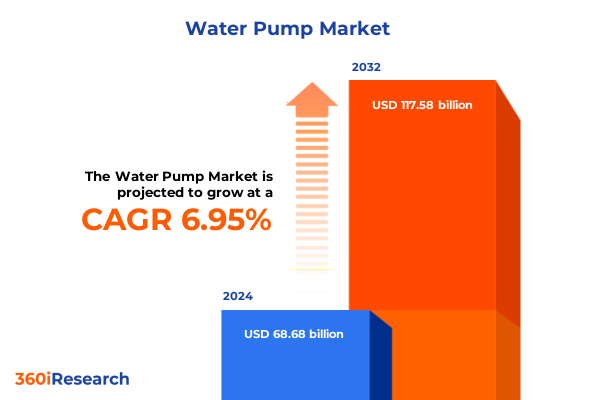

The Water Pump Market size was estimated at USD 68.68 billion in 2024 and expected to reach USD 73.29 billion in 2025, at a CAGR of 6.95% to reach USD 117.58 billion by 2032.

Emerging Global Water Scarcity, Rapid Urbanization, and Infrastructure Investments Propel Demand for Advanced, Energy-Efficient Water Pump Solutions Worldwide

The global landscape of water resources is undergoing a profound transformation, driven by mounting pressures from climate change, rapid urbanization, and escalating demand across agricultural, industrial, and municipal sectors. As freshwater availability continues to be strained, with one in ten people already living under high or critical water stress, the imperative to optimize water utilization and infrastructure resilience has never been greater. At the same time, population growth and urban migration are intensifying municipal water needs, fueling demand for efficient pumping solutions that can reliably deliver clean water for everyday use.

In response to these systemic challenges, investments in water infrastructure have accelerated globally, emphasizing the modernization of supply networks, wastewater treatment facilities, and sustainable irrigation practices. Stakeholders across public and private sectors are prioritizing energy-efficient, low-maintenance pump technologies that reduce total cost of ownership and carbon footprints. Industry reports indicate that these evolving requirements are driving water pump manufacturers to innovate rapidly, integrating digital monitoring capabilities, renewable energy compatibility, and improved hydraulic performance to meet customer expectations and regulatory mandates.

Collectively, these market forces set the stage for a water pump sector defined by heightened competition, a surge in technology adoption, and an unwavering focus on sustainable water management. This introductory overview underscores the essential role of advanced pumping solutions in addressing the world’s most urgent water challenges and serves as a foundation for the subsequent strategic analysis presented herein.

Technological Innovations, Sustainability Imperatives, and Smart Water Management Strategies Are Reshaping the Water Pump Industry’s Future Trajectory

Over the past few years, the water pump industry has witnessed transformative shifts characterized by accelerated digitalization, a surge in eco-centric solutions, and the proliferation of smart water management platforms. Manufacturers have been progressively embedding Internet of Things (IoT) sensors, variable frequency drives, and real-time analytics into pump designs, enabling predictive maintenance, remote diagnostics, and optimized energy usage. These innovations not only enhance operational reliability but also pave the way for data-driven decision-making that reduces downtime and extends equipment lifespan.

Concurrently, sustainability imperatives are reshaping product portfolios, with a marked pivot toward solar-powered pumps, low-emission drive mechanisms, and the use of recyclable materials. Solar pumping systems have garnered significant traction, especially in off-grid agricultural applications and community water projects, due to their minimal operating costs and reduced dependence on fossil fuels. Leading solar pump providers have expanded manufacturing footprints across Asia and Africa, responding to both consumer demand and government-supported renewable energy programs.

These technological and ecological imperatives are converging with evolving end-user expectations. Agricultural stakeholders seek modular, scalable pumping units that integrate with precision irrigation systems, while municipal authorities demand smart pumping networks capable of load balancing and leak detection. Industrial clients, including food and beverage and power generation sectors, are prioritizing robust pumps that conform to stringent regulatory standards and sustainability benchmarks. As a result, the competitive landscape is increasingly defined by hybrid capabilities that marry advanced digital features with environmental stewardship, propelling the industry toward a new era of intelligent, green pumping solutions.

Tariff-Driven Supply Chain Disruptions and Cost Pressures Are Reshaping the U.S. Water Pump Market Dynamics in 2025 and Beyond

The imposition of sweeping U.S. tariffs on imports of metals, components, and finished pump assemblies beginning in early 2025 has introduced significant supply chain volatility and cost pressures across the water pump sector. Tariffs of up to 25 percent on steel and aluminum have elevated input costs for pump manufacturers, directly affecting production expenses and undermining established sourcing strategies. Industry analyses warn that these duties have deepened uncertainty in capital planning, compelling firms to reevaluate supplier contracts and inventory policies in real time.

End users, particularly municipal and industrial buyers, are confronting higher procurement prices as OEMs pass through a portion of the tariff-driven cost increases. Constrained capital budgets and fixed-rate financing mechanisms for public utility projects have exacerbated the impact, prompting some water agencies to delay tenders or renegotiate contracts to mitigate budget overruns. Engineering firms have reported rebids and project timeline shifts, reflecting the market’s struggle to align long-term infrastructure plans with rapidly changing duty schedules.

Moreover, the tariffs have accelerated firms’ strategic pivots toward domestic assembly and dual sourcing. Companies with strong aftermarket service networks are better positioned to absorb margin pressures by leveraging spare parts sales and maintenance contracts. In certain instances, U.S.-based pump manufacturers have capitalized on Build America Buy America provisions to secure federally funded projects, reinforcing their competitive edge. Despite these adaptive measures, the cumulative effect of tariffs continues to drive price inflation and supply chain realignments, reshaping the U.S. water pump market’s cost structure and partner ecosystem well into 2026 and beyond.

In-Depth Analysis of Market Segmentation Reveals Critical Demand Patterns and Growth Opportunities Across Diverse Water Pump Categories

A nuanced segmentation of the water pump market reveals distinct dynamics that inform product development, marketing strategies, and investment decisions. Market analysis based on pump type distinguishes between centrifugal and positive displacement varieties. Centrifugal pumps, with subcategories including axial and mixed flow, multi-stage, single-stage, and submersible configurations, account for broad adoption in municipal water distribution and industrial processes where high flow rates are essential. Conversely, positive displacement pumps-encompassing reciprocating units such as diaphragm, piston, and plunger pumps, as well as rotary options like gear, lobe, screw, and vane pumps-are favored in applications demanding precise flow control and high pressure, including chemical dosing and oil and gas operations.

Examining the driving mechanism dimension, pumps are categorized by their power sources: diesel-driven, electric-driven, hydraulic-driven, and solar-powered. Diesel-driven units maintain relevance in remote locations lacking grid connectivity, while the predominance of electric-driven pumps aligns with urban infrastructure and manufacturing facilities. Hydraulic-driven pumps serve specialized applications such as high-pressure cleaning and slurry transport, whereas solar-powered pumps have emerged as a transformative solution for off-grid agricultural and community water projects due to their low operational cost and environmental benefits.

Further segmentation by pumping capacity-low, medium, and high capacity-highlights the tailored nature of pump selection, reflecting diverse requirements from residential booster systems to large-scale irrigation networks. Material analysis segments the market into bronze, cast iron, and stainless steel constructions, each chosen for specific corrosion resistance and durability criteria. End-user segmentation differentiates demand across agriculture and irrigation, commercial buildings, industrial plants, municipal utilities, and residential properties, noting that commercial buyers in corporate, educational, retail, and hospitality settings, as well as industrial clients across chemicals, food and beverage, mining, oil and gas, pharmaceuticals, power generation, and pulp and paper, exhibit unique performance and compliance needs. Finally, distribution channels split between offline and online sales paths, with digital platforms gaining ground for aftermarket part procurement and remote system monitoring subscriptions.

Collectively, these segmentation insights illuminate the complex interplay of technical specifications, operational environments, and end-user priorities that underpin strategic positioning and growth opportunities within the water pump market.

This comprehensive research report categorizes the Water Pump market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Driving Mechanism

- Pumping Capacity

- Material

- Control And Monitoring

- Operation Mode

- End-Use Industry

- Distribution Channel

Regional Dynamics Uncovered: How the Americas, Europe Middle East & Africa, and Asia-Pacific Are Shaping Distinct Water Pump Market Growth Profiles

The water pump market’s regional contours are shaped by varying economic priorities, resource endowments, and policy frameworks. In the Americas, the United States and Canada lead with sustained investments in modernizing legacy water infrastructure and implementing energy efficiency mandates. Federal and state-level initiatives supporting domestic manufacturing and green infrastructure have reinforced demand for smart pump systems that reduce energy consumption, lower operating costs, and integrate with utility management platforms. Latin American markets are similarly expanding, driven by public–private partnerships to upgrade urban water supply and sanitation networks, particularly in rapidly urbanizing cities.

Across Europe, the Middle East, and Africa, the confluence of regulatory pressure and acute water stress in arid regions has led to robust adoption of high-efficiency pumps and desalination-focused technologies. European Union directives promoting water reuse and reduction of leakage rates have spurred retrofit projects employing variable frequency drive pumps and IoT-enabled monitoring. In the Gulf Cooperation Council countries, significant capital flows into desalination and wastewater recycling infrastructure create opportunities for customized high-pressure and corrosion-resistant pump solutions. Meanwhile, North African nations are leveraging international financing to expand irrigation capacity, invoking demand for both centrifugal and positive displacement technologies adapted to harsh operating conditions.

In the Asia-Pacific region, rapid urbanization, agricultural modernization, and mega infrastructure projects in China, India, and Southeast Asia have fueled expansive growth. Governments are channeling resources into rural electrification and remote water access programs, amplifying solar pump deployments. Concurrently, industrial expansion in manufacturing hubs underpins a shift toward automated pump systems that support factories’ zero-latency water requirements. As a result, Asia-Pacific remains the fastest-evolving regional market, characterized by a high degree of technology adoption and a broad spectrum of capacity requirements.

This comprehensive research report examines key regions that drive the evolution of the Water Pump market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Differentiation Among Leading Global Water Pump Manufacturers Driving Industry Excellence

Market leadership in the water pump industry is concentrated among a cadre of global firms that have demonstrated robust capabilities in innovation, production scale, and aftermarket services. Flowserve and Grundfos, renowned for their extensive centrifugal pump portfolios, continue to push the envelope on efficiency by introducing low-NPSH designs and integration with building management systems. Franklin Electric and Pentair leverage vertically integrated supply chains to optimize cost structures, while also accelerating digital transformation through cloud-based monitoring solutions.

Gorman-Rupp and Sulzer differentiate through specialized offerings tailored to wastewater and heavy industrial segments, emphasizing materials science advancements that enhance corrosion resistance and abrasion tolerance. KSB and Wilo, anchored in Europe, excel at providing compact and quiet pump units suited to commercial and residential applications, often in compliance with stringent noise and efficiency regulations. Xylem’s integrated water management platforms, combining smart sensors with variable speed drives, underscore its approach to offering end-to-end solutions for utilities.

Emerging solar pump specialists, including LORENTZ and several Asia-based OEMs, have rapidly gained market share by serving off-grid agricultural and rural water supply projects, supported by micro-financing initiatives. Collectively, these players are pursuing strategic partnerships, mergers, and product diversification to capture share in lucrative segments such as municipal upgrades, renewable water harvesting, and industrial process optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Water Pump market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- ANDRITZ AG

- Atlas Copco AB

- Baker Hughes Company

- Brinkmann Pumps Inc.

- Cornell Pump Company LLC

- DAB PUMPS SPA

- EBARA CORPORATION

- Flowserve Corporation

- Franklin Electric Co., Inc.

- Gorman-Rupp Pumps by The Gorman-Rupp Company

- Grundfos Holding A/S

- Honda Motor Co., Ltd.

- Husqvarna AB

- IDEX Corporation

- Ingersoll Rand Inc.

- ITT Inc.

- Kawamoto Pump Mfg.Co.,Ltd.

- KIRLOSKAR BROTHERS LIMITED

- KSB Group

- Kubota Corporation

- LEO Pump

- MAKITA CORPORATION

- Panasonic Holdings Corporation

- PENTAIR PLC

- Robert Bosch GmbH

- Ruhrpumpen Group

- SLB N.V.

- SPX FLOW, Inc.

- Sulzer Ltd.

- Taro Pumps by Texmo Industries

- The Weir Group PLC

- Torishima Pump Mfg. Co., Ltd.

- TSURUMI MANUFACTURING CO., LTD.

- WILO SE

- Xylem, Inc.

- YANMAR HOLDINGS CO., LTD.

- Zhejiang Dayuan Pump Co., Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Technological Advancements, Sustainability Mandates, and Evolving Market Conditions

Industry leaders should adopt a multifaceted strategy to thrive amid shifting market dynamics and regulatory landscapes. First, diversifying supply chains through dual sourcing and regional manufacturing hubs will mitigate exposure to geopolitical risks and tariff shocks. Engaging local partners under Build America Buy America provisions or EU content requirements can unlock preferential contract opportunities and stabilize component costs.

Second, accelerating the integration of IoT-enabled monitoring and predictive analytics into product lines will yield competitive differentiation. By offering subscription-based digital services that enhance asset uptime and energy efficiency, pump manufacturers can generate recurring revenue streams and deepen customer relationships. Collaborations with software providers and utility management platforms will expedite market entry and enrich value propositions.

Third, embedding sustainability at the core of product development is essential. Investing in solar- and wind-powered drive options, bio-based composite materials, and lifecycle assessments will align offerings with global decarbonization targets. Such initiatives not only satisfy evolving procurement standards but also position firms to capitalize on green financing and ESG-driven procurement frameworks.

Lastly, fostering customer-centric innovation through co-development programs with key end users-including municipal utilities, agribusinesses, and industrial OEMs-will ensure that next-generation pumping solutions address real-world application challenges. Engaging in pilot deployments and collaborative R&D hubs can accelerate time-to-market and reinforce thought leadership within the industry.

Robust Multi-Source Research Methodology Integrating Expert Interviews, Extensive Secondary Research, and Rigorous Data Validation Techniques

This analysis is underpinned by a rigorous multi-phase research methodology designed to ensure comprehensive market coverage and data validity. The study commenced with an extensive review of public literature, including industry journals, regulatory filings, and specialist publications. Next, primary research was conducted via structured interviews with senior executives at OEMs, distributors, and end-user organizations across agriculture, municipal utilities, commercial real estate, and heavy industry.

Proprietary databases and transaction records were analyzed to map competitive landscapes, pricing trends, and product portfolio developments. To validate quantitative insights, triangulation techniques were employed, cross-referencing secondary data with primary interview findings and observed market transactions. Regional case studies supplemented the analysis, providing granular context on policy impacts, infrastructure programs, and localized demand dynamics.

Throughout the research process, data quality was assured via peer review and consistency checks, with any discrepancies resolved through follow-up consultations. Where applicable, statistical modeling was utilized to discern trend patterns and project scenario-based impacts, such as tariff simulations and tariff mitigation strategies. This robust methodology ensures that conclusions and recommendations presented herein rest on a solid evidentiary foundation, offering stakeholders a reliable blueprint for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water Pump market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water Pump Market, by Type

- Water Pump Market, by Driving Mechanism

- Water Pump Market, by Pumping Capacity

- Water Pump Market, by Material

- Water Pump Market, by Control And Monitoring

- Water Pump Market, by Operation Mode

- Water Pump Market, by End-Use Industry

- Water Pump Market, by Distribution Channel

- Water Pump Market, by Region

- Water Pump Market, by Group

- Water Pump Market, by Country

- United States Water Pump Market

- China Water Pump Market

- Vietnam Water Pump Market

- Indonesia Water Pump Market

- Malaysia Water Pump Market

- Competitive Landscape

- List of Figures [Total: 23]

- List of Tables [Total: 2430 ]

Concluding Perspectives on Water Pump Market Trajectories Highlight Key Imperatives for Investment, Innovation, and Operational Resilience

The water pump industry stands at a pivotal juncture, shaped by accelerating environmental imperatives, digital transformation, and evolving policy landscapes. As water scarcity intensifies and infrastructure demands grow, pump manufacturers and end users alike must navigate a complex web of technological, regulatory, and economic factors. This executive summary has explored the emergent trends driving product innovation, the systemic impact of trade policies, and the nuanced demands across market segments and regions.

Looking forward, the imperative for holistic strategies that blend supply chain resilience, sustainability, and digital solutions is clear. Organizations that effectively integrate smart pumping technologies, localize production to mitigate trade risks, and collaborate closely with customers will be best positioned to capture growth in both mature and emerging markets. Simultaneously, a deep understanding of regional policy drivers-ranging from EU water reuse mandates to solar irrigation incentives in Asia-Pacific-will be vital for aligning product offerings with market-specific dynamics.

Ultimately, the companies that can balance short-term operational agility with long-term strategic investments in R&D and ecosystem partnerships will define the next generation of industry leaders. By harnessing the insights and recommendations presented in this report, stakeholders can chart a path toward sustainable growth, operational excellence, and enhanced resilience in a world where water security is becoming ever more critical.

Unlock Exclusive Insight and Accelerate Your Competitive Advantage with a Custom Water Pump Market Report from Our Expert Team

Ready to transform your strategic planning and operational execution, our comprehensive water pump market report offers unparalleled insights tailored to your organization’s needs. Connect with Ketan Rohom, Associate Director for Sales & Marketing, to discuss how our data-driven analysis and actionable intelligence can empower you to stay ahead of market dynamics and capitalize on emerging opportunities. Take the next step in securing your competitive advantage and schedule a personalized consultation to explore licensing options and custom research solutions that align with your growth objectives.

- How big is the Water Pump Market?

- What is the Water Pump Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?