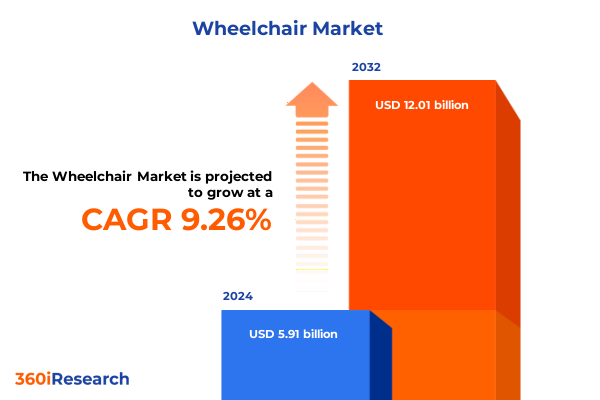

The Wheelchair Market size was estimated at USD 6.45 billion in 2025 and expected to reach USD 7.05 billion in 2026, at a CAGR of 9.27% to reach USD 12.01 billion by 2032.

Setting the Stage for a Comprehensive Examination of Emerging Mobility Trends and Technological Advancements in Wheelchair Solutions

In an era defined by unprecedented technological progress and evolving demographic needs, the wheelchair market stands at the crossroads of innovation and accessibility. The confluence of advanced engineering, digital connectivity, and shifting regulatory landscapes has elevated mobility devices from simple aids to intelligent platforms that enhance quality of life. This introduction lays the groundwork for understanding how factors such as product diversification, user profiles, and environmental considerations converge to shape demand and expectations across multiple stakeholder groups.

As populations age and chronic conditions become more prevalent, the imperative to deliver both basic and specialized mobility solutions has intensified. Manufacturers are responding by integrating cutting-edge materials, IoT-enabled features, and adaptive designs, while healthcare providers and end users alike are demanding greater ease of customization and seamless interoperability. By framing these dynamics in the broader context of policy changes, market accessibility, and emerging use cases, this section sets a clear foundation for the deeper analyses that follow.

Unveiling the Major Transformations Reshaping the Wheelchair Industry Landscape Across Products Users Environments and Technologies

The wheelchair industry is experiencing transformative shifts driven by breakthroughs in materials science, digital integration, and user-centric innovation. Advancements in titanium alloys and composite structures are delivering frames that combine exceptional strength with remarkable lightness, enabling greater portability without compromising durability. Simultaneously, the integration of sensors and smart-control algorithms has ushered in an era of cognitive mobility, where powered wheelchairs adapt to user patterns and environmental cues in real time.

Moreover, the rapid adoption of IoT-Connective platforms has created ecosystems where remote monitoring, predictive maintenance, and tele-rehabilitation are becoming increasingly commonplace. These developments not only enhance safety and reliability but also open up possibilities for novel service offerings and subscription-based models. As such, industry participants are compelled to rethink traditional value chains and partner across disciplines to deliver holistic, outcome-oriented solutions that extend beyond mere locomotion.

Analyzing the Multifaceted Implications of United States Tariffs on Wheelchair Supply Chains and Domestic Production Dynamics

In 2025, the United States implemented a series of targeted tariffs on imported wheelchair components and finished products, aiming to support domestic manufacturing and ensure supply chain resilience. The immediate effect was a noticeable increase in input costs for import-reliant manufacturers, which prompted a strategic reevaluation of sourcing policies. Companies that previously depended on overseas suppliers began to invest in onshore production capabilities, driving a modest resurgence of domestic fabrication hubs.

Over time, this tariff regime has fostered greater vertical integration, as manufactures seek to mitigate future exposure to trade policy volatility. R&D centers in North America have ramped up efforts to develop alternative materials and streamline assembly processes. However, the burden of higher component prices has also accelerated consolidation among smaller players, challenging their ability to compete against larger, vertically integrated firms. As the market calibrates to this new cost environment, industry leaders are exploring collaborative ventures and joint manufacturing ventures to balance tariff pressures with innovation incentives.

Delving into the Comprehensive Segmentation Framework Revealing Nuanced Market Drivers Across Products Users and Usage Scenarios

A nuanced understanding of the wheelchair market emerges when examining the interplay between product type, user demographics, usage contexts, technology, materials, distribution channels, end users, and applications. For instance, folding, lightweight, and standard manual wheelchairs address varying degrees of portability and affordability, while electric, heavy-duty, pediatric, and standing power wheelchairs cater to specialized therapeutic and mobility requirements. Similarly, adult, athlete, and pediatric user groups demand tailored seating designs, drive mechanisms, and safety features, reflecting distinct biomechanical and lifestyle considerations.

In different environments, indoor wheelchairs prioritize maneuverability and minimal footprint, whereas outdoor configurations-spanning all-terrain and beach models-emphasize rugged construction and traction control systems. Parallel to these, IoT-enabled and smart wheelchair categories integrate connectivity modules and machine-learning driven assistive functions to support both preventive care and seamless user experiences. Material considerations vary from aluminum’s balance of strength and weight to steel’s cost-effectiveness and titanium’s premium performance profile. Distribution pathways via medical supply stores and online retailers, and end-use settings ranging from home to hospitals and rehabilitation centers, further nuance the market landscape. Lastly, applications in personal mobility, physical therapy, and sports and recreation each call for specific ergonomic and performance attributes.

This comprehensive research report categorizes the Wheelchair market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- User Characteristics

- Usage Environment

- Technology Integration

- Material

- Sales Channel

- End User

- Application

Highlighting Regional Market Dynamics and Diverse Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific

Regionally, the wheelchair market demonstrates distinct growth trajectories shaped by demographic trends, reimbursement policies, and infrastructure development. In the Americas, aging populations and robust reimbursement frameworks drive demand for both basic and advanced mobility devices, while strong clinical research ecosystems accelerate the introduction of innovative therapeutic chairs. Urbanization in Latin America is also fueling interest in lightweight and easily transportable designs suited to densely populated environments.

Across Europe, the Middle East, and Africa, heterogeneous regulatory landscapes and varying purchasing power present both challenges and opportunities. Western European markets are leading in IoT-enabled and smart wheelchair adoption due to supportive policy incentives, whereas emerging economies in the Middle East are investing in ruggedized all-terrain models to expand accessibility in remote and desert regions. Africa’s focus on affordability is spurring growth in steel-structured manual chairs, often supplied through public-private partnerships and non-profit initiatives.

In the Asia-Pacific region, rapid industrialization, increasing healthcare budgets, and rising awareness of user-friendly mobility solutions are driving adoption. Countries such as Japan and South Korea are at the forefront of robotics-enhanced and standing power wheelchair technologies, while Southeast Asian nations are emerging as manufacturing hubs for cost-effective manual chairs, leveraging low-cost production bases and growing domestic demand.

This comprehensive research report examines key regions that drive the evolution of the Wheelchair market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Approaches of Leading Industry Stakeholders and Their Alliances Driving Innovation and Market Penetration

Key players in the wheelchair landscape are pursuing differentiated strategies to capture share and drive innovation. Established medical device manufacturers continue to invest heavily in R&D for advanced materials and smart integration, often forming alliances with technology firms to embed AI-driven assistive functions. At the same time, niche specialists focusing on pediatric or sports-oriented solutions are carving out profitable segments by delivering highly customized chairs with specialized seating and propulsion systems.

Strategic collaborations between global providers and regional distributors are becoming increasingly common, enabling rapid market entry and local customization of offerings. Companies investing in end-to-end service models-including telehealth consultations, remote diagnostics, and subscription-based maintenance-are gaining competitive advantage by fostering deeper customer engagement. In contrast, lower-cost manufacturers in emerging markets are leveraging scalable production and efficient supply chains to address affordability challenges, often partnering with NGOs and government agencies to expand reach into underpenetrated areas.

With the convergence of digital connectivity, materials innovation, and changing reimbursement policies, leading organizations are focused on forging ecosystems that encompass product, platform, and service layers. As the market evolves, those who can seamlessly integrate these dimensions while maintaining cost discipline are best positioned to outpace the competition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wheelchair market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 21st Century Scientific, Inc.

- Airchair

- Amylior Inc.

- Arcatron Mobility Private Limited

- Compass Health Brands

- Dr Trust by Nureca Limited

- Drive DeVilbiss Healthcare

- GF Health Products, Inc

- Golden Technologies

- Guangdong Kaiyang Medical Technology Group Co., Ltd.

- Hebei Manlu Medical Devices Co., Ltd.

- Honda Sun Co.,Ltd.

- Hoveround Corporation

- Inco Medical Technology Co., Ltd.

- Invacare Corporation

- Karman Healthcare, Inc.

- Laxmi Industries

- Levo AG

- Medline Industries, LP

- Merits Health Products

- MEYRA GmbH

- MRIequip.com, LLC

- Narang Medical Limited

- Newmatic Medical by MarketLab, Inc.

- Ottobock SE & Co. KGaA

- Permobil AB

- Pihsiang Machinery MFG. Co., LTD.

- Pride Mobility Products Corporation

- Satcon Medical

- Scewo AG

- Shanghai BangBang Robotics Co., Ltd.

- Shanghai Brother Medical Products Manufacturer Co., Ltd.

- Soul Mobility, Inc.

- Stryker Corporation

- Sunrise Medical (US) LLC

- United Seating and Mobility, LLC

Crafting a Balanced Playbook for Innovation Operational Resilience and Market Expansion in the Evolving Mobility Device Sector

As competition intensifies, industry leaders must adopt actionable strategies that balance innovation with operational efficiency. Prioritizing modular product architectures will enable faster customization across manual and powered wheelchair lines, reducing time to market and lowering production complexity. Concurrently, investing in localized manufacturing and assembly facilities can mitigate tariff-related cost pressures while improving supply chain resilience.

Embracing digital platforms for remote monitoring, tele-rehabilitation, and predictive maintenance will not only enhance user outcomes but also create recurring revenue streams. Partnerships with healthcare providers and patient advocacy groups should be reinforced to co-develop solutions that address real-world mobility challenges and promote higher reimbursement rates. Additionally, a dual focus on advanced materials for premium offerings and cost-effective steels for entry-level segments will help capture diverse user segments across regions.

Finally, expanding omnichannel distribution-integrating medical supply stores with robust online portals-will streamline the purchasing journey and improve service responsiveness. By executing these strategies in concert, companies can drive sustainable revenue growth, strengthen brand reputation, and secure leadership in the rapidly evolving wheelchair market.

Outlining Rigorous Multi-Source Research Techniques Ensuring Robust Data Integrity and Actionable Market Analysis

This research employs a multi-pronged methodology combining primary interviews with industry executives, healthcare professionals, and end users, alongside secondary analysis of publicly available data, patent filings, regulatory documents, and technology whitepapers. Quantitative insights are derived through proprietary databases that track historical product launches, material cost indices, and reimbursement trends, while qualitative perspectives are gathered via structured workshops and field observations in key regional markets.

Data validation protocols include cross-referencing tariff schedules, production statistics, and clinical trial registries to ensure consistency and accuracy. Market segmentation frameworks are tested through pilot surveys to refine definitions and cluster closely aligned user and application groups. Additionally, the study leverages scenario modeling to assess the impacts of policy changes and technology adoption rates under varying economic conditions. Together, these approaches offer a rigorous foundation for the insights and forecasts presented, ensuring that stakeholders can confidently apply findings to strategy development and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wheelchair market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wheelchair Market, by Product

- Wheelchair Market, by User Characteristics

- Wheelchair Market, by Usage Environment

- Wheelchair Market, by Technology Integration

- Wheelchair Market, by Material

- Wheelchair Market, by Sales Channel

- Wheelchair Market, by End User

- Wheelchair Market, by Application

- Wheelchair Market, by Region

- Wheelchair Market, by Group

- Wheelchair Market, by Country

- United States Wheelchair Market

- China Wheelchair Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Summarizing Critical Findings Highlighting Innovation Supply Chain Resilience and Segmentation Driving Future Mobility Market Success

In conclusion, the wheelchair market is poised for significant transformation as material innovations, digital connectivity, and evolving user demographics converge to redefine mobility solutions. Tariff-driven shifts in sourcing underscore the importance of supply chain agility, while segmentation insights reveal nuanced demands across products, users, and environments. Regional dynamics further highlight the need for tailored strategies that account for divergent regulatory, economic, and infrastructural contexts.

Looking ahead, success will hinge on the ability to integrate advanced functionalities with cost-effective manufacturing, supported by partnerships that bridge technology, healthcare, and distribution channels. Organizations that embrace modular design, invest in digital service platforms, and pursue balanced regional portfolios are best positioned to lead. Ultimately, the market’s trajectory will be shaped by those who deliver not only mobility but also enhanced quality of life through thoughtful innovation and collaborative ecosystems.

Empower Your Strategic Decisions with Direct Access to Executive-Level Insights and Customized Mobility Solutions Guidance

To explore the full potential of the wheelchair market and leverage our insights for strategic advantage, reach out to Associate Director, Sales & Marketing Ketan Rohom. His expertise and deep understanding of mobility trends can guide you through the nuances of product selection, regulatory impacts, and regional strategies. Engage with him to obtain the complete report, tailored dashboards, and supplementary data sets that will equip your organization to make data-driven decisions with confidence. Connect today to secure your access to the research that will drive growth and innovation in your mobility solutions portfolio.

- How big is the Wheelchair Market?

- What is the Wheelchair Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?