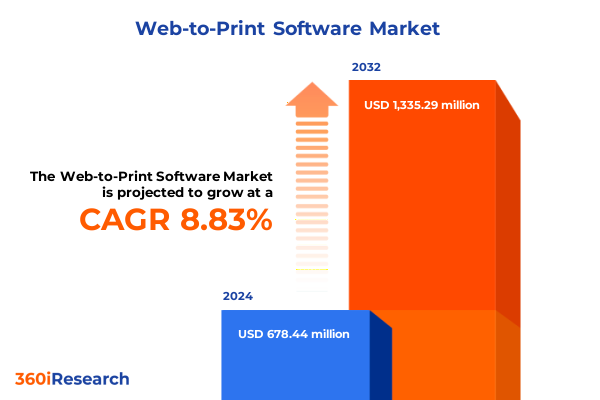

The Web-to-Print Software Market size was estimated at USD 737.34 million in 2025 and expected to reach USD 799.18 million in 2026, at a CAGR of 8.85% to reach USD 1,335.29 million by 2032.

Harnessing Web-to-Print Solutions to Revolutionize Customized Print Services and Accelerate Digital Transformation Across Industry Verticals

Organizations across diverse industries are accelerating their digital transformation journeys by incorporating web-to-print platforms that streamline the entire print procurement and delivery lifecycle. Businesses that once relied on manual processes for customizing printed collateral have quickly adapted to solutions enabling end-to-end online design, proofing, and order management. This evolution has been driven by mounting demands for speed, cost-efficiency, and personalization, as marketing and procurement teams seek greater control over branding consistency and operational workflows. By replacing legacy desktop publishing with browser-based applications, enterprises have harnessed centralized asset management and real-time approval pipelines, reducing time to market and minimizing waste.

As enterprises navigate an increasingly complex omnichannel environment, the integration of e-commerce capabilities within web-to-print platforms has become not just an enabler of convenience but a strategic differentiator. Organizations that can offer intuitive user experiences for internal stakeholders and external partners are capturing higher levels of engagement and reducing the friction associated with traditional print procurement. Looking ahead, these systems are set to become the backbone of print-on-demand and mass customization strategies. This introductory overview lays the foundation for a deep dive into the transformative forces, segmentation drivers, regional variations, and strategic imperatives shaping the web-to-print software market today and in the years to come.

Navigating the Landscape of Rapid Technological Evolution Redefining Web-to-Print Platforms Through AI, Cloud, and User-Centric Innovations

The web-to-print market is at the cusp of a new era defined by rapid technological advancements that extend beyond simple online ordering interfaces. Artificial intelligence and machine learning modules are beginning to automate design adjustments, optimize print layouts in real time, and deliver predictive maintenance alerts for digital presses. Concurrently, cloud-native architectures are enabling frictionless scalability and global deployment, allowing organizations to accommodate sudden spikes in print volume or expand services into new geographies without the cost burdens associated with on-premises infrastructure. These shifts are redefining the value proposition of web-to-print software providers, as customers now expect a seamless convergence of digital asset management, analytics, and automated workflows.

Furthermore, user-centric innovations in mobile accessibility and self-service portals are empowering non-technical users to harness powerful design tools previously available only to professional graphic artists. Intuitive WYSIWYG editors and templating engines are reducing reliance on specialized training, driving broader adoption across small teams and enterprise divisions alike. Taken together, these transformative shifts are not only reshuffling competitive dynamics but also unlocking new use cases such as real-time variable data printing for personalized marketing campaigns, on-demand packaging solutions for e-commerce sellers, and hybrid printed-digital experiences that blend physical collateral with interactive web elements.

Assessing the Ripple Effects of 2025 United States Tariffs on the Web-to-Print Ecosystem and Supply Chain Dynamics for Equipment and Consumables

In 2025, a new framework of import tariffs imposed by the United States on a range of printing hardware and related consumables triggered a reevaluation of supply chain strategies for web-to-print software providers and their customers. Increased duties on presses and digital finishing equipment inflating procurement costs prompted many organizations to delay capital investments or renegotiate vendor contracts. Mid-tier and smaller print service providers, in particular, faced elevated entry costs for next-generation digital production assets, slowing the replacement cycle for legacy machinery and driving demand instead for software-based optimization that extends equipment lifespan.

Simultaneously, higher import levies on specialized inks and substrates disrupted established logistical corridors, compelling manufacturers to seek alternate domestic or regional sources. These supply chain complexities accelerated the adoption of cloud-based print management solutions that reduce reliance on hardware upgrades by enhancing yield efficiency and waste reduction. Additionally, distributors and resellers restructured service offerings to bundle software-driven maintenance and support with existing equipment portfolios, offsetting the impact of the tariffs. As this phased tariff implementation continues through the latter half of 2025, the cumulative effect on end users has underscored the strategic importance of flexible software capabilities to weather cost headwinds and maintain competitive positioning.

Uncovering Strategic Segmentation Insights That Illuminate Component, Application, Deployment, Organizational, and Vertical Drivers of Web-to-Print Adoption

A nuanced understanding of the web-to-print market emerges when examining it through multiple strategic lenses, each revealing distinct opportunity areas. Evaluating component segmentation highlights a dual dynamic: services such as consulting, implementation, and support play an instrumental role in guiding enterprises through complex deployments, while software platforms and integration tools serve as the operational core that orchestrates design, proofing, and fulfillment. Transitioning to application segmentation uncovers key adoption drivers across custom design printing-underpinned by sophisticated graphic design systems and intuitive WYSIWYG editors-template-based printing that balances ease of use with brand control via basic and premium template libraries, and variable data printing that leverages both image personalization and text personalization to drive targeted customer engagement.

Deployment insights reveal a bifurcated preference for cloud and on-premises models. Many large organizations favor private cloud or enterprise data center implementations for heightened security and compliance, whereas agile teams and small to medium enterprises increasingly gravitate toward public cloud offerings. Likewise, considering organizational size underscores that large enterprises demand robust multi-user access controls and global asset management, while small and medium enterprises prioritize cost-effective, turnkey solutions. Finally, examining industry vertical segmentation uncovers distinct usage patterns among advertising agencies seeking high-volume campaign automation, publishing houses embracing dynamic book and magazine production workflows, and retail companies integrating on-demand signage and packaging solutions into omnichannel marketing strategies.

This comprehensive research report categorizes the Web-to-Print Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment Type

- Organization Size

- Industry Vertical

Exploring Regional Nuances Driving Web-to-Print Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional markets for web-to-print software exhibit divergent trajectories shaped by localized digital infrastructure maturity, regulatory environments, and industry concentrations. In the Americas, North American enterprises lead adoption with advanced cloud capabilities and integration into e-commerce ecosystems, whereas Latin American markets are experiencing a surge in interest from growing retail and publishing sectors seeking accessible entry-level solutions. This regional dynamic is further driven by the presence of large-scale print service bureaus that are investing heavily in automation to meet rising demand for promotional materials and packaging.

Across Europe, Middle East, and Africa, stringent data privacy regulations and varied levels of cloud readiness are influencing deployment preferences. Western European companies often opt for private cloud or on-premises deployments to comply with data sovereignty laws, while emerging markets in Eastern Europe and parts of the Middle East show an increasing appetite for public cloud models due to lower upfront capital requirements. Meanwhile, Africa’s nascent digital print sector is gradually embracing software-based workflows, spurred by partnerships between global vendors and local distributors.

In the Asia-Pacific region, robust manufacturing hubs in China, Japan, and South Korea are driving demand for integrated hardware-software packages that optimize throughput and reduce downtime. Concurrently, markets like India and Southeast Asia demonstrate strong growth in the retail and packaging sectors, fueling uptake of variable data and template-driven printing solutions to service booming e-commerce segments.

This comprehensive research report examines key regions that drive the evolution of the Web-to-Print Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Web-to-Print Vendors and Their Strategic Imperatives Shaping Product Innovation, Market Penetration, and Competitive Differentiation

A review of leading web-to-print solution providers reveals diverse strategic priorities shaping competitive differentiation. Established legacy vendors are leveraging their deep printing hardware expertise to bundle advanced integration tools and comprehensive support services, positioning themselves as end-to-end partners for large enterprises. In parallel, nimble pure-play software specialists are capitalizing on agile development cycles to introduce innovative cloud-native functionalities, such as AI-driven layout optimization and seamless API-driven connectivity with third-party e-commerce and content management platforms.

Strategic partnerships continue to serve as a catalyst for market penetration, with several vendors forging alliances with regional print service providers to co-deliver white-label platforms tailored to local compliance and language requirements. Mergers and acquisitions have also intensified, as larger players acquire niche software houses to fill gaps in variable data capabilities and data analytics modules. Additionally, some market entrants are investing in community-driven ecosystems, enabling third-party developers to create plug-ins and extensions that broaden platform capabilities, thus fostering higher customer retention and recurring revenue streams. Together, these approaches underscore a market in which innovation velocity, ecosystem depth, and service proficiency are the primary levers of competitive success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Web-to-Print Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aleyant, Inc.

- CHILI publish NV

- Cimpress N.V.

- Design'N'Buy

- Electronics For Imaging, Inc.

- Gelato AS

- Infigo Software Ltd.

- InkSoft, LLC

- iScripts

- OnPrintShop

- PressWise, Inc.

- Printavo, LLC

- Printfection, Inc.

- Printful, Inc.

- Printify Ltd.

- PrintPLANR

- Tharstern Ltd.

- XMPie, Inc.

- Zakeke S.r.l.

Charting Actionable Strategic Paths for Industry Leaders to Capitalize on Emerging Opportunities and Optimize Web-to-Print Offerings in a Dynamic Market

To capitalize on the evolving web-to-print landscape, industry leaders must adopt multifaceted strategies that align product development with market needs and operational resilience. First, investing in AI and machine learning capabilities to automate design and production workflows will drive differentiation while addressing the ongoing challenge of skilled labor shortages. Additionally, prioritizing modular, API-first architectures enables seamless integrations with e-commerce, digital asset management, and enterprise resource planning systems, delivering cohesive experiences for both internal users and external stakeholders.

Furthermore, expanding cloud portfolio offerings with flexible deployment models-spanning private and public cloud options-will cater to stringent data governance requirements while providing scalable infrastructure for seasonal demand fluctuations. Establishing regional partnerships with service bureaus and distributors can also accelerate market entry, particularly in emerging territories where local expertise is paramount. Finally, embedding sustainability features, such as ink usage optimization and automated yield monitoring, will resonate with corporate environmental goals, enhance brand reputation, and reduce total cost of ownership for end users.

Detailing a Rigorous Multi-Method Research Framework Combining Primary Interviews, Secondary Sources, and Data Triangulation for Trustworthy Insights

This report is grounded in a rigorous research framework that combines primary interviews, secondary data analysis, and systematic data triangulation. Primary research comprised in-depth discussions with C-level executives, IT managers, and print production leads across enterprise, mid-market, and small business segments, providing nuanced perspectives on deployment drivers, pain points, and future requirements. These interviews were complemented by insights gathered from leading software and hardware vendors, industry associations, and independent analysts to ensure a balanced view of competitive dynamics and technology evolution.

Secondary research encompassed an exhaustive review of industry publications, academic journals, and publicly available financial documents, enabling the identification of emerging trends and benchmarking of vendor performance. Data validation was achieved through cross-referencing multiple sources, refining estimates based on consistency checks, and conducting follow-up inquiries to resolve discrepancies. This multifaceted methodology ensures that the findings and recommendations presented herein rest on robust, reliable evidence, offering stakeholders a high level of confidence in strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Web-to-Print Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Web-to-Print Software Market, by Component

- Web-to-Print Software Market, by Application

- Web-to-Print Software Market, by Deployment Type

- Web-to-Print Software Market, by Organization Size

- Web-to-Print Software Market, by Industry Vertical

- Web-to-Print Software Market, by Region

- Web-to-Print Software Market, by Group

- Web-to-Print Software Market, by Country

- United States Web-to-Print Software Market

- China Web-to-Print Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Illuminate the Future Trajectory of Web-to-Print Software Amid Transformative Market and Technological Influences

Collectively, the insights presented throughout this report paint a comprehensive picture of a web-to-print market in the midst of profound transformation. Technological advancements such as AI-driven automation, cloud-native architectures, and user-centric design tools are enabling unprecedented levels of efficiency and personalization. At the same time, external factors-including trade policy shifts and regional infrastructure disparities-are shaping supply chain resilience and deployment strategies. By dissecting segmentation drivers, regional nuances, and vendor strategies, this analysis illuminates the pathways for sustainable growth and competitive advantage.

As organizations plan for the next phase of digital transformation, embracing flexible deployment models, investing in service-oriented offerings, and fostering strategic partnerships will be essential. The convergence of technological innovation and evolving customer expectations underscores the critical role of web-to-print platforms as enablers of both operational optimization and marketing effectiveness. With the right combination of strategic foresight and executional rigor, stakeholders across the value chain can harness these dynamics to unlock new revenue streams and drive long-term profitability.

Engage with Ketan Rohom to Secure Your Web-to-Print Market Analysis Report and Empower Strategic Decisions with Expert Guidance

To explore the full depth of opportunity that this comprehensive web-to-print market research report offers and to bring these actionable insights directly to your organization’s strategic planning, reach out to Ketan Rohom. As the Associate Director of Sales & Marketing, he can guide you through tailored packages, answer any detailed questions regarding market dynamics, and facilitate seamless access to the proprietary analysis you need. Connect today to harness customized recommendations, unlock exclusive data, and position your business for lasting success in the rapidly evolving web-to-print landscape

- How big is the Web-to-Print Software Market?

- What is the Web-to-Print Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?