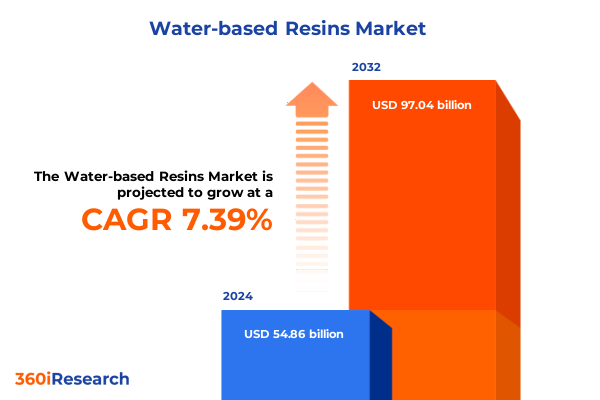

The Water-based Resins Market size was estimated at USD 58.56 billion in 2025 and expected to reach USD 62.52 billion in 2026, at a CAGR of 7.63% to reach USD 98.04 billion by 2032.

Introduction to the Emergence of Water-Based Resins as the Cornerstone of Eco-Conscious Coatings Adhesives and Industrial Applications Worldwide

The transition toward water-based resins represents a pivotal shift in the coatings, adhesives, and industrial materials landscape as environmental imperatives and regulatory mandates intensify globally. Driven by stringent air quality standards and consumer preferences for low-emission solutions, companies are abandoning traditional solvent-based formulations in favor of waterborne alternatives that significantly reduce volatile organic compound emissions. Water-based systems can lower VOC content by as much as eighty percent compared to their solvent-based counterparts, mitigating health and environmental risks associated with long-term exposure and atmospheric pollution.

Regulatory agencies worldwide are reinforcing this transformation through targeted legislation. In the United States, the Environmental Protection Agency limits VOC levels in industrial and architectural coatings, while European frameworks such as the EU Ecolabel, REACH directives, and national emissions targets have established binding thresholds for paints, coatings, and adhesives. As a result, water-based resins have emerged from niche applications into mainstream adoption across automotive, construction, furniture, packaging, textile, and printing sectors.

How Regulatory Imperatives Technological Breakthroughs and Market Dynamics Are Redefining the Water-Based Resin Landscape

The water-based resin industry is undergoing a profound transformation fueled by converging technological advancements, evolving regulatory pressures, and shifting market dynamics. Innovations in polymer chemistry have produced hybrid waterborne formulations that rival solvent-based resins in terms of adhesion, durability, and chemical resistance. Recent breakthroughs in emulsion stabilization and crosslinking mechanisms have enabled manufacturers to offer performance characteristics previously considered unattainable in waterborne systems.

Simultaneously, regulatory intensity continues to escalate. In regions such as North America and Europe, new air quality standards and product labeling requirements are compelling producers to reformulate existing product lines and accelerate new product development. These regulatory imperatives are complemented by voluntary sustainability commitments from leading corporations, which are embedding low-VOC and water-based technologies into their procurement policies. Collectively, these shifts are redefining competitive positioning, with companies that can rapidly innovate and comply gaining decisive advantages.

Analyzing the Multifaceted Impact of 2025 U.S. Trade Tariffs on Supply Chains Raw Material Costs and Resin Market Dynamics

The 2025 wave of U.S. trade tariffs has introduced complex challenges for supply chains, raw material costs, and resin market dynamics. Beginning in early 2025, a 25 percent duty on chemical imports from Mexico and Canada and a 10 percent tariff on select products from China has increased input costs for resin manufacturers, even as exemptions for bulk chemicals such as polyethylene and ethylene have provided limited relief to core feedstocks. At the same time, countervailing duties imposed on epoxy resin imports from China, levied at a significant rate following a Department of Commerce determination in April 2025, have added uncertainty to procurement strategies and pricing models.

These measures have driven short-term volatility across the resin spectrum. In the epoxy segment, import offers for liquid resins from Northeast Asia have occasionally undercut domestic pricing, while solid resin imports remain subject to residual duties and constrained supply, causing buyers to defer orders amid unclear price trajectories. Meanwhile, multinational chemical exporters, including those in Brazil, have experienced contract cancellations and financing challenges as U.S. buyers preemptively adjust sourcing decisions in anticipation of tariff enforcement. As a result, U.S. producers are recalibrating supply routes, diversifying feedstock sources, and exploring domestic alternatives to maintain continuity and mitigate cost pressures.

Uncovering Critical Insights Across Resin Type Application and Product Form Dimensions Driving Innovation and Strategic Priorities

Analysis across multiple dimensions reveals nuanced insights into how resin type, application, and product form are shaping competitive advantages and investment priorities. Within resin types, acrylics and polyurethanes continue to command widespread adoption for their balance of performance and environmental compliance, while specialty chemistries such as silicone and phenolic resins are gaining traction in high-temperature and corrosion-resistant applications, reflecting a trend toward formulation diversification to meet stringent end-use requirements. Epoxy resins remain pivotal in advanced coatings and composite technologies, despite tariff-driven supply uncertainties.

This comprehensive research report categorizes the Water-based Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Product Form

- Technology

- Application

Evaluating Regional Market Dynamics Across the Americas EMEA and Asia-Pacific That Shape Water-Based Resin Demand and Growth Trajectories

Regional market dynamics reflect the interplay of economic development, regulatory frameworks, and end-use demands across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust infrastructure projects and a growing focus on green building standards are driving the use of waterborne coatings and construction admixtures. Within North America, strategic investments in domestic manufacturing and the reinvention of circularity platforms are strengthening supply chains to offset tariff-induced disruptions.

This comprehensive research report examines key regions that drive the evolution of the Water-based Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Industry Movements Highlighting Innovation Collaborations and Competitive Positioning in Water-Based Resins

Global and regional players are actively refining their portfolios and forging collaborations to enhance their waterborne resin capabilities. Allnex, with its extensive manufacturing footprint and targeted R&D centers, remains at the forefront of industrial coating resins, investing in advanced crosslinkers and specialty additives to meet bespoke performance needs. Covestro has introduced new waterborne UV and high-performance industrial coatings for wood and building substrates, underscoring its commitment to eco-efficient solutions. Westlake’s Azures product line blends epoxies, modifiers, and curing agents free of restricted substances, reflecting rising demand for sustainable and high-durability formulations. Arkema’s acquisitions and launches in sustainable acrylic binders for battery applications further demonstrate how leading companies are extending waterborne chemistries into adjacent growth markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Water-based Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AkzoNobel N.V.

- Allnex GMBH

- Arkema S.A.

- BASF SE

- Celanese Corporation

- China Petrochemical Corporation

- Covestro AG

- DAIKIN INDUSTRIES, Ltd.

- DIC CORPORATION

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- H.B. Fuller Company

- Hexion Inc.

- Huntsman International LLC

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- PPG Industries, Inc.

- Saudi Arabia's Basic Industries Corporation

- Sika AG

- Solvay S.A.

- Synthomer PLC

- The Dow Chemical Company

- The Lubrizol Corporation

- The Sherwin-Williams Company

- TOYOCHEM CO., LTD.

Actionable Strategic Recommendations to Navigate Supply Risks Optimize Performance and Accelerate Sustainable Growth in Water-Based Resins Sector

Industry leaders should pursue strategic actions to fortify their positions amid evolving market conditions. Proactively diversifying feedstock sources and securing long-term supply agreements will help counteract tariff-related cost spikes and ensure production stability. Investing in R&D to refine hybrid resin formulations and enhance performance metrics can close remaining performance gaps with solvent-based alternatives, creating compelling value propositions for end-use markets.

Comprehensive Research Methodology Detailing Data Collection Expert Validation and Analytical Frameworks Guiding Water-Based Resin Market Insights

This analysis is grounded in a rigorous research methodology that integrates secondary and primary data collection with robust validation protocols. Secondary research encompassed regulatory filings, trade press, and technical publications to map regulatory landscapes and technological advancements. Primary interviews with industry executives, formulators, and procurement specialists provided first-hand perspectives on market dynamics and strategic priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water-based Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water-based Resins Market, by Resin Type

- Water-based Resins Market, by Product Form

- Water-based Resins Market, by Technology

- Water-based Resins Market, by Application

- Water-based Resins Market, by Region

- Water-based Resins Market, by Group

- Water-based Resins Market, by Country

- United States Water-based Resins Market

- China Water-based Resins Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Perspectives Emphasizing Sustainable Innovation Market Resilience and Strategic Imperatives for Water-Based Resin Stakeholders

Water-based resins have emerged as a transformative force in eco-efficient materials science, driven by ever-stricter environmental regulations, continuous performance innovation, and shifting trade landscapes. While 2025 tariffs and countervailing duties have introduced short-term volatility, they have also accelerated strategic realignments and spurred investments in domestic production and feedstock diversification. Across resin types, applications, and regions, resilient companies are capitalizing on segmentation opportunities by tailoring formulations to meet demanding performance and sustainability criteria.

Take Action Today to Engage with Associate Director Ketan Rohom and Gain Exclusive Access to In-Depth Water-Based Resin Market Analysis

To explore the full depth of market drivers, competitive strategies, and detailed segmentation analysis for water-based resins, connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through tailored insights and provide immediate access to the comprehensive market research report. Engage today to equip your organization with actionable intelligence that drives sustainable innovation and competitive advantage.

- How big is the Water-based Resins Market?

- What is the Water-based Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?