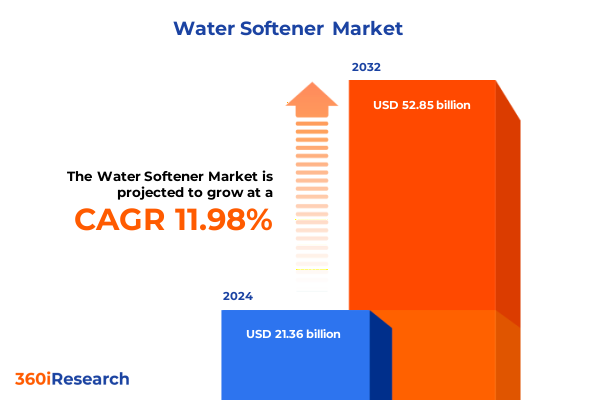

The Water Softener Market size was estimated at USD 23.93 billion in 2025 and expected to reach USD 26.81 billion in 2026, at a CAGR of 11.98% to reach USD 52.85 billion by 2032.

Setting the Stage for Unveiling the Growing Imperative of Advanced Water Softening Solutions in a Sustainability-driven Market

The evolving water softener market has become a critical focal point for businesses and policymakers seeking to address water quality challenges with innovative, sustainable solutions. Rapid urbanization, coupled with tightening environmental regulations and shifting consumer preferences, has accelerated the need for sophisticated water treatment technologies. This phenomenon is not limited to a single domain; rather, it spans across residential, commercial, and industrial sectors where the removal of hardness-causing minerals directly influences operational efficiency, equipment longevity, and the overall consumer experience.

Against this backdrop, market participants are challenged to navigate a complex interplay of technological advancements, regulatory landscapes, and shifting economic factors. The convergence of digitalization and sustainability has spurred the development of smart, low-waste systems that reduce environmental impact while delivering consistent water quality. Ecosystem partnerships, such as collaborations between materials scientists, software developers, and service providers, have emerged to co-create next-generation solutions that address both water softening and broader water management objectives.

As the global community places heightened emphasis on resource conservation and circular economy principles, the water softener industry has responded by integrating data-driven predictive maintenance, recycled media options, and modular designs that simplify installation and maintenance. These trends set the stage for deeper analysis of the transformative shifts defining the current market dynamics and lay the groundwork for actionable strategic decisions.

Examining the Dynamic Transformation of Water Treatment Ecosystems Under Pressures of Innovation Sustainability and Regulatory Evolution

In recent years, the water softener landscape has witnessed transformative shifts driven by regulatory tightening and breakthrough innovations. Environmental directives in key markets now mandate rigorous limits on discharge of sodium brine and other residuals, compelling manufacturers to adopt salt-free and hybrid technologies that minimize ecological footprints. Concurrently, rapid digitalization has enabled the advent of remote monitoring and predictive analytics, empowering end users to optimize system performance in real time and reduce unplanned downtime.

At the same time, the rise of on-site water treatment as a service is reshaping ownership models, as providers bundle equipment installation with performance guarantees and proactive maintenance contracts. This shift reflects a broader trend toward outcome-based procurement, where total cost of ownership and service reliability take precedence over initial capital expenditure. Moreover, heightened consumer awareness around potable water quality has catalyzed demand for point-of-entry units equipped with advanced filtration media and automated regeneration cycles.

Complementing these trends, strategic partnerships between technology developers and distribution networks have accelerated product accessibility across both online and traditional channels. These collaborations leverage e-commerce platforms, digital marketing, and training initiatives for channel partners, ensuring that customers across commercial, industrial, and residential segments can access tailored solutions. Together, these transformative shifts underscore a market in flux-one characterized by technological ingenuity, evolving business models, and a relentless focus on environmental stewardship.

Unraveling the Ripple Effects of United States Tariff Adjustments on Water Softening Equipment Through Early 2025 and Beyond

Throughout 2024 and into early 2025, U.S. trade policy continued to exert profound influence on the water softening equipment market, primarily through adjustments to Section 301 tariffs on imports from China. The four-year review conducted by the Office of the United States Trade Representative culminated in further tariff escalations effective September 27, 2024, with incremental increases set to apply on January 1, 2025 and beyond for select categories of machinery and parts. These measures reinforce the existing baseline duty of 25% on water filtering and purifying machinery classified under HTSUS 8421.21.0000, for which no exclusions were reinstated following the March 2022 exclusion process.

As a result, importers of salt-based water softeners, catalytic softeners, and specialized ion-exchange units have encountered sustained cost pressures. The absence of tariff relief amplifies landed expenses, which compound when combined with logistical challenges and fluctuating freight rates. Domestic producers have, in turn, experienced a relative competitive advantage, though supply chain constraints remain a concern amid elevated demand and limited manufacturing capacity for certain high-specification components.

Looking ahead, the persistent tariff environment is expected to incentivize continued localization of manufacturing and greater vertical integration among equipment suppliers. Companies are exploring strategic partnerships with domestic OEMs and converting legacy plants to produce specialized resins, magnetic modules, and advanced media in-house. While upfront capital requirements for these initiatives are significant, the move promises to mitigate future tariff risks and strengthen supply chain resilience in the face of evolving trade policies.

Dissecting Core Market Dimensions with Type Product Technology Application and Distribution Insights Driving Water Softener Demand

An in-depth examination of market segmentation reveals critical distinctions in customer requirements and solution performance expectations across the water softener category. In the realm of system type, traditional salt-based units continue to dominate settings where high hardness levels necessitate robust ion-exchange processes, while salt-free alternatives gain traction in environmentally sensitive installations and regions with stringent discharge regulations. This divergence underscores the importance of aligning system selection with sustainability goals and regulatory compliance.

Product variations further delineate market opportunities, with catalytic softeners delivering enhanced scale prevention through media-catalyzed crystallization and electromagnetic solenoids leveraging fluctuating magnetic fields to inhibit mineral deposition. Each product class addresses unique operational challenges, ranging from maintenance frequency to energy consumption, thereby shaping procurement criteria in both commercial and residential contexts.

Advances in core treatment technologies have added another dimension to market complexity. Ion exchange remains the bedrock for hardness removal, yet magnetic systems are carving out niche applications where chemical usage reduction is paramount. Meanwhile, template assisted crystallization is emerging as a hybrid approach that balances performance with reduced salt consumption, appealing to forward-thinking facility managers seeking to optimize total cost of ownership.

Further granularity emerges across applications. In commercial environments, such as hospitality and office buildings, equipment must deliver high throughput and minimal downtime, often under service agreements that guarantee water quality benchmarks. Industrial operations, including chemical production, food and beverage processing, and textile manufacturing, demand bespoke solutions tailored to specific feedwater profiles and processing requirements. Residential markets span compact point-of-use systems for under sink installation to advanced whole-house configurations, each reflecting diverging needs in terms of footprint, regeneration frequency, and user experience.

Finally, distribution channels play a pivotal role in market accessibility. Offline networks, characterized by value-added resellers and specialized installers, remain vital for high-complexity and large-scale deployments. At the same time, online platforms are rapidly expanding their footprint, offering streamlined ordering, rapid delivery, and virtual support tools that cater to tech-savvy homeowners and small businesses. Together, these segmentation layers illuminate the multifaceted demand drivers shaping strategic planning and product innovation efforts.

This comprehensive research report categorizes the Water Softener market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product

- Technology

- Application

- Distribution Channel

Mapping Regional Nuances as Market Drivers Shift Across the Americas Europe Middle East Africa and Asia Pacific Zones

Geographic dynamics continue to redefine marketplace opportunities for water softeners, as regional water quality challenges and regulatory frameworks diverge across major economic zones. In the Americas, aging infrastructure and the imperative to reduce water treatment chemicals have bolstered adoption of both salt-based and salt-free systems. Municipalities and large-scale industrial users are increasingly integrating decentralized softening units to alleviate strain on centralized treatment facilities and to minimize scaling in critical assets.

Meanwhile, Europe, the Middle East, and Africa present a complex mosaic of market drivers. In Western Europe, stringent discharge mandates and circular economy initiatives are accelerating the shift toward no-salt technologies and media regeneration services. In contrast, emerging economies across the Middle East and Africa prioritize cost-effective, reliable solutions that address hard water concerns in hospitality and industrial sectors, underscoring serviceability and local maintenance capabilities.

Asia-Pacific remains a hotbed for innovation and rapid deployment. Major markets such as China, India, and Australia grapple with diverse hardness profiles, driving demand for adaptive systems that can seamlessly transition between batch-wise and continuous softening modes. Additionally, government incentives for water conservation and green infrastructure are catalyzing investments in digital monitoring and asset management platforms, positioning leading solution providers to capitalize on integration across smart city initiatives.

Although each region exhibits distinct drivers, a unifying trend emerges: the convergence of regulatory pressure and performance expectations is fostering a new generation of resilient, low-impact water softening solutions. This trend underscores the importance of regional nuance when crafting market entry strategies and underscores the need for flexible business models that can adapt to evolving policy landscapes and end-user priorities.

This comprehensive research report examines key regions that drive the evolution of the Water Softener market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Maneuvers Shaping Competitive Dynamics in the Water Softener Arena

The competitive landscape of the water softener industry is defined by a blend of established engineering powerhouses and agile specialized innovators. Key players are deploying differentiated strategies, ranging from heavy investments in research and development to acquisitions that broaden product portfolios and geographic reach. Technology leaders are prioritizing the integration of IoT capabilities, enabling real-time performance tracking and predictive maintenance algorithms that enhance system reliability and reduce operational expenses.

In parallel, traditional manufacturers with legacy portfolios are modernizing their offerings by retrofitting existing models with advanced control systems and user-friendly digital interfaces. This retrofit trend addresses the growing need for backward-compatible upgrades among end users operating large fleets of aging units. Meanwhile, pure-play water technology firms are leveraging niche expertise in magnetic and template assisted crystallization techniques to secure footholds in environmentally demanding applications.

Collaboration and alliance formation have become pivotal, as organizations forge partnerships with media suppliers, software developers, and service integrators to deliver end-to-end water management solutions. Such ecosystems facilitate bundled offerings that encompass pre-treatment, softening, filtration, and post-treatment monitoring under unified service agreements. This convergence of disciplines signifies a shift away from standalone equipment sales toward holistic water optimization platforms.

Going forward, mergers and acquisitions are expected to accelerate, driven by the desire to achieve scale in emerging markets and to acquire specialized technology capabilities. Strategic joint ventures with regional players will be particularly instrumental in navigating local regulatory frameworks and in establishing service networks that can support high-availability contracts across diverse industry verticals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Water Softener market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AO Smith Corporation

- Canature Environmental Products Co., Ltd

- Clack Corporation

- Culligan International Company

- Evoqua Water Technologies LLC

- General Electric Company

- Hague Quality Water International

- Ion Exchange

- Kent RO Systems Ltd.

- Kinetico Incorporated

- Lanxess AG

- Marmon Holdings, Inc. by Berkshire Hathaway Inc.

- NuvoH20, LLC

- Pentair PLC

- Puronics Inc.

- RainSoft by Aquion, Inc.

- Springwell by Fortune Brands Innovations, Inc.

- Stiebel Eltron GmbH & Co. KG

- US Water Systems, Inc.

- Veolia Water Technologies

- Water Channel Partners

- WaterBoss, Inc.

- Watercare Softeners Ltd.

- Watts Water Technologies, Inc.

- Whirlpool Corporation

Translating Market Intelligence into Tangible Strategies That Empower Industry Leaders to Navigate Complex Water Softening Landscapes

Industry leaders must proactively align their product road maps and go-to-market strategies with the evolving imperatives of sustainability, regulatory compliance, and digital transformation. To do so, organizations should channel investments toward modular, scalable platforms that accommodate both salt-based and salt-free applications, allowing for seamless upgrades as performance requirements shift. Emphasizing product flexibility will enable companies to address varied hardness profiles and discharge constraints without necessitating complete system replacements.

Moreover, companies should enhance their service models by integrating remote diagnostics and data analytics tools that empower end users with actionable insights. By developing subscription-based maintenance packages and outcome-focused performance guarantees, solution providers can foster deeper customer relationships and predictable revenue streams. This shift toward service-oriented offerings will hinge on robust after-sales support infrastructure and skilled field technicians capable of leveraging digital toolkits.

Strategic collaboration remains a vital lever for success. Leaders should pursue alliances with advanced materials suppliers to co-develop next-generation media that reduce brine generation and facilitate faster regeneration cycles. Similarly, partnerships with software vendors can unlock new value propositions through AI-driven process optimization and compliance reporting modules. These interdisciplinary collaborations will expedite product innovation and broaden addressable markets.

Finally, to mitigate tariff exposure and supply chain disruptions, executives should evaluate options for localized manufacturing or in-country assembly. Establishing regional production hubs not only cushions against trade policy fluctuations but also accelerates lead times and enhances responsiveness to local market demands. By integrating these strategies, industry leaders will be well-positioned to navigate the complex water softener landscape and capture growth opportunities in a rapidly evolving environment.

Detailing the Rigorous Research Framework and Methodical Processes Underpinning the Comprehensive Water Softener Market Study

This research initiative employed a multi-tiered approach combining primary and secondary research methodologies to ensure comprehensive coverage and rigorous validation of findings. Primary interviews were conducted with key stakeholders, including system integrators, end users in residential and industrial segments, regulatory experts, and leading technology developers to capture firsthand insights into operational challenges and emerging trends. These interviews were supplemented by detailed site visits to water treatment facilities and installation sites, enabling direct observation of system performance and maintenance practices.

Secondary research encompassed an extensive review of regulatory frameworks, patent filings, technical white papers, and peer-reviewed journals to map the technological evolution of water softening solutions. Trade association publications and government databases provided clarity on tariff schedules, compliance requirements, and incentive programs across major markets. Additionally, proprietary supply chain datasets were analyzed to trace equipment origin, logistics pathways, and cost structures, offering a nuanced view of distribution channel dynamics.

Quantitative data points were triangulated through a combination of shipment records, import-export statistics from customs authorities, and reported sales figures, ensuring robust trend validation. Qualitative insights were further refined through expert panels that convened engineers, chemists, and policy analysts to challenge preliminary interpretations and refine scenario analyses. This iterative validation process underpinned the credibility of the key insights and facilitated the development of forward-looking strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water Softener market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water Softener Market, by Type

- Water Softener Market, by Product

- Water Softener Market, by Technology

- Water Softener Market, by Application

- Water Softener Market, by Distribution Channel

- Water Softener Market, by Region

- Water Softener Market, by Group

- Water Softener Market, by Country

- United States Water Softener Market

- China Water Softener Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Strategic Imperatives to Illuminate Future Trajectories in the Global Water Softening Domain

In synthesizing the key findings, it is evident that the water softener market is undergoing a paradigm shift propelled by environmental regulations, consumer demand for low-impact systems, and the relentless pace of digital innovation. The interplay of these forces has elevated the importance of adaptable technology architectures capable of addressing diverse hardness challenges while minimizing ecological footprints.

Regional disparities underscore the necessity for tailored strategies: the Americas emphasize infrastructure modernization and chemical reduction, EMEA prioritizes zero-discharge solutions under circular economy mandates, and Asia-Pacific embraces digital integration as part of broader smart city initiatives. These insights call for agile business models that can pivot across varying regional demands without compromising on service excellence or compliance.

Competitive dynamics reveal a market in which collaboration across the value chain-from media suppliers to software providers-has become essential. Firms that cultivate ecosystems centered on outcome-based offerings and predictive maintenance will differentiate themselves in a landscape increasingly defined by performance reliability and total cost of ownership.

Ultimately, companies that effectively balance technological versatility, strategic localization of production, and data-driven service models will secure a leadership position. By internalizing these strategic imperatives, decision-makers will be equipped to steer their organizations toward sustainable growth and resilience in a complex, rapidly evolving global water softener market.

Seize Your Opportunity to Gain Unparalleled Market Intelligence by Connecting with Ketan Rohom to Secure This Invaluable Research Asset

To secure full access to the detailed analyses and actionable insights contained within this comprehensive market research report, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan stands ready to guide you through our extensive findings, custom data modules, and bespoke advisory options tailored to your strategic needs. By engaging with him, you will ensure your organization gains the competitive edge and in-depth understanding required to navigate the evolving water softener landscape with confidence and precision.

- How big is the Water Softener Market?

- What is the Water Softener Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?