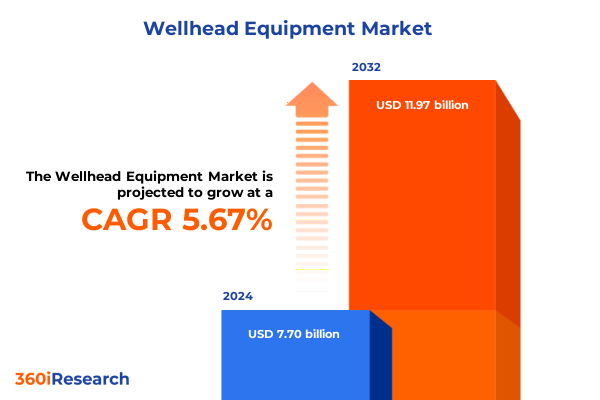

The Wellhead Equipment Market size was estimated at USD 8.12 billion in 2025 and expected to reach USD 8.56 billion in 2026, at a CAGR of 5.70% to reach USD 11.97 billion by 2032.

Overview of the Wellhead Equipment Industry Highlighting Key Drivers, Trends, Innovations and Market Dynamics Shaping the Sector Today

The global wellhead equipment sector plays a pivotal role in energy production by ensuring the safe and efficient management of oil and gas extraction at the surface. Wellheads serve as the critical interface between subsurface operations and surface facilities, maintaining pressure control, facilitating flow operations, and supporting safety systems. In recent years, the focus on well integrity, operational reliability, and environmental safeguards has intensified, driven by tightening regulations and the need to optimize production from mature and unconventional reservoirs. Consequently, wellhead equipment suppliers and operators have placed greater emphasis on innovation, seeking materials and designs that withstand high pressures, corrosive environments, and extreme temperatures.

Amid this evolving landscape, emerging demands around digital monitoring, automated control, and modular deployment have begun to reshape strategic decisions across the industry. Companies are leveraging advanced sensor integration and remote-control capabilities to reduce human exposure to hazardous conditions and to enable real-time performance optimization. At the same time, cost pressures from fluctuating commodity prices, combined with sustainability imperatives and global trade tensions, underscore the importance of supply chain resilience and adaptable manufacturing approaches. Against this backdrop, a nuanced understanding of technological trends, tariff impacts, and regional variations is essential for stakeholders aiming to navigate complexity and capture growth opportunities in the wellhead equipment domain.

How Digital Transformation, Automation, Material Advancements and Sustainability Imperatives Are Redefining the Future of Wellhead Solutions Worldwide

The wellhead equipment market is undergoing a profound transformation fueled by the convergence of digitalization, automation, and advanced materials science. Operators are increasingly embedding Internet of Things (IoT) sensors within flanges, valve systems, and sealing mechanisms to enable continuous monitoring of pressure, temperature, and flow rates. With the integration of edge computing, data processing takes place at the source, reducing latency and allowing predictive algorithms to detect seal degradation or valve wear before failures occur. This shift towards proactive maintenance minimizes unplanned downtime and enhances operational uptime, particularly in remote onshore and offshore environments where access for personnel is constrained.

At the same time, the adoption of modular wellhead assemblies is streamlining project timelines by simplifying logistics and reducing the complexity of on-site installation. Modular components, whether permanent or retrievable, can be tailored to specific casing head and tubing hanger requirements, accelerating deployment in challenging terrains. Concurrently, innovations in high-strength alloys and composite materials are extending the lifespan of critical components while resisting erosion and corrosive fluids common in mature fields. Together, these technological advances, underpinned by collaborative partnerships between equipment manufacturers and drilling service providers, are redefining value propositions across the sector. As sustainability concerns mount, manufacturers are also integrating low-emission materials and designs that facilitate rapid retrofitting, aligning wellhead solutions with industry commitments to reduce carbon footprints.

Assessing the Compound Effects of 2025 Tariff Policies on Wellhead Equipment Supply Chains, Input Costs and Operational Viability in the United States

In 2025, U.S. policy measures have imposed additional duties on imported steel and other key wellhead components, resulting in a notable rise in input costs for manufacturers and operators. Under Section 232, a 25% tariff on steel significantly increases the expense of carbon steel and alloy steel flanges, valves, and casing heads, compelling domestic producers to reassess supply chain strategies and potentially pass costs through to end users. At the same time, Section 301 tariffs on certain Chinese-manufactured sealing systems and valve systems have compounded cost pressures, eroding the margin buffer that existed prior to tariff enactment.

These combined tariff policies have also spurred supply chain bottlenecks as procurement teams scramble to identify alternative sources or petition for exemptions. According to analysis by the Federal Reserve Bank of Richmond, industries including fabricated metals and electrical equipment face average tariff rates of 10–15% under expanded scenarios, yet the wellhead equipment segment, with its heavy reliance on both steel and specialized alloys, finds itself among the most exposed. The assumption of full tariff pass-through to domestic prices suggests that well services firms may face headline cost increases nearing 20%, although actual burdens may be mitigated by sourcing from alternate markets unaffected by tariffs.

Against this backdrop, some wellhead equipment manufacturers are accelerating efforts to localize production, investing in U.S.-based facilities to circumvent tariff constraints and stabilize delivery schedules. Nonetheless, uncertainty around policy continuity and the potential for retaliatory measures from trading partners adds complexity to capital planning and contract negotiations. As a result, companies are intensifying engagement with customs authorities and legal advisors, while simultaneously exploring strategic stockpiling of critical components to insulate projects from further cost spikes.

Unveiling Core Market Segments Through Components, Types, Materials, Installation Methods, Applications and End Users to Illuminate Growth Pathways

The wellhead equipment market can be understood through multiple lenses that reveal nuanced growth trajectories and investment imperatives. When deconstructed along component lines, the market spans flanges, sealing systems, and valve systems-each demanding distinct material properties and quality assurance protocols. Transitioning to product types exposes the critical roles of casing heads, casing spools, Christmas trees, tubing hangers, and tubing heads, which collectively anchor the well completion process and determine the safety envelope of drilling operations.

Examining the material dimension underscores divergent performance requirements between alloy steel, carbon steel, cast iron, and stainless steel, with choices often driven by reservoir conditions, fluid chemistries, and regulatory mandates. Installation preferences further segment the market into permanent and retrievable systems, reflecting customer priorities around long-term reliability versus flexibility for subsea intervention. Application-driven distinctions between offshore and onshore settings introduce additional complexity, as equipment must adapt to platform-mounted rigs or land-based drilling sites. Finally, the market’s end-user profile encompasses mining operations, oil and gas producers, and water management entities, each presenting unique procurement cycles and service expectations. Together, these segment insights provide a comprehensive view of wellhead equipment dynamics and guide targeted innovation and outreach strategies.

This comprehensive research report categorizes the Wellhead Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Material

- Installation Type

- Application

- End User

Comparative Analysis of Regional Market Dynamics Across the Americas, Europe Middle East & Africa and Asia Pacific to Identify Strategic Growth Opportunities

Regional dynamics play a decisive role in shaping wellhead equipment demand and deployment strategies. In the Americas, robust shale developments, particularly in the Permian Basin and onshore U.S. plays, continue to drive requirements for durable casing and tubing heads, while Canadian operators face the added complexity of winterized materials and tight regulatory standards. Moving across the Atlantic into the Europe, Middle East & Africa region, market activity is influenced by large-scale offshore projects in the North Sea and the Gulf of Guinea, where subsea wellheads and high-pressure valves must adhere to stringent environmental and safety regulations. Infrastructure modernization efforts in the Middle East also underpin demand for modular wellhead systems designed for rapid installation and retrofit in desert and offshore environments.

In the Asia-Pacific, growth is concentrated in emerging markets such as Australia, Malaysia, and Indonesia, where new exploration initiatives and deepwater projects require specialized equipment capable of withstanding corrosive conditions and high temperatures. Furthermore, governments across Southeast Asia are increasingly mandating local content requirements, prompting manufacturers to establish regional workshops and service hubs. These divergent regional trends necessitate tailored product portfolios and localized support networks to meet project timelines and regulatory specifications in each territory.

This comprehensive research report examines key regions that drive the evolution of the Wellhead Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Positions, Innovation Portfolios and Financial Performance of Leading Wellhead Equipment Providers to Understand Competitive Landscapes

Leading wellhead equipment providers are positioning themselves through differentiated technology offerings, strategic partnerships, and targeted investments in digital and service-based models. Baker Hughes has distinguished itself by leveraging strong demand for natural gas and LNG-related systems, reporting a 28% uptick in gas technology orders during the second quarter of 2025. Despite a slight year-over-year revenue decline in traditional oilfield equipment, the firm’s emphasis on data center-driven growth and a $1.5 billion order pipeline in digital infrastructure reflects a broader pivot toward high-value service contracts and integrated solutions.

Schlumberger (SLB), as the world’s largest oilfield services and equipment supplier, reported $36.29 billion in revenue and $4.46 billion in net income in 2024, underscoring its ability to marshal scale and diversify its product portfolio across seismic, completion, and wellhead activities. SLB’s commitment to digital-enabled platforms and carbon capture applications highlights its strategy of aligning traditional wellhead offerings with energy transition imperatives.

NOV Inc. continues to strengthen its position through the rollout of proprietary subsea protection structures, with over 42 Cocoon & Shroud units delivered since inception. Recent contract awards for advanced drillship modernization and integrated automation systems exemplify the company’s focus on high-performance equipment packages tailored to offshore operators’ evolving needs. Meanwhile, industry stalwarts like Halliburton and Weatherford are navigating reduced upstream spending by emphasizing specialized maintenance services, aftermarket support, and niche valve technologies, balancing capital-intensive deployments with recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wellhead Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions

- Baker Hughes Company

- Brace Tool Inc.

- Cactus Wellhead LLC

- China Vigor Drilling Oil Tools and Equipment Co., Limited

- Delta Corporation

- Forum Energy Technologies Inc.

- Great Lakes Wellhead Inc.

- Halliburton Energy Services, Inc.

- Hunting PLC

- Jiangsu Wellhead Drilling Equipment Co. Ltd.

- NOV Inc.

- Oil States International Inc.

- Proserv UK Ltd.

- Puyang Zhongshi Group Co., Ltd.

- Rein Process Equipment (Jiangsu) Co., Ltd.

- Schlumberger Limited

- Shandong Saigao Group Corporation

- Sunnda Corporation

- TechnipFMC PLC

- Trelleborg AB

- Uztel S.A.

- Weatherford International PLC

- Weir Group PLC

Actionable Strategies for Industry Leaders to Navigate Technological, Regulatory and Trade Complexities While Enhancing Operational Resilience

Industry leaders should prioritize a dual approach of technological innovation and supply chain resilience to navigate the intersecting challenges of digital disruption and trade policy volatility. To mitigate tariff exposures, manufacturers can expand domestic machining capabilities for critical components and pursue free trade agreement sourcing, thereby reducing reliance on high-duty imports. Simultaneously, adopting digital twin models and predictive analytics will enable real-time monitoring of equipment health, minimizing unplanned downtime and optimizing maintenance windows in both permanent and retrievable installations.

Furthermore, strategic collaborations between wellhead equipment vendors and service operators can accelerate the development of modular solutions that support rapid offshore mobilization and seamless integration with emerging completion methodologies. By embedding sustainability criteria into product lifecycles-from material selection to end-of-life recycling-companies can address increasingly stringent environmental regulations and meet stakeholder expectations for low-emission operations. Ultimately, a concerted focus on agile manufacturing, data-driven decision-making, and cross-sector partnerships will be essential for organizations seeking to secure market share and deliver enhanced value in an era defined by technological convergence and geopolitical uncertainty.

Multifaceted Research Framework Combining Primary Interviews, Secondary Data Sourcing and Rigorous Analytical Techniques to Ensure Robust Market Insights

Our research methodology combines rigorous primary and secondary approaches to ensure robust and objective market insights. Primary research efforts included in-depth interviews with senior executives at equipment manufacturers, drilling service providers, and end-user technical specialists. These conversations were structured to capture firsthand perspectives on segment performance, tariff impacts, and regional deployment challenges. Secondary research encompassed a thorough review of industry reports, trade publications, regulatory filings, and financial statements to validate interview findings and enrich contextual understanding.

Quantitative analysis was conducted by triangulating data from multiple reputable sources, including government trade statistics, customs filings, and machinery import records, to estimate cost impacts and deployment volumes across segments. Qualitative insights were synthesized through thematic content analysis, enabling the identification of emerging trends, best practices, and strategic imperatives. Finally, peer reviews by subject-matter experts and iterative feedback loops with client stakeholders ensured the accuracy, relevance, and practical applicability of our conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wellhead Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wellhead Equipment Market, by Component

- Wellhead Equipment Market, by Type

- Wellhead Equipment Market, by Material

- Wellhead Equipment Market, by Installation Type

- Wellhead Equipment Market, by Application

- Wellhead Equipment Market, by End User

- Wellhead Equipment Market, by Region

- Wellhead Equipment Market, by Group

- Wellhead Equipment Market, by Country

- United States Wellhead Equipment Market

- China Wellhead Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis of Critical Findings Illustrating Market Drivers, Challenges and Strategic Priorities for Wellhead Equipment Stakeholders to Guide Decision Making

The wellhead equipment market stands at a critical juncture defined by rapid digitalization, evolving regulatory frameworks, and shifting trade policies. Key drivers such as IoT-enabled monitoring, modular system adoption, and advanced material innovations are enhancing operational efficiency and safety, while simultaneously raising the bar for supplier capabilities. At the same time, the cumulative impact of 2025 tariff measures has underscored vulnerabilities in cost structures and highlighted the strategic importance of localized manufacturing and diversified sourcing.

Looking ahead, success will depend on the ability of industry participants to marry technological advancement with supply chain agility. Segmentation analysis reveals distinct opportunities within component, type, material, installation, application, and end-user domains, while regional assessments across the Americas, Europe Middle East & Africa, and Asia-Pacific emphasize the need for market-specific go-to-market strategies. Leaders that invest in predictive analytics, strengthen domestic production pipelines, and foster collaborative innovation ecosystems will be best positioned to capture value in this dynamic environment. These strategic priorities, grounded in robust research and stakeholder engagement, will guide decision-makers as they navigate the complexities of the modern wellhead equipment landscape.

Secure In-Depth Wellhead Equipment Market Intelligence and Expert Insights by Engaging with Ketan Rohom to Propel Your Strategic Planning Forward

Engaging directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, will allow you to access comprehensive insights tailored to your strategic objectives. By partnering with our research team, you will unlock detailed analysis on wellhead equipment market dynamics, regulatory shifts, and competitive positioning, empowering your organization to make informed investment and operational decisions. Reach out today to secure your copy of the full report and elevate your planning with data-driven intelligence.

- How big is the Wellhead Equipment Market?

- What is the Wellhead Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?