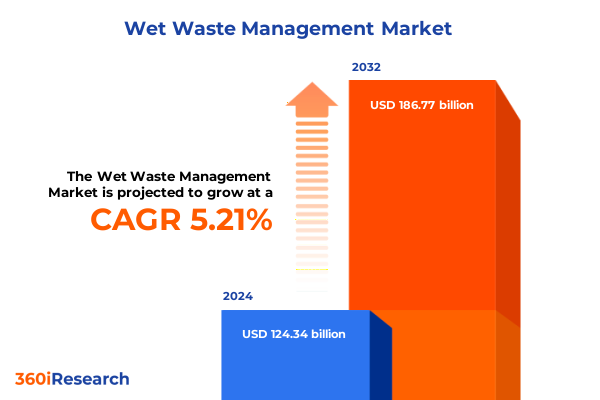

The Wet Waste Management Market size was estimated at USD 130.91 billion in 2025 and expected to reach USD 137.13 billion in 2026, at a CAGR of 5.20% to reach USD 186.77 billion by 2032.

Forging a Comprehensive Foundation for Sustainable Wet Waste Management with Evolving Practices and Emerging Environmental Imperatives

The wet waste management landscape has entered a pivotal era defined by accelerating environmental mandates, evolving stakeholder expectations, and groundbreaking operational practices. As urban centers expand and regulatory scrutiny intensifies, the imperative to treat organic residues not merely as refuse but as resource feedstock has become increasingly clear. This introduction outlines the core forces reshaping industry contours, laying the groundwork for a deeper exploration of emerging methodologies and market drivers. It underscores the criticality of aligning waste valorization strategies with sustainability targets while anticipating the ripple effects of policy changes and technological innovations.

Transitioning from traditional disposal paradigms to integrated circular frameworks demands a holistic understanding of waste composition, process synergies, and the interplay between municipal and commercial streams. Against this backdrop, food waste, garden clippings, and sewage sludge are being reframed as valuable inputs within anaerobic and composting ecosystems. Early adopters are demonstrating that collaborative value chains, underpinned by advanced process technologies, yield both environmental dividends and economic upside. This section sets the stage for readers to comprehend the foundational shifts driving investment decisions and operational recalibrations across the wet waste management sector.

Revealing the Epochal Transformation in Wet Waste Management Driven by Technological Breakthroughs and Regulatory Pressures Reshaping the Industry

Over the past decade, the wet waste management sector has experienced a profound metamorphosis driven by the convergence of regulatory reforms, public-private partnerships, and rapid technological strides. Regulatory frameworks worldwide are tightening organic waste diversion targets, compelling processors to innovate beyond conventional land application and incineration methods. In parallel, the ascent of digital solutions-from IoT-enabled collection logistics to AI-driven process optimization-has unlocked new efficiencies in throughput, quality control, and traceability.

Moreover, the proliferation of carbon credit schemes and circular economy initiatives is incentivizing end-to-end reintegration of organic residues into energy, fertilizer, and material streams. High-performance thermal processing techniques, such as gasification and pyrolysis, are complementing established composting and anaerobic digestion pathways by delivering high-yield bioproducts and renewable heat. These transformative shifts are not isolated; they are part of an integrated global movement toward redefining waste as an asset, thereby catalyzing cross-sector collaboration and seeding novel revenue models.

Unpacking the Ripple Effects of Recent United States Tariffs on Wet Waste Management Supply Chains and Economic Viability Across Stakeholder Segments

In 2025, the United States implemented a series of targeted tariffs affecting imported equipment and feedstocks integral to wet waste processing. These levies, designed to bolster domestic manufacturing of anaerobic digesters and thermal conversion units, have reverberated across supply chains. Capital costs for advanced gasification modules have risen, prompting project developers to revise financial models and extend procurement timelines. Conversely, domestically sourced primary and secondary sludge treatment systems have experienced renewed investment, spurred by incentives to localize manufacturing capacities.

The cumulative impact of these tariffs extends beyond equipment pricing. Service providers are recalibrating fleet deployment for community drop-off and curbside collection, while third-party and in-house operators reassess vendor agreements. Upstream stakeholders in pre-consumer and post-consumer food waste recovery are negotiating new contracts to mitigate cost escalations. Although challenges persist, particularly for large-scale pyrolysis installations dependent on imported catalysts, the tariff regime has also accelerated domestic innovation. By incentivizing local R&D and fostering partnerships between equipment fabricators and technology licensors, the market is gradually stabilizing into a more resilient, locally anchored ecosystem.

Decoding Market Diversity Through Waste Type Processes Collection Methods and End User Profiles Illuminating Key Pathways for Strategic Differentiation

Decoding the intricate layers of the wet waste management arena requires an appreciation of how waste type, process technology, collection modalities, and end-user profiles intersect. Within food waste streams, the bifurcation between post-consumer kitchen discards and pre-consumer manufacturing residues demands tailored treatment strategies. Similarly, garden waste ranging from grass clippings to autumn leaves commands distinct handling to optimize compost maturation, while primary and secondary sewage sludge present advanced dewatering and digestion considerations.

Process technologies further diversify the landscape. Anaerobic digestion remains a stalwart for biogas generation, while composting leverages microbial activity for soil amendment production. Thermal processing technologies, particularly gasification and pyrolysis, are ushering in a new frontier for energy-dense syngas and biochar. Vermicomposting offers a low-temperature, biologically nuanced pathway for organic stabilization. Collection mechanisms-whether through community drop-off centers, curbside pickup, or on-site arrangements managed by in-house teams or third-party operators-shape feedstock quality and logistics costs. Lastly, commercial settings spanning food service outlets, hospitality venues, and retail chains drive high-volume food waste recovery, whereas industrial players in chemical manufacturing and food processing submit to exacting performance criteria. Residential and institutional contributions underscore the need for scalable, user-friendly solutions. Together, these segmentation dimensions reveal critical levers for tailoring value propositions and achieving operational excellence.

This comprehensive research report categorizes the Wet Waste Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Waste Type

- Process Technology

- Collection Method

- End User

Mapping Regional Dynamics and Growth Trajectories in Wet Waste Management Across Major Global Economies Highlighting Unique Local Opportunities

Regional dynamics in wet waste management reflect a tapestry of regulatory environments, infrastructure maturity, and cultural attitudes toward organic recycling. In the Americas, the United States leads with robust policy drivers targeting landfill diversion and renewable energy credits, while Canada emphasizes nutrient recovery and indigenous community engagement. Mexico is advancing decentralized composting initiatives to address urban organic overload in metropolitan centers.

Across Europe, Middle East & Africa, the European Union’s circular economy directives mandate ambitious recycling rates and promote cross-border technology transfer. Middle Eastern economies are investing in thermal valorization to mitigate landfill dependency amidst arid conditions, and African nations are piloting community-scale anaerobic digestion projects to electrify rural areas. In the Asia-Pacific, rapid urbanization in China and Southeast Asia is fueling expansive investments in anaerobic digestion capacity and smart collection networks. Australia is championing advanced thermal pathways, leveraging its rich biomass resources to produce export-grade biochar. Each region’s unique confluence of policy, resource availability, and stakeholder collaboration informs a mosaic of opportunities for market entrants and incumbents alike.

This comprehensive research report examines key regions that drive the evolution of the Wet Waste Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Steering the Competitive Landscape of Wet Waste Management Industry Evolution

The competitive landscape of wet waste management is being shaped by a blend of legacy operators, technology pioneers, and innovative service providers. Established engineering firms are integrating digital twins and remote monitoring into conventional anaerobic digestion platforms, enhancing uptime and operational transparency. Startups specializing in modular pyrolysis units are challenging the status quo by offering scalable thermal conversion solutions with rapid deployment timelines. Meanwhile, composting cooperatives are harnessing community engagement to ensure consistent feedstock supply and build circular networks for soil health products.

Strategic alliances between equipment manufacturers and feedstock aggregators are streamlining value chains and accelerating commercialization of advanced treatment methods. Market leaders are also forging R&D partnerships with academic institutions to refine enzymatic pretreatment approaches and optimize biogas yield. Service providers that offer turnkey solutions-combining collection logistics, on-site processing units, and performance-based offtake agreements-are differentiating themselves through aligned incentives and lower upfront capital requirements. Collectively, these entities are driving the transition toward integrated, resilient business models that balance sustainability commitments with financial performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wet Waste Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Antony Waste Handling Cell Ltd

- Biffa Group Limited

- Casella Waste Systems Inc

- China Everbright Environment Group

- Clean Harbors Inc

- Cleanaway Waste Management Ltd

- Daiseki Co Ltd

- FCC Environment

- GFL Environmental Inc

- Hitachi Zosen Inova AG

- REMONDIS SE & Co KG

- Renewi PLC

- Republic Services Inc

- Rethmann SE & Co KG

- Saahas Zero Waste

- Sims Limited

- Stericycle Inc

- SUEZ SA

- Séché Environnement

- Urban Enviro Waste Management Ltd

- Veolia Environment SA

- Vermigold Ecotech

- Waste Connections Inc

- Waste Management Inc

Charting a Pragmatic Roadmap for Industry Leaders to Capitalize on Emerging Trends Optimize Operations and Strengthen Sustainability Outcomes

To thrive amidst rising competition and tightening environmental mandates, industry leaders must adopt a multipronged strategy centered on process optimization, stakeholder engagement, and adaptive governance. First, deploying digital monitoring systems across collection and treatment operations will unlock real-time performance analytics, enabling swift corrective actions and continuous improvement. Second, cultivating partnerships with municipal bodies and commercial generators can secure stable feedstock streams while reinforcing corporate social responsibility credentials.

Further, diversifying process portfolios by integrating complementary technologies-such as pairing anaerobic digestion with thermal valorization-enhances flexibility in revenue generation through combined energy, fertilizer, and biochar outputs. Investment in workforce upskilling and cross-disciplinary training will be imperative to manage increasingly sophisticated treatment platforms. Equally, aligning corporate strategies with emerging policy frameworks and voluntary certification schemes fortifies market positioning and preempts regulatory risks. By executing these recommendations cohesively, organizations will be better equipped to capitalize on evolving market demands and deliver enduring value to stakeholders.

Outlining a Rigorous Research Framework Incorporating Multisourced Data Acquisition Expert Consultations and Thorough Analytical Approaches

This research employs a robust methodology that synthesizes primary interviews with C-level executives, process engineers, and policy makers alongside secondary data from government publications, industry white papers, and peer-reviewed studies. Quantitative analyses of waste stream compositions and processing efficiencies are triangulated with case study assessments of pioneering facility deployments. Primary insights were gleaned through structured consultations with technology vendors, remediation specialists, and facility operators across major global regions.

To ensure analytical rigor, data validation protocols were implemented, cross-referencing public filings, trade association reports, and site visit observations. Process technology performance metrics-including methane capture rates, thermal conversion efficiencies, and compost maturity indices-were benchmarked against international standards. Market segmentation frameworks were refined through iterative workshops with domain experts, resulting in a granular classification of waste types, treatment pathways, collection modes, and end-user applications. The synthesis of these methodological steps underpins the integrity and actionable nature of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wet Waste Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wet Waste Management Market, by Waste Type

- Wet Waste Management Market, by Process Technology

- Wet Waste Management Market, by Collection Method

- Wet Waste Management Market, by End User

- Wet Waste Management Market, by Region

- Wet Waste Management Market, by Group

- Wet Waste Management Market, by Country

- United States Wet Waste Management Market

- China Wet Waste Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesis of Critical Insights Shaping the Future of Wet Waste Management and Imperatives for Stakeholders to Drive Sustainable Growth

The wet waste management sector stands at the cusp of an era marked by unprecedented collaboration and technological convergence. Stakeholders across the value chain are recognizing that sustainable outcomes are attainable through integrated strategies that align environmental stewardship with commercial imperatives. As circular economy principles become embedded in regulatory frameworks and corporate ESG agendas, the transformation from linear disposal models to regenerative systems will accelerate.

In summary, mastering the complexities of waste type segmentation, leveraging cutting-edge process technologies, and tailoring regional approaches are essential for long-term success. The interplay of tariffs, market consolidation, and innovation ecosystems will continue to shape competitive dynamics. By embracing data-driven decision-making, nurturing strategic alliances, and maintaining agility in the face of policy shifts, organizations can secure a leadership position. The insights distilled in this report offer a strategic compass to navigate emerging challenges and capitalize on the vast potential of wet waste as a resource.

Engage Expert Guidance from Ketan Rohom to Unlock In-Depth Wet Waste Management Intelligence Enhance Strategic Decisions and Propel Market Leadership

Embark on a transformative journey to unlock unparalleled insights into wet waste management by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through a tailored exploration of how cutting-edge processes and regulatory landscapes converge to reshape your strategic roadmap. By partnering with him, you gain access to exclusive proprietary analyses, granular regional breakdowns, and in-depth segmentation perspectives that empower actionable decision-making. Reach out now to secure your copy of the comprehensive market research report and harness critical intelligence that will elevate your organization’s competitive standing. The future of sustainable wet waste management awaits your leadership-take the decisive step today.

- How big is the Wet Waste Management Market?

- What is the Wet Waste Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?