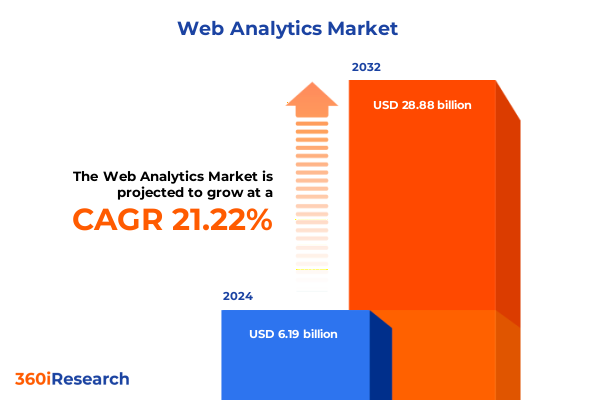

The Web Analytics Market size was estimated at USD 7.48 billion in 2025 and expected to reach USD 8.95 billion in 2026, at a CAGR of 21.27% to reach USD 28.88 billion by 2032.

An Engaging and Contextual Overview That Frames Key Objectives and Underlines the Strategic Imperatives for Leveraging Web Analytics

In the contemporary digital arena, organizations face an imperative to harness web analytics as a strategic enabler of customer engagement, operational efficiency, and competitive differentiation. Understanding user behavior across digital touchpoints has evolved from a tactical data collection exercise into a foundational component of strategic business planning. This report seeks to deliver an executive summary that illuminates the critical role of web analytics in empowering decision-makers to translate vast streams of interaction data into actionable insights. By synthesizing the most pertinent developments, this section sets the stage for an in-depth exploration of how data-driven frameworks are reshaping digital ecosystems and driving holistic performance improvements.

As organizations pivot toward integrated analytics infrastructures, clarity in objectives becomes indispensable for aligning cross-functional stakeholders. This introduction articulates the high-level goals of the study, framing how enhanced visibility into customer journeys, conversion pathways, and digital asset performance can accelerate growth and enhance ROI. Furthermore, it outlines the thematic pillars that structure the subsequent analysis, ensuring a coherent narrative flow from transformative market shifts through segmentation nuances to actionable recommendations. With this contextual foundation in place, executives are equipped to appreciate the strategic underpinnings and practical ramifications of the insights that follow.

The accelerating integration of artificial intelligence and machine learning into web analytics platforms has ushered in a new era of predictive and prescriptive capabilities. More than retrospective reporting, modern analytics environments facilitate real-time scenario modeling, anomaly detection, and personalized content optimization. Concurrently, emerging data privacy regulations and evolving consumer expectations necessitate robust governance frameworks that balance insight generation with ethical stewardship of personal data. Through this lens, the executive summary considers the symbiotic relationship between technological innovation and compliance imperatives, presenting a holistic view designed to guide strategic roadmaps.

Exploration of the Pervasive Transformative Shifts Reshaping the Web Analytics Landscape and Redefining Data-Driven Decision Making

To begin with, the web analytics landscape has undergone significant evolution as organizations embrace advanced capabilities beyond simple traffic measurement. Artificial intelligence and machine learning algorithms are being woven into analytics pipelines, enabling predictive modeling that anticipates customer actions and provides prescriptive guidance for campaign optimization. This paradigm shift allows businesses to proactively address user churn, personalize visitor experiences at scale, and allocate resources to high-impact initiatives in near real time.

Moreover, the industry is witnessing a transition toward privacy-centric architectures in response to stringent regulations and growing consumer privacy awareness. The phase-out of third-party cookies has accelerated adoption of server-side tagging, first-party data strategies, and consent management platforms, transforming how user identifiers are collected and managed. As a result, analytics practitioners are reimagining attribution models to maintain accuracy in a cookieless environment and to honor consumer preferences while still deriving meaningful insights from aggregated behavioral patterns.

Additionally, the convergence of web and mobile analytics tools has blurred traditional boundaries, giving rise to unified data ecosystems that track cross-platform user journeys. These integrated frameworks facilitate holistic analysis of digital engagement, capturing interactions from websites, mobile applications, and connected devices. In parallel, data democratization initiatives are empowering non-technical stakeholders with self-service dashboards and embedded analytics, thereby accelerating informed decision-making across marketing, product, and customer success teams.

In-Depth Analysis of the Cumulative Impact of 2025 United States Tariffs on Web Analytics Ecosystems and Digital Performance Metrics

The introduction of new United States tariffs in early 2025 has had multifaceted repercussions on the web analytics ecosystem, particularly affecting hardware acquisition and infrastructure costs for enterprises maintaining on-premises solutions. As duties increased on imported networking equipment, servers, and storage arrays, organizations have faced elevated capital expenditures when provisioning or upgrading internal analytics infrastructures. Consequently, many businesses have reassessed their deployment strategies, weighing the heightened upfront investment against their long-term operational and security requirements.

Furthermore, services that support analytics implementations-encompassing consulting, system integration, and ongoing technical support-have experienced secondary cost pressures as providers adjust fee structures to offset increased component expenses. This ripple effect is most pronounced among small and medium-sized enterprises, which often rely on packaged hardware-software offerings and leaner IT budgets. In contrast, larger enterprises have leveraged scale to negotiate with vendors and to distribute incremental costs across broader portfolios.

In reaction to elevated import costs, a notable shift toward cloud-based deployment modes has emerged, driven by the inherent flexibility and scalability of public cloud environments. Cloud hosting eliminates direct dependency on imported hardware imports subject to tariffs, enabling organizations to reallocate capital expenditures into operational expenditures. This shift has also influenced software vendors and platform providers to enhance their cloud-native offerings, embedding analytics capabilities that reduce reliance on on-premises appliances. Collectively, these dynamics underscore the interconnected nature of trade policy, infrastructure strategy, and the performance optimization of digital channels.

Comprehensive Insight into Critical Market Segmentation Dimensions Illuminating Product, Application, Deployment, and Organizational Dynamics

This analysis examines market dynamics across a spectrum of product typologies, revealing distinct trajectories within each category. Networking, servers, and storage hardware continue to underpin traditional analytics infrastructures, although innovation in edge processing and modular server designs is reshaping deployment approaches. Consulting, integration, and support services are driving value through customized implementation roadmaps and ongoing performance optimization, enabling organizations to accelerate adoption and maximize data-driven outcomes. Meanwhile, application software platforms-ranging from user behavior analytics solutions to customer journey orchestration tools-coexist with system-level software that ensures robust data collection, governance, and real-time processing capabilities.

Turning to application-specific use cases, financial services and insurance firms prioritize rigorous compliance audits and fraud detection analytics, leveraging sophisticated anomaly detection within customer transaction data. Healthcare providers are increasingly focused on patient engagement insights, harnessing digital touchpoint metrics to refine telehealth experiences and ensure HIPAA-compliant data management. In manufacturing environments, IoT-enabled sensors feed into predictive maintenance workflows, enabling analytics engines to detect operational inefficiencies before they escalate. Retailers concentrate on omnichannel customer journeys and personalization, using web analytics to orchestrate seamless interactions across e-commerce, mobile, and in-store channels.

In considering deployment preferences, a clear migration to cloud-based environments emerges, driven by the agility and scalability of public clouds and the ability to align expenditure with consumption patterns. Yet, organizations subject to stringent data residency or sovereignty requirements continue to maintain on-premises ecosystems, investing in private data centers with secure enclaves. Lastly, company size proves a pivotal factor: large enterprises lead in the adoption of AI-driven analytics frameworks and bespoke integrations, while SMEs gravitate toward integrated platforms with managed services to balance capability and cost.

This comprehensive research report categorizes the Web Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Deployment Mode

- Company Size

Strategic Examination of Regional Web Analytics Trends Highlighting Unique Drivers and Opportunities across Major Global Markets

In the Americas, organizations are at the forefront of adopting advanced web analytics capabilities, leveraging large-scale cloud providers and a mature ecosystem of specialized service providers. The United States, in particular, drives innovation with a deep pool of AI research and development, while Canada’s regulatory environment fosters robust privacy-first analytics practices. Across Latin America, digital adoption is accelerating as businesses invest in cloud-native analytics to enhance customer acquisition and retention, spurred by expanding e-commerce penetration and mobile-first engagement strategies.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of regulatory and market contexts that shape analytics deployments. The impact of data protection frameworks, epitomized by GDPR in Europe, has prompted organizations to architect privacy-centric models, emphasizing anonymization and consent management. In the Middle East, rapid infrastructure investment in the Gulf Cooperation Council countries is fueling demand for scalable analytics solutions that support smart city initiatives and digital government services. African markets are characterized by a blend of nascent digital ecosystems and targeted projects in fintech and agritech, where analytics platforms help bridge infrastructure gaps and facilitate data-driven innovation.

Asia-Pacific continues to exhibit dynamic expansion of web analytics adoption, driven by digital transformation agendas in key markets. In China, a robust domestic software ecosystem supports localized analytics platforms tailored to unique regulatory and language considerations. Southeast Asia and India are witnessing strong uptake of cloud-based analytics services, as SMEs and large enterprises alike migrate to agile models that reduce capital outlays. Cross-border initiatives and regional digital trade agreements further stimulate investment in data interoperability and real-time analytics, underscoring the region’s strategic importance in shaping the future of global digital intelligence.

This comprehensive research report examines key regions that drive the evolution of the Web Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful Overview of Leading Industry Players' Strategic Initiatives Technological Innovations and Competitive Positioning in Web Analytics

Major technology companies continue to shape the web analytics landscape through continuous investment in artificial intelligence and cross-channel integration. Organizations offering comprehensive cloud-based analytics suites are embedding advanced machine learning capabilities to deliver predictive recommendations and automated anomaly detection. These innovations not only streamline data workflows but also position these providers as strategic partners in enterprise digital transformation initiatives. Furthermore, key cloud vendors are enhancing their analytics portfolios through strategic alliances with customer data platform and CRM providers, enabling seamless orchestration of user profiles and conversion data across marketing, sales, and customer service functions.

In parallel, specialized vendors are gaining traction by focusing on niche requirements, particularly around privacy-first data collection and real-time user engagement. Their solutions often include server-side tagging, consent management modules, and lightweight SDKs designed for mobile and connected device environments. Competitive differentiation is also manifesting through open source analytics offerings that emphasize transparency and developer extensibility, appealing to organizations that prioritize in-house customization and community-driven innovation. These alternative platforms are prompting established vendors to accelerate roadmap items related to modular architecture and third-party integration.

Additionally, the services ecosystem is responding to evolving client needs by bundling analytics implementation, managed services, and optimization consulting into outcome-oriented engagements. By offering prescriptive roadmaps and continuous performance tuning, these providers help enterprises reduce time to insight and mitigate operational risks. Collectively, these strategic maneuvers demonstrate a market in which both depth of functionality and agility of delivery are critical factors for competitive positioning, driving heightened collaboration between product developers and implementation partners.

This comprehensive research report delivers an in-depth overview of the principal market players in the Web Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Amplitude Inc.

- AT Internet SAS

- Comscore Inc.

- Crazy Egg Inc.

- Google LLC

- GoSquared Ltd.

- Heap Inc.

- Hotjar Ltd.

- International Business Machines Corporation

- Microsoft Corporation

- Mixpanel Inc.

- Oracle Corporation

- Parse.ly Inc.

- Piwik PRO Sp. z o.o.

- Salesforce.com Inc.

- SAP SE

- Similarweb Ltd.

- SimpleReach Inc.

- Woopra Inc.

- Yandex N.V.

Practical and Actionable Recommendations Empowering Industry Leaders to Optimize Their Web Analytics Frameworks and Drive Business Growth

To capitalize on the momentum of advanced analytics, organizations should prioritize the integration of machine learning models into their reporting workflows. By embedding predictive scoring and anomaly detection within existing dashboards, decision-makers can proactively identify emerging customer needs and operational inefficiencies. Moreover, establishing a unified data layer across web and mobile channels will ensure consistent attribution modeling and streamlined data governance, thereby reducing silos and accelerating time to insight.

Transitioning toward privacy-first architectures is another imperative. Businesses must implement consent management platforms and server-side tagging strategies to maintain compliance with global regulations while preserving data fidelity. This approach not only safeguards consumer trust but also fortifies analytics accuracy in an increasingly cookieless ecosystem. Alongside these technical enhancements, it is essential to align analytics initiatives with core business objectives by defining clear success metrics and securing executive sponsorship to reinforce accountability and drive cross-functional collaboration.

Furthermore, companies should adopt flexible deployment models that mirror their risk tolerance and operational requirements. Leveraging a hybrid cloud strategy can provide the scalability of public cloud environments while preserving sensitive workloads within private data centers. Complementing these infrastructure decisions with targeted skill development programs and partnerships with specialized service providers can bolster in-house expertise and ensure continuous optimization. Finally, instituting a culture of ongoing performance monitoring-supported by real-time alerting and regular health checks-will enable organizations to adapt swiftly to market changes and sustainably enhance their digital performance.

Comprehensive Explanation of Rigorous Research Methodology Employed to Ensure Data Integrity and Robust Insights in Web Analytics Study

This study employed a multi-phase research methodology designed to ensure the accuracy and relevance of its conclusions. Initially, an exhaustive review of public literature, industry whitepapers, regulatory filings, and technical documentation laid the groundwork for identifying key market drivers and emerging trends. This secondary research phase was complemented by analyses of proprietary databases, providing granular insights into platform capabilities, vendor initiatives, and technology adoption patterns across diverse sectors.

Building on this foundation, the primary research phase incorporated structured interviews with senior analytics practitioners, technology executives, and service provider leaders. These interactions yielded qualitative perspectives on implementation challenges, best practices, and regional variations, enriching the quantitative findings with real-world context. Rigorous data triangulation-combining secondary insights with primary feedback-was applied to validate observations and to reconcile discrepancies, thereby reinforcing the study’s credibility.

To further bolster methodological rigor, the research team conducted workshop sessions with cross-functional domain experts to stress-test hypotheses and to refine segmentation frameworks. Data normalization and statistical analysis techniques were employed to adjust for sectoral outliers and to ensure consistency in reporting. Finally, peer review by independent analysts served as a quality control measure, verifying that the research adhered to established standards of integrity and objectivity. Through this layered approach, the study provides a robust, evidence-based perspective on the evolving web analytics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Web Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Web Analytics Market, by Product Type

- Web Analytics Market, by Application

- Web Analytics Market, by Deployment Mode

- Web Analytics Market, by Company Size

- Web Analytics Market, by Region

- Web Analytics Market, by Group

- Web Analytics Market, by Country

- United States Web Analytics Market

- China Web Analytics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concise and Insightful Conclusion Synthesizing Key Findings Highlighting Strategic Implications and Future Directions for Web Analytics

Synthesizing the analysis, it is clear that web analytics has matured into a strategic imperative, with transformative shifts such as AI-driven predictive insights, privacy-centric architectures, and unified cross-platform frameworks redefining the field. The 2025 tariff landscape in the United States has prompted a recalibration of infrastructure strategies, accelerating migration toward cloud-native deployments and influencing service cost structures. Segmentation insights underscore the diverse requirements across product typologies-from networking hardware to advanced software platforms-and application verticals that span financial services, healthcare, manufacturing, and retail. Regional dynamics further reveal differentiated adoption patterns in the Americas, EMEA, and Asia-Pacific, each shaped by regulatory environments and infrastructural readiness. Competitive positioning among leading vendors and specialized providers underscores the importance of technological innovation and strategic alliances in delivering comprehensive analytics solutions.

Looking ahead, organizations must embrace a forward-thinking stance that aligns analytics initiatives with overarching business objectives. This entails ongoing investment in machine learning capabilities, robust data governance, and hybrid deployment models that balance flexibility with security. Cultivating internal analytical talent and fostering collaborative partnerships will be essential to navigate evolving privacy regulations and to harness emerging technologies, such as edge analytics and real-time personalization engines. By adopting a culture of continuous improvement, businesses can sustain their competitive edge, turning web analytics into an engine for innovation, customer-centric growth, and operational excellence.

Compelling Invitation to Connect with Ketan Rohom for Exclusive Access to the Complete Web Analytics Market Research Report and Personalized Insights

For organizations seeking to unlock the full potential of their digital ecosystems, the comprehensive web analytics report offers unparalleled depth and actionable insights. To explore the detailed findings, segmentation analyses, and strategic recommendations tailored to your business needs, please connect with Associate Director, Sales & Marketing, Ketan Rohom. Engaging directly will provide you with the opportunity to discuss customized solutions, clarify implementation strategies, and gain early access to complementary briefings that will help you stay ahead of emerging trends.

By partnering with Ketan Rohom, you will receive dedicated support in aligning the report’s insights with your organizational objectives, ensuring that your analytics investments drive measurable outcomes. Reach out today to secure your copy of the full report and embark on a journey toward data-driven excellence.

- How big is the Web Analytics Market?

- What is the Web Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?