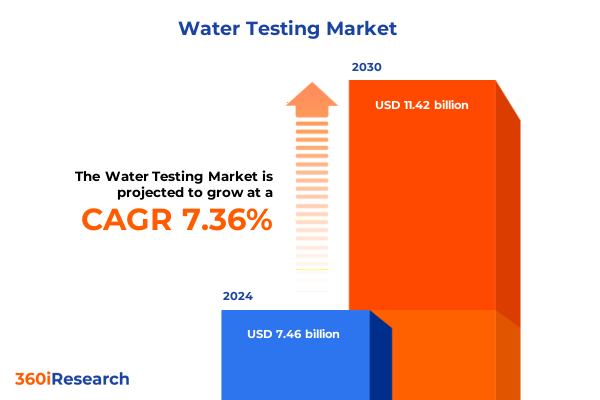

The Water Testing Market size was estimated at USD 7.46 billion in 2024 and expected to reach USD 8.00 billion in 2025, at a CAGR of 7.36% to reach USD 11.42 billion by 2030.

Understanding the strategic imperatives and growth trajectories in the evolving water testing industry landscape

In today’s complex environmental and regulatory climate, water testing has become an indispensable activity for safeguarding public health and sustaining industrial processes. This executive summary offers a strategic lens through which decision-makers can understand the multifaceted dynamics of the water testing market, drawing upon rigorous primary and secondary research. By examining technological trends, policy shifts, and evolving customer requirements, this introduction sets the stage for a comprehensive exploration of the strategic imperatives shaping water testing practices across sectors.

Anchored in a commitment to actionable insight, this section frames the core themes that will guide subsequent analysis. It underscores the critical importance of innovation in laboratory instrumentation and digital solutions, while acknowledging how global trade policies and regional regulations intersect to influence market outcomes. Positioned for both expert readers and industry newcomers, this overview primes stakeholders to appreciate the nuances of product and service offerings, key market drivers, and the competitive landscape that follows.

Emerging technological breakthroughs and regulatory reforms redefining the water testing market dynamics globally

The water testing industry has entered a period of rapid transformation driven by breakthroughs in digital analytics, miniaturized instrumentation, and integrated data platforms. Advances in portable and digital meters now enable real-time monitoring of parameters such as conductivity, dissolved oxygen, and turbidity, shifting testing from periodic sampling to continuous surveillance. Concurrently, next-generation chromatography equipment and total organic carbon analyzers have enhanced sensitivity and throughput, empowering laboratories to tackle complex challenges in chemical and radiological testing with unprecedented precision.

Regulatory reform has further accelerated this shift, as stricter discharge limits and heightened quality standards push both public and private stakeholders toward more rigorous testing protocols. The integration of Internet of Things connectivity and cloud-based data management has not only streamlined field operations but also facilitated predictive analytics, allowing for proactive maintenance of water infrastructure. Together, these technological and regulatory factors have redefined market dynamics, creating new opportunities for savvy industry players to deliver integrated solutions that meet evolving customer demands.

Assessing the multifaceted consequences of 2025 U.S. tariff policies on water testing supply chains and cost structures

The introduction of new U.S. tariffs in early 2025 has created ripple effects throughout water testing supply chains, affecting both instrument manufacturers and service providers. Import duties on certain laboratory testing instruments and portable meters have led to a recalibration of sourcing strategies, prompting many companies to explore alternative suppliers or to localize production efforts. This shift has had notable implications for cost structures, with increased landed costs influencing pricing models and contract negotiations across the value chain.

Moreover, downstream service providers that rely heavily on imported test kits and digital meters have faced margin pressures, spurring investment in domestic calibration and reagent production. While some organizations have absorbed tariff-related price hikes, others have opted to pass costs onto end users, resulting in wider variability in market pricing. Despite these challenges, the tariff landscape has also encouraged strategic alliances between U.S. entities and regional manufacturers to mitigate risk, leading to innovative co-development agreements and investments in localized testing hubs.

Uncovering deep market segmentation patterns across product sample test end user and application dimensions for targeted strategy

A nuanced view of the water testing market emerges when examining the various dimensions of segmentation by offerings, sample type, test type, end user, and application. Beginning with offerings, the market integrates a spectrum of products and services: from high-precision laboratory testing instruments such as chromatography equipment, ion selective electrodes, spectrophotometers, and TOC analyzers, to portable and digital meters measuring conductivity, dissolved oxygen, multiparameter, pH, and turbidity values, alongside services encompassing laboratory and on-site testing solutions. This multilayered framework enables stakeholders to tailor solution sets to specific operational requirements and budgetary frameworks.

Delving further, sample type segmentation distinguishes between groundwater, potable water, surface water, and wastewater streams, each carrying unique analytical demands-from trace organic compound detection to microbiological profiling. The segmentation by test type highlights biological assessments of algae, bacteria, protozoa, and viruses; chemical examinations of inorganic and organic compounds; physical evaluations such as temperature and turbidity; and radiological checks for isotopic contaminants. End-user segmentation spans environmental consulting firms, governmental regulatory agencies, industrial and commercial organizations, municipal authorities, private households, and research and academic institutions, reflecting the broad tapestry of stakeholders driving demand.

Finally, segmentation by application underscores diversified use cases including agriculture and irrigation, aquaculture and fisheries, construction and infrastructure projects, drinking water (with substreams of bottled and municipal supply), industrial water testing across chemical processing, manufacturing, oil and gas, and power generation, as well as seawater analysis and wastewater treatment. Together, these segmentation dimensions shape how companies develop targeted strategies to address specific market niches and optimize product portfolios.

This comprehensive research report categorizes the Water Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Sample Type

- Test Type

- End User

- Application

Differentiated regional market dynamics highlight unique drivers and challenges across Americas EMEA and Asia-Pacific regions

Regional dynamics in the water testing industry illustrate how local factors steer market growth and competitive positioning. In the Americas, robust regulatory frameworks and sustained infrastructure investments in municipal water systems create significant demand for both laboratory-grade instruments and portable meters. The United States, in particular, demonstrates heightened uptake of digital and IoT-enabled testing platforms, driven by stringent EPA guidelines and public investment in aging water infrastructure.

In contrast, the Europe, Middle East & Africa region exhibits an intricate interplay of regulatory diversity and infrastructural disparities. Western European countries continue to invest in high-throughput laboratory solutions to comply with REACH and other environmental regulations, while emerging markets within Eastern Europe and the Middle East prioritize cost-effective portable testing solutions to address immediate water quality challenges. African markets show nascent growth potential, with international aid projects often dictating testing protocols in regions grappling with water scarcity and contamination.

Meanwhile, Asia-Pacific stands out as the fastest adopters of integrated water testing ecosystems, reflecting rapid industrialization and heightened environmental scrutiny. Nations such as China, Japan, and Australia lead in deploying advanced spectrophotometric and chromatography technologies, whereas Southeast Asian markets show growing demand for affordable test kits and on-site services to support agriculture, aquaculture, and urban water management. Across all regions, localized partnerships and service models remain key to addressing market heterogeneity and unlocking growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Water Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry participants with strategic positioning and innovative capabilities shaping the water testing sector

Competitive analysis of major water testing players reveals a landscape defined by technological leadership, service excellence, and strategic alliances. Established instrument manufacturers continue to invest in R&D to introduce higher accuracy analytical systems, while smaller disruptors focus on modular and mobile solutions that cater to field applications. Service providers, meanwhile, leverage accreditation and quality certifications to differentiate their offerings, often bundling laboratory testing with on-site sampling and data interpretation to deliver end-to-end solutions.

Several companies have embraced open-platform strategies, enabling third-party integration of sensors and modules that extend the functionality of core testing instruments. Others have forged partnerships with software vendors to offer cloud-based dashboards, predictive maintenance algorithms, and regulatory compliance reporting tools. These strategic moves not only enhance customer stickiness but also facilitate upsell opportunities across product and service lines. As environmental and industrial stakeholders demand more holistic water quality management frameworks, the competitive battleground is shifting from standalone instrument sales to integrated solution ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Water Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Agilent Technologies, Inc.

- ALS Limited

- Anacon Laboratories

- Bureau Veritas SA

- Ecolab Inc.

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Eurofins Scientific SE

- Green Solution

- HACH India Pvt Ltd. by Veralto Corporation

- Intertek Group plc

- LuminUltra Technologies Ltd.

- Merck KGaA

- Metrohm AG

- Myron L Company

- Mérieux NutriSciences Corporation

- NSF International

- Pace Analytical Services LLC

- R J Hill Laboratories Limited

- SGS SA

- Shimadzu Corporation

- SUEZ SA

- Thermo Fisher Scientific Inc.

- TÜV SÜD AG

- Veolia Water Solutions & Technologies SA

- Xylem, Inc.

Strategic imperatives and operational tactics for industry leaders to capitalize on growth opportunities and navigate market complexities

To thrive in the evolving water testing ecosystem, industry leaders must adopt a dual approach that blends cutting-edge technology deployment with agile operational strategies. First, investing in modular, IoT-enabled instrumentation can enable real-time data collection and remote monitoring, ensuring responsiveness to regulatory changes and environmental contingencies. Strategic collaborations with software developers will further bolster value propositions through analytics and compliance management tools.

Simultaneously, organizations should enhance supply chain resilience by diversifying sourcing channels and establishing regional manufacturing or assembly hubs. This mitigates the impact of trade policy fluctuations and logistical disruptions. Companies should also cultivate service-oriented revenue streams through subscription-based on-site testing packages and managed data services, fostering long-term customer relationships and recurring income.

Finally, executive teams must prioritize workforce development and cross-functional training to ensure that technical specialists, field technicians, and data analysts can operate collaboratively. Embedding a culture of continuous learning will be crucial for integrating new testing methodologies and maintaining quality standards. By aligning technological innovation with operational excellence and human capital development, industry leaders can secure sustainable competitive advantages.

Comprehensive research framework integrating primary interviews secondary sources and rigorous data validation protocols

This market research report draws upon a robust methodology that combines primary interviews, secondary data analysis, and rigorous triangulation processes. Primary research involved in-depth interviews with industry executives, laboratory managers, regulatory officials, and end users across multiple regions, providing firsthand insights into demand drivers, purchasing criteria, and emerging challenges. Expert input was synthesized to contextualize quantitative data and validate key assumptions.

Secondary sources included publicly available governmental and agency reports, peer-reviewed journals, patent filings, and credible industry publications. Trade association data and regulatory filings were leveraged to map policy trends and compliance landscapes, while technical white papers informed the assessment of emerging instrumentation capabilities. Data points were cross-checked for consistency, and an internal peer review process ensured methodological rigor and transparency.

Finally, advanced analytical techniques, including cluster analysis and scenario modeling, were employed to derive segmentation insights and forecast potential market trajectories under various regulatory and technological scenarios. All collected data underwent stringent validation protocols to uphold accuracy, culminating in a comprehensive framework that supports strategic decision-making for stakeholders across the water testing value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water Testing Market, by Offerings

- Water Testing Market, by Sample Type

- Water Testing Market, by Test Type

- Water Testing Market, by End User

- Water Testing Market, by Application

- Water Testing Market, by Region

- Water Testing Market, by Group

- Water Testing Market, by Country

- United States Water Testing Market

- China Water Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of critical findings and forward-looking perspectives to drive strategic decision-making in water testing industry

In synthesizing the key findings from this executive summary, it is evident that the water testing industry stands at the nexus of technological innovation, regulatory evolution, and shifting global trade dynamics. Segmentation analysis underscores the need for tailored strategies that address distinct product categories, sample types, and end-user requirements, while regional insights reveal how localized factors shape market trajectories. The impact of U.S. tariffs in 2025 further highlights the imperative for supply chain agility and strategic partnerships.

Looking ahead, the convergence of IoT connectivity, analytics platforms, and advanced laboratory instrumentation will continue to drive market differentiation, enabling providers to deliver integrated solutions that span real-time monitoring to comprehensive laboratory diagnostics. To harness these trends, companies must balance investments in innovation with operational resilience, ensuring that their offerings remain both cutting-edge and commercially viable.

Ultimately, stakeholders who embrace a holistic approach-merging technological prowess with deep market understanding and robust research foundations-will be best positioned to capitalize on growth opportunities and deliver meaningful impact across the water testing ecosystem. This conclusion serves as a springboard for actionable strategies and underscores the importance of informed, forward-looking decision-making.

Engage with Ketan Rohom to leverage exclusive market intelligence and elevate your strategic positioning in the water testing market

Ready to deepen your understanding of the water testing landscape and secure a competitive advantage, you can engage directly with Associate Director of Sales & Marketing Ketan Rohom to acquire the comprehensive market research report. His in-depth knowledge and strategic insight will guide your team through the critical findings, ensuring you have the clarity and context needed to make informed decisions. By partnering with him, you’ll gain tailored access to the granular data, expert analyses, and strategic frameworks that underpin the report’s value, enabling you to confidently navigate emerging opportunities and regulatory challenges.

Taking action now positions your organization at the forefront of industry developments. Reach out to Ketan to discuss customized research packages, explore value-added deliverables, and determine the best roadmap for integrating these insights into your strategic planning. His expertise will help you translate data into decisive business actions, empowering you to outperform competitors and capture growth across multiple market segments. Don’t let critical insights slip by-connect with Ketan Rohom today and elevate your strategic positioning in the water testing market.

- How big is the Water Testing Market?

- What is the Water Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?