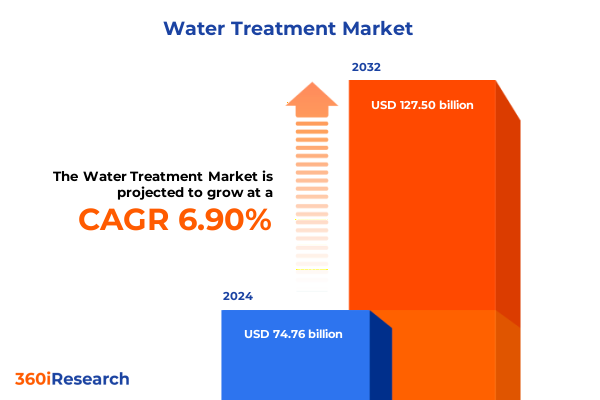

The Water Treatment Market size was estimated at USD 64.64 billion in 2025 and expected to reach USD 68.92 billion in 2026, at a CAGR of 6.90% to reach USD 103.19 billion by 2032.

Setting the stage for transformative insights into the evolving global water treatment landscape and strategic imperatives for stakeholders

Water scarcity has emerged as one of the most urgent global challenges of our time with over two billion people still lacking safely managed drinking water services and nearly half of the world’s population facing severe water stress for at least part of the year according to UN-Water turn2search5 The alarming reality is further underscored by data from the World Meteorological Organization indicating that in 2023 the world’s rivers experienced their driest conditions in more than three decades affecting billions of people across continents turn2news13 These trends have intensified demand for advanced water treatment solutions aimed at safeguarding public health protecting ecosystems and sustaining economic growth amid mounting resource constraints

Regulatory pressure is mounting as governments worldwide grapple with emerging contaminants and ageing infrastructure in urban and rural settings alike Recent shifts in U.S. drinking water policy illustrate this dynamic vividly: while limits on legacy per- and polyfluoroalkyl substances (PFAS) remain at four parts per trillion status for newer variants has been rolled back pending further review under cost and feasibility concerns turn1news14 This evolution highlights the intricate balance regulators strive to achieve between safeguarding public health and ensuring the economic viability of utilities and industries that depend on water treatment services

Against this backdrop our report provides a comprehensive compass for stakeholders by mapping transformative technological advances evolving policy frameworks and emerging competitive strategies Through a systematic exploration of market drivers challenges segmentation insights regional dynamics and company profiles we aim to equip industry leaders investors and policymakers with the strategic foresight needed to navigate the complexities of the water treatment landscape

Exploring the seismic shifts reshaping water treatment innovation regulatory paradigms and technological breakthroughs driving industry evolution

The water treatment sector is experiencing a wave of innovation driven by digitalization and connectivity Smart water management systems powered by IoT sensors and cloud-based analytics are enabling real-time monitoring of water quality treatment processes and asset performance thereby reducing unplanned downtime and driving operational efficiencies turn1search0 Simultaneously artificial intelligence and machine learning algorithms are being harnessed to predict maintenance needs optimize chemical dosing and forecast demand patterns ensuring utilities and industrial operators can deliver reliable services under increasingly stringent regulatory standards

Material science breakthroughs are propelling next-generation filtration solutions to the forefront of water treatment design Advanced membrane technologies encompassing ultrafiltration nanofiltration and reverse osmosis are leveraging hybrid polymers and novel nanomaterials to enhance contaminant rejection rates curb fouling and extend membrane lifespans by up to 20 percent in field trials turn1search1 These durable, high-performance membranes are critical to addressing complex challenges such as emerging micropollutants endocrine disruptors and micropollutants that conventional processes struggle to remove effectively

Communities and industries are also embracing sustainability-centric models such as zero liquid discharge and decentralized modular treatment units that facilitate water reuse and resource recovery While full-scale ZLD systems remain capital-intensive recent pilot projects integrating energy-efficient evaporation and crystallization stages have demonstrated the potential to recover up to 95 percent of water from industrial effluents turn1search1 At the same time containerized modular plants are delivering rapid deployments in remote or disaster-affected regions with minimal civil works requirements

Policy landscapes are evolving in parallel as states and municipalities counter federal deregulation initiatives with localized rules targeting PFAS nitrate and lead contamination Fourteen states have already enacted or proposed maximum contaminant levels for specific PFAS compounds that surpass federal guidelines compelling utilities to adopt advanced oxidation and adsorption technologies for compliance turn1news12 These converging shifts underscore the imperative for solution providers to align innovation roadmaps with an intricate mosaic of regulatory expectations and sustainability benchmarks

Assessing the cumulative effects of recent U.S. tariff measures on water treatment inputs supply chains capital planning and operational resilience

In 2025 the United States maintained Section 232 tariffs on steel and aluminum at 25 percent for all imports while introducing a new universal 10 percent levy on most manufactured goods to lessen foreign supply chain dependencies turn0search3 These measures have immediate implications for water treatment infrastructure, which relies heavily on steel- and aluminum-based components such as pressure vessels, piping, and support structures

Steel futures in the Midwest surged by more than 20 percent in the weeks following the tariff announcement reflecting the inflationary pressure on capital projects turn0search0 Municipalities planning wastewater and desalination plant upgrades now face material cost escalations that can erode contingency budgets and trigger project delays, particularly in smaller jurisdictions with limited borrowing capacity

Beyond heavy metals, utility operators report that tariffs indirectly affect chemicals and replacement parts vital for day-to-day operations Coagulants, disinfectants and filtration media sourced from global suppliers are now priced higher with duties factored into import contracts, prompting many to explore local or alternative sourcing strategies to manage chemicals budgets and mitigate rate shock for end users turn0search0

To adapt, stakeholders are employing a range of strategic responses Inventory front-loading ahead of tariff hikes has provided short-term relief, while partnerships with domestic fabricators and dual-sourcing arrangements are helping to stabilize lead times and cost projections over the medium term turn0search0 These adaptive measures highlight the need for proactive supply chain risk management as tariffs evolve within a broader geopolitical context

Detailing critical segmentation perspectives across product technology process source and application dimensions enhancing strategic decision making

The water treatment market’s product landscape encompasses chemicals, equipment and services each defined by distinct performance requirements and end-use applications Within chemicals, biocides and disinfectants are engineered to inactivate pathogens rapidly, coagulants and flocculants facilitate the aggregation of suspended solids for removal, corrosion inhibitors protect metal surfaces in distribution networks and scale inhibitors prevent mineral deposition in membranes and heat exchangers

Equipment offerings range from disinfection systems such as chlorination, ozone and UV units to distillation and ion exchange setups designed for high-purity demands. Filtration platforms extend across microfiltration to membrane systems optimized for nanofiltration and reverse osmosis, while sludge management equipment addresses residual handling through dewatering and stabilization processes. Together, these technologies form the backbone of treatment trains tailored to feedwater characteristics and effluent objectives

Service models complement hardware and chemical portfolios with consulting, installation and maintenance offerings to ensure system reliability and regulatory compliance. Consulting services provide feasibility assessments and process design expertise, installation teams execute pilot projects and full-scale deployments, and maintenance contracts deliver preventive, predictive and corrective support throughout the asset lifecycle

In parallel, the market segments by core technology pathways including adsorption, electrodialysis, ion exchange, microfiltration, ultrafiltration, nanofiltration and reverse osmosis. Each pathway addresses specific contaminant suites and resource constraints, enabling customized solutions for brackish water, surface water, groundwater, seawater or wastewater streams across industrial, municipal, commercial and domestic applications

This comprehensive research report categorizes the Water Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Water Source Type

- Process Type

- Application

Uncovering nuanced regional dynamics in the Americas EMEA and AsiaPacific markets to guide localized strategies and investment priorities

The Americas region is characterized by significant investment in infrastructure rehabilitation and compliance with evolving drinking water and wastewater regulations. Aging pipe networks and treatment facilities across North America are driving municipalities to prioritize upgrade programs that integrate advanced monitoring solutions and digital twin platforms for asset management turn2search4 Meanwhile in Latin America, expanding urban populations and industrial growth are propelling demand for compact reverse osmosis and ultrafiltration systems to address both potable supply and industrial effluent standards turn2news12

Europe, the Middle East and Africa (EMEA) exhibit a tapestry of regulatory stringency and climate imperatives. The European Union’s Water Framework Directive is catalyzing cross-border cooperation on basin-wide quality standards while Gulf states invest heavily in large-scale desalination and brine management initiatives to secure freshwater for burgeoning populations. In sub-Saharan Africa, decentralized modular plants and solar-powered treatment units are gaining traction to extend safe water access in remote communities turn2search5

Asia-Pacific is emerging as a dynamic growth frontier driven by rapid industrialization and urbanization in China, India and Southeast Asian economies. Government support for water reuse and circular economy principles is fostering the adoption of zero liquid discharge and resource recovery technologies in manufacturing sectors. Simultaneously, investments in smart water grids and digital analytics are accelerating across metropolises seeking to optimize distribution efficiency and reduce non-revenue water losses turn2search6

This comprehensive research report examines key regions that drive the evolution of the Water Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players competitive positioning and strategic initiatives shaping innovation partnerships and market leadership in water treatment

Leading companies in the global water treatment sector are actively expanding their portfolios through strategic mergers, acquisitions and partnerships to address complex customer needs. Xylem’s acquisition of Evoqua Water Technologies in 2023 created the largest pure-play water technology platform with combined expertise spanning advanced treatment systems, integrated services and digital monitoring solutions turn3search0 This consolidation has positioned the company to deliver seamless end-to-end solutions across municipal, industrial and commercial segments

Similarly Danaher Corporation has bolstered its water quality offerings by integrating Aquatic Informatics into its Water Quality platform. This move unites data management, analytics and compliance software with Hach’s hardware and sensors enabling a holistic approach to real-time water quality decision support turn4search3 Through this digital infusion Danaher is enhancing predictive maintenance capabilities and fostering data-driven optimization across operations

Beyond major consolidators specialty players are differentiating through targeted innovation. Firms focused on membrane development are launching next-generation fouling-resistant materials while biotechnology companies are engineering microbial consortia for high-efficiency biological treatment. As competitive dynamics evolve, agility in product development and depth of service networks have become vital success factors for market leadership

This comprehensive research report delivers an in-depth overview of the principal market players in the Water Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Veolia Environnement S.A.

- Ecolab Inc.

- Suez S.A.

- Xylem Inc.

- 3M Company

- GE Vernova Inc.

- Pentair plc

- DuPont de Nemours, Inc.

- The Dow Chemical Company

- Kurita Water Industries Ltd.

- Alfa Laval AB

- Aquatech International

- Arvia Water Technologies Ltd

- BioMicrobics, Inc

- BWT Holding GmbH

- Clean TeQ Water Limited

- Doosan Corporation

- Gradiant Corporation

- Ion Exchange (India) Limited

- Kemira Oyj

- Kingspan Group Plc

- Membrion, Inc.

- Nanostone Water, Inc.

- SNF Group

- Thermax Limited

- Toshiba Corporation

- VA TECH WABAG LIMITED

Empowering industry leaders with targeted recommendations for operational excellence digital transformation and sustainable growth in the water treatment sector

Industry leaders should prioritize digital transformation by deploying IoT-enabled monitoring platforms and AI-driven analytics across treatment assets to enhance process control, reduce downtime and optimize resource consumption turn1search0 Early adopter utilities are already experiencing double-digit improvements in energy efficiency and chemical usage through predictive dosing algorithms

A diversified sourcing strategy is essential to buffer supply chain volatility and tariff-driven cost fluctuations. Establishing dual-sourcing agreements, forging partnerships with domestic fabricators and maintaining safety-stock inventories can mitigate risks associated with import levies and global logistics disruptions turn0search0

Stakeholders must also accelerate investment in emerging membrane and adsorption technologies to address tightening contaminant regulations and evolving water quality challenges. Collaborative research initiatives with academic institutions and technology providers can expedite pilot validation and commercial deployment of novel materials with superior performance profiles

Finally forging public-private partnerships can unlock new financing mechanisms for infrastructure upgrades in municipalities and industrial facilities. By aligning project objectives with sustainability and resilience goals, stakeholders can leverage grants, green bonds and concessionary funding to drive large-scale modernization while ensuring long-term affordability

Exploring rigorous methodologies data collection techniques and analytical frameworks that deliver comprehensive insights into water treatment markets

This research initiative combined a robust multi-stage methodology encompassing primary interviews secondary data analysis and rigorous validation protocols to ensure the breadth and reliability of insights presented

Secondary research involved a systematic review of government publications industry white papers and peer-reviewed journals to map regulatory frameworks, emerging technologies and regional policy variations. Key sources included reports from the Environmental Protection Agency, World Health Organization and UN-Water agencies

Primary research comprised in-depth interviews with executive leadership, operations managers and R&D specialists at utilities, equipment manufacturers and service providers. These qualitative engagements enriched the quantitative findings by capturing real-world operational challenges, innovation roadmaps and strategic priorities directly from sector practitioners

Analytical frameworks applied included segmentation modeling across product, technology, source and application dimensions geographic clustering to highlight regional nuances and competitive benchmarking to assess company positioning and growth trajectories. Data triangulation and peer review processes were implemented at each stage to uphold methodological rigor and deliver a credible, actionable intelligence package

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water Treatment Market, by Product

- Water Treatment Market, by Technology

- Water Treatment Market, by Water Source Type

- Water Treatment Market, by Process Type

- Water Treatment Market, by Application

- Water Treatment Market, by Region

- Water Treatment Market, by Group

- Water Treatment Market, by Country

- United States Water Treatment Market

- China Water Treatment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing key findings and strategic implications to reinforce pathways for innovation resilience and sustainability in water treatment sectors

Our exploration of market drivers, technological breakthroughs and policy dynamics reveals a sector at the nexus of innovation and imperative investment. Climate-driven water stress, evolving contaminant regulations and shifting trade policies are collectively reshaping demand profiles and capital allocation strategies across regions

Technological advances in digital monitoring, advanced membranes and modular treatment have unlocked new pathways for sustainable operations and resource recovery. Meanwhile, strategic industry consolidation and agile partnerships are strengthening value-chain integration enabling solution providers to offer holistic services from design through long-term asset management

The cumulative baggage of ageing infrastructure, tariff-induced cost pressures, and regulatory complexity underscores the need for proactive stakeholder collaboration. Utilities, technology vendors, investors and policymakers must coalesce around shared objectives of resilience, affordability and environmental stewardship to ensure secure water futures

In synthesizing these insights, we aim to chart a clear roadmap for industry participants to prioritize investments, mitigate emerging risks and capitalize on growth opportunities in the evolving water treatment landscape

Reach out to Ketan Rohom the Associate Director of Sales & Marketing to access the full market research report and unlock actionable water treatment insights

To secure your access to the complete market research report brimming with in-depth analysis strategic insights and actionable intelligence tailored for decision-makers in the water treatment arena reach out directly to Ketan Rohom the Associate Director of Sales & Marketing He will ensure you receive personalized guidance on the report’s scope deliverables and licensing options

The report offers a comprehensive suite of content spanning regulatory landscapes technological innovations supply chain dynamics and competitive benchmarking by engaging with Ketan you can align the insights to your unique organizational priorities and investment plans

Ketan Rohom’s expertise in market advisory will facilitate an informed discussion around customization of the report’s datasets and executive briefing services to maximize the value derived from your research investment

Connecting with Ketan ensures a streamlined purchase process and rapid access to critical intelligence designed to empower your strategic initiatives and fortify your market positioning in the evolving water treatment sector

- How big is the Water Treatment Market?

- What is the Water Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?