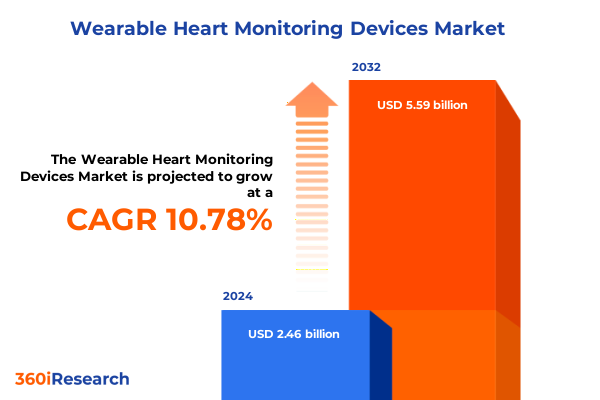

The Wearable Heart Monitoring Devices Market size was estimated at USD 2.72 billion in 2025 and expected to reach USD 3.00 billion in 2026, at a CAGR of 10.85% to reach USD 5.59 billion by 2032.

How sensor advances, clinical acceptance, and reimbursement changes have converged to reframe continuous cardiac monitoring from consumer novelty to clinical utility

The last five years have fundamentally reshaped how clinicians, payers, and consumers think about continuous cardiac care and personal health monitoring. Consumer electronics manufacturers, clinical device vendors, and software platform providers have converged around a single opportunity: making actionable cardiac signals available outside the clinic. This change did not emerge overnight; it has been driven by steady advances in sensor fidelity, the maturation of machine learning that can reduce noise and extract clinically relevant features, and shifting reimbursement and care‑delivery models that reward earlier intervention and longitudinal data. As a result, what began as basic step counting and intermittent heart‑rate logging has evolved into a hybrid ecosystem where chest straps, wrist‑worn photoplethysmography devices, and clinical ECG modules coexist to address distinct clinical and lifestyle use cases.

This executive summary distills those dynamics and synthesizes the practical implications for product teams, regulatory affairs, and commercial leaders. The focus is not on speculative sizing but on translating observable shifts-technology, policy, and supply chain-into clear strategic choices. Throughout the report you will find evidence anchors and contemporary examples that illustrate how features, distribution models, and clinical workflows are changing. The aim here is to give decision‑makers a concise, actionable orientation to the competitive, regulatory, and technical forces now shaping wearable heart monitoring, so leadership teams can prioritize investment, risk mitigation, and clinical validation pathways with greater confidence.

Converging sensor improvements, clinical guidance, and reimbursement evolution are rewriting the rules for device design, data pipelines, and care adoption

The landscape of wearable heart monitoring is undergoing transformative shifts that are technical, regulatory, and behavioral in equal measure. On the technical front, optical sensor stacks and algorithmic denoising methods now allow wrist and chest devices to extract waveform‑level features that were once available only from clinical ECG. These advances are enabling a continuum of devices that span chest straps and clinical ECG monitors through to fitness bands, smart rings, smartwatches, and even hybrid wearable pedometers fitted with optical sensors. In parallel, device manufacturers are embedding multiple sensor modalities and leveraging machine learning pipelines that turn noisy photoplethysmogram traces into clinically meaningful markers such as heart rate variability and episodic arrhythmia detection. Clinically, professional societies and specialty colleges are beginning to publish guidance for integrating consumer device data into longitudinal cardiovascular care, which is changing how clinicians think about triage and monitoring.

Concurrently, payment policy and remote care economics are making continuous and episodic monitoring commercially viable. Payers and health systems are experimenting with model updates that reward remote physiologic monitoring and earlier interventions intended to prevent costly acute episodes. This economic realignment is increasing demand for devices that meet both consumer expectations for comfort and the evidentiary bar required by clinicians. From a market behavior perspective, consumer expectations have matured: users now expect seamless connectivity, multi‑day battery life, and companion apps that convert raw signals into simple, actionable guidance. Together, these technical, regulatory, and behavioral shifts are creating a layered market in which different product types-chest straps and ECG monitors for clinical fidelity, fitness bands and smartwatches for ubiquitous surveillance, smart rings for passive continuity, and wearable pedometers for low‑friction adherence-each find defensible roles and routes to adoption.

New 2025 tariff inquiries and selective exemptions are creating asymmetric supply‑chain and sourcing risks that alter landed cost dynamics and procurement strategies

U.S. trade policy developments in 2025 have introduced new and material supply‑chain considerations for wearable device manufacturers and contract assemblers. Recent national security reviews and tariff consultations focused on medical equipment and related electronic components may translate into additional duties, or at least an elevated risk premium built into sourcing decisions for components and finished devices. At the same time, selective tariff exemptions and policy clarifications announced earlier in 2025 changed the calculus for components considered essential to the electronics value chain, creating an uneven environment where some semiconductor and display lines remain advantaged while other medical or specialized components face scrutiny. The practical consequence for product teams and procurement officers is a renewed need to model dual‑sourcing strategies, evaluate near‑shoring options, and reassess inventory policies to reduce single‑point dependency on affected jurisdictions.

From a commercial perspective, these policy shifts can affect landed costs, supplier negotiating leverage, and the timeline for bringing regulatory‑validated hardware to market. Organizations that rely on tightly scheduled just‑in‑time manufacturing will need to evaluate whether higher tariffs or new compliance checks will force slower replenishment cycles and increased working capital. Conversely, some global firms have received targeted exemptions for mainstream electronics, reducing near‑term disruption for core consumer components while leaving specialized medical modules exposed. Executives should treat tariff risk as a direct input into supplier qualification criteria and scenario planning for product roadmaps and market launches.

Holistic segmentation reveals how product form, sensor technology, connectivity mode, and end‑user needs must align to create defensible wearable heart monitoring propositions

Understanding demand and design tradeoffs requires integrating multiple segmentation lenses that reflect how clinicians and consumers actually use devices. When products are viewed through the prism of product type across chest straps, ECG monitors, fitness bands, smart rings, smartwatches, and wearable pedometers, distinct value propositions emerge: chest and clinical ECG modules prioritize waveform fidelity and diagnostic connectivity; fitness bands and smartwatches balance battery life and user engagement; smart rings emphasize unobtrusive daily wear; wearable pedometers trade granularity for simplicity and adherence. Meanwhile, underlying technology choices-ECG, optical sensor‑based solutions, and PPG-determine both the physiological signals available and the engineering investments required to achieve clinical grade performance. Connectivity choices are equally determinative: Bluetooth‑enabled devices excel at episodic sync and low power; cellular‑enabled devices support independent, always‑on telemetry for clinical monitoring; Wi‑Fi‑enabled devices optimize high‑bandwidth uploads in home or facility contexts.

Application segmentation reframes these engineering choices into clinical outcomes: blood pressure monitoring and ECG monitoring require different validation pathways and user interactions than continuous heart rate monitoring or HRV tracking, while sleep apnea detection and stress monitoring impose unique analytics and labeling requirements. End‑user segmentation-athletes, elderly people, fitness enthusiasts, and hospitals/clinics-changes the acceptable tradeoffs between accuracy, form factor, and price. An athlete might accept a chest strap for fidelity during training, whereas an elderly patient will prioritize comfort, battery life, and clinician‑grade connectivity. Finally, distribution channels shape adoption curves: offline retail supports trial and immediate purchase, enabling tactile evaluation, while online retail broadens reach and facilitates subscription models and direct device firmware updates. Effective product and go‑to‑market strategies require a coherent alignment across all these segmentation dimensions so that a device’s sensor suite, connectivity, application validation, target end‑user, and distribution channel combine to form a defensible commercial proposition.

This comprehensive research report categorizes the Wearable Heart Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Connectivity

- Application

- End-User

- Distribution Channel

Regional contrasts in reimbursement, regulatory expectations, and manufacturing capabilities are driving differentiated go‑to‑market and validation strategies across Americas, EMEA, and APAC

Regional dynamics are reshaping clinical pathways, regulatory timelines, and commercial priorities in predictable but important ways. In the Americas, high reimbursement momentum for remote monitoring, concerted policy attention to telehealth continuity, and a mature consumer electronics market create fertile conditions for integrated solutions that bridge consumer devices and clinical workflows. North American health systems are actively piloting programs that incorporate wrist‑worn and chest devices into chronic care pathways, while payer experiments are clarifying long‑term reimbursement mechanics.

Europe, the Middle East, and Africa present a heterogeneous picture driven by strong regulatory oversight in the European Union, fragmented reimbursement models across member states, and nascent but growing private‑sector adoption in several Middle Eastern markets. European regulatory emphasis on data protection and clinical evidence raises the evidentiary bar for devices offered as medical devices, while several EMEA health systems value interoperability with electronic health records. In Asia‑Pacific, high consumer adoption rates for smartwatches and bands, rapid digital health innovation, and robust manufacturing ecosystems create both demand and competitive supply advantages. Several APAC markets exhibit fast uptake of advanced features but also impose local regulatory and clinical validation requirements, making regional go‑to‑market strategies that combine localized clinical studies and manufacturing partnerships especially effective. These regional contrasts matter for product localization, regulatory planning, and commercial partnerships, and they should be used to prioritize piloting, clinical validation, and supply‑chain resilience investments across territories.

This comprehensive research report examines key regions that drive the evolution of the Wearable Heart Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Companies that couple validated sensor performance with scalable analytics and friction‑free clinical integrations will capture durable advantage in cardiac wearables

Leading companies are consolidating positions along a few clear vectors: sensor and algorithm superiority, platform ecosystems that lock in data flows, and integrated clinical services that extend device utility beyond the point of sale. Large consumer electronics firms have broadened health portfolios by introducing regulated features and building clinical partnerships to accelerate clinical acceptance. Specialist medical device firms continue to focus on point solutions that deliver high‑fidelity ECG and validated blood pressure workflows, often partnering with consumer platforms to extend reach. Meanwhile, vertical players focused on athletics or subscription‑based monitoring differentiate through specialized analytics, athlete‑grade signal processing, and performance coaching integrations.

Strategic moves to watch include deeper vertical integration of hardware and cloud analytics, efforts to secure regulatory milestones that convert consumer features into accepted clinical tools, and commercial arrangements that embed devices into chronic care management programs. Companies that can credibly demonstrate end‑to‑end security, scalable data ingestion, and clinically validated decision support will be advantaged when health systems seek to operationalize continuous monitoring. Competitive dynamics will favor organizations that can pair device reliability with streamlined clinical workflows, thereby reducing clinician cognitive load and minimizing false positive cascades. In short, the winners will be those that can combine sensor quality, validated analytics, and pragmatic clinical integration into a predictable, low‑friction pathway from device deployment to care action.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wearable Heart Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACS Diagnostics, Inc.

- AliveCor, Inc.

- Apple Inc.

- Bardy Diagnostics, Inc.

- BioTelemetry, Inc.

- Boston Scientific Corporation

- Empatica, Inc.

- Garmin Ltd.

- Google LLC by Alphabet Inc.

- Hexoskin Inc.

- Huawei Technologies Co., Ltd.

- iRhythm Technologies, Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic Inc.

- Nokia Corporation

- Nonin Medical, Inc.

- Omron Healthcare, Inc.

- Polar Electro Oy

- Qardio, Inc.

- Samsung Electronics Co., Ltd.

- Whoop, Inc.

- Xiaomi Corporation

Actionable playbook for leaders to integrate multi‑modal sensing, clinical evidence programs, and supply‑chain resilience into defensible commercialization strategies

Industry leaders should pursue a three‑track playbook that aligns product development, evidence generation, and commercial execution to the evolving market realities. First, invest in multi‑modal sensing and algorithmic denoising to reduce artifact‑related false positives and expand the range of clinically actionable outputs. Prioritizing ECG or high‑fidelity optical pathways according to the target application and end‑user will maximize clinical utility while minimizing unnecessary complexity. Second, establish clear clinical validation pathways with professional societies and health systems, using structured real‑world evidence collection alongside controlled studies so that devices can be adopted into clinician workflows with confidence. Third, treat supply‑chain resilience and tariff risk as product features: qualify secondary suppliers early, consider regional assembly for sensitive components, and model landed costs under different tariff scenarios to ensure launch timelines are robust.

Commercially, vendors should design go‑to‑market approaches that pair retail accessibility with clinician referral programs and remote patient monitoring bundles. Offer subscription models that include device provisioning, secure data hosting, and clinical escalation protocols to align incentives between vendors, providers, and payers. From an organizational perspective, build cross‑functional teams that bring product, regulatory, clinical, and reimbursement expertise together early in the development cycle. This integrated approach reduces time to clinical acceptance and creates sales narratives that address both consumer needs and provider risk tolerance. Finally, invest in transparent security and privacy reporting, because trust remains a gating factor for clinician adoption and institutional procurement.

A mixed‑methods research approach combining technical signal validation, clinical policy analysis, and commercial channel mapping to produce auditable insights

The research behind this report uses a triangulated methodology built on three pillars: technical signal assessment, clinical and policy analysis, and commercial channel mapping. Technical signal assessment synthesizes peer‑reviewed literature, device technical specifications, and algorithm validation studies to evaluate the fidelity characteristics of ECG, optical sensor‑based, and PPG technologies in ambulatory conditions. Clinical and policy analysis reviews public regulatory filings, guidance from professional societies, and payer policy changes to clarify the evidentiary thresholds and reimbursement mechanics relevant to remote monitoring. Commercial channel mapping combines primary interviews with stakeholder groups-product leaders, procurement managers in health systems, and distribution executives-with secondary sources to depict how distribution choices influence uptake.

This mixed‑methods approach emphasizes reproducibility and triangulation: technical assertions are cross‑checked against published validation studies and manufacturer specifications, policy statements are corroborated with primary regulatory notices and payer communications, and commercial claims are grounded in documented distribution contracts and interview evidence. Where data gaps exist, the methodology explicitly flags uncertainty and presents sensitivity frameworks that allow leaders to evaluate alternative assumptions. Together, these methodological elements ensure the report’s recommendations are actionable, auditable, and aligned with current clinical and commercial realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wearable Heart Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wearable Heart Monitoring Devices Market, by Product Type

- Wearable Heart Monitoring Devices Market, by Technology

- Wearable Heart Monitoring Devices Market, by Connectivity

- Wearable Heart Monitoring Devices Market, by Application

- Wearable Heart Monitoring Devices Market, by End-User

- Wearable Heart Monitoring Devices Market, by Distribution Channel

- Wearable Heart Monitoring Devices Market, by Region

- Wearable Heart Monitoring Devices Market, by Group

- Wearable Heart Monitoring Devices Market, by Country

- United States Wearable Heart Monitoring Devices Market

- China Wearable Heart Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 194 ]

Clinical credibility, operational readiness, and supply‑chain resilience will determine which wearable solutions transition from promising prototypes to scalable clinical tools

Wearable heart monitoring devices now occupy a strategic intersection between consumer convenience and clinical necessity. Sensor and algorithmic progress has elevated the clinical credibility of optical and multi‑modal devices, while reimbursement and remote monitoring policies are lowering barriers to clinical adoption. At the same time, geopolitical and tariff developments in 2025 have reintroduced supply‑chain friction that must be actively managed. The implications are clear: product teams must design with clinical endpoints in mind, procurement teams must build resilient sourcing strategies, and commercial teams must align distribution with clinical credentialing and payer requirements.

For decision‑makers, the immediate priority is not speculative market size but operational readiness: define the clinical use case precisely, validate device performance in the intended use environment, and ensure that commercial contracts and supplier networks reflect current tariff and regulatory realities. Companies that take a cross‑functional approach to product design, evidence generation, and supply‑chain planning will be best positioned to translate current technological promise into durable clinical and commercial value. The trajectory of the industry favors solutions that reduce clinician burden, produce reproducible clinical signals, and integrate seamlessly into reimbursement and care pathways. These are the practical criteria that will determine which products scale and which remain niche.

Initiate a direct purchase briefing with Ketan Rohom to secure tailored licensing, custom data extracts, and prioritized onboarding for enterprise adoption of this report

Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) is available to guide enterprise buyers and clinical teams through the report purchasing and licensing process. For organizations that need a tailored licensing package, custom data extracts, or a private briefing, Ketan can coordinate a detailed walkthrough of the report’s chapters, executive briefings, and vendor benchmarking. Engage with Ketan to arrange a demo of the dataset, confirm licensing terms for internal distribution, or discuss bundled consulting hours for implementation planning. The report purchase process includes options for single‑user access, multi‑user corporate licenses, and white‑label use for internal strategy work, and Ketan will advise on the option that best aligns with procurement policies and timelines. Contacting Ketan initiates a brief needs assessment call so the delivery package can be matched to buyer priorities, whether that is clinical validation detail, supply‑chain risk analysis, or commercialization playbooks. Organizations that act early can secure priority scheduling for follow‑on advisory sessions and tailored slide decks designed for board and C‑suite presentations. Ketan coordinates post‑purchase support that includes a one‑hour onboarding session to highlight the report’s key tables, methodology appendices, and proprietary scoring frameworks for vendor comparison. To proceed, request a purchase briefing with Ketan to receive a formal quote, confirm licensing terms, and schedule your delivery and onboarding timeline.

- How big is the Wearable Heart Monitoring Devices Market?

- What is the Wearable Heart Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?