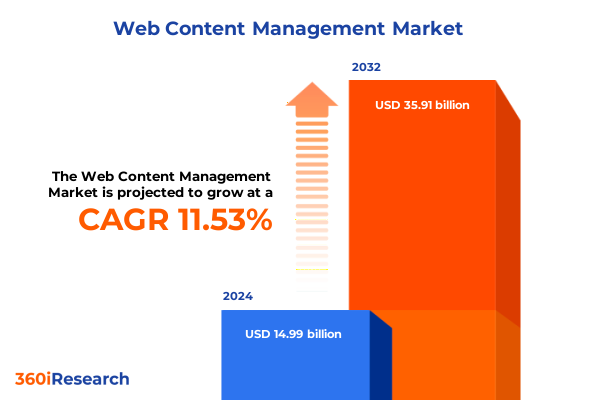

The Web Content Management Market size was estimated at USD 16.64 billion in 2025 and expected to reach USD 18.49 billion in 2026, at a CAGR of 11.61% to reach USD 35.91 billion by 2032.

Navigating the Evolving Digital Content Management Ecosystem in an Era of Strategic Technological Innovation and Market Disruption

The digital landscape is undergoing a profound transformation driven by technological innovation, shifting consumer behaviors, and accelerating competitive pressures. As organizations grapple with the complexities of creating, managing, and distributing content across multiple channels, the need for robust, integrated solutions has never been more critical. Against this backdrop, this executive summary offers a distilled view of the most consequential trends and drivers shaping the digital content management ecosystem. It explores the structural shifts in the market, examines the cumulative impact of recent trade policies, and presents strategic frameworks for segmenting opportunities based on component, content type, deployment model, organizational scale, industry vertical, and end-user profiles.

By synthesizing primary research insights and secondary data analysis, this document empowers decision-makers to navigate uncertainty, prioritize investments, and capitalize on emergent growth vectors. From transformative technological waves to evolving regulatory landscapes, each section provides a clear, actionable narrative. Together, these insights form a holistic blueprint for designing resilient content management strategies that align with organizational goals and market realities.

Exploring the Pivotal Transformations Redefining Digital Content Management Through Cloud, AI Integration, and User-Centric Experience Strategies

Digital content management is no longer defined solely by traditional storage and retrieval; it hasexpanded into a strategic capability that underpins customer experience, brand engagement, and operational efficiency. The advent of cloud-native architectures has liberated organizations from on-premises infrastructure constraints, enabling elastic scalability and rapid feature deployment. Moreover, the integration of artificial intelligence and machine learning into content workflows is automating metadata tagging, personalization, and predictive analytics, thereby elevating content relevance and audience resonance.

In parallel, demands for omnichannel consistency have compelled enterprises to adopt headless content platforms and microservices-based design principles. This shift facilitates seamless content delivery across web, mobile, social, and emerging immersive channels such as augmented and virtual reality. Furthermore, organizations are increasingly embedding real-time collaboration tools to accelerate content creation and streamline cross-functional alignment between marketing, IT, and compliance teams.

Security and compliance have also taken center stage, with data privacy regulations and intellectual property concerns driving the adoption of advanced encryption, digital rights management, and secure access controls. Consequently, modern content management solutions must balance openness with stringent governance capabilities to safeguard brand integrity and trust.

Assessing the Comprehensive Effects of United States Tariffs Implemented in 2025 on the Digital Content Management Infrastructure and Cost Dynamics

The introduction of targeted tariffs by the United States in 2025 has reverberated across the digital content management supply chain, affecting both hardware and software components. Imported processors, storage devices, and networking equipment now carry elevated duties that have translated into higher infrastructure costs for both cloud service providers and on-premises deployments. Organizations are facing the challenge of absorbing or passing along these incremental expenses, which has influenced procurement cycles and vendor negotiations. In many instances, service providers have instituted modest price adjustments to offset tariff-related cost pressures, reshaping total cost of ownership calculations and prioritization of feature investments.

Beyond direct hardware implications, U.S. trade policy has also exerted indirect effects on the broader technology ecosystem. The threat of significantly increased duties on foreign media content triggered market concerns about rising consumer prices and disrupted content production pipelines, as major studios and streaming platforms weighed the financial impact of potential film import tariffs on operational budgets. Concurrently, trade negotiations have become a strategic lever for protecting digital services from discriminatory foreign taxes, underscoring the interconnectedness of tariff policy and regulatory frameworks in global content distribution.

Collectively, these tariff measures have compelled digital content leaders to reevaluate sourcing strategies, accelerate supplier diversification, and explore regional hosting alternatives. The shifting cost dynamics underscore the importance of flexible architectures and proactive vendor collaboration to maintain performance and compliance objectives amidst evolving trade considerations.

Revealing Market Segmentation Perspectives That Illuminate Component, Deployment, Content Type, Organization Size, Industry, and End-User Dynamics

A nuanced understanding of the digital content management market requires a multifaceted segmentation approach that aligns offerings with specific functional, technological, and organizational criteria. By examining the market through the lens of component typologies, it becomes clear that services and solutions occupy distinct yet interconnected spheres. Services encompass consulting engagements, ongoing managed services, professional implementation support, and dedicated training programs, while solutions range from content analytics engines to web creation and editing platforms.

Diving deeper into content typology, the differentiation between audio-visual assets, text-centric deliverables, and visually driven collaterals guides product roadmaps and user adoption patterns. Text-based materials such as blog articles and whitepapers coalesce with visually rich galleries and infographics to meet diverse communication objectives. Parallel to this, deployment considerations dictate whether cloud-native modalities-spanning public, private, and hybrid cloud models-or traditional on-premises installations best align with an organization’s regulatory and latency requirements.

Further stratification emerges when considering organizational scale, distinguishing the needs and budgets of large enterprises from those of small and medium enterprises. Industry-specific regulations and content workflows then refine these groupings, from heavily regulated sectors like healthcare and finance to creative domains such as media and entertainment. Finally, end-user profiles-including content creators, IT specialists, and marketing practitioners-shape feature prioritization, with bloggers, developers, and SEO experts demanding tailored capabilities that enhance productivity and content performance.

This comprehensive research report categorizes the Web Content Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Content Type

- Deployment Type

- Organization Size

- Industry

- End-User

Delivering Strategic Regional Insights Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets to Drive Localized Growth

Geographic markets for digital content management exhibit distinct priorities and growth trajectories, shaped by regional economic conditions, regulatory landscapes, and technology adoption patterns. In the Americas, businesses continue to lead in cloud migration and advanced analytics integration, driven by mature digital infrastructures and high competitive intensity. Demand for headless architectures and AI-powered personalization is particularly strong in North America, where early adopters leverage predictive insights to optimize customer journeys and increase share of wallet.

Across Europe, the Middle East, and Africa, regulatory compliance and data sovereignty concerns are paramount. European organizations prioritize on-premises or private cloud deployments to align with stringent data protection mandates, while Gulf states invest in content platforms that support large-scale government initiatives and public sector transparency. Africa’s emerging markets are witnessing rapid mobile-centric content growth, prompting regional cloud providers to expand low-latency infrastructure and tailored security frameworks.

In Asia-Pacific, digital content consumption is marked by rapid mobile adoption, localized social platforms, and an appetite for immersive experiences. Public cloud hyperscalers are building regionally distributed data centers to meet requirements for low-latency streaming and real-time collaboration. Meanwhile, government-led digital transformation programs in countries such as India and Australia are accelerating content management modernization to support e-governance, education, and healthcare initiatives.

This comprehensive research report examines key regions that drive the evolution of the Web Content Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Influential Industry Leaders Shaping the Future of Digital Content Management Through Innovation, Partnerships, and Strategic Acquisitions

Leading technology vendors are investing heavily in product innovation, strategic partnerships, and targeted acquisitions to expand their footprint in the digital content management arena. Enterprises such as Adobe continue to evolve their flagship experience management platforms by infusing generative AI capabilities that automate asset creation and semantic search. Similarly, Microsoft’s investment in unified collaboration suites integrates content repositories with productivity workspaces, enabling seamless content lifecycles from ideation through publication.

Traditional enterprise software powerhouses like IBM and Oracle are leveraging their cloud infrastructure services and database expertise to deliver end-to-end content solutions that address complex regulatory requirements. Meanwhile, specialized providers such as OpenText and Sitecore differentiate themselves through vertical-specific capabilities and modular architectures that support rapid deployment. Partnerships between these vendors and cloud hyperscalers, along with alliances with system integrators and digital agencies, are amplifying go-to-market reach and accelerating customer onboarding.

Emerging challengers are also making their mark by targeting underserved segments. Innovative startups are focusing on niche use cases-such as localized multimedia streaming or AI-driven content compliance-to capture pockets of market demand. The cumulative effect of these competitive dynamics is an increasingly dense ecosystem that rewards agility, deep domain expertise, and relentless customer focus.

This comprehensive research report delivers an in-depth overview of the principal market players in the Web Content Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acquia Inc.

- Adobe Inc.

- Bloomreach Inc.

- Butter CMS

- Contentful Inc.

- Contentstack LLC

- Core dna

- Crownpeak Technology Inc.

- HubSpot Inc.

- Kentico Software

- Magnolia International Ltd.

- Microsoft Corporation

- Open Text Corporation

- Oracle Corporation

- Progress Software Corporation

- Salesforce Inc.

- Shopify Inc.

- Sitecore

- Squarespace Inc.

- Storyblok GmbH

- Strapi Solutions Inc.

- WordPress Foundation

Empowering Industry Leaders with Actionable Recommendations to Optimize Content Management Strategies and Strengthen Competitive Edge in a Dynamic Market

To thrive in this dynamic environment, organizations must embrace several actionable strategies that align investments with evolving market demands. First, they should prioritize modular, API-first platforms that facilitate incremental feature adoption and minimize vendor lock-in. By selecting solutions built on microservices architectures, enterprises can accelerate time-to-value while maintaining the flexibility to integrate best-of-breed components as needs evolve.

Moreover, embedding artificial intelligence and machine learning into core workflows can deliver immediate productivity gains. Automating repetitive tasks such as metadata tagging, rights management, and content quality checks frees creative teams to focus on high-value activities and accelerates publication cycles. In addition, organizations should establish governance frameworks that balance agility with risk mitigation, ensuring compliance with data protection regulations and brand guidelines without impeding innovation.

Building strategic partnerships with technology providers and consultancies can also amplify internal capabilities. Joint innovation labs and co-development initiatives enable organizations to pilot emerging features and secure early access to roadmap enhancements. Finally, continuous measurement of content performance through integrated analytics dashboards will inform iterative optimization, empowering decision-makers to reallocate resources, refine messaging, and enhance user engagement through data-driven insights.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Insight Accuracy and Depth

This research leverages a rigorous, multi-stage methodology designed to ensure both breadth and depth of insight. The process begins with comprehensive secondary research, aggregating data from industry publications, regulatory filings, and public company disclosures. This foundational phase establishes a contextual baseline of market structure, technology adoption patterns, and regulatory influences.

Building on this groundwork, primary research efforts include structured interviews and surveys with over one hundred senior executives, practitioners, and subject matter experts across content creation, IT operations, and marketing functions. These engagements yield qualitative insights into adoption drivers, pain points, and strategic priorities. Responses are systematically coded and triangulated with secondary data to validate thematic consistency and uncover emergent trends.

Quantitative data modeling is then employed to map segmentation categories-encompassing component typologies, content types, deployment modes, organizational scales, industry verticals, and end-user profiles-against observed demand patterns. Throughout the research lifecycle, an independent expert review panel scrutinizes methodologies, challenge assumptions, and endorses final findings. This layered validation protocol ensures analytical rigor, minimizes bias, and delivers a robust empirical foundation for the report’s strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Web Content Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Web Content Management Market, by Component

- Web Content Management Market, by Content Type

- Web Content Management Market, by Deployment Type

- Web Content Management Market, by Organization Size

- Web Content Management Market, by Industry

- Web Content Management Market, by End-User

- Web Content Management Market, by Region

- Web Content Management Market, by Group

- Web Content Management Market, by Country

- United States Web Content Management Market

- China Web Content Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings and Strategic Implications of Digital Content Management Trends to Guide Decision-Making and Future Growth Initiatives

In synthesizing the key findings, several overarching themes emerge. The relentless progression of cloud adoption and AI integration continues to redefine expectations for agility, scalability, and personalized engagement. Tariff-driven cost pressures have underscored the criticality of supply chain diversification and flexible deployment architectures. At the same time, regional market nuances-from data sovereignty in EMEA to mobile-first dynamics in Asia-Pacific-highlight the need for localized go-to-market approaches.

Segmenting the market across multiple dimensions-component, content type, deployment, organization size, industry, and end-user profiles-provides a nuanced framework for tailoring offerings and prioritizing investments. Leading companies differentiate through strategic partnerships, targeted acquisitions, and a relentless focus on customer outcomes. To maintain competitive momentum, organizations must adopt modular platforms, embed intelligent automation, and establish governance mechanisms that balance innovation with compliance.

Together, these insights form an integrated blueprint for navigating the evolving digital content management landscape. By internalizing these findings and aligning organizational capabilities accordingly, decision-makers can accelerate value delivery, deepen stakeholder engagement, and secure enduring growth in an increasingly complex market.

Partner with Ketan Rohom to Unlock the Full Value of Market Intelligence and Drive Strategic Growth with a Custom Research Report Purchase Discussion

For a deeper understanding of the market dynamics and to gain tailored insights that align with your strategic objectives, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings a wealth of knowledge in content management market research and can guide you through the report’s key findings, customization options, and enterprise licensing models. By partnering with Ketan, you will secure access to in-depth analysis, proprietary data sets, and actionable recommendations that empower you to stay ahead of competitive challenges.

Whether you represent a global enterprise seeking to optimize digital asset workflows or a rapidly growing organization planning your next content management investment, Ketan Rohom will ensure your specific needs are addressed. Reach out today to discuss how this market research report can be tailored to your requirements and how you can leverage its insights to drive innovation, reduce operational complexity, and achieve sustainable growth.

- How big is the Web Content Management Market?

- What is the Web Content Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?