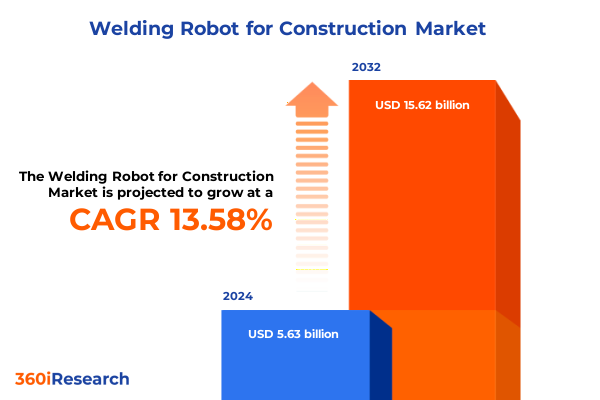

The Welding Robot for Construction Market size was estimated at USD 6.32 billion in 2025 and expected to reach USD 7.21 billion in 2026, at a CAGR of 13.78% to reach USD 15.62 billion by 2032.

Pioneering the Future of Construction: Unveiling How Welding Robots Are Revolutionizing Efficiency Safety and Sustainability on Modern Job Sites

The construction industry is undergoing a paradigm shift driven by a convergence of technological innovation, labor dynamics, and sustainability imperatives. As complex infrastructure projects proliferate and the skilled welding workforce ages, industry leaders are under mounting pressure to enhance productivity while upholding quality and safety standards. Traditional welding processes, often labor-intensive and ergonomically challenging, struggle to meet growing project demands within tight timelines. In response, forward-thinking firms are turning to robotic automation to bridge the gap between workforce capacity and project complexity, setting the stage for welding robots to emerge as a cornerstone of modern construction workflows.

Welding robots integrate advanced robotic arms, precision-controlled power sources, and sophisticated sensor arrays to execute welds with consistent quality across repetitive tasks. These systems encompass both traditional industrial robots and collaborative “cobots,” the latter designed to operate safely alongside human welders without extensive safety barriers. The infusion of real-time data monitoring and cloud-enabled analytics further enhances process control, enabling predictive maintenance and traceability of welding parameters. By automating standard welding tasks in prefabrication shops, structural steel erection, and pipeline installation, these machines accelerate cycle times and reduce rework, while alleviating physical strain on workers. As such, welding robots are redefining the balance between human expertise and machine precision in construction environments

From Artificial Intelligence to Cobots: Charting the Transformative Shifts Driving Welding Robot Adoption and Operational Excellence Across Construction Workflows

As the construction sector embraces robotics, key technological shifts are redefining industry norms and driving welding robot adoption at scale. Autonomous capabilities are transitioning from pilot demonstrations to mainstream deployment, enabling machines to execute complex tasks such as structural steel joint welding with minimal human oversight. By 2025, fully autonomous construction equipment will move beyond excavation and material handling, incorporating advanced welding modules that leverage LiDAR, computer vision, and adaptive path planning. Concurrently, artificial intelligence and machine learning algorithms empower robots to analyze weld quality in real time, adjust parameters for varying material thicknesses, and self-optimize workflows based on historical performance data. These developments mark a significant departure from rule-based automation toward cognitive, learning-enabled systems that adapt to dynamic site conditions.

Off-site prefabrication and modular construction methods are also experiencing a renaissance thanks to robotics. Automated assembly lines equipped with multi-axis welding arms ensure that prefabricated modules meet exacting tolerances, accelerating on-site installation and reducing weather-related delays. Digital twin technology further extends these benefits by creating virtual replicas of robotic welding cells, allowing engineers to simulate production flow, predict maintenance needs, and optimize resource allocation before physical deployment. The integration of Building Information Modeling with robotic control systems ensures seamless data exchange across design and production stages, fostering a continuous feedback loop that enhances both quality and efficiency. Together, these shifts underscore a transformative era in which welding robots become integral to a data-driven, resilient construction ecosystem.

Assessing the Far-Reaching Consequences of 2025 United States Steel and Aluminum Tariffs on Welding Robot Deployment in Construction Projects

In early 2025, the United States reinstated and expanded Section 232 tariffs on steel and aluminum, extending the 25% levy to fabricated structural steel and downstream derivative products. This policy adjustment addresses long-standing concerns over import surges that have depressed domestic capacity utilization and threatens to impair national security interests in critical infrastructure. By mandating “melted and poured” domestic content for structural steel, the administration narrowed a loophole that allowed tariff avoidance via off-shore fabrication. These enhanced duties, effective March 12, 2025, have reconfigured supply chains and raised raw material costs across multiple construction segments.

The ripple effects on welding robot deployment are substantial. Elevated steel and aluminum prices increase the cost of robotic consumables, including fixture plates and tooling bases, while longer lead times for fabricated components delay system integrations and on-site commissioning. Construction firms face budgetary pressure from both higher unit costs and potential scope reductions, complicating return-on-investment calculations for automation projects. Moreover, compliance with stricter domestic content requirements may constrain access to competitively priced foreign-made robotic workstations, forcing procurement teams to navigate a more complex web of trade exemptions and waiver processes. As a result, companies must adopt strategic sourcing and risk mitigation strategies to sustain welding robot initiatives under the new tariff regime.

Unlocking Market Dynamics Through Comprehensive Segmentation: Mobility Robot Types Automation Levels Control Systems Payload Capacities Applications and End Users

Market segmentation illuminates the nuanced dynamics driving welding robot adoption across construction applications. From a mobility standpoint, stationary systems excel in controlled prefabrication environments where high throughput and repeatability are paramount, while mobile platforms navigate on-site structural frameworks to perform spot welding on steel beams. When examining robot type, articulated arms dominate due to their versatility and reach; within this category, five-axis models accommodate basic joint welds, four-axis configurations optimize planar tasks, and six-axis machines deliver full spatial flexibility for intricate, multi-surface operations. Delta and SCARA robots complement these solutions by offering high-speed trimming and tack welding capabilities in enclosed fabrication cells.

The level of automation further differentiates market offerings. Fully automatic systems provide end-to-end welding with integrated vision inspection, parameter adjustment, and quality verification, requiring minimal human intervention once programmed. In contrast, semi-automatic machines retain manual oversight for complex joints or variable geometries, striking a balance between flexibility and automation. Control system architectures range from embedded controllers that offer compact, self-contained units to PC-based platforms enabling seamless integration with enterprise resource planning software and cloud analytics.

Payload capacity shapes the spectrum of applications, with lighter robots handling less than 10 kilograms suited to fine-arterial work and repetitive spot welding, mid-range models in the 10-to-50-kilogram class optimized for structural beam fusion, and high-capacity arms exceeding 50 kilograms equipped to manipulate heavy subassemblies. Application segments encompass arc welding for structural steel, beam welding for modular frames, pipe welding in subterranean projects, and spot welding in prefabricated unit assembly. End users span residential developers installing steel reinforcements, commercial contractors fabricating façade panels, industrial plant integrators, and infrastructure authorities erecting bridge trusses. Technological considerations encompass welding processes such as laser beam-both CO2 and fiber variants-MIG, plasma arc, and TIG, each selected based on material thickness, joint geometry, and heat-affected-zone constraints.

This comprehensive research report categorizes the Welding Robot for Construction market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mobility

- Robot Type

- Automation Level

- Control System

- Payload Capacity

- Technology

- Application

- End User

Deciphering Regional Market Trajectories for Welding Robots in Construction Across the Americas Europe Middle East Africa and Asia-Pacific

In the Americas, welding robot adoption is propelled by robust infrastructure spending and public-sector mandates on domestic content for federal projects. The reinstated Section 232 tariffs have invigorated U.S. steel production yet driven input costs higher, prompting contractors to reevaluate automation investments to preserve margins. Canada and Mexico, key steel suppliers under USMCA, face elevated duties that have reshaped sourcing strategies. Despite these headwinds, leading construction firms in North America are accelerating prefabrication initiatives, leveraging stationary robotic work cells to maintain schedule adherence amid material volatility.

Europe, the Middle East, and Africa are characterized by a confluence of historic infrastructure revitalization and ambitious sustainability targets. Governments across the European Union are embedding digital twin and BIM requirements in procurement, fostering an environment where welding robots integrate seamlessly with digital workflows. In the Middle East, megaprojects such as stadiums and transit networks prioritize modular construction, driving demand for high-capacity six-axis robots. Meanwhile, African markets, grappling with labor shortages and cost containment pressures, view robotic automation as a pathway to leapfrog traditional construction methods and accelerate urban development.

Asia-Pacific remains the fastest growing region for welding robots in construction, fueled by rapid urbanization, ambitious industrialization plans, and pervasive labor challenges. China and Japan lead in R&D investment, piloting humanoid welding prototypes for shipyard and infrastructure applications, with target deployments by the late 2020s. Southeast Asian nations are adopting collaborative robots to augment limited skilled labor, while Australia’s mining and resource infrastructure sectors deploy heavy-payload robotic cells for structural assembly and pipeline welding projects. Across the region, initiatives to standardize safety regulations and incentivize automation are accelerating the transition from manual to robotic welding in construction projects.

This comprehensive research report examines key regions that drive the evolution of the Welding Robot for Construction market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Welding Robot Ecosystem for Construction Through Strategic Partnerships Technological Advancements and Market Positioning

Global incumbents have intensified their focus on welding robot solutions tailored to construction environments. Universal Robots, Fanuc, ABB, and Kuka are expanding their portfolios with modular end-effectors, simplified programming interfaces, and integrated vision systems that address the variability of on-site workflows. These companies are forging partnerships with construction equipment OEMs to deliver turnkey automation packages, combining heavy-duty robotic arms with field-rugged controllers and wireless communication modules. Notably, investments in adaptive path planning software and cloud-based fleet management platforms enable remote monitoring and real-time diagnostics, reducing downtime and optimizing asset utilization.

Emerging entrants and specialized startups are also influencing the competitive landscape. Persona AI’s collaboration with HD Hyundai Robotics and shipyard operators to develop humanoid welding robots underscores the push toward human-robot collaboration in complex, hazardous environments. These initiatives signal a shift from traditional fixed-base installations to mobile, self-navigating platforms capable of working alongside skilled technicians. As a result, the ecosystem is diversifying, with new players introducing innovative materials handling solutions, collaborative safety features, and AI-driven quality assurance modules that complement established robotic welding systems in construction projects.

This comprehensive research report delivers an in-depth overview of the principal market players in the Welding Robot for Construction market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AGT ROBOTIQUE INC.

- Carl Cloos Schweißtechnik GmbH

- Comau S.p.A.

- DAIHEN Corporation

- EFORT Intelligent Equipment Co., Ltd.

- Estun Automation Co., Ltd.

- FANUC Corporation

- FICEP S.p.A.

- Fronius International GmbH

- HD Hyundai Robotics Co., Ltd.

- igm Robotersysteme AG

- Kawasaki Heavy Industries, Ltd.

- KUKA Aktiengesellschaft

- Lincoln Electric Holdings, Inc.

- Mitsubishi Electric Corporation

- NACHI-FUJIKOSHI CORP.

- Novarc Technologies Inc.

- Panasonic Holdings Corporation

- Path Robotics, Inc.

- Pemamek Oy

- Polysoude S.A.S.

- Siasun Robot & Automation Co., Ltd.

- Yaskawa Electric Corporation

Strategic Imperatives for Construction Industry Leaders to Harness Welding Robotics Through Investment Collaboration and Policy Advocacy

To capitalize on the transformative potential of welding robots, construction leaders must invest in collaborative automation platforms that balance human expertise with machine precision. Prioritizing systems with intuitive teach-pendant interfaces and seamless integration into existing workflows accelerates adoption and minimizes disruption. Furthermore, forging alliances with robotics integrators and equipment suppliers enables custom-engineered solutions tailored to project-specific requirements, driving higher utilization rates and faster payback periods.

The integration of digital twin environments and IoT-enabled sensors is essential for achieving continuous performance optimization. By capturing weld parameters, energy usage, and cycle times, project teams can apply machine learning algorithms to refine process recipes, predict maintenance needs, and mitigate quality risks before they escalate. Additionally, diversifying supply chains to include both domestic fabricators and qualified international partners reduces exposure to tariff-induced cost spikes, ensuring consistent access to critical components.

Engagement in policy advocacy and industry consortia supports the development of standards and regulatory frameworks that foster safe, interoperable robotic deployments. By collaborating with trade associations and standards bodies, companies can shape guidelines for collaborative safety zones, data interoperability, and certification programs that accelerate industry-wide adoption. Finally, investing in workforce retraining and upskilling programs ensures that technicians can program, maintain, and optimize robotic welding cells, securing a talent pipeline capable of sustaining long-term automation strategies.

Methodological Framework Combining Primary Interviews Secondary Data Trade Analysis and Expert Validation to Ensure Rigorous Insights in Welding Robot Research

This research synthesizes insights from primary and secondary sources to deliver a holistic perspective on welding robot adoption in construction. Primary data were obtained through in-depth interviews with automation engineers, construction project managers, and trade association executives, providing first-hand accounts of deployment challenges, technology requirements, and ROI considerations. Secondary research encompassed an exhaustive review of government policy documents, trade journals, and patent filings to track regulatory shifts and emerging innovations.

Market dynamics were analyzed using a segmentation framework that considers mobility, robot type, automation level, control system, payload capacity, application, end user, and welding technology. Regional assessments leveraged customs data and infrastructure spending reports to gauge demand patterns across the Americas, EMEA, and Asia-Pacific. A multi-stage validation process, including expert panel reviews and cross-referencing with publicly available case studies, ensured that findings accurately reflect current trends and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Welding Robot for Construction market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Welding Robot for Construction Market, by Mobility

- Welding Robot for Construction Market, by Robot Type

- Welding Robot for Construction Market, by Automation Level

- Welding Robot for Construction Market, by Control System

- Welding Robot for Construction Market, by Payload Capacity

- Welding Robot for Construction Market, by Technology

- Welding Robot for Construction Market, by Application

- Welding Robot for Construction Market, by End User

- Welding Robot for Construction Market, by Region

- Welding Robot for Construction Market, by Group

- Welding Robot for Construction Market, by Country

- United States Welding Robot for Construction Market

- China Welding Robot for Construction Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Emerging Opportunities That Define the Welding Robot Revolution in Construction Industry Transformation

The advent of welding robots in construction signifies a watershed moment for an industry steeped in tradition yet eager for innovation. Fueled by advancements in robotics hardware, artificial intelligence, and digital integration, welding automation is unlocking new levels of productivity, safety, and quality across prefabrication, structural assembly, and on-site operations. However, success hinges on strategic navigation of geopolitical influences such as tariffs, careful segmentation of technology offerings, and region-specific deployment strategies.

By aligning investment priorities with actionable recommendations-focusing on collaborative systems, digital twins, diversified sourcing, policy engagement, and workforce development-industry leaders can harness the full potential of robotic welding to address labor shortages, cost pressures, and sustainability goals. As the construction landscape evolves, these technologies will redefine how structures are conceived, built, and maintained, heralding a new era of precision and efficiency.

Secure Expert-Informed Market Intelligence on Welding Robot Adoption by Connecting with Ketan Rohom Associate Director Sales Marketing to Purchase the Comprehensive Report

To secure unparalleled intelligence and strategic foresight on the welding robot for construction landscape, engage with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the comprehensive market research report. This in-depth study delivers actionable insights, rigorous analysis, and expert perspectives tailored to empower your organization’s decision-making. Connect with Ketan to explore bespoke licensing options, enterprise solutions, or single-user access to the report’s extensive findings. Elevate your competitive advantage today by leveraging data-driven guidance that illuminates emerging growth opportunities, technological trajectories, and regulatory considerations shaping the future of welding robotics in construction.

- How big is the Welding Robot for Construction Market?

- What is the Welding Robot for Construction Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?