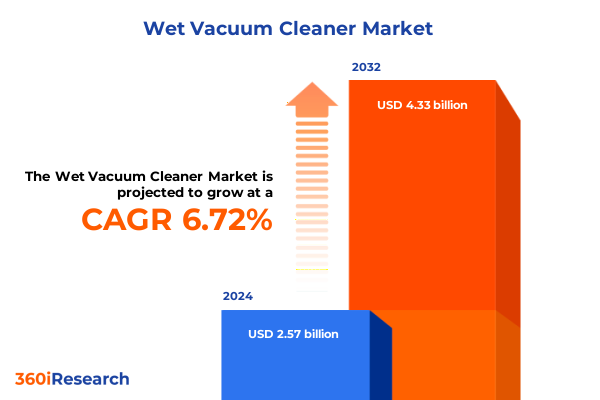

The Wet Vacuum Cleaner Market size was estimated at USD 2.74 billion in 2025 and expected to reach USD 2.90 billion in 2026, at a CAGR of 6.72% to reach USD 4.33 billion by 2032.

An incisive introduction to the wet vacuum cleaner category that articulates functionality, stakeholder evolution, and strategic drivers shaping manufacturer and buyer priorities

The wet vacuum cleaner category sits at the intersection of industrial robustness and household convenience, and in this introduction we set the stage for why this product class demands renewed strategic attention. Across commercial facilities and residential homes alike, wet-capable units perform a distinctive role-moving beyond dry debris removal to address liquid recovery, deep-extraction cleaning, and mixed debris scenarios that standard vacuums cannot service effectively. This functional versatility has expanded the range of buyer profiles, from facilities managers in hospitality and manufacturing to homeowners seeking one-tool solutions for seasonal and emergency cleaning needs.

As supply chains, product architectures, and regulations evolve, stakeholders must reassess traditional assumptions about product differentiation, channel economics, and the role of materials in cost structures. The industry is experiencing converging pressures: technological improvements in motors and filtration, accelerating adoption of cordless and flexible power architectures, and policy-driven shifts in cross-border trade that influence sourcing decisions. Against this backdrop, an executive-level understanding of product segments, distribution pathways, and regulatory touchpoints is essential for prioritizing investments in R&D, channel partnerships, and manufacturing footprint changes. This introduction frames the subsequent sections by highlighting the operational realities that buyers and manufacturers now navigate, and it emphasizes why timely commercial decisions are consequential for competitiveness.

How rapid advances in design, battery technology, and omnichannel distribution are redefining product roadmaps and supply chain strategies for wet vacuum cleaners

The landscape for wet vacuum cleaners is being reshaped by a set of transformative shifts that change how products are designed, sold, and serviced. Technological progress is one clear vector: improvements in motor efficiency, more robust filtration systems suitable for wet-dry applications, and advances in battery chemistry have blurred the line between corded industrial models and portable cordless units. As a consequence, product roadmaps now emphasize modularity, multi-function toolkits, and user-friendly maintenance features that reduce total cost of ownership for commercial buyers while preserving convenience for residential consumers.

Concurrently, distribution and buying behaviours have transformed. Traditional procurement channels for commercial end users remain important, but brand-owned e-commerce, large domestic platforms, international marketplaces, and social commerce make it easier for smaller brands to reach niche segments quickly. This omnichannel reality incentivizes manufacturers to invest in direct-to-consumer experiences, post-sale support platforms, and content-driven commerce that help communicate product capabilities for wet applications. Meanwhile, manufacturing and sourcing strategies are being rebalanced: dual-sourcing and nearshoring are becoming routine risk-mitigation tactics as import duties and steel-related trade policy introduce new cost variables. Taken together, these shifts require companies to re-evaluate product positioning, customer-engagement models, and the agility of their supply chains in order to capture value as the market’s technical and commercial dynamics evolve.

A detailed analysis of how 2025 U.S. tariff measures, HTS revisions, and steel-focused policy expansions combine to alter sourcing, costing, and compliance for wet vacuum cleaner imports

Recent U.S. trade measures and tariff developments in 2025 have a cumulative effect on the commercial calculus associated with wet vacuum cleaner manufacturing and import strategies. Harmonized Tariff Schedule classifications for vacuum cleaners (notably HTS heading 8508) remain the primary reference for duty treatment, and current HTS notes indicate that while general duty rates for many vacuum subheadings are zero, additional ad valorem tariffs may apply to goods of Chinese origin under existing trade remedies and tariff actions. This means that products and components sourced from China can face add-on duties that materially change landed cost assumptions and sourcing decisions for OEMs and private-label assemblers.

Overlaying existing Section 301 measures are the 2025 expansions in sector-specific tariff policy that target steel-intensive household appliances; official notices and market reporting in mid-2025 confirm that certain steel-derivative appliance classifications were added to elevated duty lists, effective from June 2025. For wet vacuum cleaners that contain significant steel components-motor housings, chassis, tanks, or structural frames-these actions raise the prospect of an import duty calculated on the value of steel content or otherwise altering the duty treatment of finished units. The combined effect of HTS-based add-on duties for specific country origins and the inclusion of household appliances within steel-focused measures requires manufacturers to revisit bill-of-materials composition, supplier country of origin, and incremental pricing strategies.

Because HTS revisions are periodically issued throughout the year, companies must include HTS monitoring and classification reviews in their compliance and commercial planning processes. U.S. tariff schedules have seen multiple 2025 HTS revisions, and those technical updates can change the subheading interpretation and the application of notes tied to tariff lists-processes that importers, customs brokers, and legal teams should monitor closely to avoid misclassification exposure and unexpected duty assessments. In parallel, U.S. policy actions increasing Section 301 rates on targeted Chinese-origin product groups in prior years established a legal and administrative precedent for incremental tariff updates that may be applied to appliance-related HTS codes, creating ongoing uncertainty for sourcing decisions.

Clear segmentation insights that connect application, channel, power source, capacity, and end-use industry nuances to product strategy and commercial prioritization

Segmentation strategies for wet vacuum cleaners reveal distinct performance and commercial imperatives across product families and customer segments, and these distinctions should shape go-to-market and innovation choices. When considered by application, the product set divides into commercial and residential uses, each with different durability expectations, service models, and procurement cycles; commercial buyers typically prioritize uptime, warranty support, and compatibility with facility cleaning protocols while residential buyers weigh size, noise, storage, and multi-function convenience more heavily.

Distribution channel segmentation likewise dictates how firms allocate sales and marketing investments. Offline channels include specialty stores, supermarkets and hypermarkets, and wholesale distributors, where specialty channels further distinguish between chain stores and independent retailers; these outlets remain essential for professional-grade units and B2B relationships. Online channels encompass brand-owned websites, e-commerce platforms-both domestic and international-and social commerce, and they are increasingly important for direct consumer education, rapid product iteration feedback, and subscription-based accessories or consumables. Power source segmentation, split between corded and cordless, drives engineering roadmaps; corded designs still dominate heavy-duty wet recovery and long-duration cleaning, whereas cordless architectures gain traction in light-to-medium residential and quick-response commercial use cases due to improved batteries and motor efficiency. Capacity segmentation across under 20 liters, 20 to 40 liters, and above 40 liters informs product architecture choices; smaller tanks favor portability and residential convenience, mid-range capacities suit mixed-use and small commercial applications, and larger tanks meet the throughput needs of manufacturing and large hospitality sites. End-use industry segmentation-covering healthcare, hospitality, manufacturing, and retail-highlights differentiated requirements: healthcare places a premium on filtration, sanitisation compatibility, and validated cleaning protocols; hospitality seeks quiet, discreet operations and rapid turnaround; manufacturing demands ruggedness and easy servicing; and retail requires versatile units suited to stores and back-of-house maintenance. Collectively, these segmentation lenses produce distinct roadmaps for product features, channel economics, after-sales service models, and procurement lead-times that manufacturers and distributors should explicitly map to captive audiences and go-to-market investments.

This comprehensive research report categorizes the Wet Vacuum Cleaner market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Distribution Channel

- Power Source

- Capacity

- End Use Industry

Insightful regional perspectives that map Americas, Europe–Middle East–Africa, and Asia-Pacific dynamics to product design, distribution, and after-sales considerations

Regional dynamics shape both demand and supply-side strategy for wet vacuum cleaners, and treating each geography as a suite of commercial and regulatory considerations enables more precise market entry and investment choices. In the Americas, procurement is heavily influenced by commercial retrofit cycles, facility regulations, and an established retail ecosystem that supports premium product introductions; North American buyers in healthcare and hospitality particularly emphasize certified filtration and service agreements, while Latin American markets present differentiated price sensitivity and distribution complexity that favor regional distributors and localized after-sales networks.

Across Europe, the Middle East, and Africa, product regulations, energy efficiency expectations, and evolving sustainability requirements influence product design and material choices. Buyers in EMEA increasingly seek products with clear end-of-life recycling plans and lower embodied carbon in manufacturing, driving demand for modular designs and recyclable materials. Distribution in this region is heterogenous: Western Europe balances premium retail and B2B procurement channels, while parts of the Middle East and Africa rely more on distributor-led service models and project-based commercial procurement. Asia-Pacific demonstrates the most heterogenous demand profile and the fastest pace of product adoption across a range of price points; rapid urbanization, dense multi-unit housing, and high e-commerce adoption create fertile ground for cordless and compact wet-dry units, while industrial hubs and manufacturing centers drive demand for larger capacity, high-durability units. Strategic regional differentiation in product portfolios, service offerings, and channel partnerships is therefore essential for capturing geographically specific demand vectors.

This comprehensive research report examines key regions that drive the evolution of the Wet Vacuum Cleaner market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A comprehensive look at incumbent advantages, challenger disruption, and component partnerships that determine competitive positioning and aftermarket strength

Competitive dynamics in the wet vacuum cleaner space continue to be characterized by an interplay between long-standing appliance incumbents and emerging specialists that combine niche engineering with direct distribution capabilities. Established players retain advantages in scale manufacturing, global aftermarket networks, and certification pathways important to commercial buyers; these firms often leverage extensive dealer and distributor channels to reach facilities requiring scheduled maintenance and bulk procurement. At the same time, challenger brands are disrupting segments through product differentiation-particularly in cordless light-duty units, smart diagnostics, and subscription consumables-and by leveraging digital-first channels to reach consumers directly.

Partnerships and component-level innovation are central to competitive advantage. Manufacturers that secure preferential supply of higher-performing motors, durable stainless steel tanks, and advanced filtration cartridges can command premium positioning in healthcare and hospitality verticals. Similarly, alliances with battery firms delivering longer run-times or faster charge cycles allow cordless wet-capable units to expand into applications that were previously corded-only territory. Competitive footprints are also determined by the depth of aftermarket service; brands with rapid spare-parts distribution and certified service networks maintain stronger relationships with commercial buyers who prioritize uptime and predictable maintenance costs. Taken together, these dynamics reward firms that can simultaneously manage cost-efficient production, targeted innovation investments, and tiered channel strategies to address distinct buyer value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wet Vacuum Cleaner market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfred Kärcher SE & Co. KG

- American Vacuum Company

- Bissell Inc.

- Cleva North America

- Delfin Professional Systems GmbH

- Emerson Electric Co.

- Euro-Pro Operating LLC

- Goodman Holding Company

- Goodway Technologies Corp.

- Miele & Cie. KG

- Milwaukee Electric Tool Corporation

- Nederman Holding AB

- Nilfisk Group

- NSS Enterprises Inc.

- Numatic International Ltd.

- Stanley Black & Decker Inc.

- Techtronic Industries Co. Ltd.

- Vacuum Specialists LLC

Practical and urgent recommendations for manufacturers and distributors to reconfigure sourcing, channels, and product roadmaps to withstand tariff and market disruption

To remain resilient and capture growth while navigating trade and channel disruption, industry leaders should pursue a set of actionable moves that align product development, sourcing, and commercial execution with emergent realities. First, re-evaluate the bill of materials and supplier footprints to isolate steel-intensive components and identify feasible substitutes, alternative suppliers, or nearshore production options that reduce exposure to targeted steel tariffs and origin-based duties. This supply-side rebalancing should be complemented by a thorough customs classification and HTS monitoring program so that product design changes and regulatory revisions are reflected in landed-cost models and pricing strategies in real time.

Second, double down on channel segmentation-build differentiated offerings for commercial procurement partners versus direct-to-consumer channels. For commercial buyers, enhance service-level agreements, certified training for on-site teams, and bundled consumable programs that lock in recurring revenue; for consumer channels, invest in product education content, streamlined return and warranty processes, and social-commerce activations that shorten the conversion funnel. Third, accelerate product modularity and electrification efforts: prioritize interchangeable battery packs, corrosion-resistant materials for wet use, and filter systems that meet healthcare and hospitality certification requirements. Finally, integrate tariff-scenario planning into capital and pricing decisions by modelling plausible duty escalations and identifying price and margin levers, financing alternatives, and contractual pass-through terms that preserve competitive positioning. Executed together, these recommendations create a resilient posture that mitigates near-term trade shocks while positioning firms to capture structural shifts toward cordless convenience and omnichannel commerce.

A transparent research methodology that combines primary stakeholder interviews, HTS and tariff review, and scenario analysis to validate strategic insights and compliance implications

The research underpinning this executive summary synthesizes primary and secondary inputs with a structured classification and validation process to ensure defensible findings. Primary inputs include structured interviews with procurement leads, facility managers, and channel partners across healthcare, hospitality, manufacturing, and retail segments; these conversations were used to validate feature priorities, service expectations, and procurement cycles. Secondary inputs included a systematic review of HTS revisions and official tariff notices, trade press coverage, and technical product literature to triangulate claims about component materials, motor and battery developments, and distribution trends. Legal and customs advisory summaries were consulted to interpret the application of Section 301 measures and steel-related tariff notices to appliance classifications.

Analytically, the methodology applied a segmentation-first approach, layering application-based buyer needs, distribution channel economics, power-source trade-offs, capacity requirements, and end-use industry standards. Each finding was stress-tested through scenario analysis that examined the combined effects of country-of-origin add-on duties, steel-content levies, and channel-mix shifts on landed costs and margin corridors. The research also included a cross-regional scan that compared regulatory drivers and buyer preferences across the Americas, EMEA, and Asia-Pacific. Where public data and regulatory notices were used as inputs, the exact references were captured and reviewed to ensure accurate interpretation of tariff schedules and effective dates, and classification changes were highlighted as part of the compliance recommendation set. This layered approach provides a pragmatic synthesis that balances technical tariff detail with commercial strategy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wet Vacuum Cleaner market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wet Vacuum Cleaner Market, by Application

- Wet Vacuum Cleaner Market, by Distribution Channel

- Wet Vacuum Cleaner Market, by Power Source

- Wet Vacuum Cleaner Market, by Capacity

- Wet Vacuum Cleaner Market, by End Use Industry

- Wet Vacuum Cleaner Market, by Region

- Wet Vacuum Cleaner Market, by Group

- Wet Vacuum Cleaner Market, by Country

- United States Wet Vacuum Cleaner Market

- China Wet Vacuum Cleaner Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

A decisive conclusion that synthesizes technological, channel, and tariff-driven imperatives to guide strategic prioritization for industry decision-makers

In conclusion, the wet vacuum cleaner category is at an inflection point where product, channel, and policy forces collectively shape near-term competitiveness and longer-term strategic choices. Technological improvements-particularly in battery systems and filtration-are expanding the available use cases for cordless and hybrid designs, while omnichannel distribution and content-driven commerce alter how value is communicated and captured. At the same time, evolving tariff regimes in 2025, including origin-based add-on duties and steel content-focused measures, introduce an additional layer of commercial complexity that can materially affect sourcing, pricing, and product architecture decisions.

Leaders that treat tariff exposure and HTS classification as integral to product and procurement strategy will be best positioned to protect margins and maintain supply resilience. Concurrent investments in modular product design, after-sales service networks, and targeted channel programs will enable firms to respond nimbly to customer expectations across healthcare, hospitality, manufacturing, and retail grounds. The synthesis presented here is intended to help decision-makers prioritize actions that deliver both defensive protection against policy shocks and proactive capture of emerging customer needs; combining rigorous compliance monitoring with focused innovation and channel execution is the practical path to sustained advantage in this evolving market.

Purchase the comprehensive wet vacuum cleaner market report and arrange a tailored briefing with Ketan Rohom to translate insights into commercial advantage

To obtain the full market research report and unlock granular data, tailor-made competitive benchmarking, and scenario-based tariff modelling for strategic planning, contact Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through custom licensing options, executive briefings, and bespoke data extracts designed for procurement teams, product managers, and corporate strategy groups. Reach out to schedule a private demo of the dataset, request a sample chapter, or arrange a consultative session that maps report findings to your business priorities; this conversation will accelerate decision-making and give your team the clarity to act with confidence.

- How big is the Wet Vacuum Cleaner Market?

- What is the Wet Vacuum Cleaner Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?