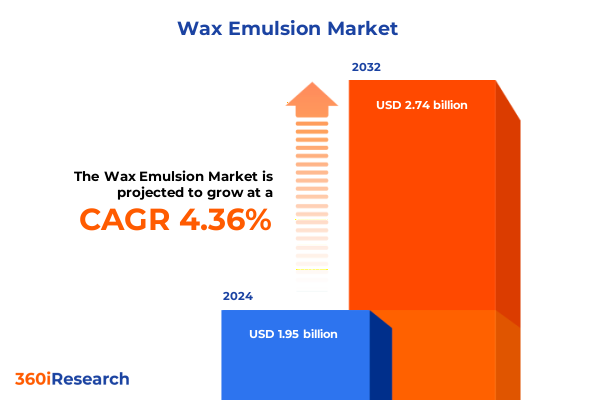

The Wax Emulsion Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.11 billion in 2026, at a CAGR of 4.37% to reach USD 2.74 billion by 2032.

Understanding the Flourishing Wax Emulsion Market Dynamics and Their Emerging Opportunities in Diverse Industrial Applications Across Key End-Use Segments

The wax emulsion arena has emerged as a critical intersection between traditional materials and modern performance requirements, driving innovation across countless industrial applications. Over recent years, advancements in polymer science and surface engineering have elevated wax emulsions from niche finishing agents to integral components in sectors ranging from paper manufacturing to textiles. As materials science has evolved, so too has the role of these colloidal systems, with manufacturers and end users identifying novel functionalities that enhance product durability, improve process efficiency, and reduce environmental impact.

Amidst this backdrop, end-use industries have demanded greater customization, fostering a shift toward more specialized wax formulations that balance stability, film formation, and compatibility with complex substrates. This evolution reflects a broader industry commitment to sustainability, as formulators leverage water-based systems to replace solvent-heavy alternatives without compromising performance. Consequently, wax emulsions now play a pivotal role in enabling greener operations while catering to stringent regulatory standards.

As we delve into this executive summary, readers will uncover how technological breakthroughs, regulatory pressures, and shifting customer preferences are collectively sculpting the wax emulsion landscape. From supply chain disruptions to strategic partnerships, this introduction sets the stage for a detailed exploration of the market’s evolving challenges and opportunities.

Exploring the Pivotal Technological and Regulatory Disruptions Reshaping the Wax Emulsion Ecosystem and Driving Industry Innovation

Recent years have witnessed transformative currents reshaping the wax emulsion space, propelled by both technological ingenuity and shifting market priorities. One of the most notable shifts involves the integration of nanotechnology, enabling the engineering of emulsions with enhanced barrier properties, improved adhesion, and tunable rheology. These nanoscale additives have opened new frontiers in protective coatings and functional finishes, allowing manufacturers to meet ever-tightening performance demands.

Concurrently, sustainability metrics have redefined product development paradigms, ushering in bio-based waxes derived from renewable feedstocks. This pivot not only addresses environmental mandates but also resonates with end users seeking ethically sourced materials. As players recalibrate their portfolios, the emphasis on lifecycle assessments and reduced carbon footprints has catalyzed partnerships between producers of feedstock and emulsion formulators, signaling a more integrated value chain.

Meanwhile, regulatory landscapes around volatile organic compounds continue to tighten across North America, EMEA, and APAC regions, reinforcing the shift toward waterborne systems. To maintain compliance and competitive edge, companies are enhancing their quality control protocols and investing in advanced analytical instrumentation. Together, these technological and regulatory forces are driving a marketwide transformation, redefining capabilities and raising the bar for performance and sustainability.

Evaluating the Comprehensive Effects of 2025 United States Import Tariffs on Wax Emulsion Supply Chains and Cost Structures

In 2025, newly implemented United States import tariffs on select chemicals and polymeric materials have exerted a noticeable ripple effect on the wax emulsion supply chain. The tariff measures, designed to protect domestic production, have introduced additional costs for manufacturers reliant on imported feedstocks, particularly paraffin and specialized wax derivatives. These heightened duties have compelled formulators to re-evaluate their procurement strategies, seeking alternative sources and negotiating longer-term agreements to stabilize input costs.

Moreover, the increased import expenses have accelerated the shift toward domestically produced alternatives, such as microcrystalline and synthetic waxes, where vertical integration with United States-based refineries offers a cost buffer. Supply chain management teams have diversified their supplier base, exploring partnerships with regional producers in EMEA and APAC to circumvent tariff-related price escalations. Such strategic realignments have improved resiliency, yet they also introduce complexities around quality consistency and delivery lead times.

As a result, manufacturers are implementing cost-control measures, including optimizing emulsion viscosity and refining process yields, to offset tariff impacts. While these adjustments present short-term challenges, they ultimately encourage innovation in formulation efficiency and stronger collaborations with local raw material producers-reinforcing a market dynamic where strategic agility is paramount.

Uncovering Critical Insights from Product, Emulsion, Wax, Application, and Distribution Channel Segmentation to Inform Strategic Decision Making

Dissecting the wax emulsion market through multiple segmentation lenses illuminates nuanced performance drivers. Based on ionic charge characteristics, formulators select between anionic, cationic, and nonionic systems, each offering distinct compatibility with substrates such as textile fibers, paper coatings, and wood finishes. Anionic emulsions, favored for leather finishing and surface sizing, deliver strong water resistance, while cationic variants excel in warp and weft textile sizing operations. Nonionic emulsions, on the other hand, are prized for their broad substrate affinity and stability in diverse application environments.

Examining emulsion type reveals foundational differences between oil-in-water and water-in-oil systems. Oil-in-water emulsions dominate in paper internal sizing and polishes due to their ease of handling and lower viscosity, whereas water-in-oil counterparts are leveraged in specialized applications like wood polishing, where enhanced moisture resistance is critical. This delineation underscores the importance of tailoring emulsion architecture to end-use requirements.

When categorized by wax type, the market’s complexity becomes evident; from natural options like beeswax and carnauba to engineered materials such as polyethylene and synthetic waxes, each class contributes unique thermal characteristics and film formation behaviors. Beeswax and carnauba remain central to premium polish formulations, while microcrystalline and montan waxes are preferred for robust coatings. Synthetic varieties, meanwhile, enable formulation flexibility and cost efficiency.

Application-driven segmentation further refines market understanding by mapping product performance to leather finishing, paper coating (with both internal and surface sizing disciplines), polishes and coatings, textile sizing (across warp and weft processes), and wood polishing. Lastly, distribution channel analysis highlights the interplay between direct sales, distributor networks, and online platforms, revealing how access models impact customer engagement and buying patterns. Together, these segmentation insights offer a strategic blueprint for targeted product development and market positioning.

This comprehensive research report categorizes the Wax Emulsion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Emulsion Type

- Wax Type

- Application

- Distribution Channel

Assessing Regional Dynamics Across Americas, EMEA, and Asia-Pacific to Illuminate Growth Hotspots and Sectoral Variances in Wax Emulsions

Regional analysis of the wax emulsion landscape uncovers varied growth trajectories and technology adoption rates across the Americas, Europe, Middle East & Africa, and Asia-Pacific zones. In the Americas, ongoing investments in packaging innovation and an expanding leather goods sector drive demand for advanced emulsion systems, particularly those offering enhanced gloss and water resistance. North American producers are collaborating closely with automotive and furniture manufacturers to develop custom formulations aligned with evolving aesthetic standards.

Within Europe, Middle East & Africa, strict environmental regulations and robust coatings industries spurred by infrastructure renewal projects have catalyzed adoption of waterborne wax emulsions. Key markets in Western Europe emphasize bio-based wax sources to align with regional decarbonization targets, whereas Middle Eastern nations are prioritizing high-temperature stability to service oilfield and construction applications. Africa’s emerging manufacturing hubs are increasingly integrating wax emulsions into plastic processing and textile finishing operations, signaling a broader industrial maturation.

Asia-Pacific stands out for its rapid expansion, driven by burgeoning paper and textile production in China, India, and Southeast Asia. Local players are investing heavily in R&D to manufacture cost-effective wax emulsions that adhere to global quality benchmarks. This regional momentum is further supported by government initiatives aiming to reduce solvent-based coatings, resulting in heightened demand for waterborne formulations.

Observable variances in regional end-use preferences and regulatory frameworks underscore the necessity of tailored strategies. Market participants must remain vigilant to shifting policy landscapes and supply chain disruptions unique to each geography, ensuring that product development and distribution plans are regionally optimized.

This comprehensive research report examines key regions that drive the evolution of the Wax Emulsion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Positioning and Strategic Initiatives of Leading Players Driving Innovation and Market Penetration in Wax Emulsion Domain

Key market participants have adopted diverse strategic postures to enhance their competitive foothold in the wax emulsion sector. Major chemical conglomerates are leveraging their integrated production platforms to secure steady access to feedstocks, translating into cost advantages and reliable supply chains. These firms invest in continuous process improvement and advanced control systems to elevate batch consistency and reduce cycle times.

Conversely, specialized mid-tier players concentrate on niche applications, such as premium leather coatings or high-performance paper internal sizings, forging partnerships with end-use equipment suppliers to co-develop tailored emulsion formulations. Collaboration across the value chain fosters quicker product validation and custom blending services, enabling these companies to command premium pricing and fortified customer loyalty.

Start-ups and research-focused entities contribute to the innovation pipeline by experimenting with next-generation bio-based wax substitutes and novel surfactant packages that enhance emulsion stability in extreme pH or temperature conditions. Their agility in scaling pilot batches and conducting rapid prototyping affords larger players a window into emerging technology trends, often resulting in licensing agreements or joint ventures.

Across the competitive landscape, strategic alliances-whether through mergers, acquisitions, or technology licensing-serve as key accelerators for growth. Firms that blend technical expertise with expansive distribution networks are best positioned to address diverse customer needs, driving market penetration while maintaining robust profit margins.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wax Emulsion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. P. Chemicals

- ALTANA AG

- Arkema S.A.

- BASF SE

- Clariant AG

- Croda International Plc

- Dow Inc.

- Evonik Industries AG

- ExxonMobil Corporation

- Harmony Additives Private Limited

- Henkel AG & Co. KGaA

- Michelman, Inc.

- Nippon Seiro Co., Ltd.

- Pacific Texchem Private Limited

- Paramelt B.V.

- Sasol Limited

- The Lubrizol Corporation

- Thurs Organics Private Limited

- Vertex Chem Private Limited

- Wacker Chemie AG

Delivering Tactical and Strategic Recommendations to Empower Industry Leaders in Capitalizing on Emerging Trends Within the Wax Emulsion Sector

Industry leaders should prioritize collaborations with renewable feedstock suppliers to secure a sustainable raw material pipeline that aligns with evolving environmental regulations. By forging strategic partnerships early, organizations can de-risk supply interruptions and leverage joint R&D efforts to accelerate development of bio-derived wax emulsions with comparable performance to petroleum-based counterparts.

Simultaneously, companies must invest in digital process controls and industry 4.0 capabilities to optimize production efficiency and minimize waste. Implementing real-time monitoring tools for viscosity, particle size distribution, and pH can yield actionable data that streamlines batch consistency and reduces energy consumption, thereby bolstering both cost competitiveness and sustainability credentials.

To capture diverse end-user segments, manufacturers should adopt a modular product architecture that enables rapid customization of ionic charge, wax composition, and emulsion type. This approach allows sales and technical teams to respond swiftly to customer specifications in applications ranging from internal paper sizing to wood polishing, fostering deeper client engagement and shorter development cycles.

Finally, organizations are encouraged to diversify distribution models by integrating e-commerce platforms alongside traditional direct and distributor channels. Embracing digital marketplaces not only expands geographical reach but also provides valuable insights into buyer behavior, informing product bundling and promotional strategies. Such a balanced channel ecosystem will ensure that companies remain agile in meeting shifting purchasing patterns and competitive pressures.

Detailing the Rigorous Research Framework and Analytical Techniques Underpinning the Insights Presented in the Wax Emulsion Market Study

This research framework integrates primary and secondary methodologies to deliver a robust analysis of the wax emulsion market. Primary research consisted of structured interviews with industry executives, technical experts, and end users across sectors such as paper manufacturing, textiles, and coatings. These one-on-one dialogues provided nuanced perspectives on formulation challenges, regulatory compliance hurdles, and evolving customer requirements.

Secondary research encompassed a comprehensive review of trade journals, patent filings, and regulatory documents to trace technological advancements and legislative shifts. Company annual reports, financial filings, and investment presentations were examined to map strategic initiatives and competitive positioning. This dual-source approach enabled triangulation of data points, enhancing the study’s credibility and depth.

Quantitative insights were derived through analysis of input cost indices, supply chain performance metrics, and pricing trends, while qualitative assessments focused on innovation roadmaps, market drivers, and adoption barriers. Advanced analytical techniques, including SWOT analysis and Porter’s Five Forces, were employed to evaluate competitive dynamics and market attractiveness.

By combining rigorous field research with meticulous desk-based investigations, this methodology ensures that the findings and recommendations presented are both actionable and enduring. Stakeholders can rely on this structured approach to inform their strategic roadmaps in the dynamic wax emulsion landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wax Emulsion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wax Emulsion Market, by Type

- Wax Emulsion Market, by Emulsion Type

- Wax Emulsion Market, by Wax Type

- Wax Emulsion Market, by Application

- Wax Emulsion Market, by Distribution Channel

- Wax Emulsion Market, by Region

- Wax Emulsion Market, by Group

- Wax Emulsion Market, by Country

- United States Wax Emulsion Market

- China Wax Emulsion Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Implications to Guide Stakeholders in Navigating the Evolving Wax Emulsion Market Landscape

In synthesizing the findings, it is clear that the wax emulsion market stands at a crossroads of innovation, sustainability, and strategic realignment. Technological advances in nano-additives and bio-derived waxes, coupled with shifting regulatory demands, are redefining the boundaries of performance and environmental stewardship. Manufacturers that anticipate these changes by investing in flexible production capabilities and sustainable supply chains will secure a competitive edge.

Segment-level insights reveal the importance of tailoring emulsion chemistries to specific ionic charge requirements, emulsion architectures, wax properties, and application needs, while distribution channel diversification remains essential for market penetration. Regionally, growth hotspots in Asia-Pacific and emerging segments in EMEA underscore the need for nuanced regional strategies that account for policy frameworks and local industry maturity.

Competitive analysis underscores the value of strategic partnerships, digital transformation, and modular product design as key differentiators. By aligning tactical execution with long-term sustainability goals, industry participants can drive margin expansion and foster deeper customer loyalty.

Overall, this research highlights actionable pathways that stakeholders can adopt to navigate headwinds, capitalize on emerging trends, and chart a course for sustained growth in the dynamic wax emulsion ecosystem.

Contact Associate Director of Sales and Marketing to Secure Your Comprehensive Wax Emulsion Market Research Report Today

To explore the full depth of the wax emulsion market and access detailed analyses, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will unlock the strategic intelligence you need to shape product roadmaps, refine distribution approaches, and capitalize on emerging industrial opportunities. His expertise in linking market insights to actionable growth strategies ensures that you receive a comprehensive overview tailored to your organization’s unique challenges and objectives.

By initiating this conversation, you position your team at the forefront of innovation, armed with reliable data and expert guidance. Secure your market research report today and take the first step toward outpacing competitors, optimizing your supply chain, and maximizing profitability in the dynamic wax emulsion sector.

- How big is the Wax Emulsion Market?

- What is the Wax Emulsion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?