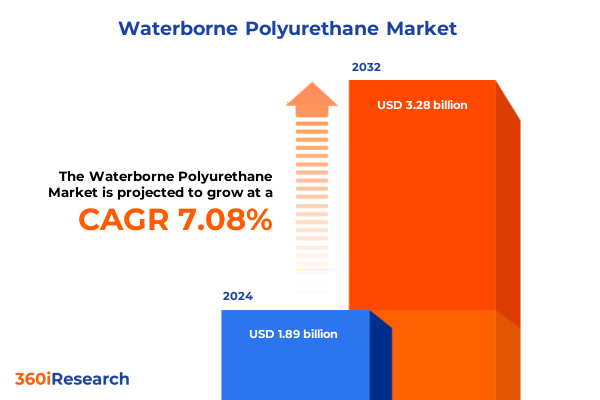

The Waterborne Polyurethane Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.17 billion in 2026, at a CAGR of 7.10% to reach USD 3.28 billion by 2032.

How Waterborne Polyurethane Is Revolutionizing the Coatings Industry Through Sustainable Innovation Low-VOC Compliance and Market Expansion Strategies

Waterborne polyurethane is reshaping the landscape of contemporary coatings by marrying stringent environmental regulations with superior performance characteristics. In an era defined by low-VOC mandates and sustainability imperatives, formulators are substituting solvent-based chemistries with waterborne systems that reduce toxic emissions while delivering enhanced adhesion, flexibility, and chemical resistance. This transition is fueled by policy frameworks in key regions, where regulatory bodies increasingly limit permissible levels of volatile organic compounds, prompting manufacturers to accelerate the adoption of waterborne polyurethane dispersions to achieve compliance without sacrificing durability or application versatility.

Concurrently, end-use industries such as automotive refinishing, wood and metal coatings in construction, and textile finishing have embraced waterborne polyurethane to meet evolving consumer expectations for green products. Innovations in raw-material sourcing, including the integration of bio-based polyols, are amplifying market momentum. Research and development investments have prioritized low-temperature curing and enhanced crosslinking strategies, enabling faster production cycles and energy savings on the shop floor. This convergence of regulatory pressure, technological advancement, and sustainability focus underscores why waterborne polyurethane has emerged as the cornerstone of next-generation coating solutions globally. citeturn0search0turn0search2

Unprecedented Transformations Driving Waterborne Polyurethane Adoption From Digital Manufacturing to Nanotechnology-Enabled Formulations Shaping the Future

Over the past several years, waterborne polyurethane has undergone a profound transformation driven by digital manufacturing technologies and nanotechnology-enabled formulations. Advanced dispersion techniques now leverage ultrasonic mixing and high-shear homogenization to achieve finer particle sizes, resulting in coatings with unmatched gloss retention, scratch resistance, and barrier properties. At the same time, digital printing applications in packaging have unlocked new revenue streams, as waterborne polyurethane inks deliver vivid color consistency with lower environmental footprints compared to solvent-borne analogs. This shift toward digitalization is redefining supply-chain agility, enabling just-in-time production through automated color matching and closed-loop quality control. citeturn0search0turn0search3

Furthermore, the integration of smart coatings-materials that self-heal minor damage or respond to environmental stimuli-has accelerated innovation cycles. R&D collaborations between polymer scientists and electronics experts are pioneering waterborne systems embedded with conductive nanoparticles for anti-corrosion and anti-icing functionalities in aerospace and infrastructure segments. Meanwhile, additive manufacturing techniques are being explored to create complex three-dimensional structures with gradient mechanical properties, pushing the boundaries of design freedom. These transformative shifts reflect a broad industry consensus: waterborne polyurethane is no longer a niche substitute but the foundational platform for sustainable, high-performance coating architectures in the modern era.

Assessing the Cumulative Impact of 2025 U S Tariff Policy on Waterborne Polyurethane Raw Materials Supply Chains Cost Structures and Market Dynamics

In 2025, the U.S. government implemented a series of escalating tariffs that have cumulatively reshaped the economics of waterborne polyurethane feedstocks and intermediates. Beginning in early April, the administration imposed a 34% tariff on Chinese chemical imports, swiftly increasing the levy to 84% before additional reciprocal measures drove the total burden on certain polyols to 145% of their base value. These surcharges, layered atop existing duties, have significantly inflated the landed cost of polyether polyols and isocyanates sourced from Asia, compelling U.S. polyurethane producers to absorb higher input costs or pass them onto industrial consumers. citeturn1search0

Concurrently, an additional 20% ad valorem tariff on March 4, 2025, targeted all polyurethane raw materials from China, further squeezing margins across the value chain. Domestic suppliers have responded by raising quotations in Q2, while downstream industries-spanning automotive seating foams, architectural coatings, and textile finishes-brace for upward price adjustments and potential demand softening. Moreover, Section 232 tariffs on steel and aluminum have indirectly increased operational expenses for reactor vessels and processing equipment, amplifying volatility in raw material sourcing. These combined measures have disrupted established trade routes and prompted a wave of supply-chain diversification, as manufacturers seek alternative suppliers in Southeast Asia, Europe, and India to mitigate risk and preserve production continuity. citeturn1search1turn1search4

In-Depth Insights Into Segment-Specific Demand Patterns Highlighting End-Use Applications Technology Preferences and Component Configurations

End-use application segmentation uncovers nuanced demand dynamics that industry participants can leverage for product positioning. In the automotive segment, original equipment manufacturers prioritize two-component aliphatic dispersions for their superior weather resistance, while the refinish subsegment increasingly opts for one-component acrylic formulations to accelerate repair turnaround times. The building and construction domain exhibits distinct preferences: flooring systems favor high-hardness aromatic dispersions that withstand heavy foot traffic; insulation panels rely on low-density, high-expansion foams; and wall panels demand waterborne sealants with rapid tack development. Meanwhile, the furniture sector bifurcates into office furnishings-where formaldehyde-free, low-odor office-grade coatings are paramount-and residential applications that balance esthetic gloss with durable scuff resistance.

Packaging applications further demonstrate divergent needs: flexible packaging coatings require high-barrier, food-contact-safe acrylic dispersions, whereas rigid packaging systems leverage aliphatic variants for superior UV stability and scratch resistance. In textile and footwear markets, manufacturers of apparel coatings emphasize soft-hand feel one-component emulsions, while shoe-coating lines adopt two-component aromatic systems to achieve robust abrasion and flexing endurance. Across these end-use scenarios, formulation chemistries are selected based on performance trade-offs between process simplicity, cost, and long-term durability.

This comprehensive research report categorizes the Waterborne Polyurethane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Component

- End Use

- Distribution Channel

Strategic Regional Developments Shaping the Waterborne Polyurethane Market Across the Americas Europe Middle East Africa and Asia Pacific

Regional landscapes present unique growth trajectories shaped by regulatory frameworks, infrastructure investment, and end-market maturity. In the Americas, stringent U.S. environmental regulations have driven early adoption of low-VOC waterborne polyurethane in architectural and industrial coatings, while Brazil and Mexico emerge as high-growth markets buoyed by urbanization and public infrastructure spending. Trade agreements under the United States-Mexico-Canada Agreement reinforce integrated supply chains, enabling seamless movement of intermediate polymers and finished coatings across North America.

In Europe, Middle East and Africa, European Union directives on air quality and chemical safety have catalyzed widespread adoption of waterborne polyurethane formulations, particularly in Germany, France, and the U.K., where green public procurement policies favor sustainable building materials. Simultaneously, Gulf Cooperation Council countries invest heavily in real estate and tourism infrastructure, driving demand for decorative and protective coatings. Across Africa, expanding construction and automotive assembly hubs are opening new frontiers for locally produced waterborne polyurethane systems.

Asia‐Pacific maintains its position as the preeminent market, led by China’s extensive manufacturing base and infrastructure rollouts. Government incentives for green buildings and automotive electrification in India are spurring domestic R&D and capacity expansions. Meanwhile, Japan and South Korea continue to pioneer high-performance dispersions for electronics and precision-coating applications. Southeast Asian nations, leveraging lower production costs and preferential trade arrangements, are increasingly becoming alternative export hubs for waterborne polyurethane feedstocks. citeturn0search2

This comprehensive research report examines key regions that drive the evolution of the Waterborne Polyurethane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Dynamics and Innovation Strategies of Leading Waterborne Polyurethane Manufacturers Influencing Product Portfolios and Market Leadership

Leading global players are intensifying investments to differentiate their portfolios and capture share in high-growth segments. BASF and The Dow Chemical Company have expanded capacity for bio-based polyol intermediates, reflecting broader commitments to circular economy principles. PPG Industries and Axalta Coating Systems are deepening collaborations with automotive OEMs to co-develop tailored waterborne formulations that meet electrification and lightweighting requirements. H.B. Fuller and Henkel are leveraging their adhesive expertise to introduce co-optimized coating-adhesive systems, streamlining assembly processes for furniture and packaging manufacturers.

Meanwhile, emerging regional champions such as Wanhua Chemical Group and Kamsons Chemicals are capitalizing on cost advantages and localized market insights to offer competitively priced dispersions in Asia and the Middle East. Investments in advanced analytics and digital twin technologies by Covestro and Allnex are enhancing process efficiency and quality control, reducing batch-to-batch variability. Consortia between specialty chemical firms and research institutions are also forming to accelerate breakthroughs in self-healing coatings and smart material platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Waterborne Polyurethane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allnex Belgium SA/NV

- BASF SE

- Covestro AG

- Dow Inc.

- Evonik Industries AG

- Huntsman International LLC

- Mitsui Chemicals, Inc.

- The Lubrizol Corporation

- Wacker Chemie AG

- Wanhua Chemical Group Co., Ltd.

Actionable Strategies for Industry Leaders to Navigate Supply Chain Disruptions Regulatory Changes and Emerging Growth Opportunities in Waterborne Polyurethane

To navigate ongoing volatility and capitalize on growth opportunities, industry leaders should expand regional production footprints and diversify sourcing beyond traditional suppliers. Securing long-term supply agreements with polyol and isocyanate producers in Southeast Asia and Europe can buffer against U.S. tariff fluctuations. Concurrently, allocating R&D resources to bio-based and waterborne hybrid chemistries will satisfy emerging regulatory guidelines while addressing evolving consumer preferences for sustainable product attributes.

Operationally, deploying predictive analytics and digital supply-chain platforms can enhance demand forecasting, asset utilization, and risk mitigation. Companies should pursue strategic partnerships with OEMs and end-users to co-innovate application-specific solutions, thereby deepening customer engagement and establishing technology roadmaps. Finally, assembling cross-functional regulatory and policy advocacy teams will enable proactive adaptation to evolving environmental standards and trade measures, ensuring uninterrupted market access and competitive positioning.

Comprehensive Research Methodology Employed for Rigorous Market Analysis Leveraging Multifaceted Data Sources Expert Interviews and Validation Techniques

The research framework combines both primary and secondary methodologies to ensure a holistic understanding of the waterborne polyurethane market dynamics. Primary data was collected through in-depth interviews with senior executives from leading chemical manufacturers, key end-users in the automotive, construction, and textile sectors, as well as subject matter experts in polymer science. These interviews provided qualitative insights into emerging trends, technology adoption rates, and regulatory impacts.

Secondary research involved exhaustive analysis of industry reports, peer-reviewed journals, government policy documents, and trade association publications. Proprietary databases were leveraged to cross-validate shipment volumes, production capacities, and patent filings. A bottom-up approach was employed to reconcile company-level performance with overarching market patterns, while data triangulation methods ensured consistency and robustness. Finally, the findings were subjected to multiple rounds of validation by internal subject-matter experts to guarantee accuracy and impartiality in portraying the competitive landscape and growth drivers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Waterborne Polyurethane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Waterborne Polyurethane Market, by Product Type

- Waterborne Polyurethane Market, by Technology

- Waterborne Polyurethane Market, by Component

- Waterborne Polyurethane Market, by End Use

- Waterborne Polyurethane Market, by Distribution Channel

- Waterborne Polyurethane Market, by Region

- Waterborne Polyurethane Market, by Group

- Waterborne Polyurethane Market, by Country

- United States Waterborne Polyurethane Market

- China Waterborne Polyurethane Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Future Outlook for the Waterborne Polyurethane Market in a Rapidly Evolving Sustainability-Driven Landscape

The waterborne polyurethane market stands at the intersection of sustainability mandates, technological innovation, and evolving trade policies. The confluence of stringent environmental regulations, advanced formulation techniques, and escalating U.S. tariffs has catalyzed a realignment of supply chains and accelerated the transition from solvent-based alternatives. Growth is underscored by segment-specific drivers, including automotive electrification, green building certification requirements, and demand for eco-friendly textiles and packaging.

Looking ahead, industry growth will be propelled by advancements in bio-based polyol chemistries, digital manufacturing platforms, and smart coating functionalities that respond adaptively to environmental stimuli. Regional diversification strategies and strategic partnerships will remain paramount as companies seek to balance cost pressures with performance imperatives. Collectively, these factors illustrate a market evolving beyond simple volume expansion toward a sophisticated ecosystem of collaborative innovation and sustainable value creation.

Connect With Ketan Rohom to Unlock Detailed Market Intelligence and Secure Your Path to Strategic Advantage in Waterborne Polyurethane Markets as Report Purchaser

To explore the most comprehensive and timely analysis of the waterborne polyurethane market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through the intricacies of the report’s findings, share executive briefings tailored to your strategic priorities, and provide a customized proposal that aligns with your organization’s goals. Engaging directly with Ketan ensures you gain privileged insights into growth levers, competitive positioning, and risk factors before competitors. Secure your copy of the full market research report today and position your business at the forefront of sustainable coatings innovation.

- How big is the Waterborne Polyurethane Market?

- What is the Waterborne Polyurethane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?