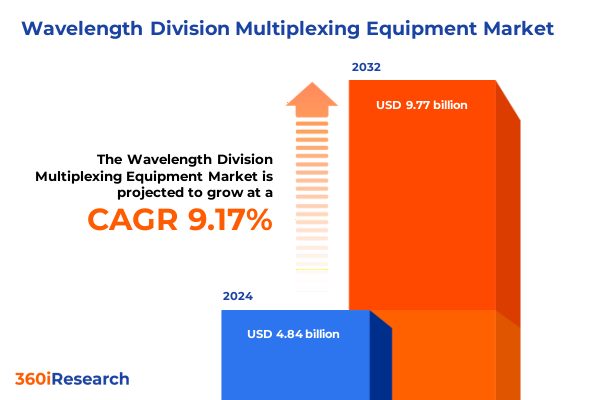

The Wavelength Division Multiplexing Equipment Market size was estimated at USD 5.26 billion in 2025 and expected to reach USD 5.71 billion in 2026, at a CAGR of 9.24% to reach USD 9.77 billion by 2032.

Unlocking the Future of Optical Networks Through Advanced Wavelength Division Multiplexing Technologies Transforming Connectivity

Emerging bandwidth requirements and exponential growth in data-intensive applications have accelerated the adoption of wavelength division multiplexing equipment as a foundational pillar of modern optical networks. By enabling the simultaneous transmission of multiple wavelength channels over a single fiber, this technology multiplies capacity without the need for costly infrastructure overhauls. As enterprises, cloud service providers, and telecom operators grapple with surging video streaming, artificial intelligence workloads, and immersive technologies, WDM solutions offer a scalable pathway to satisfy evolving performance expectations.

This executive summary provides a high-level examination of the optical networking landscape, highlighting the key forces, structural shifts, and market dynamics that define WDM equipment today. Drawing on comprehensive qualitative research and expert insights, it outlines transformative technological trends, evaluates policy impacts such as recent tariff measures, and distills critical segmentation and regional perspectives. Industry leaders and decision-makers will gain a clear understanding of how equipment types, underlying technologies, real-world applications, and end-user profiles interact to shape strategic opportunities. Through this narrative, you will be equipped with actionable intelligence to inform supply chain decisions, technology roadmaps, and partnership strategies in an increasingly competitive environment.

Accelerating Network Evolution Through Transformative Shifts Driving Flexgrid Adoption And High-Capacity Optical Architectures

The optical networking ecosystem is undergoing a profound evolution driven by the convergence of coherent optics innovations, flexible spectral management, and software-defined architectures. As operators seek to optimize spectrum utilization, the transition from fixed-grid DWDM to flexible grid, or Flexgrid, multiplies channel density and supports dynamic allocation of sub-bands. This shift not only addresses capacity bottlenecks but also aligns with broader trends toward network automation and programmability.

Beyond spectral flexibility, the integration of digital signal processing improvements and photonic integration has propelled coherent transponder capabilities to new heights, reaching higher data rates with lower power consumption. Simultaneously, the rise of open networking principles and software-defined control planes has redefined the management of wavelength routing and restoration. As a result, networks can dynamically adapt to traffic fluctuations, enable multi-layer orchestration, and deliver on-demand wavelengths through API-driven workflows. These innovations collectively reshape the deployment landscape, offering transformative potential for optical operators committed to future-proofing their infrastructure.

Assessing The Far-Reaching Impact Of United States Tariff Measures On Optical Component Supply Chains And Equipment Costs

In early 2025, the United States enacted a series of tariff measures targeting imported optical components, creating a ripple effect across global supply chains. These duties, applied to key sub-assemblies and finished WDM modules, have increased procurement costs for OEMs and network operators, prompting a reassessment of sourcing strategies. The immediate consequence has been a shift toward regional supplier diversification and greater emphasis on local manufacturing partnerships to mitigate cost volatility.

Furthermore, the tariff-driven cost escalation has spurred innovation in alternative material sourcing and component design, as vendors seek to preserve margin structures without compromising performance. While some equipment suppliers have absorbed a portion of the additional expense, end users are recalibrating budgets and timelines to accommodate the new cost environment. In parallel, industry stakeholders are engaging with policymakers to advocate for tariff relief or exemptions on critical photonic technologies. This regulatory pressure underscores the need for agile strategic planning, enabling network architects to navigate evolving trade frameworks while sustaining their upgrade roadmaps.

Revealing Critical Insights Across Equipment Technology And Application Segmentation To Guide Strategic Decision Making In Optical Networking

A granular examination of equipment type segmentation reveals diverse market demands stretching from optical amplifiers to intelligent ROADMs and high-capacity transponders. Within the amplifier segment, erbium-doped fiber amplifiers remain prevalent for their reliability, while Raman-based solutions are gaining traction for extended reach and noise reduction. The Mux/Demux category encompasses both add-drop and terminal modules, with add-drop units facilitating flexible wavelength insertion and extraction, and terminal assemblies anchoring point-to-point links. ROADMs now span colorless directionless, colorless directionless contentionless, and wavelength-selective variants, each addressing unique network architectures and restoration requirements. Transponders split between CFP and QSFP form factors, balancing power efficiency, port density, and upgrade paths to 400G and beyond.

Parallel to equipment type, technological segmentation differentiates fixed-grid CWDM, traditional DWDM, and emergent Flexgrid solutions. DWDM systems are stratified by line rates, encompassing the latest 100G, 200G, and 400G coherent channels that fuel metro and long-haul backbones. The application spectrum ranges from data center interconnect links-to include both cloud interconnect provisions and enterprise peering fabrics-to expansive long-haul corridors and dynamic metro rings. Critical end-user verticals span cloud service providers, large enterprises deploying private networks, government and defense agencies prioritizing secure transmission, and telecom service providers scaling access and backbone services. Together, these segmentation dimensions inform target use-case prioritization and product roadmapping for network operators and equipment suppliers alike.

This comprehensive research report categorizes the Wavelength Division Multiplexing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- Application

- End User

Uncovering Regional Dynamics And Growth Patterns Shaping Optical Networking Deployments Across Americas Europe Middle East Africa And Asia Pacific

Regional dynamics in the WDM equipment landscape underscore distinct investment drivers and deployment patterns across the Americas, Europe Middle East and Africa, and Asia Pacific markets. In the Americas, a mature fiber infrastructure and aggressive content distribution networks sustain steady upgrades to higher-capacity DWDM and Flexgrid architectures, particularly along data-intensive coastal corridors. Vendors here emphasize integration with cloud on-ramps and edge data centers to meet surging consumer and enterprise traffic demands.

Europe Middle East and Africa display a heterogeneous mix of advanced national backbones alongside greenfield projects in growth corridors. Legacy networks are being modernized with intelligent ROADMs and multi-degree node architectures, while defense and public sector clients prioritize encryption and network resilience. Asia Pacific exhibits the fastest growth trajectory, driven by rapid urbanization, government digitalization initiatives, and hyperscale data center rollouts. Operators in this region focus on high-density C+L band solutions and integrated photonic modules to address capacity crunches and power constraints. These regional contours shape vendor go-to-market strategies, partnership formations, and localized innovation roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Wavelength Division Multiplexing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Pioneering Innovations And Strategic Collaborations In Wdm Equipment Market Landscape

Industry leaders are advancing the WDM equipment market through a combination of organic innovation and strategic collaborations. Established players are investing heavily in photonic integration and silicon photonics to shrink form factors and optimize power consumption, with several forging alliances with semiconductor foundries to accelerate chipset development. Others are expanding software-defined networking ecosystems by integrating machine learning-driven performance analytics and automated failure prediction capabilities within their management platforms.

In parallel, mid-tier vendors and niche specialists are differentiating through targeted solutions, such as compact colorless directionless contentionless ROADMs optimized for edge deployments and domain-specific transponders tailored to cloud interconnect use cases. Joint development agreements between equipment manufacturers and hyperscale data center operators are emerging to co-design modular pluggable optics that align with modular data center architectures. These collaborative models are fostering a more interoperable ecosystem, enabling multi-vendor deployments and reducing integration overhead for operators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wavelength Division Multiplexing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADVA Optical Networking SE

- Ciena Corporation

- Cisco Systems, Inc.

- Fujitsu Limited

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Infinera Corporation

- NEC Corporation

- Nokia Corporation

- Shenzhen GL-COM Technology Co., Ltd.

- Shenzhen HTFuture Co., Ltd.

- Shenzhen Optico Communication Co.,Ltd.

- Telefonaktiebolaget LM Ericsson

- Thor Broadcast

- ViaLite by Pulse Power and Measurement Ltd.

- VIAVI Solutions Inc.

- ZTE Corporation

Actionable Strategies For Industry Leaders To Enhance Resilience Drive Innovation And Capitalize On Emerging Optical Networking Opportunities

To navigate the evolving WDM equipment environment, industry leaders should prioritize a strategic supplier diversification plan that includes both established and emerging component providers. By engaging multiple sources for amplifiers, ROADMs, and transponders, organizations can reduce exposure to tariff-induced cost fluctuations and potential single-source disruptions. Concurrently, investing in network automation frameworks and open-optical control planes will enable dynamic wavelength provisioning and rapid service rollouts, elevating operational efficiency and responsiveness.

Moreover, adopting flexible spectrum management through Flexgrid-capable hardware and software will future-proof networks against unpredictable traffic surges and unfolding application demands. Strategic partnerships with photonic integration specialists and chipset vendors can accelerate the adoption of compact, energy-efficient modules for both core and edge architectures. Finally, maintaining ongoing dialogue with regulatory bodies and participating in industry forums will ensure that policy developments, such as import duty adjustments, are anticipated and integrated into long-term capital expenditure plans.

Detailing The Rigorous Research Methodology Combining Primary And Secondary Investigations Expert Interviews And Comprehensive Data Analysis Procedures

This research employs a rigorous methodology combining primary and secondary investigations to ensure comprehensive market insight. The primary phase involved in-depth interviews with senior network architects, carrier executives, and equipment OEM leaders, providing firsthand perspectives on technology adoption drivers and procurement challenges. These interviews were complemented by on-site visits to data center facilities and regional network operations centers, offering contextual understanding of deployment environments and performance benchmarks.

The secondary phase leveraged an extensive review of technical white papers, vendor product briefs, industry conference proceedings, and government policy publications. Data points were cross-validated through multiple sources and refined via a data triangulation process. Expert panel workshops were convened to vet preliminary findings and refine thematic interpretations. This multi-faceted approach ensures that the insights presented herein reflect both the current state of WDM equipment deployments and the emergent trends poised to define future network architectures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wavelength Division Multiplexing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wavelength Division Multiplexing Equipment Market, by Equipment Type

- Wavelength Division Multiplexing Equipment Market, by Technology

- Wavelength Division Multiplexing Equipment Market, by Application

- Wavelength Division Multiplexing Equipment Market, by End User

- Wavelength Division Multiplexing Equipment Market, by Region

- Wavelength Division Multiplexing Equipment Market, by Group

- Wavelength Division Multiplexing Equipment Market, by Country

- United States Wavelength Division Multiplexing Equipment Market

- China Wavelength Division Multiplexing Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Perspectives Emphasizing Key Takeaways From Market Dynamics Technological Trends And Strategic Imperatives In Optical Networking

The optical networking sector is at an inflection point, where capacity demands, spectral flexibility, and policy considerations converge to shape strategic imperatives for WDM equipment adoption. Key transformative shifts-ranging from advanced coherent optics to software-driven orchestration-underscore the necessity for agile network designs that can scale seamlessly and adapt to evolving traffic patterns.

Simultaneously, regional nuances and tariff landscapes reinforce the importance of a diversified supply chain and localized innovation strategies. As equipment types, technologies, and application requirements intersect, stakeholders must align their roadmaps with clear segmentation insights to capture growth opportunities and mitigate risk. By integrating robust automation frameworks, pursuing collaborative development agreements, and engaging proactively with regulatory bodies, industry leaders can position their optical networks for long-term resilience, efficiency, and competitive advantage.

Activate Growth Opportunities By Engaging With Associate Director Sales And Marketing To Secure A Comprehensive Optical Networking Market Study

To explore this in-depth market intelligence and uncover the strategic pathways that will shape your optical networking investments, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings a wealth of expertise in guiding decision-makers through complex technology landscapes and will provide personalized insights tailored to your organization’s priorities. Engage directly to request the complete research dossier and unlock privileged access to proprietary analysis, comparative technology assessments, and region-specific intelligence. By partnering with Ketan, you will gain a comprehensive understanding of how advanced wavelength division multiplexing equipment can drive resilience, efficiency, and competitive advantage for your network architecture. Contact Ketan now to secure your copy of the full report and confidently navigate the evolving demands of next-generation optical networks.

- How big is the Wavelength Division Multiplexing Equipment Market?

- What is the Wavelength Division Multiplexing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?