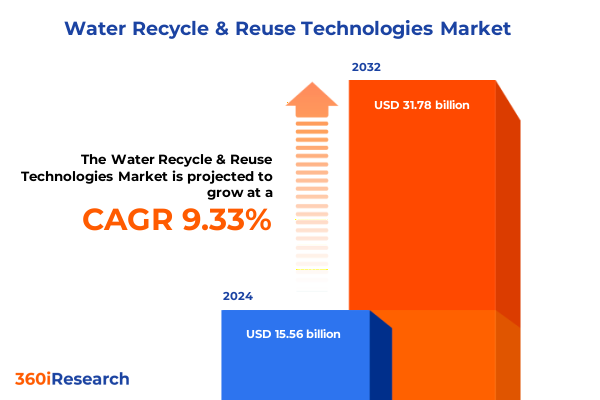

The Water Recycle & Reuse Technologies Market size was estimated at USD 16.88 billion in 2025 and expected to reach USD 18.36 billion in 2026, at a CAGR of 9.46% to reach USD 31.78 billion by 2032.

Confronting Water Scarcity and Environmental Pressures Through Innovative Recycling and Reuse Technologies for Sustainable Resource Management

The accelerating challenges of water scarcity, driven by prolonged droughts, shifting precipitation patterns, and rapid urbanization, are underscoring the critical importance of recycling and reuse technologies. In regions such as California, ongoing drought conditions and heightened agricultural and urban demand have prompted innovative onsite water-reuse initiatives that recycle greywater for non-potable applications and explore direct potable reuse to secure municipal supplies. Concurrently, the U.S. Environmental Protection Agency’s National Water Reuse Action Plan highlights growing demands from data centers and manufacturing facilities, which increasingly rely on reclaimed water to support uninterrupted operations and enhance resilience against supply disruptions. As a result, water reuse has emerged as a vital tool for communities, industries, and agricultural sectors seeking reliable, alternative water sources.

Embracing Digital Transformation and Decentralized Systems to Drive the Next Wave of Water Recycling and Reuse Innovation Worldwide

The water recycle and reuse sector is undergoing a profound digital transformation, leveraging Internet of Things (IoT) sensors, real-time monitoring platforms, and artificial intelligence to optimize treatment processes and forecast demand patterns. Utilities and industrial operators are deploying predictive maintenance algorithms to reduce downtime and extend equipment lifecycles, while data analytics enable dynamic control of membrane bioreactor performance and energy consumption. At the same time, decentralized water treatment modules are gaining traction, providing modular, scalable solutions closer to end users and reducing the reliance on extensive distribution networks. These localized systems can integrate multiple water sources, including rainwater, stormwater, and greywater, to serve commercial complexes and residential communities efficiently. Public-private partnerships and innovative financing models have emerged to address high capital requirements and de-risk project development, attracting private investment into municipal recycling initiatives and cross-sector collaborations. Furthermore, the convergence of renewable energy integration and decarbonization efforts is reshaping system design, with solar-powered desalination units and biogas recovery from anaerobic digestion reducing the carbon footprint of water reuse facilities. Alongside these advancements, membrane bioreactors, reverse osmosis, and ultraviolet disinfection continue to evolve, delivering higher contaminant removal efficiencies and supporting both non-potable and potable reuse applications across diverse market segments.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Policies on the Water Treatment Equipment Supply Chain and Project Viability

In April 2025, the U.S. government implemented a baseline reciprocal tariff of 10 percent on all imported goods, including critical components for water treatment systems, as part of a broader strategy to rebalance trade deficits and strengthen domestic manufacturing capacity. Targeted duties of 25 percent on steel and aluminum used in tanks, piping, and structural elements, 34 percent on filtration membranes from key producers, and 20 percent on smart sensors and IoT devices have substantially increased procurement costs for treatment equipment. The reverse osmosis membrane industry has experienced average import cost increases of approximately 20 percent, while midstream production equipment imports have risen by around 10 percent, placing additional price pressures on U.S. manufacturers and forcing many to reconsider their supply chain strategies. Downstream water treatment and industrial users have faced higher project budgets, prompting delays or scope reductions; surveys indicate that nearly one-quarter of end users have deferred equipment renewals in response to elevated costs.

Understanding Market Dynamics Through Technology, Source Water, Plant Scale, and Application Dimensions to Uncover Critical Segmentation Insights

The market for water recycle and reuse technologies is segmented by a diverse array of treatment platforms, from conventional activated sludge processes and ion exchange systems to advanced membrane solutions such as ultrafiltration with capillary and hollow fiber modules, nanofiltration, and reverse osmosis utilizing spiral wound and tubular membranes. Membrane bioreactor configurations are further distinguished by flat sheet and hollow fiber designs, each offering distinct trade-offs in footprint, fouling resistance, and energy efficiency. Source water categories range from brackish water desalination and stormwater harvesting to the treatment of rainwater, greywater, and treated wastewater effluent, the latter encompassing both domestic and industrial effluent streams. Plant scale considerations vary widely, with large-scale municipal installations coexisting alongside medium and small decentralized units that serve commercial and residential applications directly. Across application verticals, systems are tailored to the specific demands of municipal water supply, industrial process reuse-spanning sectors from chemicals and petrochemicals to pharmaceuticals, food and beverage, power generation, and pulp and paper-and residential and commercial non-potable uses. This multi-dimensional segmentation enables stakeholders to align technology selection with water quality requirements, spatial constraints, and economic considerations.

This comprehensive research report categorizes the Water Recycle & Reuse Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Source Water

- Plant Scale

- Application

Exploring Regional Nuances Across the Americas, EMEA, and Asia-Pacific to Unveil Distinct Drivers Shaping Water Recycling and Reuse Adoption

In the Americas, the United States leads with robust federal initiatives such as the National Water Reuse Action Plan and complementary state-level programs, exemplified by California’s direct potable reuse pilots and Texas’s recent produced water legislation, which collectively drive investment in advanced treatment and resource recovery. Canada’s focus on nutrient recovery from agricultural runoff and Latin American governments’ emphasis on public-private partnerships reflect region-specific water security imperatives. Across Europe, Regulation (EU) 2020/741 has established harmonized quality and monitoring standards for agricultural irrigation reuse, but implementation challenges in smaller municipalities have sparked calls for regulatory refinement to ensure broader access and cost-effective compliance. France has emerged as a pioneer, with Veolia’s Jourdain project demonstrating large-scale potable reuse during dry seasons and leveraging compact Barrel™ units to expand drought-resilient supply. In Asia-Pacific, Singapore’s integrated Deep Tunnel Sewerage System and Tuas NEWater expansion are set to increase recycled water contributions from 40 percent to over 55 percent of total demand by 2025, showcasing comprehensive wastewater reclamation paired with membrane bioreactor and RO purification modules to meet industrial and potable requirements.

This comprehensive research report examines key regions that drive the evolution of the Water Recycle & Reuse Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Water Technology Providers and Their Pioneering Projects That Are Shaping the Recycle and Reuse Landscape Across Multiple Geographies

Veolia has been instrumental in scaling wastewater reuse technologies at a global level, inaugurating France’s first potable reuse unit in Vendée under the Jourdain program and deploying the compact Barrel™ membrane system to provide up to 1.5 million cubic meters of drinking water during peak dry seasons. In Qatar, Veolia Water Technologies and Katara Project launched a flagship reuse facility capable of supplying up to 15,000 cubic meters of treated wastewater daily for cooling and irrigation at the Katara Cultural Village, reducing fresh water consumption and energy use by over 80 percent. In North America, Veolia’s $62.4 million plan to treat PFAS in Delaware’s Stanton Water Treatment Plant and a $181 million collaboration with Tampa Bay Water to expand regional drinking water supply underscore its commitment to infrastructure resilience and regulatory compliance. Xylem has enabled the reuse of 18.1 billion cubic meters of water globally since 2019 through its portfolio of membrane, pump, and digital monitoring solutions, achieving all 2025 customer sustainability goals ahead of schedule and setting new targets to reduce annual water demand by 2 billion cubic meters by 2030. Its innovative “Reuse Brew” beer produced from treated wastewater in Bavaria further illustrates the potential to shift public perceptions and demonstrate water recycling’s viability in consumer-facing applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Water Recycle & Reuse Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.O. Smith.

- Alfa Laval Ltd

- Aquatech

- Arvia Water Technologies Ltd.

- BWT AG

- ClearBlu Environmental

- Concurrent Technologies Corporation

- DuPont de Nemours, Inc.

- Ecolab Inc.

- Envirochemie GmbH

- Epic Cleantec Inc.

- Evoqua Water Technologies LLC

- FieldFactors

- Fluence Corporation

- Fluid Equipment Development Company

- General Electric Company

- Gradiant Corporation

- H2O Innovation Inc.

- Hitachi, Ltd.

- Hydraloop Inc.

- J Mark Systems Inc.

- KSB SE & Co. KGaA

- KUBOTA Corporation

- KURARAY CO., LTD.

- Lenntech B.V.

- Lenntech B.V.

- Melbourne Water

- OVIVO Inc.

- Pall Corporation.

- Pentair plc

- ProChem, Inc.

- Siemens AG

- Sitration Inc.

- Solenis LLC

- SUEZ Group

- Tangent Company LLC

- Tetra Tech, Inc.

- Triton Systems Inc.

- Veolia Environnement SA

- Xylem Inc.

Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience, Optimize Costs, and Accelerate Adoption of Innovative Water Reuse Solutions

Industry leaders should accelerate investments in digital and AI-enabled monitoring ecosystems to optimize treatment performance, predict maintenance needs, and reduce non-revenue water through data-driven insights and advanced analytics. To mitigate the impact of trade tariffs and supply chain disruptions, companies are advised to diversify procurement channels, develop local manufacturing capabilities for critical components such as membranes and sensor modules, and consider regional assembly hubs to control costs and lead times. Engaging proactively in public-private partnerships and collaborative financing models can unlock capital for large-scale reuse infrastructure projects, while early coordination with regulators ensures alignment on risk-based treatment benchmarks and permits. Embracing renewable energy integration and decarbonization strategies, such as co-locating solar arrays or biogas units at treatment plants, will lower operational emissions and enhance long-term sustainability credentials. Finally, organizations should explore circular economy approaches that upcycle wastewater streams into valuable byproducts, including nutrient recovery and biosolids-derived energy, to create new revenue streams and reinforce environmental stewardship narratives.

Outlining Rigorous Primary and Secondary Research Methodologies Employed to Ensure Robust Insights and Accurate Assessments of the Water Reuse Market

This research combined primary qualitative interviews with water utility executives, treatment technology providers, and regulatory agencies to capture firsthand insights on emerging challenges, technology performance, and policy developments. Secondary sources included government publications such as EPA’s National Water Reuse Action Plan updates, European Commission regulatory documents, industry press releases, and peer-reviewed journals to validate technological trends and regional policy impacts. Data triangulation across these multiple sources ensured robustness and mitigated bias, while structured review sessions with subject-matter experts provided quality assurance. Limitations include evolving tariff policies and fluctuating raw material costs, which were monitored through continuous literature surveillance and expert consultations to update assumptions and maintain accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water Recycle & Reuse Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water Recycle & Reuse Technologies Market, by Technology

- Water Recycle & Reuse Technologies Market, by Source Water

- Water Recycle & Reuse Technologies Market, by Plant Scale

- Water Recycle & Reuse Technologies Market, by Application

- Water Recycle & Reuse Technologies Market, by Region

- Water Recycle & Reuse Technologies Market, by Group

- Water Recycle & Reuse Technologies Market, by Country

- United States Water Recycle & Reuse Technologies Market

- China Water Recycle & Reuse Technologies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Reflections on the Imperative for Collaborative and Integrated Approaches to Advance Water Recycling and Reuse Technologies Globally

The global urgency to address water scarcity and climate-driven variability demands an integrated approach that leverages advanced treatment technologies, digital transformation, and collaborative frameworks to unlock the full potential of water recycle and reuse solutions. As digitalization and renewable integration converge with modular, decentralized systems, the sector is poised for accelerated innovation and broader adoption across municipal, industrial, and residential segments. Continued alignment between regulators, technology providers, investors, and end users will be essential to streamline permitting pathways, secure financing, and sustain public acceptance, ensuring that the next generation of water infrastructure delivers resilience, efficiency, and environmental benefits at scale.

Connect with Ketan Rohom to Unlock Comprehensive Water Recycle and Reuse Market Intelligence and Drive Informed Decision-Making

For tailored insights and comprehensive data on market trends, competitive strategies, and region-specific developments in water recycle and reuse technologies, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the report’s full breadth of analysis, answer any queries, and facilitate your acquisition of this essential resource to drive informed decisions and strategic planning.

- How big is the Water Recycle & Reuse Technologies Market?

- What is the Water Recycle & Reuse Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?