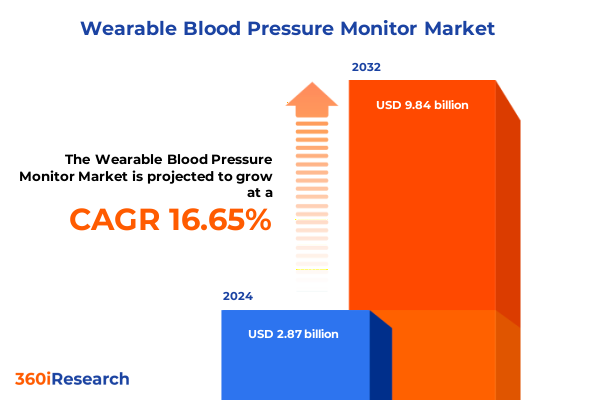

The Wearable Blood Pressure Monitor Market size was estimated at USD 3.35 billion in 2025 and expected to reach USD 3.87 billion in 2026, at a CAGR of 16.60% to reach USD 9.84 billion by 2032.

Exploring the Rising Significance of Wearable Blood Pressure Monitors in Empowering Chronic Disease Management and Shaping the Future of Personal Healthcare

The evolution of personal healthcare technology has ushered in a new era of proactive health management, placing advanced monitoring tools directly in the hands of consumers. Wearable blood pressure monitors exemplify this shift by offering continuous insights into cardiovascular health outside clinical settings. This transformation is driven by the growing global burden of hypertension, a condition affecting an estimated 1.28 billion adults aged 30–79 years, of whom nearly half remain unaware of their status while only one in five have it under control. As medical guidelines emphasize early detection and ongoing management, wearable solutions have emerged as critical enablers of timely intervention and sustained wellness.

Moreover, the increasing prevalence of lifestyle-related risk factors-such as poor diet, sedentary behavior, and stress-has elevated consumer demand for convenient and noninvasive monitoring alternatives. Traditional cuff-based devices, while accurate, often lack portability and real-time feedback. In contrast, wearable form factors seamlessly integrate into daily routines, providing users with instant alerts and trend analysis. This level of accessibility empowers individuals to take charge of their health journey, fostering greater engagement with preventive care protocols.

Technological advancements underpin the reliability and sophistication of modern wearable monitors. From cuffless optical sensors to miniaturized oscillometric components, these devices leverage breakthroughs in photoplethysmography, machine learning algorithms, and Bluetooth connectivity to deliver clinical-grade accuracy in ambulatory environments. The convergence of hardware innovation and software intelligence also enables seamless data sharing with electronic health record systems and telehealth platforms, strengthening the bridge between patients and healthcare providers.

In light of these developments, this executive summary aims to provide a comprehensive overview of the market dynamics shaping the wearable blood pressure monitor landscape in 2025, spotlighting transformative trends, regulatory influences, segmentation insights, regional outlooks, competitive strategies, and actionable recommendations for industry stakeholders.

Unveiling the Converging Forces Redefining the Wearable Blood Pressure Monitor Market Through Innovation Partnerships and Regulatory Evolution

The wearable blood pressure monitor market is being reshaped by a confluence of strategic partnerships, regulatory advancements, and technological convergence that collectively accelerate innovation cycles and market penetration. Notable collaborations between device manufacturers and digital health platforms are fostering interoperable ecosystems that streamline data exchange, enhance user experience, and strengthen clinical validation pathways. For example, several leading brands are partnering with telemedicine providers to integrate real-time blood pressure data into virtual care workflows, enabling proactive patient management and remote consultations that reduce hospital admissions.

Meanwhile, evolving regulatory frameworks are lowering barriers to market entry while upholding safety and efficacy standards. Agencies such as the U.S. Food and Drug Administration have established clear guidelines for the clearance of wearable diagnostics, with an increasing number of cuffless monitors receiving FDA approval and CE marking for the European market. This clarity is encouraging a broader array of innovators, from consumer electronics giants to medtech startups, to develop differentiated solutions aligned with clinical requirements.

Simultaneously, advancements in sensor miniaturization and power efficiency are enabling seamless integration of continuous monitoring functionalities into diverse form factors. The transition from traditional arm-cuff designs to sleek wrist-worn devices has been particularly impactful among health-conscious consumers, driving adoption across fitness and wellness segments. As a result, wearable blood pressure monitors are no longer niche medical tools but mainstream health accessories, reflecting the industry’s trajectory toward ubiquitous, user-friendly diagnostics.

Assessing the Cumulative Impact of Recent United States Tariffs on the Wearable Blood Pressure Monitor Supply Chain and Cost Structures

Since September 27, 2024, the United States has maintained and expanded a series of duties on imported goods from China and other key trading partners, encompassing critical inputs such as solar cells, lithium-ion batteries, steel, and aluminum. Many of these measures originated under Section 301 of the Trade Act, reflecting concerns over unfair trade practices and the protection of strategic industries. The most recent adjustments introduced a 50% levy on solar modules and critical minerals, alongside 25% duties on steel and aluminum imports, while preserving elevated rates on electric vehicles and certain battery components.

Further compounding these costs, a new tranche of Section 301 tariffs targeting semiconductor materials and non-lithium-ion battery parts entered into force on January 1, 2025. Under this expansion, semiconductor imports now face a 50% duty, effectively doubling the previous rate and significantly impacting manufacturers that rely on offshore chip fabrication and sensor elements for cuffless blood pressure solutions. Simultaneously, other medical-related products such as rubber examination gloves and respirators saw tariff increases, although some exclusions were carved out to alleviate immediate supply shortages.

To mitigate the burden on critical healthcare imports, the Office of the U.S. Trade Representative granted a three-month extension of existing exclusions through August 31, 2025. This measure preserves duty-free access for 164 product categories originally exempted in May 2024, as well as 14 additional solar equipment items, providing temporary relief to device assemblers and component suppliers. Despite this reprieve, the overall cost structure for wearable monitor production has risen, driving companies to explore alternative sourcing strategies.

The cumulative effect of these tariff policies has been a marked increase in component acquisition costs, prompting manufacturers to reassess their supply chains. Many are diversifying production footprints across Southeast Asia and Mexico to reduce exposure to high-duty jurisdictions. Moreover, firms are negotiating longer-term contracts, leveraging local partnerships, and in some cases passing cost increases onto end users. As the trade environment remains fluid, the wearable blood pressure monitor industry is adapting through resilience and strategic agility to sustain innovation and market competitiveness.

Deciphering Market Dynamics Across Product Types Measurement Technologies Distribution Channels and Diverse End Users in Wearable Blood Pressure Monitoring

Market dynamics in wearable blood pressure monitoring are profoundly influenced by multiple layers of segmentation that together define the competitive landscape and adoption patterns. Devices are predominantly differentiated by form factor, where arm-type monitors continue to appeal to clinical settings for their proven cuff-based accuracy, while wrist-type counterparts are gaining traction among active consumers seeking portability and ease of use.

A second dimension is the underlying measurement technology. Traditional auscultatory approaches coexist with oscillometric methods that leverage cuff inflation and deflation patterns, while optical sensor technologies, anchored in photoplethysmography, offer cuffless continuous monitoring. Emerging piezoelectric solutions promise enhanced sensitivity and reduced power consumption, though they are still advancing through validation stages.

Distribution strategies are equally varied. Legacy offline channels such as pharmacies, medical supply distributors, and clinical equipment vendors ensure reliable access and professional endorsement. However, online avenues have grown significantly, with general eCommerce marketplaces and direct manufacturer websites providing rapid fulfillment and broader geographic reach. This dual-channel model enables companies to target both traditional healthcare customers and digitally native consumers.

Finally, the end-user landscape spans fitness and wellness centers-encompassing gyms and yoga studios-where devices support preventative health initiatives, to home healthcare markets where remote patient monitoring is on the rise. Hospitals and clinics continue to utilize wearable monitors for inpatient and outpatient care coordination, while research institutes leverage advanced platforms for clinical trials and epidemiological studies. Together, this segmentation framework underscores the multifaceted appeal of wearable blood pressure monitors and the necessity for tailored strategies in product development and go-to-market execution.

This comprehensive research report categorizes the Wearable Blood Pressure Monitor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Measurement Technology

- Distribution Channel

- End-User

Mapping Regional Growth Patterns and Emerging Opportunities in the Wearable Blood Pressure Monitor Market Across Americas EMEA and Asia-Pacific Regions

Regional variations in healthcare infrastructure, regulatory regimes, and consumer behavior shape distinct trajectories for wearable blood pressure monitor adoption across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, rising demand is fueled by comprehensive insurance coverage policies and growing reimbursement pathways for remote patient monitoring, which lower out-of-pocket costs for end users. The prevalence of telehealth platforms further integrates wearable data into mainstream care models, especially in the United States and Canada.

Across the EMEA region, momentum is driven by national health services’ push toward digital transformation and the harmonization of medical device regulations. Countries such as Germany and France are early adopters of digital health reimbursements, while the Gulf Cooperation Council markets are investing heavily in smart hospital initiatives. Regulatory clarity under the EU Medical Device Regulation (MDR) also provides a predictable approval environment for innovative wearable products.

In the Asia-Pacific region, rapid economic growth, escalating healthcare expenditures, and high mobile penetration underpin a robust growth outlook. Markets like Japan, South Korea, and Australia exhibit strong consumer receptivity to connected health devices, while emerging nations in Southeast Asia present expansion opportunities due to rising hypertension prevalence and increasing private healthcare investments. Local manufacturing incentives and strategic public-private partnerships are further enhancing supply-side capabilities in this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Wearable Blood Pressure Monitor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Innovation Portfolios of Leading Players Accelerating Competition in the Wearable Blood Pressure Monitor Industry

Leading companies in the wearable blood pressure monitor arena are deploying a combination of research alliances, portfolio expansions, and channel diversification to secure competitive advantage. Omron, a long-standing name in blood pressure measurement, is extending its manufacturing footprint to meet regional demand, notably through its first production facility in Chennai, India, which aims to improve access and reduce logistics lead times. The company is concurrently engaging with policymakers to establish formal prescriptions frameworks, thereby facilitating more systematic clinical recommendations for home monitoring.

Consumer electronics firms are also intensifying their involvement. Withings has integrated AI-driven trend analysis into its cuffless offerings, enhancing predictive alert capabilities and user engagement. Samsung and Apple are leveraging their broad wearable ecosystems, embedding blood pressure monitoring functionalities alongside fitness tracking and ECG readings in smartwatches. Such convergence capitalizes on existing brand loyalty and accelerates time-to-market.

Meanwhile, specialized medtech startups are focusing on niche applications, such as continuous nocturnal monitoring or pediatric hypertension screening, through bespoke sensor configurations. These innovators often collaborate with academic institutions and clinical research networks to validate their technologies and secure early adopter endorsements. Collectively, these strategic moves highlight a competitive landscape where incumbents, new entrants, and cross-industry players converge to address evolving customer needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wearable Blood Pressure Monitor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Asia Connection Co., Ltd.

- Beurer GmbH

- Charmcare Co., Ltd.

- ChroniSense Medical, Ltd.

- Cofoe Medical Technology Co., Ltd.

- ForaCare Suisse AG

- Garmin Ltd.

- General Electric Company

- Google LLC by Alphabet Inc.

- Guangdong Transtek Medical Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- ICU Medical, Inc.

- iHealth Labs Inc.

- Koninklijke Philips N.V.

Implementing Future-Focused Strategies to Drive Innovation Market Expansion and Sustainable Growth in the Wearable Blood Pressure Monitor Sector

To thrive in this rapidly evolving market, industry leaders should prioritize partnerships that accelerate clinical validation and interoperability. Engaging with telehealth providers and electronic health record vendors can ensure seamless data integration, enhancing both provider adoption and patient outcomes. Investing in joint development agreements with sensor specialists and AI developers will also be critical to differentiate through accuracy improvements and novel predictive analytics features.

Leaders must also refine their go-to-market strategies by balancing offline and online channels. Strengthening relationships with healthcare distributors complements direct-to-consumer campaigns on digital platforms, expanding reach while maintaining professional credibility. Tailoring value propositions for diverse end users-ranging from fitness centers to research institutions-will maximize relevance and foster deeper market penetration.

In response to tariff pressures and supply chain uncertainties, companies should consider nearshoring production and establishing multi-sourced procurement frameworks. Collaborating with regional contract manufacturers can mitigate tariff exposure and improve resilience. Furthermore, proactive engagement with regulatory bodies to secure ongoing exclusions and clearances will sustain market access and support product innovation.

Finally, organizations should cultivate customer education initiatives, leveraging app-based tutorials, remote training programs, and physician endorsements to build trust. By demonstrating clinical efficacy and real-world value, companies can drive broader adoption and foster long-term user adherence.

Detailing a Rigorous Multimethod Research Approach to Uncover Market Intelligence and Validate Insights for Wearable Blood Pressure Monitors

This analysis is founded on a rigorous, multimethod research framework designed to ensure the validity and relevance of insights. Primary research was conducted through structured interviews with key opinion leaders, including cardiologists, healthcare technology integrators, and purchasing managers in hospitals. These interviews provided firsthand perspectives on clinical requirements, adoption barriers, and unmet needs in both patient and professional contexts.

Supplementing primary data, a comprehensive secondary research phase encompassed regulatory filings, tax and tariff announcements from official government sources, and peer-reviewed journals detailing technological advancements in sensor design and signal processing algorithms. Industry white papers, patent databases, and corporate press releases were examined to map competitive strategies and innovation trajectories.

Quantitative analysis employed data triangulation techniques, cross-verifying information from public health agencies, trade associations, and market intelligence platforms. Trend extrapolation and scenario modeling were utilized to interpret the cumulative impact of tariff developments, technological shifts, and regional policy initiatives on supply chain dynamics and cost structures.

Finally, ongoing validation workshops with domain experts were conducted to test preliminary findings and refine strategic recommendations. This iterative process ensured that the final report reflects current market realities, aligns with stakeholder priorities, and provides actionable guidance for decision makers across the wearable blood pressure monitoring ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wearable Blood Pressure Monitor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wearable Blood Pressure Monitor Market, by Product Type

- Wearable Blood Pressure Monitor Market, by Measurement Technology

- Wearable Blood Pressure Monitor Market, by Distribution Channel

- Wearable Blood Pressure Monitor Market, by End-User

- Wearable Blood Pressure Monitor Market, by Region

- Wearable Blood Pressure Monitor Market, by Group

- Wearable Blood Pressure Monitor Market, by Country

- United States Wearable Blood Pressure Monitor Market

- China Wearable Blood Pressure Monitor Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Key Findings and Strategic Imperatives to Navigate the Dynamic Landscape of Wearable Blood Pressure Monitoring Solutions

In summary, the wearable blood pressure monitor market is poised at the intersection of clinical necessity and consumer empowerment, underpinned by robust technological progress and a shifting policy landscape. The convergence of continuous, cuffless monitoring solutions and AI-driven analytics is redefining disease management paradigms, enabling predictive interventions and personalized care pathways.

Segmentation analysis reveals that product form factors, measurement technologies, distribution channels, and end-user applications each contribute to nuanced adoption patterns. Regional insights highlight mature reimbursement frameworks in the Americas, regulatory harmonization in EMEA, and surging digital health initiatives across Asia-Pacific. Against this backdrop, tariffs and trade policies have introduced cost pressures, prompting strategic supply chain realignments but also creating incentives for localization and diversification.

Competitive profiling underscores a dynamic environment where established medtech leaders, consumer electronics powerhouses, and agile startups are all vying to capture market share through innovation, partnerships, and market expansion. To navigate this complexity, industry players must leverage integrated go-to-market strategies, proactive regulatory engagement, and a relentless focus on user experience and clinical validation.

Ultimately, the industry’s trajectory will be shaped by its ability to combine technical excellence with strategic agility, delivering solutions that not only track blood pressure but also drive better health outcomes and system efficiencies.

Secure Your Comprehensive Wearable Blood Pressure Monitor Market Analysis Report by Connecting with Ketan Rohom for Exclusive Purchase Guidance

To secure an authoritative and deeply researched analysis of the wearable blood pressure monitor market, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, he can guide you through the report features, answer your questions, and customize access options tailored to your strategic priorities. Engaging with Ketan ensures you obtain the comprehensive insights and actionable intelligence necessary to make informed decisions in this rapidly evolving sector.

- How big is the Wearable Blood Pressure Monitor Market?

- What is the Wearable Blood Pressure Monitor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?