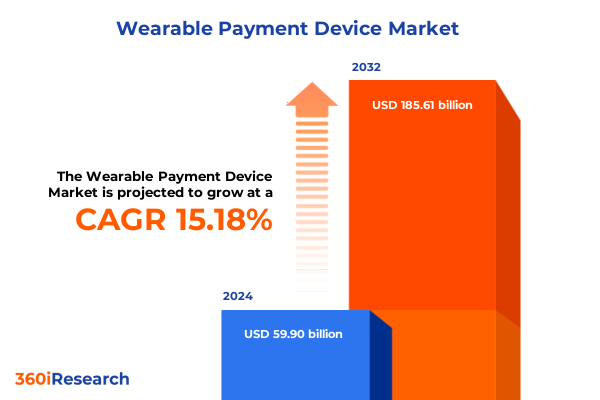

The Wearable Payment Device Market size was estimated at USD 68.93 billion in 2025 and expected to reach USD 79.32 billion in 2026, at a CAGR of 15.20% to reach USD 185.61 billion by 2032.

Pioneering Wearable Payment Devices Poised to Redefine Consumer Transactions and Drive Next-Generation Digital Commerce Experiences

Wearable payment devices represent an unprecedented convergence of fashion, technology, and finance, fundamentally redefining how consumers interact with digital commerce. From the early days of basic RFID-enabled wristbands to the latest biometric smart rings, this innovation trajectory has been propelled by advances in miniaturization and secure element technology. As smartphones and mobile wallets have reached saturation in many markets, industry participants have sought new frontiers for seamless transactions, embedding payment capabilities directly into everyday accessories. This shift addresses rising consumer demand for frictionless experiences, enabling tap-and-go payments without the friction of physical cards or phones.

This executive summary presents a comprehensive analysis of the wearable payment device landscape, highlighting key trends, segmentation dynamics, regional nuances, and competitive strategies. Decision makers will gain insights into how tactile form factors-from jackets with embedded sensors to next-generation smart glasses-are reshaping user engagement. The narrative further uncovers how payment technologies such as host card emulation and dynamic QR codes integrate with diverse form factors, driving adoption across consumer and commercial verticals. The subsequent sections distill transformative forces, assess policy impacts, and outline actionable recommendations to navigate a fast-evolving ecosystem.

Historically, the intersection of IoT proliferation and stringent security mandates has spurred collaborative ventures between fashion houses, semiconductor vendors, and payment networks. Regulatory bodies worldwide have accelerated standards for contactless and e-commerce security, while the pandemic era underscored hygiene and non-contact transactions, accelerating consumer receptivity. Moving forward, wearable payment devices will sit at the nexus of convenience, health monitoring, and digital identity, offering enterprises and brands novel avenues for engagement and loyalty.

Emerging Technological Innovations and Shifting Consumer Behaviors That Are Rapidly Transforming the Wearable Payments Ecosystem and User Engagement Models

Revolutionary advances in near-field communication, host card emulation, and dynamic QR protocols have created fertile ground for novel wearable payment form factors. Ultra-low-power secure elements now enable rings and wristbands to process encrypted payment tokens independent of smartphones, while smart glasses prototype direct-tap checkout in augmented reality overlays. At the same time, dynamic QR code generation in smart earwear offers a software-centric, cross-platform alternative for merchants lacking NFC infrastructure.

Parallel to technology breakthroughs, consumer behaviors are shifting toward experiences that seamlessly blend lifestyle and commerce. The rise of omnichannel retail has primed buyers to expect a consistent payment interface, whether at the café, at a fitness center, or in online communities. Loyalty programs are increasingly integrated into wearable platforms, delivering personalized offers based on biometric and location insights. Moreover, strategic alliances between fintech firms, fashion brands, and mobile network operators have accelerated go-to-market cycles, enabling iterative co-creation of hardware and services.

Regulatory developments and security mandates continue to guide the pace of innovation. In Europe, PSD2 and strong customer authentication requirements have validated biometric and token-based arrangements, while emerging U.S. data protection frameworks anticipate similar rigor. Payment Card Industry Council guidelines now encompass wearable certification criteria, ensuring interoperability across global terminals. This regulatory alignment not only safeguards consumer data but also builds merchant confidence, fostering broader deployment.

Ultimately, the intersection of cutting-edge communication protocols, adaptive form factors, and evolving consumer expectations is rewriting the rules of digital transactions, positioning wearable payment devices as a transformative pillar of tomorrow’s commerce.

Assessing How Recent 2025 Tariff Policies Are Shaping the Competitive Landscape and Cost Structures for Wearable Payment Device Manufacturers and Providers

Early in 2025, the United States implemented tariff measures targeting key electronic components, including semiconductor chips and sensor modules integral to wearable payment devices. Imported from leading Asian suppliers, these components now attract additional duties, raising the landed cost for manufacturers and potentially impacting retail pricing. The tariff adjustments underscore broader geopolitical tensions and highlight vulnerabilities in complex global supply chains, prompting device makers to reconsider sourcing strategies and cost structures.

In response, many manufacturers are diversifying supplier portfolios to mitigate exposure, exploring nearshore assembly facilities in Mexico and Central America to reduce transit times and tariff burdens. Others are negotiating long-term component agreements or investing in modular design frameworks that allow for alternative chipsets. Retailers and channel partners face the challenge of balancing cost pass-through with competitive positioning, often absorbing a portion of increased expenses to maintain price parity in consumer markets. At the same time, service providers are collaborating on joint procurement initiatives to leverage scale and negotiate favorable terms.

Looking ahead, ongoing trade negotiations and potential tariff revisions under bilateral agreements may alter the landscape once more, requiring industry stakeholders to maintain agile procurement and risk management practices. Initiatives to encourage domestic manufacturing of secure element chips and payment modules are gaining traction, supported by government incentives and research grants. Ultimately, the interplay between policy decisions and supply chain resilience will determine the pace at which wearable payment devices achieve mainstream adoption.

Unveiling Critical Device Type Payment Technology And End User Distribution Channel Segmentation Dynamics That Drive Consumer Adoption Patterns

The wearable payment device market can be dissected by device type, each offering unique value propositions and user experiences. Clothing-integrated solutions, such as smart jackets and shirts, embed sensors and antennas within fabric, blending fashion with functionality for a seamless payment experience. Rings provide ultra-compact convenience for micropayments, while smart earwear leverages in-ear biometric authentication to secure transactions. Smart glasses are emerging as experimental payment hubs with AR overlays guiding in-store interactions, and wrist wearables encompass both premium smartwatches and accessible wristbands tailored to diverse consumer segments.

Payment technology further refines this landscape, with EMV-based chip transactions serving as the backbone for hardware security. Magnetic secure transmission (MST) enables backward compatibility with legacy terminals by emulating card swipes, while near-field communication (NFC) dominates new contactless installations. Within NFC, host card emulation allows cloud-managed token provisioning, and secure elements offer isolated hardware protection. Meanwhile, merchants embrace QR code approaches, where dynamic QR generation supports real-time transaction settlement and static QR codes facilitate offline acceptance.

End-user segmentation reveals distinct patterns. Commercial deployments in enterprise settings streamline employee expenses and loyalty programs, whereas small businesses adopt plug-and-pay models for ease of integration. On the consumer front, early adopters gravitate toward premium wearable formats, with fashion-forward partnerships driving mainstream interest. These insights inform product roadmaps and marketing strategies, ensuring feature sets align with the nuanced requirements of each audience segment.

Distribution channels shape market penetration, beginning with direct-to-consumer models that foster brand engagement and customization. Offline retail remains critical, as carrier stores, electronics retailers, and specialty outlets offer hands-on demonstrations that build trust. Online retail channels, comprising brand-managed websites and e-commerce platforms, provide scalability and convenience, enabling enterprises to reach global audiences while capturing valuable consumer data.

This comprehensive research report categorizes the Wearable Payment Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Payment Technology

- End User

- Distribution Channel

Examining Distinct Market Drivers And Consumer Preferences Across Americas Europe Middle East Africa And Asia Pacific Regions To Inform Strategic Positioning

The Americas exhibit a robust appetite for wearable payment devices, underpinned by mature NFC infrastructure, high smartphone penetration, and a culture of mobility. The United States leads with corporate wellness and transit programs deploying wrist wearables, while Canada’s retail and hospitality sectors pilot ring and clothing-based payments. Latin American markets, conversely, demonstrate rapid uptake of QR code solutions, driven by mobile-first consumers and burgeoning digital wallet ecosystems.

In Europe, strict data privacy standards and expansive contactless networks in Western markets have created an environment ripe for adoption of secure element–enabled wearables. Simultaneously, the Middle East’s government-backed smart city initiatives integrate payment functionalities into urban wearables, enhancing public transport and campus access. In Africa, where mobile money platforms have leapfrogged traditional banking, QR code–centric devices find enthusiastic reception among unbanked and underbanked populations.

The Asia-Pacific region presents a tapestry of innovation. China’s dual NFC and QR code ecosystems coexist, supported by major tech conglomerates embedding payments into smart glasses and earwear. Japan balances cultural reverence for physical tokens with cutting-edge collaborations between consumer electronics giants and payment networks. India’s dynamic landscape favors smartphone-based QR transactions, but pilot programs across smart bracelets and biometric rings indicate growing interest in alternative form factors. Across these regions, regulatory frameworks, technology maturity, and consumer preferences combine to dictate tailored market entry and scaling strategies.

This comprehensive research report examines key regions that drive the evolution of the Wearable Payment Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators And Market Disruptors Shaping The Future Of Wearable Payment Device Industry With Emphasis On Collaboration And Innovation

Global technology leaders have set the pace by integrating payment modules directly into flagship smartwatches, forging deep collaborations with major payment networks to embed tokenization protocols and biometric authentication. Semiconductor vendors respond by developing ultra-low-power chipsets optimized for wallet applications, while standalone wearable manufacturers diversify portfolios to include smart rings, clothing-infused sensors, and smart glasses prototypes.

Major payment networks and card issuers continuously refine certification programs to accommodate host card emulation and dynamic QR code standards, enabling nimble fintech entrants to leverage secure element frameworks. Partnerships between device OEMs and payment processors have condensed certification cycles from months to weeks, accelerating time to market and enhancing interoperability across global terminals.

At the same time, emerging disruptors differentiate through experimental convergence of health monitoring and payments, embedding biometric sensors in earwear and wellness-focused wristbands that authenticate and authorize transactions. Fashion-tech collaborations are driving consumer acceptance, as renowned apparel brands co-create limited-edition sensor-enabled garments that double as payment terminals, blending style and utility in a single offering.

Case studies highlight strategic alliances such as a leading wearable company partnering with a global payment network to pilot in-venue tap payments at major sporting venues, and a consortium of retailers collaborating on an open QR standard to unify acceptance across disparate platforms. These initiatives underscore how inter-ecosystem cooperation is pivotal in scaling wearable payments beyond early adopters.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wearable Payment Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Fitbit, Inc.

- Fossil Group, Inc.

- Garmin Ltd.

- Google LLC

- Huami Corporation

- Huawei Technologies Co., Ltd.

- Mastercard Inc.

- McLEAR Ltd.

- Mobvoi Information Technology Company Limited

- OPPO Digital Inc.

- Oura Health Oy

- PayPal Holdings Inc.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Visa Inc.

- Xiaomi Corporation

Strategic Recommendations And Best Practices For Industry Leaders To Capitalize On Wearable Payment Device Advancements And Stay Ahead In A Marketplace

Industry leaders should adopt modular hardware architectures that facilitate rapid integration of emerging payment technologies and iterative software updates. Coupled with robust security layers-balancing secure elements with cloud-based token vaults-this approach ensures resilience against evolving threat vectors. Establishing strategic alliances with major payment networks and mobile network operators will streamline certification and distribution processes, expediting market entry in key geographies.

Investments in user-centric design research are paramount. By conducting targeted pilot programs in representative markets, manufacturers and brands can refine form factors and user interfaces to match demographic and lifestyle preferences. Blending immersive in-store demonstrations through offline retail with personalized online customization platforms will cultivate brand loyalty and drive repeat engagement.

To counteract cost pressures stemming from tariffs and component shortages, organizations must diversify supply chains across regions and explore nearshore assembly partnerships. Engaging proactively with policy makers and industry standards bodies will enable stakeholders to influence regulatory frameworks while anticipating compliance obligations. This dual focus on operational agility and policy engagement will position companies to capitalize on evolving market opportunities and sustain competitive advantage.

Comprehensive Research Approach Combining Primary Interviews Secondary Research To Deliver Actionable Insights On Wearable Payment Devices

This research employs a multi-faceted methodology to deliver a nuanced understanding of wearable payment device dynamics. Primary insights were garnered through in-depth interviews with key stakeholders, including device OEM executives, banking partners, retail technology integrators, and regulatory authorities. Complementary qualitative data were collected via consumer focus groups and targeted surveys spanning a broad demographic spectrum, ensuring robust validation of preference indicators.

Secondary research encompassed a comprehensive review of industry white papers, regulatory filings, open standards documentation, and thought leadership publications. By systematically triangulating data from vendor presentations, trade association reports, and academic studies, the analysis identified both established benchmarks and emergent themes. This layering of perspectives reduced reliance on single-source information and enhanced the reliability of trend interpretations.

Quantitative analysis was performed using cross-sectional metrics derived from partner databases, syndicated industry trackers, and anonymized transaction data feeds. Statistical rigor was applied to benchmark adoption rates, form factor penetration, and channel effectiveness, while sensitivity testing assessed the impact of policy shifts and technology disruptions.

To ensure methodological integrity, the study incorporated peer review sessions with external advisors and iterative feedback cycles with subject matter experts. Limitations related to emerging form factors and rapidly evolving standards were mitigated through continuous data updates and scenario planning, guaranteeing that the final deliverables reflect an accurate and forward-looking perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wearable Payment Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wearable Payment Device Market, by Device Type

- Wearable Payment Device Market, by Payment Technology

- Wearable Payment Device Market, by End User

- Wearable Payment Device Market, by Distribution Channel

- Wearable Payment Device Market, by Region

- Wearable Payment Device Market, by Group

- Wearable Payment Device Market, by Country

- United States Wearable Payment Device Market

- China Wearable Payment Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing Key Takeaways And Future Outlook For Wearable Payment Devices Guiding Decision Makers Toward Informed Strategic Investments And Partnerships

The fusion of biometric authentication, miniaturized secure elements, and advanced communication protocols marks a significant inflection point in digital commerce, as wearable payment devices transition from novelty to mainstream utility. Device type diversification-from smart rings and earwear to sensor-infused apparel-caters to evolving consumer sensibilities, enabling transactions that align with lifestyle, health, and security expectations.

Regional disparities underscore the need for tailored approaches, whether leveraging QR code ubiquity in emerging economies or navigating stringent data privacy regimes in developed markets. Stakeholders must calibrate product designs, certification pathways, and channel strategies to local infrastructure realities and regulatory requirements, ensuring both speed to market and compliance.

The current tariff environment accentuates the importance of supply chain resilience and cost-efficient manufacturing, compelling organizations to adopt flexible sourcing strategies and nearshore partnerships. Proactive engagement with policymakers and standards bodies will be instrumental in shaping favorable conditions for device certification and market access.

By synthesizing these insights, decision makers can craft informed strategies that leverage technological innovation, optimize channel mix, and build collaborative ecosystems, ultimately driving sustainable growth in a competitive landscape where wearable payments are poised to become ubiquitous.

Connect With Ketan Rohom To Unlock Comprehensive Wearable Payment Device Market Research Report And Empower Your Strategic Growth Initiatives Today

For organizations seeking a deeper exploration of these trends, segmentation analyses, and regional dynamics, engage with Ketan Rohom Associate Director Sales & Marketing to secure full access to the specialized research report. His expertise will guide your team through the intricacies of wearable payment device innovation, offering tailored insights to drive your strategic growth initiatives. Reach out to initiate a consultation and discover how this comprehensive study can inform your roadmap, strengthen partnerships, and substantiate investment decisions for a rapidly evolving digital commerce landscape

- How big is the Wearable Payment Device Market?

- What is the Wearable Payment Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?