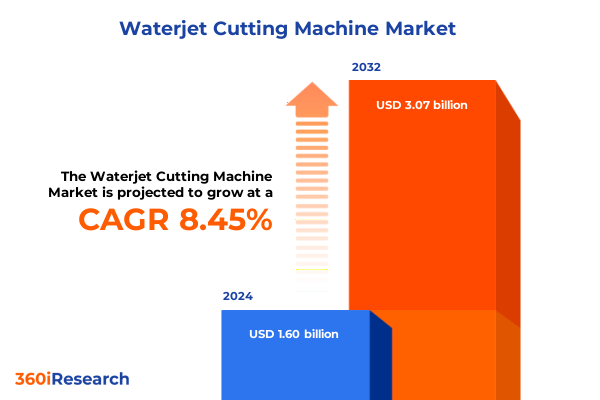

The Waterjet Cutting Machine Market size was estimated at USD 1.74 billion in 2025 and expected to reach USD 1.89 billion in 2026, at a CAGR of 9.43% to reach USD 3.27 billion by 2032.

Introduction to the waterjet cutting machine market outlining core capabilities, evolving industrial applications and emerging strategic opportunities

The landscape of precision cutting has undergone a transformative evolution, with waterjet cutting machines emerging as a cornerstone technology across a spectrum of industries. From aerospace fabrication to architectural stonework, these systems harness the power of high-pressure water streams-often infused with abrasive particles-to slice through materials ranging from metal alloys to delicate glass with extraordinary accuracy. As manufacturing paradigms shift toward customization, lean processes, and sustainability, industry decision-makers are increasingly recognizing the strategic importance of integrating waterjet technology into their operations. Rapid advancements in pump design, nozzle engineering, and control software have not only enhanced cutting precision but also reduced operational costs and environmental impact. Moreover, the adaptability of waterjet systems to handle complex geometries and mixed-material assemblies positions them as a versatile solution at the intersection of innovation and efficiency.

Looking beyond traditional heavy industry, early adopters in emerging sectors such as composite panel fabrication and medical device prototyping are capitalizing on waterjet’s ability to deliver burr-free cuts without heat-affected zones. This heat-free characteristic preserves material integrity, making waterjet cutting indispensable for temperature-sensitive applications. As global supply chains become more interconnected, the agility afforded by modular waterjet systems further underscores their appeal. Organizations that harness these capabilities now stand to benefit from accelerated time-to-market and enhanced product differentiation, establishing a competitive advantage that will endure as the technology continues to mature.

Transformative shifts reshaping the waterjet cutting machine landscape from technological breakthroughs to evolving customer demands and sustainability focus

The waterjet cutting machine industry is experiencing a wave of transformative shifts that are redefining conventional manufacturing norms. Advanced pump technologies now deliver pressures exceeding 60,000 psi with improved energy efficiency, enabling higher cutting speeds and finer tolerances. At the same time, integration with digital design platforms and additive manufacturing workflows has unlocked new possibilities for complex, multi-axis cutting operations. These technological breakthroughs are driving a shift from standalone cutting centers to fully automated production cells, where waterjet units collaborate with robotics and vision systems to execute intricate cutting paths with minimal human intervention.

Concurrently, customer demands are evolving to prioritize sustainability and resource optimization. Closed-loop water recycling systems have emerged as a differentiator, allowing manufacturers to reclaim and purify spent cutting water and abrasive media. This shift toward circular resource management reflects broader corporate responsibility goals and regulatory pressures aimed at minimizing industrial waste. End-users in sectors such as automotive and aerospace are particularly sensitive to lifecycle costs and environmental credentials, prompting original equipment manufacturers to innovate waterjet designs that reduce abrasive consumption and power draw.

Furthermore, the expansion of service-based business models is reshaping vendor-client relationships. Subscription-style agreements that bundle equipment, maintenance, and software updates are overtaking traditional capital purchase structures, offering predictable cost profiles and continuous performance upgrades. As a result, suppliers are investing heavily in remote monitoring and predictive analytics platforms to ensure uptime and optimize machine utilization. This blend of digitalization and service orientation not only enhances customer satisfaction but also generates recurring revenue streams, marking a fundamental shift in how waterjet cutting solutions are marketed and supported.

Cumulative effects of recent United States tariffs implemented in 2025 on supply chains, pricing dynamics, and competitive positioning in the waterjet market

In 2025, new United States tariffs targeting key components and finished equipment for waterjet cutting systems have had a ripple effect across the value chain. Valve assemblies and precision pump units, previously sourced primarily from overseas suppliers, saw duty increases that directly impacted production costs for OEMs. This realignment has prompted several manufacturers to diversify their supplier base, bringing in additional regional partners to mitigate exposure and ensure continuity of component availability. While the initial cost pressure translated into higher entry-level machine pricing, those firms that proactively renegotiated supplier contracts and localized certain production steps managed to contain price escalation and protect end-user budgets.

On the demand side, certain industrial segments accelerated domestic adoption in response to concerns over import dependency. Infrastructure and defense contractors, in particular, prioritized Made-in-USA certification, leveraging tariff-driven cost differentials as an impetus to invest in domestic waterjet capabilities. This surge in localized demand has, in turn, spurred capacity expansions at several U.S.-based manufacturing sites. However, smaller regional dealers faced tighter margins and longer lead times as they contended with stock shortages and elevated inventory carrying costs.

Overall, while the 2025 tariffs introduced short-term volatility, they also catalyzed strategic realignment across the industry. Suppliers and system integrators that embraced supply chain transparency, diversified sourcing, and localized production have emerged with more resilient operational models. This foundation positions them to respond more agilely to future trade policy adjustments and to maintain competitive pricing in a market characterized by ongoing geopolitical uncertainty.

Key segmentation insights derived from type, material, and pump configurations revealing critical market drivers, niche applications, and growth opportunities

Examining the market through a segmentation lens reveals nuanced drivers and differentiators that shape investment priorities. When segmenting by machine type, abrasive waterjet systems dominate high-hardness material applications, leveraging garnet or synthetic abrasives to process ferrous and non-ferrous metals, stone, and advanced composites with precision. Pure waterjet configurations, by contrast, excel in scenarios requiring contamination-free cutting, such as foam rubber, delicate glass panels, and food processing, where the absence of abrasive particulates ensures both material purity and operator safety.

Material-based segmentation further illuminates usage patterns. Composite panels, which include carbon fiber components and laminate structures, are processed with high-pressure abrasive jets to achieve tight tolerances necessary for aerospace interiors and lightweight automotive assemblies. In foam rubber applications, pure waterjets create complex gaskets and insulation parts without tearing or bonding issues, while glass ceramics applications leverage pure streams for stress-free cuts that prevent microfractures. Metals-both ferrous and non-ferrous-represent a core revenue segment, driving demand for intensifier-pump systems capable of sustained high pressures and consistent jet quality. Meanwhile, stone materials such as granite and marble rely on abrasive waterjets for decorative facades and functional architectural elements, with growing interest in multi-jet configurations for high-throughput cutting centers.

Pump-type segmentation rounds out the picture, distinguishing between direct drive units that offer compact footprints and rapid pressure generation, and intensifier-drive systems prized for energy efficiency and lower maintenance cycles. Manufacturers calibrate pump choices to match production scale requirements, balancing uptime targets with total cost of ownership considerations. By synthesizing type, material, and pump-type insights, stakeholders can pinpoint optimal configurations that align with both operational objectives and long-term investment strategies.

This comprehensive research report categorizes the Waterjet Cutting Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Pump Type

- End User

Comprehensive regional insights highlighting distinct market trajectories and strategic imperatives across the Americas, EMEA, and Asia-Pacific landscapes

The Americas region continues to serve as a strategic hub for waterjet cutting technology, driven by robust demand in aerospace, automotive prototyping, and infrastructure refurbishment. North American end-users benefit from established dealer networks and rapidly evolving aftermarket support services. Latin American markets, while smaller, are witnessing growing uptake in mining and construction sectors where stone cutting and metal fabrication are essential.

Across Europe, the Middle East & Africa, advanced manufacturing clusters in Germany, Italy, and the United Kingdom maintain high adoption rates, fueled by well-capitalized OEMs and stringent quality certifications. In the Middle East, large-scale infrastructure projects and jewel fabrication initiatives are increasing demand for versatile cutting systems. African markets, though in early development stages, are showing potential in resource extraction and artisanal stone work, with select industry players establishing local partnerships to seed growth.

In the Asia-Pacific, Asia’s manufacturing powerhouses continue to lead consumption, with China, Japan, and South Korea at the forefront of both production and technological innovation. Growing investments in automation and smart factory deployments in Southeast Asia are expanding the regional footprint beyond traditional markets. Australia’s mining and building industries are also notable growth drivers, leveraging abrasive waterjets for critical cutting tasks in remote and demanding environments. These regional dynamics are shaping tailored product offerings, with suppliers customizing machine features to address local energy costs, workforce skills, and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Waterjet Cutting Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful company analysis demonstrating competitive strategies, innovation leadership, and partnership dynamics with key waterjet cutting machine manufacturers

A cadre of established and emerging companies is propelling innovation in waterjet cutting technology. Key legacy players continue to refine their core product lines with advanced software modules, predictive maintenance capabilities, and integrated automation interfaces. Simultaneously, agile market entrants are differentiating through niche offerings, such as micro-abrasive jets for microelectronics and hybrid cutting heads that combine waterjet and laser technologies to optimize versatility.

Strategic partnerships and aftermarket service models are increasingly central to competitive positioning. Some manufacturers have formed alliances with sensor and AI solution providers to deliver machine health analytics that preemptively identify wear patterns and streamline maintenance scheduling. Others are investing in localized manufacturing hubs to accelerate delivery timelines and reduce tariff exposure, reflecting a more adaptive approach to global trade fluctuations.

Furthermore, mergers and acquisitions activity underscores a drive toward end-to-end solution portfolios. Leading firms are acquiring software specialists and abrasive media producers to control critical supply chain nodes and enhance customer value propositions. This trend is fostering cross-functional integration, enabling seamless data flows from design conception through final part production, and reinforcing the role of waterjet cutting as a pivotal link in modern digital manufacturing ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Waterjet Cutting Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bystronic AG

- Dardi International Corporation

- Flow International Corporation

- Hornet Cutting Systems

- Hypertherm, Inc.

- Jet Edge, Inc.

- Kennametal Inc.

- KMT Waterjet

- Koike Aronson, Inc.

- OMAX Corporation

- Resato International B.V.

- Techni Waterjet

- WARDJet (AXYZ Automation Group)

- Water Jet Sweden AB

- Waterjet Corporation S.R.L.

Actionable recommendations for industry leaders to capitalize on emerging waterjet technologies, optimize supply chain resilience, and drive competitive advantage

Industry leaders seeking to harness the full potential of waterjet cutting technology should prioritize strategic investments in digital integration, supply chain resilience, and sustainability. First, embedding connectivity and IoT platforms into existing machine fleets will unlock real-time performance data, driving continuous process optimization and reducing unplanned downtime. By collaborating with software integrators and adopting open-architecture control systems, organizations can future-proof their operations against evolving automation standards.

Second, diversifying supplier networks for critical pump components and high-quality abrasives is essential. Executives should evaluate on-shore and near-shore partnerships to mitigate tariff risks and shorten lead times. Establishing consortia with peer organizations to negotiate collective purchasing agreements can further stabilize cost structures and ensure priority access during market disruptions.

Third, embracing circular economy principles will yield long-term cost and environmental benefits. Implementing closed-loop abrasive recovery and water filtration systems not only aligns with corporate sustainability targets but also reduces raw material expenditure. Decision-makers should conduct lifecycle impact assessments to quantify resource savings and incorporate these insights into capital budgeting frameworks. Through these focused actions, industry leaders will be well-positioned to capitalize on emerging technology enhancements, regulatory shifts, and shifting customer expectations.

Detailed research methodology outlining data sources, multi-stage analysis techniques, validation processes, and framework for comprehensive market insights

The research methodology underpinning this analysis combines both primary and secondary data collection approaches to ensure robust and objective findings. Expert interviews were conducted with senior executives, equipment engineers, and procurement specialists across key end-use industries to capture real-world insights on technology adoption drivers and operational challenges. These qualitative inputs were triangulated with published company reports, industry whitepapers, and technical journals to validate emerging trends and benchmark performance metrics.

Quantitative analysis involved the consolidation of shipment data, import-export statistics, and financial disclosures from public filings. Advanced analytics techniques, including regression modeling and cluster analysis, were applied to identify correlations between macroeconomic indicators and segment-specific demand patterns. Additionally, a rigorous vendor evaluation framework assessed the competitive landscape, scoring companies on criteria such as innovation capacity, service footprint, and partnership ecosystems.

To enhance the credibility of our conclusions, iterative validation rounds were executed with subject-matter experts, ensuring alignment between quantitative outcomes and on-the-ground observations. This methodological rigor not only strengthens the reliability of insights but also provides a transparent audit trail for stakeholders seeking to understand the analysis process and replicate key findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Waterjet Cutting Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Waterjet Cutting Machine Market, by Type

- Waterjet Cutting Machine Market, by Material

- Waterjet Cutting Machine Market, by Pump Type

- Waterjet Cutting Machine Market, by End User

- Waterjet Cutting Machine Market, by Region

- Waterjet Cutting Machine Market, by Group

- Waterjet Cutting Machine Market, by Country

- United States Waterjet Cutting Machine Market

- China Waterjet Cutting Machine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Conclusion summarizing insights, strategic implications, and the future outlook for waterjet cutting machine stakeholders navigating a dynamic market environment

In conclusion, the waterjet cutting machine industry stands at a pivotal juncture where technological advancements, evolving customer expectations, and shifting trade policies are converging to redefine market dynamics. The integration of high-pressure pump innovations, digital process controls, and sustainable recycling systems underscores a broader shift toward agile, environmentally conscious manufacturing. Companies that align their strategic imperatives with these trends will not only unlock operational efficiencies but also differentiate themselves in increasingly competitive environments.

Tariff-induced supply chain realignments have highlighted the importance of diversified sourcing strategies and proactive risk management. Furthermore, a nuanced understanding of segmentation-across machine types, material applications, and pump technologies-enables stakeholders to tailor solutions that meet precise operational requirements and budgetary constraints. Regional insights reveal that growth trajectories vary significantly across the Americas, EMEA, and Asia-Pacific, necessitating a localized approach to product development and service delivery.

Ultimately, the firms that leverage data-driven decision-making, foster collaborative supplier ecosystems, and champion sustainability initiatives will emerge as market leaders. The strategic recommendations outlined herein provide a roadmap for navigating complexities and capitalizing on opportunities in the waterjet cutting machine sector. As the industry continues to evolve, maintaining a forward-looking perspective will be essential for driving long-term growth and technological differentiation.

Compelling call to action to connect with Ketan Rohom and secure the comprehensive waterjet cutting machine market research report

Ready to take the next step in gaining a competitive edge through unmatched industry intelligence? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report on the waterjet cutting machine industry. With expert support tailored to your organization’s specific needs, Ketan will guide you through our detailed findings, clarify any questions you have, and ensure you obtain the strategic insights necessary to drive informed decisions. Don’t miss the opportunity to harness in-depth analysis covering the latest technological innovations, tariff implications, segmentation dynamics, and regional trends. Connect with Ketan today to elevate your strategic planning and position your company for success in a rapidly evolving market.

- How big is the Waterjet Cutting Machine Market?

- What is the Waterjet Cutting Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?