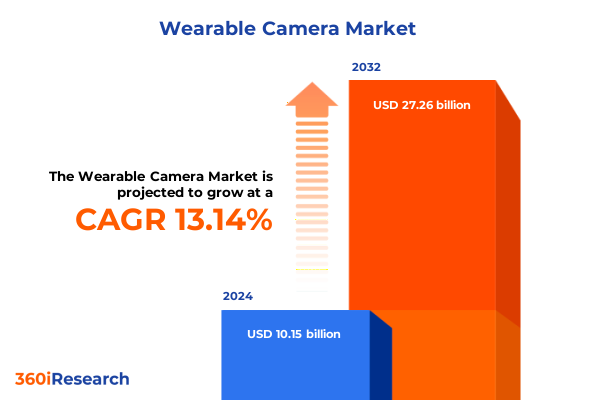

The Wearable Camera Market size was estimated at USD 11.46 billion in 2025 and expected to reach USD 12.95 billion in 2026, at a CAGR of 13.17% to reach USD 27.26 billion by 2032.

Exploring the Rise of Compact Wearable Imaging Devices and Their Role in Shaping Consumer and Commercial Applications Worldwide

Over the past decade, wearable imaging devices have undergone rapid evolution from niche gadgets to indispensable tools across consumer and professional domains. Miniaturization of sensors and advances in optical stabilization have fueled the transition from bulky prototypes to sleek, resilient units that can be mounted on helmets, bodies, or vehicles with minimal disruption to daily activities. These devices now fulfill a diverse set of functions ranging from capturing high-octane sports footage to conducting covert security surveillance, all while offering users hands-free operation and seamless integration with smartphones and cloud platforms. As a result, the wearable camera ecosystem has expanded far beyond its early adopters to encompass a broader audience that values portability, reliability, and ease of use.

Consequently, the convergence of real-time connectivity and high-resolution capture has driven strong interest among content creators, enterprise security teams, and medical professionals. Whether streaming live events to social media, documenting patient procedures for remote consultation, or enabling law enforcement to record critical incidents, wearable cameras have become intrinsic to modern workflows. Parallel improvements in battery life and ruggedized design have further pushed these devices into more demanding environments, opening new possibilities for immersive experiences and data-driven decision making.

Moving forward, understanding the interplay of technological innovation, regulatory shifts, and evolving user behaviors will be crucial for stakeholders seeking to navigate this dynamic landscape. This executive summary provides a concise yet comprehensive analysis of the transformative trends, policy developments, market segmentations, and regional nuances that will shape the future of wearable cameras.

Unveiling the Key Technological Advances, User Behavior Changes, and Emerging Partnerships Driving the Wearable Camera Ecosystem into a New Era

The wearable camera industry is experiencing a period of unprecedented transformation as technological breakthroughs reshape both product capabilities and user expectations. High-efficiency image sensors and next-generation stabilization algorithms now power devices capable of capturing 8K footage or streaming live content with minimal latency, enabling new use cases that were once the realm of science fiction. At the same time, artificial intelligence–driven features such as automated scene detection and real-time analytics have elevated these devices from passive recorders to intelligent assistants, fundamentally altering how data is captured, processed, and utilized across applications.

Alongside these technical advances, consumer behavior has evolved rapidly. Enthusiasts no longer view wearable cameras solely as tools for adventure sports; instead, they rely on them for everyday activities, from culinary tutorials to urban exploration. In parallel, enterprise adoption in sectors such as security and healthcare has accelerated as organizations recognize the value of continuous, high-quality visual documentation. This shift has encouraged collaboration between camera manufacturers and industry partners, resulting in integrated solutions that connect wearable devices to broader software ecosystems.

These trends collectively mark a shift from novelty gadgets to indispensable assets, driving a convergence of hardware innovation and service-oriented models. As players across the value chain respond to these new imperatives, the landscape of wearable imaging is poised to enter an era defined not only by superior performance but also by comprehensive ecosystem engagement.

Analyzing the Comprehensive Effects of the 2025 United States Tariff Adjustments on Production Costs and Global Supply Chain Dynamics

The implementation of revised United States tariffs in 2025 has introduced a new set of considerations for manufacturers and suppliers within the wearable camera supply chain. Increased duties on key components-such as precision lenses, semiconductors, and high-performance memory modules-have led to elevated production costs, prompting firms to reevaluate sourcing strategies. As a result, many companies are exploring near-shoring options or negotiating long-term contracts to stabilize input prices and mitigate the impact of fluctuating import levies. These tariff adjustments have also influenced relationships with assembly partners in Asia, driving a more diversified supplier base to reduce concentration risk and ensure uninterrupted component availability.

Furthermore, the altered cost structure has rippled through distribution networks, placing pressure on both offline retailers and online channels to balance pricing competitiveness with margin preservation. The necessity to absorb incremental duties has triggered strategic adjustments, including dynamic pricing models and the introduction of service bundles that offset perceived cost increases. In turn, this has stimulated investment in digital sales platforms and direct-to-consumer initiatives aimed at preserving value propositions without sacrificing profitability.

Looking ahead, these cumulative tariff effects underscore the importance of proactive supply chain management and agile pricing tactics. Companies that swiftly adapt to the evolving trade environment by optimizing logistics flows and enhancing supplier collaboration will be better positioned to maintain operational resilience and protect brand integrity.

Delving into Wearable Camera Market Segmentation Insights Spanning Product Variants, Pricing Tiers, Resolution Standards, Distribution Channels, Application Areas

A nuanced understanding of segmentation is critical to unlocking value in the wearable camera market, where consumer requirements and enterprise use cases vary significantly. From a product perspective, offerings span action cameras optimized for capturing sports sequences or mounted on vehicles, body worn units tailored to hands-free security and inspection tasks, and helmet cameras designed for immersive first-person perspectives. Each variant demands distinct feature sets-from wide-angle optics and rugged enclosures to specialized mounting accessories-that align with end-user expectations and operational constraints.

Pricing strategies play a pivotal role in market positioning, ranging from low-range models that deliver essential functionality at entry-level price points to premium devices featuring cutting-edge stabilization and extended battery performance. Mid-range segments maintain a balance of advanced imaging capabilities and affordability, appealing to prosumers who seek professional-grade features without the highest premium. Price tier differentiation is reinforced by resolution standards, with offerings that include everything from high-definition capture to Full HD, 4K UHD, and even emerging 8K formats, thereby enabling tailored use cases across streaming, broadcast, and archival applications.

Distribution channels further influence product availability and customer outreach. Offline retail environments-comprising electronic stores and specialty outlets-provide hands-on experiences that build consumer confidence, while online retail ecosystems offer convenience and broad selection enhanced by digital marketing tools. Lastly, application contexts shape development roadmaps: in healthcare, high-precision imaging supports telemedicine and procedural documentation; in media and entertainment, broadcasting-grade devices facilitate both live events and professional content creation; in retail and security, compact body worn units bolster loss prevention and situational awareness; and in sports, rugged action cameras capture athlete performance under extreme conditions.

This comprehensive research report categorizes the Wearable Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Price Range

- Resolution

- Distribution Channel

- Application

Examining Regional Dynamics in Wearable Camera Adoption Highlighting Distinct Trends and Drivers Across the Americas, Europe Middle East & Africa and Asia-Pacific

Geographic dynamics play a defining role in determining adoption rates and innovation pathways within the wearable camera sector. In the Americas, consumer enthusiasm for adventure sports and the proliferation of content creators have fueled widespread uptake of both entry-level and professional-grade devices. This region’s advanced e-commerce infrastructure has further accelerated online sales, while offline specialty retailers continue to foster brand loyalty through curated demonstrations and after-sales support.

Across Europe Middle East & Africa, regulatory environments and data-privacy considerations exert a significant influence on design priorities and go-to-market strategies. Security and law enforcement applications benefit from supportive government procurement initiatives, yet stringent certification requirements necessitate close collaboration between manufacturers and regulatory bodies. Additionally, enterprise interest in body worn camera solutions for public safety drives innovation in encrypted storage and tamper-proof authentication features.

Meanwhile, the Asia-Pacific region stands out for its dual role as a manufacturing powerhouse and a rapidly expanding consumer market. Leading electronics producers based in this region have leveraged local supply chain efficiencies to introduce highly competitive devices, while achieving regional market penetration through a mix of online marketplaces and traditional retail chains. Emerging economies within Asia-Pacific are also showcasing strong demand for affordable HD and Full HD models, as urbanization and digital infrastructure investments bring wearable imaging to new user segments.

This comprehensive research report examines key regions that drive the evolution of the Wearable Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Wearable Camera Manufacturers and Innovators with Focus on Strategic Partnerships, Technological Differentiation and Market Positioning Tactics

A diverse ecosystem of established leaders and innovative challengers defines today’s wearable camera landscape. Industry stalwarts leverage deep expertise in optical engineering and brand recognition to defend premium positions, while nimble entrants focus on specialized features and vertical-specific integrations. Collaborative alliances with telecommunication providers and cloud service vendors have emerged as a key differentiator, enabling connected solutions that offer real-time collaboration and analytics.

Leading manufacturers have prioritized investments in next-generation sensor architectures, delivering breakthroughs in low-light performance and image stabilization. At the same time, emerging players are carving out niches through unique form factors, such as panoramic and 360-degree capture devices, or by embedding advanced machine-learning capabilities directly on the device. Partnerships between camera innovators and industry software providers have also expanded usage scenarios, from live broadcasting workflows to automated compliance reporting in security operations.

Overall, competitive dynamics hinge on the ability to marry hardware excellence with compelling software ecosystems and service offerings. Companies that successfully integrate seamless user experiences, robust data management, and scalable support models will capture the greatest share of high-value use cases in both consumer and enterprise segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wearable Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arashi Vision Inc.

- Axon Enterprise, Inc.

- Contour, LLC

- DJI Technology Co., Ltd.

- Drift Innovation Ltd.

- Garmin Ltd.

- GoPro, Inc.

- iON America LLC

- Narrative AB

- Nikon Corporation

- OPKIX Inc.

- Panasonic Corporation

- Pinnacle Response Ltd.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Taser International, Inc.

- Transcend Information Inc.

- Veho World Ltd.

- Vuzix Corporation

- Xiaomi Corporation

Delivering Actionable Strategic Guidelines for Industry Leaders to Capitalize on Emerging Wearable Camera Trends and Optimize Operations

Industry leaders must embrace a multi-faceted approach to capitalize on the accelerating momentum around wearable imaging. First, continued investment in artificial intelligence and sensor miniaturization will unlock new use cases and enhance user engagement, particularly as demand for autonomous capture and real-time insights grows. In parallel, diversifying supply chain footprints by incorporating alternative manufacturing hubs and forging strategic component alliances will mitigate exposure to geopolitical disruptions and tariff volatility.

Furthermore, developing tiered product portfolios that address both cost-sensitive entry-level customers and high-end professional users will broaden market reach and reinforce brand resilience. Tailoring channel strategies to balance offline experiential retail with dynamic digital platforms will keep audiences engaged while optimizing cost efficiencies. Equally important is the cultivation of deeper partnerships across application verticals, such as collaborating with sports leagues for co-branded equipment or working with healthcare institutions to validate clinical use cases.

By aligning R&D roadmaps with targeted go-to-market tactics and fostering ecosystem synergies, industry players can position themselves to thrive amid intensifying competition. Clear prioritization of scalability, service integration, and user-centric design will ultimately determine which organizations lead the next wave of innovation in wearable camera technologies.

Outlining Rigorous Research Methodology Combining Primary Engagements, Secondary Analysis and Data Validation Protocols for Wearable Camera Market Study

The research methodology underpinning this analysis combines rigorous primary engagements with comprehensive secondary data validation to ensure both depth and accuracy. Primary research included structured interviews and in-depth discussions with key executives, product engineers, and channel partners, capturing firsthand insights into technological trajectories and commercial strategies. Complementing these findings, a systematic review of publicly available technical white papers, industry publications, and company disclosures provided context on historical developments and foreseeable inflection points.

Data synthesis employed a multi-tiered validation protocol whereby qualitative inputs were cross-checked against supplier databases, patent filings, and trade statistics. Statistical analyses and thematic coding techniques were applied to distill core trends and identify emerging patterns across product types, price points, resolution capabilities, distribution networks, and application domains. Throughout this process, strict quality controls and data integrity checks assured consistency, while ethical guidelines were adhered to in both interview conduct and data handling.

This dual-track approach, marrying empirical primary evidence with systematic secondary corroboration, lays the foundation for robust conclusions and actionable recommendations. It ensures that stakeholders gain a reliable, 360-degree view of the wearable camera landscape and can confidently inform their strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wearable Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wearable Camera Market, by Product Type

- Wearable Camera Market, by Price Range

- Wearable Camera Market, by Resolution

- Wearable Camera Market, by Distribution Channel

- Wearable Camera Market, by Application

- Wearable Camera Market, by Region

- Wearable Camera Market, by Group

- Wearable Camera Market, by Country

- United States Wearable Camera Market

- China Wearable Camera Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Illuminate Strategic Implications of Wearable Camera Innovations for Stakeholders

Synthesizing the insights gleaned from technological developments, trade policy shifts, and segmentation analyses reveals a market at the nexus of innovation and strategic adaptation. Advanced stabilization and AI-enhanced capture capabilities are redefining user expectations, while evolving tariff structures underscore the critical importance of supply chain agility. The interplay of product diversity-spanning action, body worn, and helmet cameras-alongside tiered pricing models and multi-channel distribution approaches accentuates the need for tailored strategies that resonate with distinct customer cohorts.

Regional nuances further shape the competitive battleground, as consumer affinity in the Americas, regulatory imperatives in Europe Middle East & Africa, and manufacturing leadership in Asia-Pacific each demand bespoke solutions. Leading companies that integrate hardware prowess with software ecosystems, foster strategic alliances, and remain attuned to emerging application niches will secure sustainable advantage. Moreover, actionable recommendations highlight the value of balancing short-term operational resilience with long-term investment in R&D and ecosystem development.

Ultimately, this analysis illuminates strategic pathways that can guide stakeholders through the next phase of wearable camera evolution. By embracing a holistic perspective and leveraging the detailed insights presented herein, decision-makers can navigate complexity, capture growth opportunities, and shape the future of immersive imaging technologies.

Connect Directly with Associate Director Ketan Rohom Today to Secure Your Comprehensive Wearable Camera Market Research Report

Engage with Associate Director Ketan Rohom today to explore how this in-depth research can support your strategic planning and product development efforts. He can guide you through tailored solutions, answer your specific queries, and ensure you receive the most relevant insights to drive growth. Don’t miss the opportunity to leverage our comprehensive analysis of the wearable camera landscape-reach out now to secure your full report and stay ahead of evolving market dynamics.

- How big is the Wearable Camera Market?

- What is the Wearable Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?