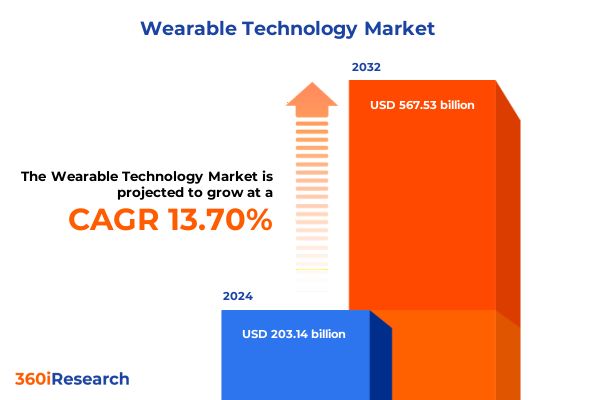

The Wearable Technology Market size was estimated at USD 229.77 billion in 2025 and expected to reach USD 260.54 billion in 2026, at a CAGR of 13.78% to reach USD 567.53 billion by 2032.

Strategic Overview of Wearable Technology Market Dynamics and Emerging Innovations Driving Transformation of Consumer and Enterprise Experiences

The current landscape of wearable technology reflects an unprecedented convergence of miniaturization, connectivity, and user-centered design that continues to reshape how people interact with personal devices. Over the past decade, advancements in sensor accuracy, low-power wireless protocols, and flexible electronics have transformed once nascent concepts into mainstream consumer and enterprise applications. In turn, that evolution has driven manufacturers and developers to reimagine device form factors, user experiences, and data ecosystems, resulting in a vibrant market characterized by rapid product cycles and diverse use cases.

As interest in health and wellness deepens and the Internet of Things expands, wearable devices have become integral to daily routines, enabling continuous fitness tracking, biometric monitoring, and seamless communication. At the same time, enterprises have embraced wearables for workforce safety, productivity analytics, and immersive training. By bridging digital and physical experiences, the technology is unlocking new avenues for personalization, real-time feedback, and predictive insights. In this context, stakeholders across consumer electronics, healthcare, and industrial sectors are accelerating innovation to capitalize on emergent opportunities.

This introduction sets the stage for examining how transformative shifts, regulatory changes, and market segmentation dynamics are driving both competitive pressure and strategic investments. With consumer expectations at an all-time high and regulatory environments evolving, understanding foundational trends is crucial for industry leaders aiming to navigate and shape the future trajectory of wearable technology.

Critical Shifts in Wearable Technology Landscape Unveiling How Convergence of AI Connectivity and Design Innovation Propels Market Evolution

Recent years have witnessed fundamental realignments in the wearable technology domain as artificial intelligence, advanced connectivity, and ergonomic design principles converge to redefine product capabilities. Machine learning algorithms now power on-device analytics, allowing for personalized health recommendations and context-aware notifications without reliance on cloud processing. Simultaneously, the rollout of 5G and enhancements in Bluetooth Low Energy protocols have further reduced latency, enabling richer multimedia experiences and more sophisticated real-time communication.

In addition, aesthetic considerations and material science breakthroughs have spurred the rise of smart clothing and adaptable form factors that blend seamlessly with everyday attire. As a result, consumer adoption patterns are shifting from single-purpose devices toward multifunctional platforms that fuse fitness tracking, biometric sensing, and hands-free communication. Moreover, through the integration of augmented reality in smart eyewear, enterprises are exploring remote assistance and training applications, pushing the boundaries of on-the-job productivity.

Taken together, these dynamics are triggering a wave of product innovation cycles and strategic partnerships between technology firms, fashion brands, and healthcare providers. The interplay of user experience expectations and technological possibilities is fostering a new era of wearable ecosystems, one that will shape purchase decisions and investment priorities over the coming years.

Assessing the Cumulative Effects of United States Trade Tariffs on Wearable Technology Ecosystems and Supply Chain Economics through 2025

The imposition and continuation of United States trade tariffs on imported components and finished goods have exerted significant pressure on the wearable technology supply chain, with cumulative effects intensifying cost structures through 2025. Since the introduction of Section 301 tariffs on electronics and related subassemblies, manufacturers have confronted increases in duty rates that have in some cases exceeded twenty percent. Consequently, device producers and component suppliers have reevaluated sourcing strategies, balancing tariffs against manufacturing efficiencies and logistics capabilities.

In response, many industry participants have pursued supplier diversification by relocating production to tariff-friendly countries or by investing in nearshoring strategies within North America. These shifts have mitigated some cost escalations, yet they have introduced new complexities in vendor qualification, quality control, and lead-time management. Additionally, higher import duties have prompted downstream channel partners to adjust pricing models, which in turn influences consumer demand elasticity and willingness to pay for premium features such as advanced sensors and longer battery life.

Furthermore, the ongoing tariff landscape has underscored the strategic importance of vertical integration, leading several leading manufacturers to secure critical components in-house or through long-term contracts that offer more predictable cost bases. Looking ahead, the interplay between trade policy and component sourcing will remain a key determinant of profitability and innovation cadence within the wearable ecosystem.

Insightful Analysis of Wearable Technology Market Segmentation by Device Components User Applications and Distribution Channels Revealing Growth Drivers

An examination of the wearable technology market through the lens of device types reveals that smartwatches continue to anchor revenue growth, with fully featured models driving premium segment dynamics while hybrid variants appeal to traditional watch enthusiasts seeking connected functionality. Fitness trackers maintain broad consumer appeal through affordability and focused health-tracking capabilities, even as hearables carve out a niche for seamless audio experiences enhanced by voice assistants and biosensors. Emerging categories such as smart clothing and smart eyewear further expand the ecosystem, with embedded fabrics and optical displays promising novel interaction paradigms.

When assessing market components, sensors emerge as pivotal enablers, with accelerometers, gyroscopes, and heart rate monitors delivering the core data streams that underpin activity recognition and health analytics. Complementing these, processors have become more efficient and powerful, connectivity modules manage multi-protocol communications, displays evolve toward flexible OLED, and battery innovations continue to push endurance thresholds.

From an end-user vantage, consumer applications remain dominant, yet enterprise and industrial segments are gaining prominence through use cases such as worker safety monitoring and process optimization. Healthcare is another critical vertical, where devices facilitate both cardiac monitoring and sleep analysis, enabling clinicians to extend patient engagement beyond clinic walls. Sports and fitness applications also persist as growth drivers, fueling demand for real-time performance feedback.

Finally, distribution channels reflect a dual-track approach: offline channels leverage direct sales teams and specialty retail environments to deliver hands-on experiences, while online avenues, including e-commerce marketplaces and manufacturer websites, grant unparalleled reach and convenience. This multi-pronged distribution map underscores the importance of orchestrating channel strategies that align with product positioning and end-user preferences.

This comprehensive research report categorizes the Wearable Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Component

- Application

- End User

- Distribution Channel

Regional Perspectives on Wearable Technology Adoption and Market Diversity across Americas Europe Middle East Africa and Asia Pacific Territories

Across the Americas, wearables benefit from a mature consumer market that prioritizes health, fitness, and seamless connectivity, driving widespread adoption of smartwatches and hearables. High consumer spending power, coupled with supportive healthcare infrastructure, amplifies demand for advanced biometric monitoring and premium device features. In contrast, Europe, the Middle East, and Africa present a more heterogeneous landscape where regulatory frameworks and cultural factors influence segment performance. While consumers in Western Europe embrace multifunctional smartwatches, enterprises in certain EMEA regions are intensifying investments in industrial safety wearables and augmented reality eyewear for field service applications.

Shifting attention to the Asia-Pacific region, rapid urbanization, government initiatives supporting digital health, and a strong manufacturing base collectively fuel both innovation and domestic consumption. Markets in China, Japan, South Korea, and India exhibit heightened interest in fitness tracking and mobile connectivity, with local manufacturers leveraging economies of scale to introduce competitively priced devices. In parallel, regional partnerships between telecom providers and device makers facilitate the rollout of next-generation connectivity services such as 5G-enabled wearables. As cross-regional collaborations grow, manufacturers and service providers are finding new routes to unlock value across these distinct economic and cultural environments.

This comprehensive research report examines key regions that drive the evolution of the Wearable Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape of Leading Wearable Technology Innovators Highlighting Strategic Initiatives Collaborations and Market Positioning Trends

Key players in the wearable technology arena are engaged in an intense competition centered on ecosystem development, feature differentiation, and strategic alliances. Industry stalwarts that have built broad platforms around operating systems and cloud services emphasize seamless integration between devices and mobile or web applications. Concurrently, consumer electronics companies are refining hardware innovation through in-house chip design and proprietary sensor algorithms to enhance performance metrics.

Strategic partnerships further underscore the competitive landscape, with alliances spanning component suppliers, telecommunication carriers, healthcare providers, and fashion brands. These collaborations aim to accelerate time-to-market for new form factors, improve data interoperability for health monitoring, and curate specialized content streams for lifestyle applications. Additionally, notable acquisitions of niche wearable startups by larger technology conglomerates have reinforced portfolio breadth and fortified intellectual property holdings.

Emerging challengers and specialized vendors continue to pressure established names by focusing on targeted use cases such as sleep analytics, stress management, and enterprise wearables for industry-specific needs. Their emphasis on rapid prototyping, community-driven software development, and flexible licensing models demonstrates an agility that triggers response initiatives among incumbents. Ultimately, each competitive move shapes product roadmaps and determines the pathways through which wearable technologies will proliferate across both consumer and professional domains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wearable Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Amazon.com, Inc

- Apple Inc

- BOE Technology Group Co., Ltd.

- Bose Corporation

- Fossil Group, Inc.

- Garmin Ltd

- Google LLC

- HTC Corporation

- Huawei Technologies Co., Ltd

- Imagine Marketing Limited boAt

- Lenovo Group Ltd

- LG Electronics

- Magic Leap, Inc.

- Meta Platforms Inc

- Microsoft Corporation

- Nike Inc

- OPPO

- Oura Health Oy

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd

- Sony Group Corporation

- Vuzix Corporation

- WHOOP Inc

- Zepp Health Corporation

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities in Wearable Technology Markets with Sustainable Growth Focus

Industry leaders must seize opportunities by harnessing artificial intelligence and edge computing to deliver personalized user experiences that differentiate their offerings. By embedding advanced analytics capabilities directly on devices, manufacturers can offer proactive health insights and actionable recommendations in real time. To offset continued tariff pressures, decision-makers should prioritize supply chain diversification by identifying alternative production hubs and forging long-term agreements with component suppliers to stabilize cost structures and safeguard against geopolitical uncertainties.

From a product design perspective, developing hybrid smartwatches that combine classic aesthetics with selective digital functions can appeal to traditional consumer segments, while continuing to expand form factor innovation will open new market niches. In parallel, leveraging partnerships with healthcare institutions and fitness ecosystems can expedite regulatory approvals and drive enterprise adoption for clinical and occupational use cases. Moreover, accelerating battery and connectivity improvements will enhance user satisfaction, extending device uptime and enabling richer data streams.

Finally, a synchronized go-to-market strategy that blends offline experiential retail with targeted online campaigns will maximize reach. By cultivating brand ambassadors and utilizing localized content for key regions, companies can increase awareness and foster deeper engagement. Adopting these actionable strategies will position organizations to capitalize on emerging trends and achieve sustainable growth within the evolving wearable technology sphere.

Robust Research Framework Outlining Methodological Approaches Data Collection and Analytical Techniques for Wearable Technology Insights

The research methodology underpinning this executive summary incorporates a blend of qualitative and quantitative approaches designed to deliver a holistic view of the wearable technology market. Primary research involved structured interviews with device manufacturers, component vendors, channel partners, and end-user organizations to capture firsthand perspectives on innovation drivers, operational challenges, and adoption trajectories. These dialogues were complemented by surveys targeting both consumers and enterprise decision-makers to quantify sentiment around feature preferences and purchasing considerations.

Secondary research leveraged publicly accessible sources such as corporate filings, patent databases, trade publications, and regulatory filings to trace historical developments in component technologies, tariff enactments, and standards roadmaps. In addition, data from technology conferences and open-source datasets provided insight into emerging form factors, power management breakthroughs, and connectivity evolutions. Analytical frameworks such as SWOT and Porter’s Five Forces were applied to evaluate competitive dynamics, barrier to entry factors, and the influence of broader macroeconomic trends.

To ensure rigor and relevance, information was triangulated across multiple inputs, with discrepancies cross-checked through follow-up interviews or targeted data queries. This rigorous approach delivers a robust foundation for the insights and recommendations presented, fostering confidence in the findings among both technical specialists and strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wearable Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wearable Technology Market, by Device Type

- Wearable Technology Market, by Component

- Wearable Technology Market, by Application

- Wearable Technology Market, by End User

- Wearable Technology Market, by Distribution Channel

- Wearable Technology Market, by Region

- Wearable Technology Market, by Group

- Wearable Technology Market, by Country

- United States Wearable Technology Market

- China Wearable Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on Wearable Technology Evolution Implications for Stakeholders and Future Directions in Innovation and Market Dynamics

The wearable technology sector stands at a pivotal juncture where the interplay of sensor innovation, data analytics, and user experience is reshaping market trajectories. Key trends such as the integration of edge-based artificial intelligence, the rise of multifunctional form factors, and the maturation of distribution strategies underscore the sector’s dynamic nature. Moreover, the ongoing influence of trade policies necessitates adaptive supply chain models that can withstand cost volatility and geopolitical fluctuations.

As segmentation insights reveal differentiated growth pockets across device types, components, end-user verticals, applications, and channels, stakeholders have a roadmap for targeting investments and fine-tuning product portfolios. Regional variances further highlight the need for market-specific approaches, whether that involves leveraging established retail networks in the Americas or capitalizing on manufacturing scale in Asia-Pacific. The competitive landscape continues to evolve through alliances, acquisitions, and technology breakthroughs, reinforcing the importance of strategic agility.

Looking forward, organizations that align innovation roadmaps with consumer sentiment, regulatory environments, and supply chain realities will be best positioned to lead. The actionable strategies outlined herein provide a blueprint for navigating this complex environment and unlocking long-term value. Ultimately, the confluence of technical excellence, market insight, and operational resilience will determine the leaders in the next wave of wearable technology adoption.

Empowering Your Strategic Decisions in Wearable Technology Markets Take the Next Step with Direct Support from Our Sales and Marketing Leadership

To secure this comprehensive market research report and equip your organization with actionable insights for the rapidly evolving wearable technology sector, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through the report’s detailed findings, clarify any questions you may have, and facilitate the acquisition process so that you can make well-informed strategic decisions without delay. Engage with Ketan to tailor the report package to your specific business needs and gain a competitive edge in wearable technology innovation and investment.

- How big is the Wearable Technology Market?

- What is the Wearable Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?