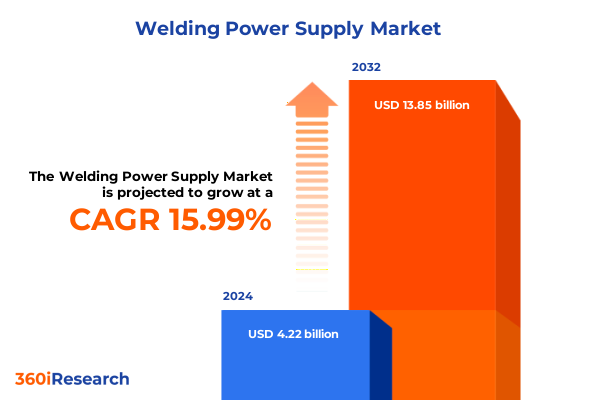

The Welding Power Supply Market size was estimated at USD 4.90 billion in 2025 and expected to reach USD 5.60 billion in 2026, at a CAGR of 15.99% to reach USD 13.85 billion by 2032.

Revealing the Critical Role of Advanced Welding Power Supplies in Driving Industrial Efficiency and Innovation Across Diverse Manufacturing Sectors

The evolution of welding power supplies has been pivotal in shaping modern manufacturing capabilities and industrial productivity. From early transformer-based units to today’s sophisticated inverter-driven systems, advances in power control have enabled higher precision, reduced energy consumption, and expanded application scopes. This report delves into the technological trajectory of welding power supplies and underscores their essential role in supporting critical sectors such as automotive, construction, and energy infrastructure.

As manufacturing environments demand faster cycle times, superior weld quality, and greater process repeatability, power supply innovations have risen to meet these challenges. The integration of digital interfaces and advanced control algorithms has facilitated real-time monitoring and closed-loop feedback, minimizing defects and enhancing operator consistency. Furthermore, the push toward electrification and lightweight materials has increased the need for adaptable power sources capable of handling diverse welding processes.

This introduction sets the stage for a comprehensive examination of emerging trends, tariff influences, market segmentation nuances, regional dynamics, competitive strategies, and actionable recommendations. By understanding the drivers and constraints that define the current welding power supply landscape, decision-makers can align investments and partnerships to capitalize on growth opportunities. The ensuing sections will navigate through transformative shifts, regulatory impacts, granular segmentation insights, and strategic imperatives to equip stakeholders with the knowledge required to stay ahead in this ever-evolving domain.

Unveiling How Technological Advancements and Industry 4.0 Integration Are Transforming Welding Power Supply Capabilities Across Manufacturing Applications

Recent years have witnessed a paradigm shift in welding power supply technology, spurred by digitalization and the advent of Industry 4.0 principles. Intelligent inverters now deliver instantaneous arc sensing and adaptive control, enabling processes that self-optimize based on real-time feedback. This capability has unlocked precision welding across complex geometries, from thin-gauge automotive body panels to thick structural joints in heavy machinery. In parallel, connectivity features such as Ethernet and wireless protocols facilitate remote diagnostics and firmware updates, reducing downtime and supporting predictive maintenance strategies.

Concurrently, additive manufacturing and hybrid welding techniques have expanded the application envelope. Laser-arc hybrid systems exemplify this convergence, combining laser preciseness with the deposition rate of arc welding to achieve high-quality, high-speed welds. Solid state welding methods, including friction stir welding, have gained traction in specialized sectors like aerospace due to their solid-state diffusion bonding and minimal distortion. These transformative integrations between power supply architectures and process innovations are reshaping production paradigms and compelling equipment suppliers to invest heavily in research and development.

Transitioning to this new landscape requires rethinking traditional power modules and controls. Manufacturers are now adopting modular, scalable designs that allow for seamless upgrades as new features emerge. Consequently, the welding power supply market is evolving from static hardware offerings into dynamic solutions ecosystems where software, data analytics, and hardware coalesce to deliver heightened performance and operational agility.

Evaluating the Compounding Effects of 2025 United States Tariffs on Import Costs and Competitive Dynamics in the Welding Power Supply Market

In 2025, adjustments to United States tariff policies have introduced additional levies on imported steel, aluminum, and select electronics, impacting the cost structure of welding power supply production. These measures, aimed at bolstering domestic manufacturing, have resulted in higher input costs for transformer cores and power semiconductors, prompting suppliers to reassess sourcing strategies. The cumulative effect has been a shift toward nearshore suppliers and an increased emphasis on local content to mitigate tariff exposure and currency fluctuations.

As a consequence, many global equipment manufacturers have reevaluated their supply chains, forging strategic partnerships with U.S.-based foundries and component fabricators. This realignment has led to shorter lead times and improved responsiveness to local demand, albeit with adjustments in production footprints. Moreover, tariff-induced price pressures have driven innovation in alternative materials and design efficiencies, such as the adoption of high-permeability alloys that reduce core weight without compromising performance.

Fiscal implications extend beyond immediate cost increases. Companies are reconfiguring production networks to balance tariff impacts with labor and logistics considerations. Collaborative joint ventures and licensed manufacturing agreements have proliferated as viable routes to maintain market access while preserving competitiveness. Ultimately, the 2025 tariff landscape has accelerated supply chain diversification and intensified focus on value engineering to sustain profit margins and uphold product quality standards.

Decoding Market Segmentation to Uncover Diverse Process Industry Power Source Operation Mode Phase Power Rating and Cooling Preferences

A nuanced view of the welding power supply arena emerges when examining the full spectrum of segmentation criteria. Process segmentation spans traditional arc welding technologies-encompassing flux-cored, MIG, plasma, stick, and TIG variations-alongside laser welding, resistance methods including flash, projection, seam, and spot welding, and the rising prominence of solid state techniques such as friction stir and ultrasonic welding. Each process category demands tailored power delivery characteristics, from precise current ramps to specific waveform profiles, which in turn shape equipment design and control parameters.

End user industry insights reveal distinct application requirements. Automotive assembly and aftermarket service lines prioritize compact, inverter-driven models for robotic integration and on-the-go repairs, whereas construction and general manufacturing sectors lean toward robust transformer-based units for heavy structural work. Energy and power outfits require high-capacity systems to handle pipeline construction and grid infrastructure maintenance, while shipbuilding facilities often deploy modular power sources that can adapt to varying dockside environments.

Further segmentation by power source highlights generator models for remote field operations, inverter configurations prized for portability and efficiency, and transformer-based supplies valued for their proven reliability under harsh industrial conditions. Operation mode segmentation underscores the dichotomy between fully automated production cells, manual bench welding stations, and semi-automatic setups that blend human control with mechanized wire feeding. Phase considerations differentiate single phase solutions for light-duty workshops from three phase equipment designed for continuous, high-load operations. Power rating distinctions-ranging from low and medium duty to high-powered systems-dictate selection based on thickness and throughput requirements, while cooling method preferences, either air-cooled or water-cooled architectures, influence footprint, noise levels, and maintenance protocols. This layered segmentation framework illuminates competitive positioning and guides product roadmaps across diverse market niches.

This comprehensive research report categorizes the Welding Power Supply market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process

- End User Industry

- Power Source

- Operation Mode

- Phase

- Power Rating

- Cooling Method

Assessing Regional Dynamics in the Americas Europe Middle East & Africa and Asia-Pacific to Highlight Growth Drivers and Adoption Trends

Regional dynamics exhibit pronounced variations in adoption rates and growth catalysts for welding power supplies. In the Americas, infrastructure modernization projects and a resurgent automotive sector are fueling demand for advanced inverter-based solutions that enhance throughput and reduce energy consumption. Domestic manufacturing incentives have further encouraged localized production of key components, while on-site service networks support sustained uptime for critical industrial clients.

Across Europe, the Middle East and Africa, stringent emission regulations and a push toward renewable energy infrastructure are driving the uptake of energy-efficient welding systems. European Original Equipment Manufacturers (OEMs) are integrating digital monitoring into their equipment portfolios to comply with environmental standards and optimize operational expenditures. Meanwhile, Middle Eastern construction and EAF-based steel production have propelled demand for high-capacity transformer and inverter hybrids, and South African mining sectors are adopting ruggedized units tailored for extreme conditions.

In the Asia-Pacific region, China’s Belt and Road Initiative and India’s infrastructure expansion programs continue to underpin robust growth in welding equipment installations. Domestic manufacturers are rapidly scaling up capacity, benefiting from economies of scale and government subsidies. Japan and South Korea, with their strong electronics ecosystems, are pioneering compact, high-frequency inverter technologies, and Australia’s resource extraction industries are investing in modular power supply units to support remote site operations. These regional distinctions underscore the importance of tailored market approaches and highlight key opportunities for technology providers to align offerings with localized demands.

This comprehensive research report examines key regions that drive the evolution of the Welding Power Supply market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Innovation Endeavors of Leading Welding Power Supply Manufacturers Shaping the Market Trajectory

Leading welding power supply manufacturers are deploying multifaceted strategies to fortify their market presence and accelerate innovation. One prominent player has invested heavily in the integration of artificial intelligence into its control platforms, enabling predictive arc adjustments and facilitating operator guidance through augmented reality interfaces. Another organization has pursued strategic acquisitions of niche laser welding specialists to broaden its high-precision portfolio and strengthen vertical integration.

Simultaneously, partnerships between established transformer manufacturers and power electronics firms have emerged, blending material science expertise with advanced semiconductor design to produce lighter, more efficient power modules. Several competitors are expanding their global service footprints through remote monitoring hubs and mobile technical support units, shortening response times and deepening customer engagement.

R&D collaborations with academic and research institutions have also gained traction, particularly in exploring solid state welding modalities and next-generation cooling solutions. Intellectual property filings in hybrid power architectures and digital process control algorithms reflect a shift toward platform-based offerings that can be continuously updated through software releases. This convergence of hardware prowess, digital acumen, and strategic alliances is setting a new competitive baseline and prompting all participants to evolve beyond traditional product-centric business models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Welding Power Supply market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aotai Electric Co. Ltd.

- CEA Weld Italia S.r.l.

- Cemont S.p.A.

- Deca S.r.l.

- ESAB Corporation

- Everlast Power Equipment Inc.

- EWM AG

- Fronius International GmbH

- GYS GmbH

- Illinois Tool Works Inc.

- ITW Welding

- Jasic Technology Co. Ltd.

- Kemppi Oy

- L-TEC Welding & Cutting

- Lincoln Electric Holdings Inc.

- Lorch Schweißtechnik GmbH

- Migatronic A/S

- OTC Daihen Inc.

- Panasonic Holdings Corporation

- Parweld Ltd.

- Riland Industry Co. Ltd.

- Stamos Welding Group GmbH

- Telwin S.p.A.

Formulating Strategic Imperatives and Actionable Insights to Empower Industry Leaders in Elevating Welding Power Supply Performance Standards

Industry leaders should prioritize digital transformation by embedding advanced analytics and connectivity features into their welding power supplies. By leveraging real-time performance data, organizations can implement predictive maintenance regimes that minimize unplanned downtime and extend equipment life. Integrating intuitive user interfaces and remote access capabilities will further enhance operational flexibility and support decentralized production models.

Enhancing supply chain resilience is equally critical. Firms must diversify sourcing channels, cultivate strategic partnerships with regional component suppliers, and evaluate nearshoring options to reduce tariff exposure and logistics delays. Value engineering initiatives should explore lightweight core materials and modular architectures that can be tailored to specific application profiles without incurring significant redesign costs.

To capture emerging opportunities in additive manufacturing and hybrid welding, companies should establish dedicated innovation labs and collaborate with end users to co-develop specialized power solutions. Investing in training programs that upskill technicians on advanced processes will not only drive product adoption but also foster brand loyalty. Finally, a customer-centric service strategy-combining digital support platforms with on-the-ground technical teams-will differentiate offerings and create a sustainable competitive advantage in an increasingly data-driven market landscape.

Outlining a Rigorous Research Methodology Leveraging Primary Interviews Secondary Analysis and Quantitative Mapping to Uphold Data Integrity

This study employs a comprehensive research framework combining primary and secondary methodologies to ensure analytical rigor. Primary insights were gathered through in-depth interviews with key executives, R&D engineers, and procurement managers across equipment manufacturers, raw material suppliers, and end user sectors. These discussions provided direct perspectives on technology adoption challenges, supply chain dynamics, and regulatory impacts.

Secondary research encompassed an exhaustive review of technical journals, patent registries, industry white papers, and government publications. Company annual reports and public financial statements were analyzed to capture strategic initiatives, product launches, and partnership developments. Data triangulation techniques were applied to validate market trends and identify discrepancies between reported figures and on-the-ground realities.

Quantitative data analysis included segmentation mapping by process, end user industry, power source, operation mode, phase, power rating, and cooling method to uncover nuanced demand patterns. Regional market dynamics were assessed through trade flow statistics and tariff databases, while competitive landscapes were illuminated via benchmarking of R&D expenditures and intellectual property filings. This multifaceted approach ensures that findings are both robust and reflective of the most current industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Welding Power Supply market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Welding Power Supply Market, by Process

- Welding Power Supply Market, by End User Industry

- Welding Power Supply Market, by Power Source

- Welding Power Supply Market, by Operation Mode

- Welding Power Supply Market, by Phase

- Welding Power Supply Market, by Power Rating

- Welding Power Supply Market, by Cooling Method

- Welding Power Supply Market, by Region

- Welding Power Supply Market, by Group

- Welding Power Supply Market, by Country

- United States Welding Power Supply Market

- China Welding Power Supply Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Provide a Cohesive Perspective on Market Drivers Challenges and Future Pathways for Welding Power Supplies

The welding power supply market stands at an inflection point where technological progress, regulatory shifts, and evolving customer expectations converge. Key drivers such as digital control integration and Industry 4.0 connectivity are accelerating product differentiation, while tariff adjustments and supply chain realignments are reshaping cost structures and sourcing strategies. Segmentation analysis highlights the multiplicity of application-specific requirements that mandate a tailored approach to power supply design and service delivery.

Regional ecosystems exhibit varied growth trajectories, from infrastructure-led expansion in the Americas to innovation-driven adoption in Asia-Pacific and regulatory-driven optimization in Europe, the Middle East and Africa. Competitive dynamics underscore a move toward platform-based solutions, strategic collaborations, and continuous software enhancement as core differentiators. Actionable recommendations emphasize the necessity of digital transformation, supply chain diversification, and customer-centric service models.

Ultimately, stakeholders equipped with these insights can navigate complexities with greater confidence, align product roadmaps with market demands, and foster collaborative ecosystems that advance welding power supply technologies. The confluence of strategic foresight and operational excellence will determine market leadership in this rapidly evolving landscape.

Engaging with Ketan Rohom to Secure Comprehensive Welding Power Supply Market Insights and Propel Informed Decision-Making for Business Growth

To access the full suite of strategic insights and in-depth analysis presented in this report, engage with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through tailored purchasing options and demonstrate how these actionable findings can be leveraged to optimize your competitive positioning and operational efficiency. Secure your copy today to gain an unparalleled vantage point on the welding power supply landscape and drive informed decision-making that delivers tangible business impact.

- How big is the Welding Power Supply Market?

- What is the Welding Power Supply Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?