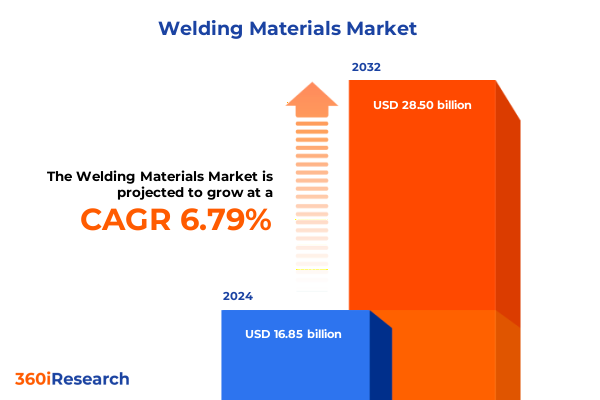

The Welding Materials Market size was estimated at USD 18.01 billion in 2025 and expected to reach USD 19.25 billion in 2026, at a CAGR of 7.30% to reach USD 29.50 billion by 2032.

Shaping the Future of Welding Materials Through a Comprehensive Market Overview Highlighting Critical Drivers Innovations and Strategic Imperatives

Welding materials constitute the core components that enable the fabrication, repair, and joining of metals across countless applications. As global manufacturing expands and infrastructure projects accelerate, the demand for reliable, high-performance welding consumables continues to intensify. This introduction explores how the welding materials landscape is shaped by rapid industrialization, rising expectations for product quality, and the imperative of operational efficiency.

At the forefront of this evolution is the drive to adopt advanced materials that deliver superior weld integrity under increasingly stringent performance criteria. From lightweight alloys utilized in aerospace components to corrosion-resistant electrodes deployed in oil and gas environments, manufacturers are seeking tailored welding consumables that meet specialized requirements. Consequently, product developers and end-use industries are collaborating more closely than ever to co-engineer solutions that align with unique processing parameters and regulatory standards.

Moreover, heightened awareness of environmental impact and occupational safety has spurred the development of lower-emission fluxes, cleaner shielding gas blends, and ergonomic filler wire formats. Alongside this, the integration of digital monitoring and quality-control technologies is enhancing process visibility, reducing rework, and driving cost efficiencies. Consequently, welding materials producers are pivoting toward greater innovation and service orientation, recognizing that value extends beyond the weld puddle to encompass supply-chain transparency and lifecycle performance.

Navigating Rapid Transformative Shifts in the Welding Materials Landscape Driven by Advanced Technologies Supply Chain Evolution and Stringent Environmental Standards

Over the past several years, the welding materials landscape has undergone transformative shifts driven by the convergence of technological innovation and evolving industry priorities. Breakthroughs in materials science have enabled the creation of ultra-low spatter consumables and high-strength filler metals, thus elevating weld quality and throughput for sectors from automotive to heavy machinery. Additionally, the incorporation of sensors and data analytics within welding torches has ushered in a new era of process control, allowing for real-time feedback and adaptive parameter adjustments.

Furthermore, supply chain dynamics have been reshaped by a growing emphasis on regional resilience and just-in-time delivery models. This has prompted producers to establish decentralized manufacturing hubs and stockrooms strategically positioned near key fabrication clusters. Consequently, lead times have shortened and inventory costs have been optimized. At the same time, sustainability mandates and customer demand for green manufacturing solutions have incentivized the adoption of inert gas blends with lower global warming potential and flux formulations minimizing hazardous emissions.

Looking ahead, the proliferation of robotic and collaborative welding systems foreshadows a further shift toward automation and intelligent orchestration of consumable inputs. As manufacturers invest in end-to-end digitization, welding materials suppliers must align their innovation roadmaps with broader Industry 4.0 strategies. In this context, agility, interoperability, and eco-friendly product portfolios emerge as critical differentiators.

Assessing the Cumulative Impact of United States Tariffs on Welding Materials in 2025 Including Trade Dynamics Cost Pressures and Strategic Industry Responses

United States trade policy has introduced a series of tariffs that have cumulatively exerted significant pressure on the welding materials sector. Initially implemented under Section 232 and extended through subsequent trade actions, these levies have affected key inputs ranging from stainless steel electrodes to copper-based welding wires. The result is an elevated cost base for domestic producers that has reverberated across the manufacturing value chain.

Consequently, many end-use customers have sought alternative sourcing strategies, including the import of tariff-free filler metals from allied nations or the ramping up of in-country production capacity. While these measures have provided some relief, they have also introduced complexity into procurement processes and underscored the importance of supplier diversification. In parallel, welding consumables manufacturers have pursued localized raw material partnerships to cushion against import duties and maintain competitive pricing.

Moreover, the tariff environment has catalyzed greater dialogue between industry associations and policymakers regarding the efficacy and sector-specific impacts of trade measures. As the landscape continues to evolve in 2025, stakeholders must remain vigilant to potential revisions in duty structures, exemption criteria, and retaliatory actions. Ultimately, a proactive approach to trade compliance, coupled with strategic inventory planning, will be essential for mitigating cost volatility and sustaining operational continuity.

Unveiling Key Segmentation Insights Across Material Types Welding Technologies End-Use Industries and Operation Modes Driving Market Differentiation and Value Creation

Segmentation of the welding materials market by material type reveals distinct demand profiles across flux cored wire, solid wire, welding electrodes, welding flux, and welding gases, with the gases category further distinguished into active gases and inert gases, each offering specific shielding characteristics that impact weld quality. In the realm of welding technology, gas metal arc welding remains widely adopted for its versatility, while gas tungsten arc welding delivers precision in critical applications, and laser beam welding and plasma arc welding continue to gain traction in high-speed, high-precision sectors. Resistance welding and shielded metal arc welding persist in heavy industrial contexts, even as submerged arc welding provides efficient, mechanized solutions for thick-plate joining.

The end-use industry segmentation encompasses aerospace, automotive, construction, energy and power, general fabrication, heavy machinery, oil and gas, and shipbuilding and marine, each sector driving unique specifications for filler alloys, flux compositions, and gas blends based on factors such as corrosion resistance, mechanical strength, and weld aesthetics. Equally, operation mode segmentation differentiates fully automatic welding systems, manual welding processes, robotic welding cells, and semi-automatic setups, illuminating how automation levels influence consumable consumption rates, operator skill requirements, and capital expenditure considerations.

By understanding where demand concentrates across these four segmentation dimensions, manufacturers and suppliers can better tailor product development, distribution strategies, and service offerings to align with the nuanced requirements of distinct application segments. This holistic view provides a framework for prioritizing investments and aligning go-to-market approaches with the most lucrative and growth-oriented segments.

This comprehensive research report categorizes the Welding Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Welding Technology

- Operation Mode

- End-Use Industry

Uncovering Critical Regional Insights in the Welding Materials Market Across Americas Europe Middle East Africa and the Asia-Pacific Growth Hotspots and Strategic Considerations

Regionally, the Americas continue to exhibit robust demand owing to sustained infrastructure modernization and the strength of the automotive and oil and gas sectors, with the United States at the forefront, supported by Canada’s focus on advanced manufacturing and Brazil’s expanding construction footprint. Moreover, localized production and near-shore supply hubs have enhanced responsiveness to market needs and alleviated some of the challenges posed by transcontinental logistics.

In Europe, Middle East and Africa, stringent regulatory frameworks in Western Europe regarding emissions and worker safety have spurred innovation in low-spatter electrodes and clean-burning gas blends, while Middle Eastern energy investments and African industrialization initiatives have created fresh opportunities for consumables designed for high-temperature and corrosive environments. Collaboration between regional suppliers and end-users has intensified as companies seek to co-innovate products tailored to diverse climatic and regulatory landscapes.

Meanwhile, Asia-Pacific emerges as a pivotal growth frontier, driven by China’s leadership in shipbuilding and general fabrication, India’s ambitious infrastructure projects, and the rapid adoption of advanced manufacturing in South Korea and Japan. ASEAN economies are also gaining traction as manufacturing relocates to lower-cost environments. Across this tri-regional view, the interplay of policy incentives, labor dynamics, and technological deployment shapes strategic priorities for welding materials producers seeking to maximize regional footprint.

This comprehensive research report examines key regions that drive the evolution of the Welding Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies in the Welding Materials Sector Through Strategic Positioning Innovation Capabilities and Collaborative Partnerships Shaping Industry Evolution

Leading participants in the welding materials arena demonstrate a blend of global scale, specialized expertise, and agile innovation. One prominent player has leveraged decades of engineering heritage and robust distribution networks to maintain leadership in electrodes and flux formulations, while another has distinguished itself through the integration of digital monitoring systems with its consumable offerings. A multinational gas supplier has capitalized on its broad industrial gas portfolio to deliver turnkey welding gas solutions, and a specialist in solid and flux-cored wires has carved out a competitive edge by focusing on application-specific alloy development.

Collaborative partnerships further underscore the competitive dynamics, as companies forge alliances with equipment manufacturers to co-develop consumables optimized for new welding platforms. Additionally, strategic investments in research and development centers and pilot-scale production facilities enable faster iteration of product innovations, particularly in low-emission fluxes and advanced filler metals designed for high-strength and corrosion-resistant applications.

Smaller niche suppliers also play a critical role, offering highly customized formulations for ultra-thin sections or exotic alloy requirements that larger producers may not prioritize. This broad competitive tapestry highlights the necessity for incumbents to balance portfolio breadth with deep technological capabilities and customer intimacy to sustain advantage in an increasingly fragmented market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Welding Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Atlantic China Welding Consumables, Inc.

- ESAB Corporation

- Illinois Tool Works Inc.

- Kobe Steel, Ltd.

- Lincoln Electric Holdings, Inc.

- Linde plc

- OC Oerlikon Corporation AG

- Panasonic Holdings Corporation

- Sandvik AB

- Tianjin Golden Bridge Welding Materials Group Co., Ltd.

- voestalpine AG

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Market Opportunities Mitigate Risks and Drive Sustainable Growth in Welding Materials

Industry leaders should prioritize investment in research and development focused on next-generation alloys and eco-friendly flux technologies to stay ahead of tightening regulatory standards and growing customer expectations for sustainability. By forging strategic alliances with welding equipment manufacturers, they can ensure seamless compatibility between consumables and automated systems, driving productivity gains and quality improvements for end-users.

Simultaneously, expanding regional production capabilities near key fabrication clusters will enhance supply chain resilience and minimize transportation costs. Companies should also explore localized partnerships for raw material sourcing to mitigate the financial impact of fluctuating tariffs and trade barriers. Implementing digital platforms for inventory management and demand forecasting will further optimize stock levels and reduce lead times, ensuring rapid responsiveness to market fluctuations.

Moreover, cultivating talent through specialized training programs and accreditation initiatives will help address the growing skills gap in welding operations. By offering technical workshops and certification courses in collaboration with industry associations, suppliers can reinforce customer loyalty and differentiate their service offerings. Finally, adopting a consultative sales approach that leverages data analytics to recommend tailored solutions will deepen customer relationships and unlock new revenue streams.

Detailing the Rigorous Research Methodology Employed Including Data Collection Sources Analytical Frameworks and Validation Processes Ensuring Robust Insights

This report synthesizes insights through a rigorous multi-stage research methodology that combines both primary and secondary data collection. In the initial phase, in-depth interviews were conducted with a cross-section of industry stakeholders, including manufacturing executives, welding engineers, and procurement specialists, to gather qualitative perspectives on emerging trends and pain points. These interactions provided ground-level intelligence on technology adoption, regulatory impacts, and supply chain challenges.

Complementing this qualitative input, secondary research leveraged trade journals, industry white papers, corporate financial disclosures, and governmental trade statistics to establish a robust factual baseline. Information was triangulated across diverse sources to validate consistency and mitigate bias. A structured analytical framework was then applied to segment the market, identify competitive positioning, and assess regional dynamics.

Finally, data validation steps included peer reviews by independent experts and feedback loops with select respondents to confirm the accuracy of interpretations. Through this methodological rigor, the report delivers reliable, actionable insights that underpin confident strategic decision-making in the welding materials sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Welding Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Welding Materials Market, by Material Type

- Welding Materials Market, by Welding Technology

- Welding Materials Market, by Operation Mode

- Welding Materials Market, by End-Use Industry

- Welding Materials Market, by Region

- Welding Materials Market, by Group

- Welding Materials Market, by Country

- United States Welding Materials Market

- China Welding Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Crafting a Comprehensive Conclusion That Synthesizes Core Findings Highlights Strategic Implications and Reinforces the Importance of Proactive Market Engagement

The comprehensive analysis presented herein underscores the complex interplay of technological breakthroughs, regulatory pressures, and trade dynamics shaping the welding materials market. Key trends such as the drive toward automation, the push for cleaner consumable formulations, and the strategic responses to tariff regimes have collectively redefined competitive imperatives. Segment-level insights reveal where value creation is concentrated across materials, technologies, end-use applications, and operational modes.

Regional dynamics further highlight divergent growth drivers in the Americas, Europe, Middle East and Africa, and Asia-Pacific, underscoring the importance of localized strategies and collaborative innovation. Meanwhile, the competitive landscape reflects a balance of scale-driven incumbents, specialty suppliers, and technology-focused challengers vying for market share. Taken together, these factors point to a marketplace characterized by both opportunity and complexity.

As industry participants navigate these shifts, proactive investment in R&D, digital integration, and supply chain resilience will be pivotal. By aligning strategic priorities with the actionable recommendations outlined above, companies can harness emerging trends to reinforce market leadership and drive sustainable growth in the welding materials domain.

Engaging with Ketan Rohom to Secure the Essential Welding Materials Market Research Report that Empowers Informed Decision-Making and Drives Competitive Advantage

If you’re ready to transform insights into action and lead in the rapidly evolving welding materials market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By partnering with him, you gain direct access to in-depth analysis, expert guidance, and bespoke solutions tailored to your strategic goals. Whether you require deeper dives into segmentation dynamics, region-specific trends, or competitive benchmarking, Ketan Rohom can facilitate timely delivery of the comprehensive market research report.

With his expertise and dedication to client success, engaging with Ketan ensures you receive personalized support throughout the purchasing process. Contacting him will provide clarity on report scope, pricing options, and value-added services that align with your organizational priorities. Seize this opportunity to equip your team with authoritative intelligence, mitigate emerging risks, and seize opportunities ahead of industry peers. Partner with Ketan Rohom today to secure your essential welding materials market research report and drive sustained competitive advantage.

- How big is the Welding Materials Market?

- What is the Welding Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?