscore a commitment to maximizing energy recovery from waste streams and enhancing resource efficiency in urban environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Waste Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Disposal Services, Inc.

- Biffa plc

- Casella Waste Systems, Inc.

- Clean Harbors, Inc.

- Cleanaway Waste Management Limited

- Covanta Holding Corporation

- GFL Environmental Inc.

- Heritage Environmental Services, LLC

- Hitachi Zosen Corporation

- Progressive Waste Solutions Ltd.

- Remondis SE & Co. KG

- Renewi plc

- Republic Services, Inc.

- Stericycle, Inc.

- SUEZ S.A.

- Texas Disposal Systems, Inc.

- Urbaser S.A.U.

- Veolia Environnement S.A.

- Waste Connections, Inc.

- Waste Management, Inc.

Actionable Strategies for Industry Leaders to Drive Digital Adoption, Forge Circular Partnerships, and Optimize Regional Opportunities

Industry leaders should prioritize comprehensive digital transformation initiatives to unlock operational efficiencies and data-driven insights. By integrating AI-powered sorting systems, predictive maintenance platforms, and IoT-enabled asset monitoring, organizations can significantly reduce downtime, optimize routing, and enhance material recovery rates-strategies proven to deliver efficiency gains exceeding 50% in pilot deployments. Such investments not only elevate cost-effectiveness but also position companies to meet evolving regulatory requirements for traceability and reporting.

Circular economy partnerships remain essential for driving sustainable growth and mitigating supply chain risks. Service providers are advised to forge collaborations with manufacturers and logistics specialists to establish closed-loop product take-back programs and develop waste-to-resource hubs. Simultaneously, active engagement in policy advocacy-seeking tariff exemptions on recycled materials and promoting incentives for domestic processing-will be critical to safeguarding the financial viability of recycling operations amid shifting trade landscapes.

Strategic alignment with regional priorities can unlock new market opportunities. In high-growth Asia-Pacific jurisdictions, compliance with emerging EPR frameworks and participation in deposit return schemes will yield competitive differentiation. In Americas and EMEA, expanding landfill gas capture and investing in modular composting infrastructures offer resilient revenue streams. Leaders should segment offerings according to client profiles-customizing collection frequencies, processing techniques, and value-added services for healthcare, retail, industrial, and infrastructure clients-to maximize service adoption and retention.

Finally, a robust talent and change management strategy will underpin successful transformation. Companies must cultivate digital skills through targeted training, foster a culture of innovation, and engage frontline teams in continuous improvement initiatives. By marrying technological advancements with human expertise, organizations will be better equipped to navigate complexity, accelerate sustainability agendas, and secure long-term competitive advantage.

Comprehensive Research Methodology Leveraging Secondary Analysis, Primary Insights, and Data Triangulation to Ensure Robust and Actionable Findings

The research methodology underpinning this executive summary combined rigorous secondary research, targeted primary engagements, and comprehensive data triangulation to ensure accuracy and relevance. Secondary sources encompassed authoritative industry publications, peer-reviewed articles, regulatory filings, and reputable news outlets, providing a panoramic view of market dynamics, technological innovations, and policy developments.

Primary insights were garnered through in-depth interviews with sector executives, technology providers, and policy experts, supplemented by survey responses from waste management professionals across diverse geographies. This approach enabled nuanced understanding of operational challenges, investment priorities, and emerging business models.

To enhance the robustness of findings, data triangulation techniques were applied, cross-referencing quantitative metrics with qualitative inputs and scenario analysis. Segment-specific mappings leveraged proprietary frameworks to align service models with waste streams, end-user requirements, and disposal techniques.

Quality assurance measures included iterative peer reviews by domain specialists and validation workshops with select client stakeholders, ensuring that the final deliverables reflect both strategic foresight and practical applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Waste Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Waste Management Market, by Service Type

- Waste Management Market, by Waste Type

- Waste Management Market, by Disposal Technique

- Waste Management Market, by End User

- Waste Management Market, by Region

- Waste Management Market, by Group

- Waste Management Market, by Country

- United States Waste Management Market

- China Waste Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesis of Strategic Insights Highlighting Imperatives for Digital Innovation, Circular Integration, and Policy Resilience in Waste Management Industry Growth Metrics Across Segments and Geographies

As environmental imperatives, regulatory complexities, and technological advancements converge, the waste management industry stands poised at a critical inflection point. Embracing digital innovations-AI, IoT, and advanced analytics-will be paramount to unlocking efficiency and transparency across end-to-end operations. Concurrently, circular economy principles and strategic alliances will drive new value-creation pathways, from energy recovery to material repurposing.

Navigating the nuanced impacts of 2025 tariffs requires proactive policy engagement and supply chain resilience measures, ensuring that recycling and composting programs remain economically viable. Tailored segmentation strategies and regional market alignments will further reinforce competitive positioning, enabling service providers to meet diverse end-user needs while advancing sustainability targets.

By integrating these insights into strategic planning, industry leaders can transcend traditional service models to deliver holistic waste-to-resource solutions, fostering both environmental stewardship and profitable growth in an era defined by change and opportunity.

Unlock Exclusive Insights and Propel Your Organization’s Waste Management Strategy Forward with Expert Market Research

Take the next step toward market leadership by securing your comprehensive waste management report. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored insights, discuss your business objectives, and access exclusive analysis that will empower your decision-making.

Contact Ketan Rohom today to transform insights into impact and drive your organization to new heights in sustainability and profitability.

- How big is the Waste Management Market?

- What is the Waste Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?