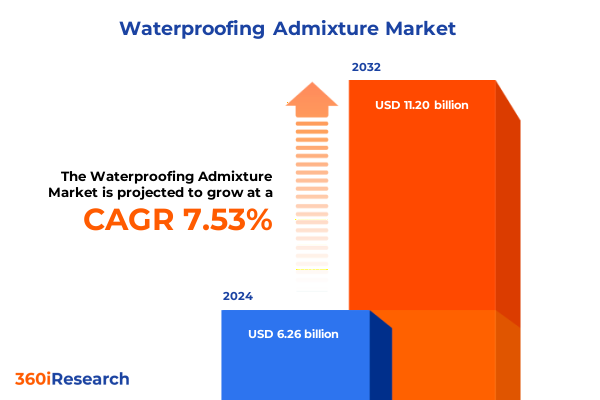

The Waterproofing Admixture Market size was estimated at USD 5.89 billion in 2025 and expected to reach USD 6.25 billion in 2026, at a CAGR of 6.21% to reach USD 8.99 billion by 2032.

Establishing the Critical Foundation of Waterproofing Admixtures to Enhance Structural Integrity and Resilience across Diverse Construction Applications in Commercial, Industrial, and Residential Projects Worldwide

Concrete structures face an array of environmental and operational challenges, from moisture ingress to chemical exposure, which can compromise their longevity and integrity. As a vital addition to standard mix designs, waterproofing admixtures play a transformative role by imparting impermeability and resilience to cementitious materials. This executive summary provides a concise yet comprehensive introduction to the technical, regulatory, and market forces that shape the adoption of these specialized chemical solutions across construction sectors.

The rapid pace of urbanization, coupled with growing demand for sustainable and low maintenance infrastructure, has elevated the importance of advanced admixture technologies capable of addressing water related risks. Notably, architects and engineers increasingly specify crystalline and pore blocking systems to meet stringent durability standards, while balancing cost and ease of application. Moreover, emerging green building certifications and regulatory frameworks are driving manufacturers to refine formulations that minimize environmental impact without compromising performance.

By exploring the underlying mechanisms of waterproofing admixtures, their strategic applications, and the broader market context, this section lays the groundwork for a deeper understanding of key trends, segmentation nuances, regulatory impacts, regional dynamics, and strategic imperatives. As the construction industry continues to evolve, a clear grasp of these foundational elements is essential for stakeholders seeking to navigate complexities and capitalize on growth opportunities in the waterproofing admixture domain.

Unveiling Pivotal Technological Advancements and Sustainable Trends Driving a Paradigm Shift in Waterproofing Admixture Formulation and Application across Global Construction Landscapes

Over the past decade, the landscape of waterproofing admixtures has undergone transformative shifts driven by the convergence of innovation, sustainability mandates, and evolving performance expectations. Initially dominated by traditional cementitious coatings and membrane based approaches, the market has progressively tilted toward admixture based systems that integrate directly into concrete and mortar matrices. This transition has enabled uniform protection at the microstructural level, delivering enhanced durability and reduced lifecycle costs.

In parallel, advancements in polymer chemistry and nanotechnology have introduced novel crystalline technologies capable of self healing micro cracks and dynamically responding to hydrostatic pressure. Consequently, developers and owners benefit from extended service life and minimized maintenance schedules. Furthermore, manufacturers are increasingly leveraging digital formulation tools and real time quality control analytics to optimize admixture performance against specific project requirements, thereby reinforcing product reliability and application consistency.

Moreover, sustainability considerations now underpin every stage of product development, from raw material sourcing to end of life. The incorporation of bio based additives, reduction of volatile organic compounds, and alignment with international building certification standards reflect a broader industry commitment to environmental stewardship. As a result, waterproofing admixture providers are not only differentiating on technical merit but also on their ability to deliver greener solutions that address both regulatory demands and corporate social responsibility goals.

Analyzing the Complex Cumulative Effects of Recent United States Tariff Measures on Waterproofing Admixture Supply Chains, Cost Structures, and Competitive Dynamics in 2025

The introduction of new tariff measures by United States authorities in early 2025 has significantly altered the cost and supply chain dynamics for chemicals integral to waterproofing admixtures. Tariffs targeting specific imported raw materials, including specialized polymers and mineral additives, have increased procurement costs for admixture manufacturers. These additional duties have prompted many producers to reevaluate sourcing strategies and renegotiate supplier contracts to maintain margin stability and competitive pricing structures.

Consequently, several manufacturers have accelerated efforts to diversify supply bases, exploring regional partnerships and nearshoring options in North America and Latin America to mitigate exposure to elevated import duties. Such strategic adjustments have been supplemented by accelerated internal research and development programs aimed at validating alternative raw material sources with comparable performance characteristics. Moreover, the need for tariff induced cost optimization has driven leaner production methodologies and more rigorous waste reduction protocols across manufacturing operations.

In addition, end users-including contractors and project owners-are increasingly factoring tariff related cost escalations into bid pricing and project budgets. As a result, demand elasticity has become more pronounced, requiring manufacturers to demonstrate clear cost to performance benefits and provide enhanced technical support. By understanding the cumulative impact of United States tariffs, stakeholders across the value chain can develop proactive strategies to preserve supply continuity, optimize cost structures, and safeguard long term project viability.

Revealing Critical Segmentation Perspectives Based on Type, Application, End Use, and Form to Illuminate Waterproofing Admixture Market Dynamics and Specialized Performance Requirements

A nuanced analysis of market segmentation reveals distinct drivers and application considerations across type, application, end use, and form categories. When viewed through the lens of type, crystalline admixtures subdivide into hydrophilic and hydrophobic systems, each delivering customized moisture blocking mechanisms suited to subgrade and superstructure applications. Pore blocking admixtures complement these offerings by filling capillary voids, thereby enhancing impermeability in environments with varying hydrostatic pressures.

Application oriented segmentation highlights diversifications across basement, parking structures, roof, and tunnel use cases. Basement protection spans above grade installations that integrate seamlessly with architectural finishes as well as underground applications demanding high hydrostatic resistance. Parking structure formulations are adapted for indoor environments with lighter vehicular loads and outdoor decks exposed to deicing salts, whereas roof systems optimize flat and pitched designs for weatherproofing and thermal performance. Tunnel solutions split between bored tunnel linings and cut and cover segments, each requiring specific admixture chemistries to address groundwater intrusion and soil chemistry nuances.

Further, end use segmentation emphasizes unique performance benchmarks across commercial, industrial, and residential sectors. Commercial projects typically demand rapid turnaround and aesthetic integration, industrial facilities prioritize chemical resistance and mechanical durability, while residential constructions focus on user friendly application, cost efficiency, and compliance with green building certifications. Finally, form based segmentation contrasts liquid concentrates and ready to use solutions with powder variants that are either pre blended or require additional additives. These form distinctions influence onsite handling, storage logistics, and dosing precision, shaping procurement and specification decisions.

This comprehensive research report categorizes the Waterproofing Admixture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End Use

Deciphering Regional Variabilities and Strategic Drivers in the Americas, Europe Middle East & Africa, and Asia Pacific Markets Shaping the Adoption of Waterproofing Admixtures

Regional dynamics in the Americas are characterized by significant infrastructure investment programs driven by government stimulus and renewable energy projects. In North America, modernization of aging water treatment plants and transportation networks has spurred demand for high performance admixtures capable of extending asset life and reducing maintenance costs. Latin American markets, in turn, exhibit growing interest in cost effective solutions that balance performance with the constraints of local supply chains and regulatory frameworks.

Across Europe, the Middle East, and Africa, regulatory compliance and heritage preservation are key drivers for admixture adoption. Stringent European Union standards for water tightness and carbon footprint have incentivized manufacturers to tailor formulations that minimize embodied energy and meet localized climatic challenges. Meanwhile, the Gulf region’s rapid urban development and mega infrastructure investments have created niches for admixtures that withstand extreme temperature fluctuations and high salt exposure, whereas emerging African markets emphasize affordability and ease of application in residential and small commercial projects.

In the Asia Pacific region, the convergence of urbanization, industrial expansion, and strict seismic design codes positions waterproofing admixtures as indispensable components in high rise and mass transit development. China’s emphasis on sustainable construction and India’s growing residential sector foster demand for both advanced crystalline systems and economical powder blends. Australia and Southeast Asia further present opportunities tied to coastal developments and renewable energy infrastructure that require specialized moisture protection against tropical climates and saline environments.

This comprehensive research report examines key regions that drive the evolution of the Waterproofing Admixture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Innovation Pipelines, and Partnerships of Leading Companies Transforming the Competitive Landscape in Waterproofing Admixture Development and Distribution

Leading providers in the waterproofing admixture sector are differentiating through targeted investments in research platforms and strategic partnerships. For instance, global chemical innovators have established specialized laboratories to simulate extreme environmental conditions, enabling rapid formulation iterations and data driven performance validation. These initiatives have empowered manufacturers to bring next generation crystalline and polymer based systems to market with enhanced durability, self healing capabilities, and lower carbon footprints.

In addition, companies are actively pursuing collaborative agreements with construction contractors and engineering consultancies to embed technical support and specification services upstream in the project lifecycle. By offering digital tools for mix design optimization and on site training modules, these industry leaders are strengthening customer relationships while gathering critical real world performance data. Consequently, a competitive landscape has emerged where service integration and knowledge transfer are as pivotal as product quality in securing long term contracts.

Moreover, strategic acquisitions targeting regional blending facilities and specialty raw material suppliers have enabled key market participants to expand their global footprint and improve supply chain resilience. These vertical integration strategies have not only mitigated tariff induced cost pressures but also facilitated localized production of customized admixture solutions. As a result, leading companies now operate with greater agility, delivering faster turnaround times and tailored formulations to address unique project demands across diverse geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Waterproofing Admixture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Chryso SAS

- Fosroc International Limited

- Fritz-Pak Corporation

- GCP Applied Technologies Inc.

- Ha-Be Betonchemie GmbH

- MAPEI S.p.A.

- MBCC Group GmbH

- Normet Group

- Rhein-Chemotechnik GmbH

- RPM International Inc.

- Sika AG

- Solvay SA

- Thermax Limited

- Yara International ASA

Empowering Industry Stakeholders with Actionable Strategies to Capitalize on Emerging Opportunities, Mitigate Risks, and Drive Sustainable Growth in the Waterproofing Admixture Sector

Industry leaders must proactively align their strategies with evolving regulatory landscapes and sustainability objectives to maintain relevance and growth. Firms should prioritize the development of eco optimized admixtures that comply with carbon reduction mandates and contribute to green building certifications, thereby meeting the rising demand for environmentally responsible construction materials. Simultaneously, investing in modular production facilities and flexible blending capabilities will enable rapid adaptation to shifting raw material availabilities and tariff fluctuations, reducing operational risk.

Furthermore, fostering collaborative ecosystems that integrate chemical experts, structural engineers, and digital construction platforms can drive greater value creation. By co developing specification guidelines and digital mix design tools, organizations can accelerate project approval cycles while ensuring optimal admixture performance. In addition, expanding technical training programs for applicators and contractors will enhance installation quality and foster brand loyalty, translating into repeat business and deeper market penetration.

Finally, pursuing targeted geographic expansion into high growth regions such as Southeast Asia and selective Latin American markets will unlock new revenue streams. Companies should leverage data driven market entry assessments, local regulatory expertise, and joint ventures with established regional players to minimize market entry barriers. By executing these actionable strategies, industry stakeholders can better navigate complexities, harness emerging opportunities, and strengthen their competitive positioning in the waterproofing admixture sector.

Detailing a Robust Research Methodology Integrating Primary Expert Interviews, Secondary Data Analysis, and Multidimensional Validation to Ensure Comprehensive Market Insights

This research adopts a multi tiered approach combining primary and secondary methodologies to ensure the rigor and relevance of insights. Primary research involved in depth interviews with chemical engineers, specification consultants, and project managers across commercial, industrial, and residential applications. These qualitative discussions provided firsthand perspectives on performance requirements, procurement challenges, and innovation priorities, enabling a granular understanding of market drivers and adoption barriers.

Secondary research encompassed a thorough review of technical journals, patent filings, and regulatory publications to map historical developments and emerging trends in admixture chemistries and application techniques. Trade association reports and standards documents were analyzed to validate compliance frameworks and anticipate regulatory trajectories. In addition, supply chain mapping of key raw material flows was conducted to identify potential risks associated with tariff measures and logistical constraints.

Quantitative validation was achieved by triangulating findings against multiple data sources, including proprietary laboratory performance datasets and anonymized purchasing records from construction firms. This multidimensional validation process ensured that conclusions reflect both macro level trends and micro level performance metrics. By integrating these complementary research techniques, the study offers a holistic, evidence based portrait of the waterproofing admixture landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Waterproofing Admixture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Waterproofing Admixture Market, by Type

- Waterproofing Admixture Market, by Form

- Waterproofing Admixture Market, by Application

- Waterproofing Admixture Market, by End Use

- Waterproofing Admixture Market, by Region

- Waterproofing Admixture Market, by Group

- Waterproofing Admixture Market, by Country

- United States Waterproofing Admixture Market

- China Waterproofing Admixture Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Consolidating Key Insights and Strategic Imperatives to Navigate the Evolving Landscape of Waterproofing Admixtures and Achieve Long Term Competitive Advantage

The evolving waterproofing admixture landscape presents a strategic inflection point for manufacturers, distributors, and end users alike. Technological breakthroughs in crystalline and polymer adaptations have unlocked new performance thresholds, while sustainability requirements and tariff driven cost pressures necessitate agile supply chain strategies. Stakeholders must therefore blend innovation with operational resilience to navigate this complex terrain effectively.

Key segmentation insights underscore the need for tailored solutions across diverse application environments, from subterranean basements to elevated roof structures and specialized tunnel projects. Regional disparities reveal unique drivers in infrastructure spending, regulatory stringency, and climatic exposures that must inform product positioning and go to market approaches. Meanwhile, leading companies are demonstrating the value of integrated service offerings, local manufacturing footprints, and digital toolkits in fostering robust customer relationships.

Looking forward, success in the waterproofing admixture sector will depend on balancing technical excellence and sustainable practices, underpinned by data driven decision making and collaborative industry partnerships. By synthesizing the findings of this executive summary, organizations can refine their strategic roadmaps, enhance product development focus, and secure a competitive edge in an increasingly demanding marketplace.

Connect Directly with Ketan Rohom to Secure the Full Market Research Report on Waterproofing Admixtures and Unlock Informed Decision Making for Strategic Business Growth

To gain unparalleled insights and make data driven decisions, connect with Ketan Rohom, Associate Director of Sales & Marketing, and secure your comprehensive market research report on waterproofing admixtures. His expertise in bridging technical depth with market intelligence will enable your team to align strategy with real time industry dynamics, discover actionable growth levers, and preemptively address emerging challenges. Engage now to unlock exclusive analyses, detailed segmentation insights, and forward looking recommendations that empower your organization to lead in innovation and achieve sustained competitive advantage.

- How big is the Waterproofing Admixture Market?

- What is the Waterproofing Admixture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?