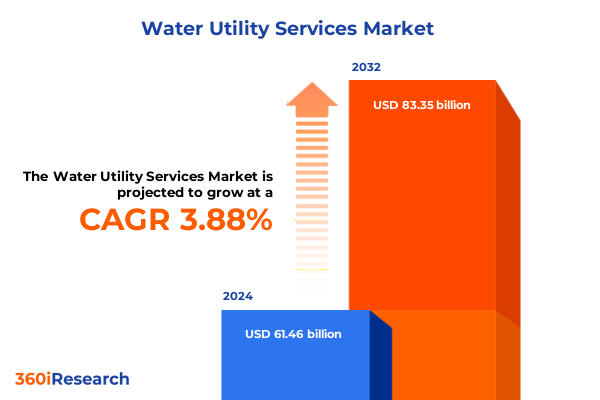

The Water Utility Services Market size was estimated at USD 63.72 billion in 2025 and expected to reach USD 66.10 billion in 2026, at a CAGR of 3.90% to reach USD 83.35 billion by 2032.

Navigating the Rapidly Evolving Water Utility Services Market Through Cutting-Edge Innovation, Sustainable Solutions, and Resilient Infrastructure Development

The water utility services industry stands at a pivotal crossroads, where shifting demographics, tightening regulations, and escalating environmental challenges intersect to reshape traditional operating models. Rapid urbanization is increasing demand for clean, safe water while simultaneously amplifying pressure on aging infrastructure. Climate variability further complicates supply reliability, intensifying the imperative for resilient networks and adaptive management strategies.

Innovation has emerged as the backbone of this transformation, with advanced treatment processes, real-time monitoring, and data analytics driving a new era of efficiency and sustainability. Stakeholders across the value chain now demand transparent, end-to-end solutions that align with ambitious environmental objectives and community expectations. This executive summary illuminates the core market dynamics, regulatory drivers, and technological breakthroughs that define the current water utility services landscape. By synthesizing diverse trends and insights, we aim to equip decision-makers with a clear strategic foundation from which to navigate emerging complexities and seize opportunities for growth.

Understanding the Transformational Forces Redefining the Water Utility Services Ecosystem and Driving Unprecedented Sectoral Advancement

The water utility services landscape has undergone profound transformation as digitalization, sustainability mandates, and stakeholder engagement converge to redefine sector priorities. Over the past few years, the integration of Internet-enabled sensors, artificial intelligence, and digital twin models has accelerated predictive maintenance and asset optimization. This shift has empowered operators to anticipate system failures, streamline maintenance schedules, and ultimately reduce unplanned downtime.

Simultaneously, stricter effluent standards and ambitious decarbonization targets have compelled utilities to rethink process design and energy consumption. Adopting circular economy principles, enterprises now seek to convert wastewater into valuable by-products such as biogas and fertilizers. Public-private partnerships have become instrumental in financing large-scale upgrade projects, bridging budget constraints while fostering operational expertise.

These developments have not only disrupted legacy approaches but also created a fertile environment for innovative entrants. As utilities strive to balance financial viability with environmental stewardship, collaborative ecosystems of technology vendors, engineering firms, and regulatory bodies are emerging. This ecosystemic shift is setting the stage for unprecedented advancements in water resource management and service delivery.

Examining the Comprehensive Effects of 2025 United States Tariff Policies on Water Utility Services Supply Chains, Costs, and Stakeholder Strategies

In 2025, the United States government introduced targeted tariff policies aimed at protecting domestic manufacturing, especially in sectors critical to infrastructure development. Elevated duties on imported steel and specialized water treatment components have driven up capital expenditure for new and retrofit projects. Suppliers and operators are now grappling with increased input costs, extended procurement timelines, and the need to reassess procurement strategies to maintain project viability.

These tariffs have triggered a wave of supplier diversification, as utilities seek alternative sources and consider reshoring partnerships with domestic fabricators. While this transition enhances supply chain resilience, it also requires substantial upfront investment in qualification, testing, and quality assurance for new vendors. Simultaneously, companies must navigate evolving trade agreements and regulatory complexities to optimize cost structures without compromising performance or compliance standards.

Consequently, industry leaders are prioritizing long-term procurement contracts, strategic inventory buffers, and collaborative frameworks that foster innovation with domestic partners. These adaptations are proving essential to mitigate tariff-induced volatility and to uphold commitments to infrastructure reliability, environmental compliance, and stakeholder expectations in an increasingly protectionist trade environment.

Harnessing Critical Segment-Specific Insights Across System Types, Service Offerings, Treatment Technologies, and End-User Applications to Drive Market Clarity

Critical segmentation analysis reveals distinct dynamics within integrated water systems compared to single function water systems. Integrated systems, which consolidate treatment, distribution, and wastewater processes, tend to leverage advanced digital platforms and economies of scale to deliver end-to-end water services. In contrast, single function water systems often specialize in discrete operations such as wastewater management or water supply, enabling focused investments in core capabilities and niche technologies.

Within service categories, desalination services have seen rapid uptake in arid regions, driven by rising concerns over freshwater scarcity. Wastewater management continues to evolve with the adoption of modular, decentralized treatment units that can be deployed in remote or underserved areas. Traditional wastewater treatment facilities are embracing energy-positive processes that harness methane from sludge digestion, while water supply networks emphasize pressure management and leak detection to reduce non-revenue water loss.

Advances in water treatment technologies are reshaping operational footprints as well. Biological water treatment techniques, including moving bed biofilm reactors, are becoming more widely implemented for their energy efficiency and robustness. Chemical treatment solutions, such as advanced oxidation processes, address emerging contaminants that conventional methods struggle to remove. Meanwhile, membrane filtration systems-ranging from microfiltration to reverse osmosis-are gaining traction for their ability to deliver high-purity water while minimizing chemical usage.

End-user segmentation underlines differentiated demand patterns across agricultural, commercial, industrial, and residential segments. Agricultural users, confronted with fluctuating water availability, prioritize efficient irrigation and nutrient recovery systems. Commercial and institutional operators seek reliable, cost-effective water supply coupled with stringent quality controls. Industrial end-users demand bespoke treatment packages tailored to process-specific effluent requirements, while residential communities increasingly value sustainable water management practices that enhance resilience and reduce municipal burden.

This comprehensive research report categorizes the Water Utility Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Services

- Water Treatment Technologies

- End-User

Unveiling Regional Dynamics and Growth Drivers Shaping Water Utility Services in the Americas, EMEA, and Asia-Pacific Markets for Strategic Expansion

The Americas region has been at the forefront of infrastructural rejuvenation, fueled by government stimulus plans and evolving regulatory frameworks that emphasize utility resilience and environmental performance. North American utilities are rolling out smart metering programs and network digitization to boost transparency and operational agility. In Latin America, public-private models have accelerated water access initiatives, especially in burgeoning urban centers facing capacity constraints.

In Europe, Middle East & Africa, stringent water quality directives and ambitious circular economy targets are shaping strategic investments. European utilities lead in pioneering advanced treatment solutions for micropollutant removal, while Middle Eastern operators continue to expand large-scale desalination capacity under public-sector sponsorship. African utilities, though often challenged by funding limitations, are leveraging modular treatment and off-grid solutions to extend services into rural communities.

Asia-Pacific markets demonstrate a spectrum of opportunities, from rapidly urbanizing megacities to resource-scarce island nations. In East Asia, high population density drives urgent upgrades to aging systems and the integration of digital water management platforms. Southeast Asian governments are prioritizing flood mitigation and water reuse as part of climate adaptation strategies. Down under, Australia’s emphasis on water reuse and stormwater harvesting has fostered cutting-edge projects that serve as global benchmarks for sustainable water management practices.

This comprehensive research report examines key regions that drive the evolution of the Water Utility Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Players’ Strategic Initiatives, Technological Innovations, and Collaborative Efforts Propelling the Water Utility Services Sector Forward

Leading global integrated utilities have diversified service portfolios by incorporating digital asset management, advanced analytics, and turnkey engineering solutions. These incumbents capitalize on their large operating footprints to pilot groundbreaking technologies at scale, such as AI-driven leak detection and blockchain-enabled water tracing. Meanwhile, specialized engineering firms focus on modular treatment plants and rapid deployment capabilities, catering to municipal and industrial clients requiring agility.

Technology providers, ranging from membrane manufacturers to chemical reagent innovators, are forging partnerships with engineering consultancies to co-develop next-generation treatment packages. Collaborative alliances between material science firms and software developers have yielded hybrid solutions that merge real-time monitoring with adaptive process controls. This convergence is reshaping the competitive landscape, as traditional equipment suppliers evolve into integrated technology partners.

Meanwhile, forward-thinking utilities and private operators are engaging in strategic mergers and minority investments to bolster their digital service offerings. By integrating IoT sensor networks, cloud-based platforms, and predictive analytics, these entities gain differentiated capabilities in network optimization and regulatory compliance. Such initiatives not only enhance operational efficiency but also strengthen customer engagement through improved transparency and service quality.

This comprehensive research report delivers an in-depth overview of the principal market players in the Water Utility Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. O. Smith Corporation

- American Water Works Company, Inc.

- Aqua America Inc.

- Arcadis N.V.

- Badger Meter, Inc.

- BHP Billiton Limited

- Consolidated Water Co. Ltd.

- Essential Utilities, Inc

- Flowserve Corporation

- Franklin Electric Co., Inc.

- Gorman-Rupp Company

- Grundfos Holding A/S

- Itron Inc.

- JGC Corporation

- Mott MacDonald

- Mueller Water Products, Inc.

- Newmont Corporation

- Pentair plc

- Rio Tinto plc

- Roper Technologies, Inc.

- Severn Trent plc

- SUEZ SA

- United Utilities Group Plc

- Veolia Environnement SA

- Watts Water Technologies, Inc.

- WSP Global Inc.

- Xylem Inc.

Implementing Strategic Roadmaps and Best Practices to Enhance Operational Efficiency, Sustainability, and Stakeholder Value in Water Utility Services

Industry leaders should prioritize the development of comprehensive digital roadmaps that integrate asset management, data analytics, and customer engagement platforms. Aligning cross-functional teams around a unified digital vision ensures cohesive implementation and maximizes return on investment. Early adoption of open-architecture systems can facilitate interoperability across vendor solutions, streamlining future upgrades and reducing operational silos.

Utilities must also expand partnerships with technology innovators, forging joint development agreements to co-create tailored water treatment and monitoring solutions. By securing co-investment structures with equipment manufacturers and software firms, operators can share development risks, accelerate deployment timelines, and gain preferential access to emerging technologies. This collaborative paradigm supports continuous improvement and promotes agile adaptation to evolving regulatory requirements.

To mitigate supply chain vulnerabilities exposed by tariff fluctuations, organizations should diversify their supplier base and invest in dual-sourcing strategies for critical components. Establishing regional inventory nodes and partnering with domestic fabricators can further insulate projects from geopolitical disruptions. Finally, proactive engagement with policymakers and industry associations will enable companies to influence regulatory dialogue and stay ahead of compliance shifts.

Exploring Rigorous Multistage Research Methodologies, Data Collection Techniques, and Analytical Frameworks Underpinning Insights into Water Utility Services

Our research employed a multistage methodology, combining primary interviews with senior executives, engineers, and regulatory experts alongside extensive secondary analysis of technical papers, policy documents, and industry publications. We conducted over fifty in-depth discussions to capture firsthand perspectives on emerging technologies, operational challenges, and strategic priorities.

Quantitative data was sourced from publicly available performance metrics, regulatory filings, and infrastructure investment records. We applied rigorous data triangulation techniques, cross-validating information from diverse origins to ensure accuracy and consistency. Advanced analytics tools facilitated trend identification and enabled robust comparisons across regions, service segments, and technology categories.

Finally, an expert review panel comprising practitioners and academic authorities assessed our findings for technical validity and strategic relevance. This governance framework ensured that insights reflect real-world applications and meet the high standards expected by executive stakeholders. Through iterative validation and peer review, the research delivers a comprehensive, reliable, and actionable overview of the global water utility services sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water Utility Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water Utility Services Market, by Type

- Water Utility Services Market, by Services

- Water Utility Services Market, by Water Treatment Technologies

- Water Utility Services Market, by End-User

- Water Utility Services Market, by Region

- Water Utility Services Market, by Group

- Water Utility Services Market, by Country

- United States Water Utility Services Market

- China Water Utility Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Key Findings and Strategic Imperatives to Navigate Future Challenges and Opportunities in the Water Utility Services Landscape

The convergence of digital innovation, regulatory evolution, and sustainability imperatives is driving a transformative era for water utility services. Organizations that embrace integrated systems, advanced treatment technologies, and collaborative ecosystems will gain a decisive competitive edge. By synthesizing strategic trends across segmentation categories, regional markets, and corporate initiatives, decision-makers can craft holistic strategies that address both immediate challenges and long-term objectives.

In the face of trade policy volatility and infrastructure renewal demands, proactive adaptation remains critical. Prioritizing resilience-through diversified supply chains, open-architecture digital solutions, and stakeholder engagement-will determine organizational success. As the water utility sector continues to evolve, those who leverage the insights and best practices outlined in this report will be best positioned to secure sustainable growth and operational excellence.

Engage with Ketan Rohom to Unlock Actionable Intelligence and Secure Your Comprehensive Water Utility Services Market Research Report Today

We invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and actionable guidance designed to address your organization’s distinct challenges in the water utility sector. Ketan brings extensive expertise in aligning strategic priorities with emerging market dynamics, and he stands ready to guide you through customizing the research findings to unlock maximum value.

By engaging with Ketan, you will gain privileged access to detailed analyses, competitive intelligence, and strategic roadmaps that empower informed decision-making. Reach out to arrange a confidential consultation and secure your copy of the comprehensive report, so you can confidently lead your team toward sustainable growth in the evolving water utility services landscape today

- How big is the Water Utility Services Market?

- What is the Water Utility Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?