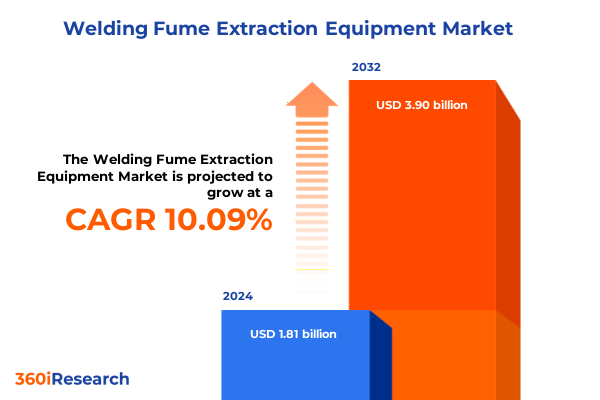

The Welding Fume Extraction Equipment Market size was estimated at USD 1.97 billion in 2025 and expected to reach USD 2.16 billion in 2026, at a CAGR of 10.22% to reach USD 3.90 billion by 2032.

Exploring the Evolving Welding Fume Extraction Landscape and Its Critical Role in Ensuring Workplace Safety and Regulatory Compliance

The welding fume extraction equipment market has emerged as a critical driver of workplace safety, operational efficiency, and regulatory compliance across industrial sectors. As welding processes continue to evolve in complexity, the imperative to control airborne contaminants has elevated extraction solutions from optional add-ons to indispensable components of manufacturing ecosystems. Transitioning from rudimentary filtration devices to advanced integrated systems, organizations now seek extraction equipment that not only captures particulate matter but also integrates seamlessly with broader production workflows, ensuring uninterrupted performance and adherence to stringent health standards.

Amid growing awareness of long-term health risks associated with inhalation of welding byproducts, government agencies and industry bodies have intensified enforcement of occupational exposure limits. This heightened regulatory scrutiny has accelerated investments in extraction technologies capable of reliably removing fumes at source and within enclosed work environments. Simultaneously, sustainability objectives and cost-efficiency pressures have catalyzed the development of energy-optimized systems, driving innovation in filter media, airflow management, and real-time monitoring. Consequently, stakeholders face the dual challenge of selecting equipment that satisfies compliance mandates while delivering cost-effective operation over the equipment lifecycle.

In this context, understanding the nuanced interplay of technological advancements, regulatory landscapes, and end-user requirements is essential for stakeholders aiming to navigate the next phase of market growth. The following sections delve into transformative market shifts, tariff implications, segmentation analyses, and regional dynamics to present a holistic executive-level perspective on the welding fume extraction equipment landscape.

Uncovering the Pivotal Technological Breakthroughs and Market Dynamics That Are Shifting Welding Fume Extraction Toward Greater Efficiency and Sustainability

Recent years have witnessed a paradigm shift in welding fume extraction driven by breakthroughs in filtration technology and digital connectivity. High-efficiency particulate air (HEPA) systems and electrostatic precipitators have evolved to deliver tighter capture rates while minimizing energy consumption. Meanwhile, modular extraction units featuring plug-and-play architectures have gained traction, enabling rapid deployment in dynamic production environments. These technological advances have not only enhanced operational flexibility but also reduced maintenance requirements, thereby lowering the total cost of ownership and improving return on investment.

Parallel to hardware enhancements, the integration of Industry 4.0 principles has redefined how extraction systems operate and communicate. Sensors embedded within filters and ducts now provide continuous feedback on particulate load, motor performance, and airflow resistance. When coupled with cloud-based analytics platforms, such real-time data streams empower operators to predict maintenance intervals, mitigate unplanned downtime, and optimize system parameters through remote diagnostics. This convergence of smart extraction equipment with predictive analytics fosters a proactive maintenance culture and aligns with broader digital transformation agendas within manufacturing.

Moreover, the growing emphasis on sustainability has prompted manufacturers to develop eco-friendly extraction solutions that minimize waste and energy usage. Innovations such as washable cartridge filters, low-power axial fans, and heat-recovery modules exemplify the sector’s shift toward circular economy principles. Consequently, organizations can demonstrate environmental stewardship while achieving operational excellence, reinforcing the competitive imperative to adopt advanced extraction technologies that align with both productivity and ESG objectives.

Analyzing the 2025 United States Tariff Adjustments and Their Compound Effects on Supply Chains Costs and Equipment Adoption Trends

In 2025, the United States introduced revised tariff schedules on imported metalworking equipment, including components integral to welding fume extraction systems. These tariff adjustments, ranging from moderate increases on filter media to higher duties on complete extraction assemblies, have altered the cost calculus for manufacturers and end users alike. Organizations reliant on global supply chains have been compelled to reassess procurement strategies, weighing the impact of elevated import duties against local sourcing and in-house fabrication options.

The compounded effect of these tariff changes has been a partial reshoring of component production to domestic facilities, supported by government incentives aimed at strengthening critical manufacturing capabilities. However, this trend has encountered obstacles, notably the high capital investment required to replicate specialized filter production capabilities at scale. Consequently, while some industry leaders have achieved strategic insulation from tariff volatility through diversified supply networks, smaller operators face increased pressure on profit margins, prompting consolidation within the supplier base and driving demand for scalable, cost-effective extraction solutions.

Furthermore, end users have responded by accelerating investments in high-durability, low-maintenance equipment that offsets the higher upfront costs associated with tariff-influenced pricing. Lifecycle costing models have become more prominent in purchase evaluations, with organizations prioritizing extraction systems that deliver consistent performance over extended periods, thus mitigating the financial impact of import duties. As regulatory agencies continue to refine tariff policies in response to broader trade dynamics, stakeholders must remain vigilant in their sourcing decisions and agile in adapting to evolving economic incentives.

Delving into How Diverse Type User Technology Application Portability and Welding Process Segmentation Reveal Key Adoption Drivers

A granular segmentation analysis of the welding fume extraction equipment market reveals distinct adoption patterns and technology preferences across various criteria. When considering the type of equipment, Central Extraction Systems dominate large-scale manufacturing facilities due to their robust capacity, whereas Downdraft Tables find favor in job shops requiring localized fume capture. Extraction Booths serve as turnkey solutions for high-throughput environments, while Mobile Extraction Units deliver flexibility for maintenance operations and field servicing. Meanwhile, Source Extraction Arms offer precise, on-demand capture directly at the weld site, reflecting growing demand for operator-centric ergonomics and safety.

Evaluating end-user segments underscores divergent priorities among sectors. Aerospace manufacturers lead in adopting ultra-precise filtration technologies, driven by stringent quality requirements, whereas the automotive industry emphasizes system throughput to support high-volume assembly lines. Construction and shipbuilding entities prioritize portable extraction setups and ruggedized components to accommodate variable job site conditions, and general manufacturing segments often opt for hybrid configurations that balance performance with capital constraints.

Technology-based segmentation highlights the ascendancy of cartridge filters for their ease of maintenance and compact footprint, while Electrostatic Precipitators are preferred in environments producing fine particulates. HEPA Filters are mandated in industries with the most stringent air quality standards, and Wet Scrubbers remain relevant in applications generating acid gases or oily smoke. Meanwhile, application distinctions between Manual Welding and Robotic Welding reveal that automated processes tend to integrate fixed extraction booths, whereas manual operations rely heavily on source capture systems.

Insights into portability segmentation indicate that Portable units excel in scenarios demanding rapid redeployment, whereas Stationary installations underpin centralized ventilation strategies in dedicated production cells. Finally, analyzing welding process segmentation shows that Laser and Tig welding, producing lower fume volumes, often pair with compact extraction modules, while Mig/Mag and Plasma welding-characterized by higher particulate concentrations-require heavy-duty filtration and airflow management solutions.

This comprehensive research report categorizes the Welding Fume Extraction Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- End User

- Technology

- Application

- Portability

- Welding Process

Examining Regional Variations Across the Americas Europe Middle East Africa and Asia Pacific to Understand Differential Market Motivators

Regional market dynamics for welding fume extraction equipment exhibit pronounced variation driven by differing regulatory frameworks, industrial maturation levels, and capital investment capacities. In the Americas, robust enforcement of occupational health regulations and incentives for domestic manufacturing have catalyzed growth in advanced extraction systems. North American automotive and aerospace hubs, in particular, prioritize high-efficiency, digitalized solutions, whereas Latin American markets show gradual adoption curves, often favoring entry-level units with simplified maintenance requirements.

Europe, the Middle East, and Africa present a mosaic of adoption profiles. Western European nations lead with stringent air quality standards and a strong emphasis on sustainability, driving uptake of low-energy, recyclable filter technologies. Gulf Cooperation Council countries leverage substantial construction and infrastructure investments, stimulating demand for mobile extraction units that accommodate project-based work. In contrast, parts of Africa are emerging markets, where cost sensitivity dictates reliance on modular, scalable systems that can be upgraded incrementally as budgets permit.

Across Asia-Pacific, heterogeneity remains a defining feature. Mature economies such as Japan and South Korea adopt sophisticated electrostatic and HEPA systems integrated with factory automation networks, reflecting high labor and compliance costs. China’s expansive manufacturing sector utilizes a blend of centralized and localized extraction solutions, while Southeast Asian nations show increasing interest in portable and hybrid configurations to support small-to-medium enterprises. Additionally, Australia’s mining and shipbuilding operations favor ruggedized booths and high-capacity central extraction units, underscoring the region’s diverse end-use landscape.

This comprehensive research report examines key regions that drive the evolution of the Welding Fume Extraction Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategies Competitive Positioning and Innovation Portfolios of Leading Manufacturers Shaping the Welding Fume Extraction Equipment Market

Key players in the welding fume extraction equipment industry differentiate themselves through continuous innovation, strategic partnerships, and comprehensive service offerings. Several established manufacturers leverage decades of filtration expertise to introduce next-generation cartridge and HEPA filter media, delivering higher capture efficiencies and extended service intervals. These companies also invest heavily in research collaborations with academic institutions to develop novel electrostatic precipitator designs and smart sensor integration, strengthening their competitive positioning in premium market segments.

In parallel, agile specialized firms focus on niche applications and rapid customization capabilities. By maintaining close relationships with end users in sectors such as aerospace and shipbuilding, these entities tailor extraction booths and source arms to unique workflow patterns and spatial constraints. Their ability to expedite prototype deployments and offer modular upgrade paths enables them to capture market share among customers requiring swift adaptations to evolving production demands.

Moreover, several global conglomerates are broadening their portfolios through mergers and acquisitions, acquiring complementary filtration and ventilation technology companies to create vertically integrated solutions. This consolidation not only expands their geographic reach but also enhances their end-to-end service governance-from initial system design and installation to predictive maintenance and consumables supply. Through these strategic moves, leading companies reinforce their resilience against tariff fluctuations and supply chain disruptions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Welding Fume Extraction Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aercology Inc.

- Airflow Systems, Inc.

- BOFA International Ltd.

- Camfil AB

- Donaldson Company, Inc.

- ESAB Corporation

- Eurovac GmbH

- Filcar S.p.A.

- Fumex GmbH & Co. KG

- Kemper GmbH

- Lincoln Electric Holdings, Inc.

- Nederman Holding AB

- Parker-Hannifin Corporation

- Plymovent Group BV

- TBI AirClean Systems, Inc.

Delivering Targeted Actionable Recommendations for Industry Leaders to Leverage Emerging Technologies and Navigate Market Complexities Effectively

Industry leaders seeking to maintain market relevance should prioritize the integration of real-time performance monitoring capabilities into their extraction solutions. By embedding IoT sensors within filtration and airflow subsystems, providers can offer predictive maintenance services that reduce unplanned downtime and lower total cost of ownership over the system’s operational life. Aligning these offerings with managed service models will also generate recurring revenue streams, fostering closer customer relationships and enhanced lifetime value.

Furthermore, expanding modular product families capable of addressing both entry-level requirements and premium segment demands will enable companies to capture a broader share of the market. Designing scalable systems that permit seamless upgrades-from basic portable extractors to centralized, digitally enabled installations-will resonate across diverse end-use sectors and budget profiles. This approach mitigates barriers to initial adoption and paves the way for future technology migration.

Collaborating with filter media specialists to develop eco-friendly, regenerable filter solutions represents another critical opportunity. By reducing consumables waste and energy consumption, providers can differentiate their portfolios on environmental performance metrics. Coupled with transparent lifecycle assessments and third-party sustainability certifications, these advancements will strengthen brand reputation among customers prioritizing ESG objectives.

Finally, strengthening regional service networks through strategic partnerships and local manufacturing alliances will help buffer against geopolitical uncertainties and tariff impacts. Establishing assembly or filter repackaging facilities closer to end-use markets reduces lead times, lowers logistics costs, and enhances responsiveness to rapid demand shifts. This regionalized supply chain architecture will be key to sustaining competitive advantage in an increasingly complex global landscape.

Providing a Robust Research Methodology Outline Illustrating Data Collection Analysis Triangulation and Validation Techniques Underpinning the Report

This report’s findings are rooted in a rigorous research methodology that integrates both primary and secondary data sources to ensure comprehensive coverage and analytical robustness. Primary research involved in-depth interviews with key stakeholders, including equipment manufacturers, filtration experts, and plant managers across major industrial sectors. These qualitative insights were supplemented by quantitative survey data collected from end users in aerospace, automotive, construction, manufacturing, and shipbuilding industries, providing direct perspectives on purchasing criteria, performance expectations, and future investment plans.

Secondary research encompassed a thorough review of industry publications, regulatory documents, academic journals, and technology whitepapers to map historical trends and benchmark best practices. Trade association reports and government policy papers offered critical context regarding occupational health regulations and tariff frameworks, while technical literature illuminated the evolution of filter technologies and system architectures.

To triangulate findings and validate conclusions, a multi-step process was employed. First, data points from primary interviews were cross-referenced with survey responses to assess consistency. Next, secondary market data were audited against proprietary databases and vendor disclosures to verify accuracy and resolve discrepancies. Finally, an expert advisory panel comprising filtration technologists and safety engineers reviewed draft analyses, ensuring that interpretations and recommendations align with practical industry realities.

The research framework combined top-down and bottom-up analytical approaches. A top-down view evaluated macroeconomic factors, trade policies, and overarching regulatory drivers, while a bottom-up assessment aggregated granular data on equipment shipments, installation volumes, and filter consumables consumption. This dual lens enabled a holistic understanding of market dynamics, empowering stakeholders to make informed decisions backed by meticulously validated evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Welding Fume Extraction Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Welding Fume Extraction Equipment Market, by Type

- Welding Fume Extraction Equipment Market, by End User

- Welding Fume Extraction Equipment Market, by Technology

- Welding Fume Extraction Equipment Market, by Application

- Welding Fume Extraction Equipment Market, by Portability

- Welding Fume Extraction Equipment Market, by Welding Process

- Welding Fume Extraction Equipment Market, by Region

- Welding Fume Extraction Equipment Market, by Group

- Welding Fume Extraction Equipment Market, by Country

- United States Welding Fume Extraction Equipment Market

- China Welding Fume Extraction Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing the Strategic Imperatives Insights and Concluding Perspectives That Define the Future Trajectory of Welding Fume Extraction Solutions

The welding fume extraction equipment market is poised for sustained transformation as technological innovation converges with evolving regulatory landscapes and shifting trade policies. Strategic imperatives for stakeholders include harnessing digitalization to deliver predictive maintenance services, expanding modular product lines to capture a spectrum of end-user segments, and prioritizing sustainable filter solutions to reinforce environmental commitments. Through a nuanced understanding of tariff impacts, regional adoption patterns, and segmentation-driven preferences, market participants can unlock new growth avenues while safeguarding operational resilience.

This executive summary has highlighted the critical role of advanced filtration technologies, the necessity of agile supply chain structures, and the importance of data-driven decision making in navigating market complexities. As manufacturers refine their competitive positioning and end users seek increasingly tailored solutions, the integration of real-time analytics, eco-design principles, and localized service networks will define market leadership. Ultimately, organizations that embrace these strategic themes will be best equipped to capitalize on emerging opportunities, mitigate risks associated with regulatory and trade shifts, and drive long-term value creation across the welding fume extraction equipment ecosystem.

Encouraging Decision Makers to Secure the In Depth Welding Fume Extraction Equipment Market Research Report Through a Direct Consultation With Ketan Rohom

Engaging with Ketan Rohom offers a unique opportunity to explore the full breadth of insights, analysis, and strategic guidance featured in the comprehensive welding fume extraction equipment report. His deep understanding of market dynamics and sales expertise ensures that your organization receives tailored recommendations aligned with your strategic objectives. Through a direct consultation, you can clarify how the detailed segmentation, regional breakdowns, and tariff impact assessments apply to your specific needs, enabling you to make informed purchasing decisions.

By reaching out for a personalized discussion, decision makers can unlock early access to executive overviews, comparative technology matrices, and competitive intelligence profiles that are not available in public summaries. This tailored approach accelerates your internal evaluation process and empowers you to secure critical intelligence ahead of competitors. Connect with Ketan Rohom today to initiate your acquisition process and gain decisive advantages in the rapidly evolving welding fume extraction equipment market.

- How big is the Welding Fume Extraction Equipment Market?

- What is the Welding Fume Extraction Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?