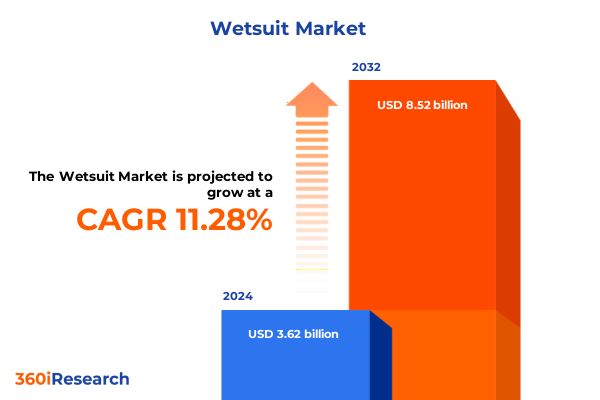

The Wetsuit Market size was estimated at USD 4.03 billion in 2025 and expected to reach USD 4.38 billion in 2026, at a CAGR of 11.26% to reach USD 8.52 billion by 2032.

Exploring the Dynamic Evolution of the Wetsuit Market Driven by Innovation, Consumer Demand and Emerging Industry Trends

The wetsuit market stands at the intersection of performance, innovation, and consumer expression, with its trajectory shaped by shifting preferences, technological breakthroughs, and evolving environmental consciousness. As water sports enthusiasts demand ever-greater freedom of movement, thermal protection, and sustainability credentials, manufacturers and retailers are compelled to deliver solutions that balance comfort, durability, and ecological responsibility. In this landscape, traditional neoprene formulations coexist with cutting-edge biomaterials, and modular, multi-platform designs are gaining momentum alongside specialized silhouettes.

Against this backdrop, the market’s competitive fabric is woven from an expanding array of participants, ranging from heritage surf brands to agile start-ups pioneering eco-friendly composites. Consumer expectations extend beyond functional performance to encompass aesthetic customization, comprehensive after-sales services, and transparent sourcing practices. Consequently, product road maps are increasingly informed by insights gleaned from both professional athletes and lifestyle enthusiasts, underscoring the importance of user-centric innovation.

Looking ahead, the convergence of digitalization and sustainability will redefine value propositions, driving integration of data-driven personalization, circular economy models, and end-to-end supply chain transparency. To navigate this dynamic environment, stakeholders must cultivate strategic agility, invest in R&D, and establish meaningful collaborations across the value chain. As you explore the following analysis, you will gain a holistic view of the forces shaping the wetsuit market and the levers that will determine future leadership.

How Technological Advances, Sustainability and Consumer Preferences Are Propelling Fundamental Transformations Across the Wetsuit Industry

The wetsuit industry is undergoing a fundamental transformation fueled by advances in materials science, digital technologies, and heightened environmental awareness. Recent years have seen the emergence of sustainable bio-elastomers and recycled neoprene alternatives, responding to concerns over greenhouse gas emissions, microplastic pollution, and petrochemical dependency. For instance, leading brands are increasingly incorporating plant-based rubbers and post-consumer recycled fibers in their liner fabrics, signaling a shift towards circular design principles and reducing the carbon footprint of every suit.

Meanwhile, digital innovation is reshaping the consumer journey, with virtual fit platforms, augmented reality configurators, and AI-powered recommendation engines streamlining product selection and personalization. These tools not only enhance user engagement but also optimize inventory planning and minimize returns, aligning with broader retail efficiency goals. In parallel, manufacturing processes have been refined through advanced CNC cuttings and automated seam welding, delivering tighter tolerances, improved seam strength, and accelerated production cycles.

Moreover, demographic shifts-such as the rise of women’s and youth participation in action sports-are driving a broader suite of specialized silhouettes and performance levels. Brands are investing in gender-specific fit technologies and modular garment architectures to address diverse anatomical requirements and seasonal use cases. As a result, the market has witnessed a proliferation of lightweight spring suits, performance-tuned full suits, and hybrid hybrids tailored for both water sports and lifestyle wear.

Taken together, these technological and cultural undercurrents are converging to redefine competitive benchmarks and open new avenues for value creation. Stakeholders keen to capitalize on these transformative trends must accelerate their innovation agendas and foster cross-sector partnerships.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Manufacturing, Supply Chains and Pricing Structures for Wetsuits

The introduction of significant tariff measures in 2025 has had a pronounced effect on the economics of wetsuit manufacturing and distribution. With the United States imposing a 145% levy on selected Chinese imports, manufacturers that relied heavily on Chinese supply chains faced steep cost increases overnight. Simultaneously, tariffs on imports from Vietnam, Cambodia, and Thailand-key wetsuit production hubs-were raised to rates of 46%, 49%, and 37% respectively, further squeezing profit margins and compelling companies to revisit sourcing strategies.

These cumulative duties have prompted several industry players to pass on expenses to end consumers or implement service-fee surcharges, as evidenced by premium wetsuit specialists announcing price adjustments upward of 15% to 25%. In extreme cases, companies have suspended U.S. operations entirely to reassess their supply chains, citing unsustainable cost structures. One notable example saw a leading surf-gear supplier pause domestic sales while evaluating alternative manufacturing geographies and revised pricing frameworks.

The immediate ramifications include elongated lead times, diminished inventory flexibility, and increased complexity in cost forecasting. Midstream fabricators and component suppliers are under pressure to negotiate volume commitments, invest in tariff mitigation bonds, and explore tariff exclusion petitions. Downstream, retailers confront the dual challenge of maintaining competitive shelf pricing and preserving brand equity amid consumer resistance to elevated costs.

In the medium term, the tariff landscape may catalyze a resurgence of near-shore and reshored manufacturing initiatives, driving capital investment in automation and local workforce development. Moreover, the crisis has underscored the strategic imperative of supply chain diversification, prompting several firms to secure production capacities in alternate territories such as Central America and Eastern Europe. By adopting a more resilient sourcing matrix, stakeholders can mitigate the impact of potential future trade disruptions.

Uncovering Critical Insights From Multiple Segmentation Dimensions Shaping the Contemporary Wetsuit Market Landscape and Consumer Preferences

A nuanced view of the wetsuit market requires an appreciation of how consumer requirements and product architectures intersect across multiple segmentation dimensions. Full suits continue to anchor performance-oriented portfolios, offering comprehensive thermal insulation for cold-water disciplines, whereas spring suits and short johns serve as entry points for recreational swimmers and warm-water enthusiasts seeking lightweight coverage and ease of maneuverability. Long johns have gained traction among kayakers and snorkelers who require core protection while preserving limb mobility, reflecting a broader trend toward hybrid multisport applications.

Material composition remains a defining attribute, as neoprene variants dominate high-performance categories with their proven stretch-to-weight ratios and heat retention. At the same time, Lycra-based skinsuits have carved out a niche in triathlon and pool-training regimes, prized for their minimal water absorption and hydrodynamic properties. Emerging thermoplastic elastomers (TPE) are attracting interest from entry-level brands for their cost efficiency and reduced environmental impact, signaling potential for broader adoption across value tiers.

Beyond raw materials, zipper architectures illustrate the interplay between user convenience and water-ingress prevention. Back-zip configurations offer streamlined donning and robust watertight seals, favored by novice divers and snorkelers. Chest-zip and zip-free designs, in contrast, are rising in popularity among surfers and free divers who demand maximum shoulder flexibility and minimal seam interruption. These innovations underscore the industry’s drive to harmonize ergonomics with performance imperatives.

End-user demographics also inform product development, with adults commanding the largest segment, subdivided into men’s and women’s fits optimized for anatomical contours and range-of-motion variances. Kids’ suits, engineered for rapid growth cycles and robust abrasion resistance, reflect growing youth participation in surf schools and aquatic sports programs. Finally, the distribution landscape spans traditional specialty retail and hypermarket channels, while direct-to-consumer brand websites and leading e-commerce platforms fuel digital penetration and omnichannel convergence.

This comprehensive research report categorizes the Wetsuit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wetsuit Types

- Material

- Zipper Type

- Activity

- User Type

- Sales Channel

Examining Regional Market Dynamics Across the Americas, Europe Middle East Africa and Asia-Pacific to Reveal Distinct Drivers of Wetsuit Demand

Regional nuances play a pivotal role in shaping demand dynamics and competitive positioning within the wetsuit market. In the Americas, rising interest in triathlon events, adventure tourism, and cold-water surfing has elevated the importance of technologically advanced full suits and modular layering systems. Retail channels in North America and Latin America vary significantly, with specialty surf shops leading in the United States and Canada, while hypermarket chains maintain significant presence in certain Latin American markets.

Moving to Europe, Middle East and Africa, the landscape is marked by a diverse climatic range, from Mediterranean snorkeling hotspots to North Atlantic big-wave territories. This has spurred multi-climate product strategies, emphasizing both premium thermal insulation for winter surfing and flexible spring suits for temperate conditions. The region’s well-established outdoor sports networks and robust event circuits-such as triathlon races and diving expos-provide vital platforms for brand engagement and product launches.

In Asia-Pacific, proximity to major manufacturing bases in Vietnam, Thailand and China delivers cost advantages, yet also exposes brands to regional trade policy fluctuations. Consumer preferences here lean heavily toward value-priced essentials and entry-level suits, supported by rapid e-commerce adoption and mobile shopping trends. Government incentives in key markets like Japan and Australia for local textile innovation are fostering material research hubs, while strong surf cultures in Australia and New Zealand continue to influence global product road maps.

This comprehensive research report examines key regions that drive the evolution of the Wetsuit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Industry Leaders’ Strategies Innovation Practices and Competitive Advantages Driving Success in the Global Wetsuit Sector

The competitive landscape of the wetsuit sector features a mix of established surf heritage brands and innovative challengers. O’Neill remains a bellwether, leveraging decades of technical expertise to advance sustainable material use and high-performance design. Recent introductions of plant-based Yulex natural rubber and graphene-enhanced linings represent its commitment to blending thermal efficiency with environmental stewardship. In parallel, its comprehensive repair-and-recycle network reinforces a circular product lifecycle ethos that resonates with eco-conscious consumers.

Rip Curl and Billabong have similarly broadened their portfolios, integrating recycled neoprene liners and water-based adhesive systems to minimize VOC emissions. Patagonia’s R4 Regulator, crafted from Yulex rubber and featuring attached hoods, exemplifies the premium frontier of eco-friendly wetsuit innovation and underscores the rising demand for performance-driven sustainability. Meanwhile, XCEL continues to refine multi-pane thermal structures and exterior stretch composites, catering to cold-water adventure sports.

On the newer brand front, Blueseventy’s decision to adjust pricing in response to tariff escalation illustrates the financial pressures confronting import-dependent specialists. Vissla’s leadership in sustainable apparel and its transparent public stance on tariff burdens underscore the sector’s broader challenges, as executives caution against prolonged trade disruptions. Complementing these players, start-ups such as C-Skins and Finisterre are pioneering dark-matter chest panels and rapid-dry biomaterial blends, targeting niche segments that prize both performance and eco-credentials.

Collectively, these companies set the bar for product differentiation, channel innovation, and environmental accountability. Their strategies provide a blueprint for balancing competitive advantage with industry-wide imperatives to reduce carbon footprints and enhance supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wetsuit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aqualung Trading

- AthleteSportsWorld BV

- Blueseventy LLC

- Boardriders, Inc.

- Body Glove IP Holdings LP

- Boz Wetsuits by Cayma E.I.R.L.

- Buell Wetsuits & Surf

- C-SKINS

- Decathlon SE

- Frankies Bikinis LLC

- Helly Hansen AS

- Hyperflex Wetsuits

- Isurus Inc.

- JMJ Manufacture, Inc.

- Lunasurf Limited

- O’Neill Europe B.V.

- Patagonia, Inc.

- Radiator Wetsuits

- Rip Curl, Inc.

- SHEICO Group

- Sisstrevolution

- Speedo International Limited

- Typhoon International Limited

- Vissla

- Xcel Wetsuits

- XTERRA WETSUITS

Strategic and Operational Imperatives for Industry Leaders to Navigate Market Disruptions and Capitalize on Growth Opportunities in the Wetsuit Sector

Industry leaders must adopt a multifaceted approach to navigate the current market volatility and capitalize on emerging opportunities. First, they should diversify manufacturing footprints to mitigate tariff exposure, exploring both near-shoring and strategic partnerships in tariff-friendly jurisdictions. This approach will safeguard supply chain continuity and enable more agile responses to policy shifts.

Second, investing in sustainable materials and advanced manufacturing processes is imperative. Brands that expand their eco-product lines with plant-based rubbers, recycled fibers, and low-energy production techniques will benefit from growing regulatory incentives and consumer willingness to pay premiums for green credentials. Additionally, integrating circular-economy initiatives-such as repair programs, material take-back schemes, and remanufacturing facilities-will enhance brand loyalty and reduce environmental impact.

Third, accelerating digital transformation across the value chain can unlock new growth vectors. Virtual try-on technologies, AI-driven personalization engines, and advanced demand-planning systems will not only improve customer engagement but also optimize inventory management. Meanwhile, robust e-commerce platforms that seamlessly integrate direct-to-consumer and wholesale channels will expand market reach and strengthen pricing integrity.

Finally, fostering cross-sector collaborations with material science firms, conservation organizations, and logistics specialists can drive open innovation and shared infrastructure investments. By co-creating solutions that address both performance demands and environmental imperatives, industry leaders can establish long-term competitive moats while elevating collective resilience to external shocks.

Detailing the Rigorous Research Methodology Underpinning Wetsuit Market Analysis Including Data Sources Research Techniques and Analytical Frameworks

The research methodology underpinning this analysis was structured to yield comprehensive, reliable insights into the wetsuit market’s current state and future trajectories. Initially, a robust secondary research phase was conducted, reviewing industry publications, trade journals, patent filings, and regulatory announcements to map technological innovations, trade policies, and competitive strategies. This phase was complemented by quantitative data collection from customs records, manufacturing indices, and e-commerce sales trackers to triangulate production and distribution trends.

Concurrently, primary research included in-depth interviews with executives from leading wetsuit manufacturers, material suppliers, and retail channel operators. These discussions provided qualitative context on supply chain adaptations, pricing strategies, and sustainability road maps. Furthermore, surveys targeting professional athletes, watersport instructors, and lifestyle consumers were administered online to capture user preferences, performance expectations, and brand perceptions across demographic segments.

The analytical framework integrated these data streams through data normalization, cross-validation, and scenario modeling. Sensitivity analyses were performed around tariff fluctuations and raw material cost variations to assess potential market scenarios. Finally, regional market maps and segmentation matrices were developed to illustrate demand hotspots and high-growth niches. This mixed-methods approach ensures that the findings reflect both empirical rigor and real-world applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wetsuit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wetsuit Market, by Wetsuit Types

- Wetsuit Market, by Material

- Wetsuit Market, by Zipper Type

- Wetsuit Market, by Activity

- Wetsuit Market, by User Type

- Wetsuit Market, by Sales Channel

- Wetsuit Market, by Region

- Wetsuit Market, by Group

- Wetsuit Market, by Country

- United States Wetsuit Market

- China Wetsuit Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Critical Findings and Future Outlook for the Wetsuit Market Amidst Evolving Consumer Demands Trade Dynamics and Technological Innovations

This executive summary has highlighted the critical drivers, challenges, and opportunities defining the wetsuit market amid a period of rapid transformation. Technological advances in materials and manufacturing, coupled with elevated sustainability imperatives, are reshaping product development paradigms. Meanwhile, the imposition of significant tariff measures in 2025 has underscored the strategic need for supply chain diversification and agile cost management.

Key segmentation insights reveal that product portfolios must span a spectrum of silhouettes-from full suits optimized for thermal protection to modular short johns and spring suits catering to warm-water and recreational use. Regional markets display distinct dynamics, with demand shaped by local climate, regulatory frameworks, and distribution channels. Leading companies are responding with differentiated strategies that emphasize eco-innovation, direct-to-consumer engagement, and collaborative R&D.

Looking forward, stakeholders that excel in integrating sustainable materials, leveraging digital platforms, and forging resilient supply networks will be well-positioned to outpace competitors. The path to market leadership rests on a balanced approach that prioritizes performance, environmental responsibility, and consumer-centric experiences. As industry participants refine their strategic plans, the insights presented here offer a roadmap for navigating uncertainty and unlocking long-term growth.

Engage With Ketan Rohom Associate Director Sales Marketing to Secure Exclusive Wetsuit Market Insights and Purchase the Comprehensive Research Report Today

If you’re seeking to deepen your understanding of the wetsuit market and make informed strategic decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He possesses an in-depth grasp of market dynamics, competitive landscapes, and emerging consumer trends that will empower your organization to stay ahead of the curve. Whether you aim to evaluate new product innovations, assess regional growth opportunities, or understand the implications of recent trade policies, Ketan can connect you with the comprehensive research report that delivers actionable insights and detailed analysis. Contact him today to secure your copy and unlock the competitive intelligence you need to drive success in the dynamic world of wetsuits

- How big is the Wetsuit Market?

- What is the Wetsuit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?