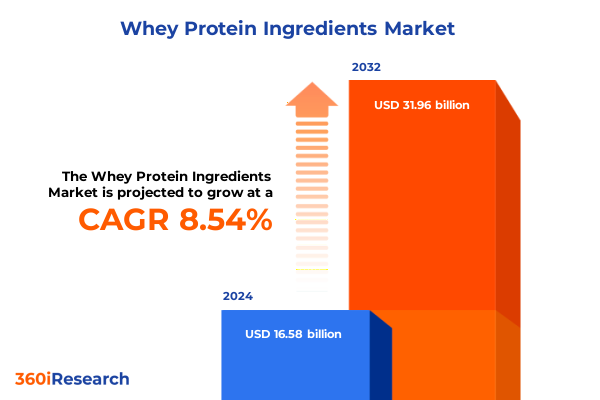

The Whey Protein Ingredients Market size was estimated at USD 18.00 billion in 2025 and expected to reach USD 19.35 billion in 2026, at a CAGR of 8.54% to reach USD 31.96 billion by 2032.

Setting the Stage for Comprehensive Understanding of Whey Protein Ingredients as Key Drivers in Nutritional Innovation and Industrial Applications

Whey protein has transformed from a byproduct of dairy processing into a cornerstone of nutritional innovation, driving both health-conscious consumption and industrial formulation. Its ascent can be traced to growing consumer awareness of protein’s role in muscle recovery, weight management, and overall well-being. As athletes, fitness enthusiasts, and mainstream consumers increasingly seek functional nutrition, whey protein ingredients have emerged at the forefront of product development.

Simultaneously, manufacturers have unlocked novel processing technologies and purification methods that yield protein concentrates, isolates, and hydrolysates with enhanced solubility, purity, and bioavailability. These advances have not only elevated product performance but have also expanded the application canvas beyond traditional sports nutrition, encompassing dairy analogs, fortified beverages, bakery formulations, and even personal care items. The growing emphasis on clean labels and transparency has further propelled demand for minimally processed, high-quality whey fractions.

Within this evolving environment, key stakeholders-from ingredient suppliers and contract manufacturers to brand owners and regulatory bodies-must navigate shifting consumer preferences, technological breakthroughs, and complex trade dynamics. This introduction sets the stage for a comprehensive exploration of market forces, strategic segmentation, and actionable insights essential for informed decision-making in the whey protein ingredients domain.

Examining the Key Technological Advancements and Consumer Behavior Shifts That Are Redefining the Whey Protein Ingredients Market Landscape and Value Chain

In recent years, the whey protein ingredients landscape has undergone transformative shifts fueled by both technological ingenuity and changing consumer behavior. One of the most significant advancements lies in enzymatic hydrolysis processes that deliver tailored peptide profiles, enhancing digestibility and accelerating the rate of muscle protein synthesis. This precision engineering of hydrolysates has opened doors to sports nutrition formulations with reduced allergenic potential and improved palatability, thereby attracting a broader demographic of health seekers.

Moreover, consumer trends have pivoted toward on-the-go convenience and functional snacking, prompting the rise of protein-enriched bars and ready-to-drink beverages. Innovations in micro-encapsulation and flavor masking have enabled manufacturers to maintain protein integrity while delivering taste profiles that rival indulgent snacks. Sustainability considerations are also reshaping procurement strategies, with an increasing number of suppliers integrating farm-to-fork traceability systems and zero-waste processing techniques.

In parallel, digital transformation is empowering data-driven optimization across the supply chain. From real-time quality monitoring to predictive yield forecasting, companies are leveraging artificial intelligence and advanced analytics to improve operational efficiency and reduce costs. These converging trends-from advanced fractionation and consumer-centric product formats to eco-friendly practices and Industry 4.0 integration-are collectively redefining how whey protein ingredients are produced, marketed, and consumed.

Analyzing the Cascading Effects of 2025 United States Tariff Measures on Whey Protein Ingredient Supply Chains, Cost Structures, and Industry Dynamics

The introduction of tariff hikes by the United States in early 2025 has reverberated across the whey protein ingredients ecosystem, leading to cascading effects on supply chains and cost structures. Imported concentrates and isolates are now subject to heightened duties, prompting domestic manufacturers to reassess sourcing strategies and negotiate new supplier contracts. These adjustments have, in many instances, led to elevated landed costs for end users, particularly in segments reliant on high-purity isolates for premium product positioning.

Furthermore, the cumulative impact of these measures has intensified competition among global exporters seeking to maintain market share. Some have absorbed a portion of the additional fees to protect customer relationships, while others have redirected volumes toward more favorable markets. Consequently, price volatility has increased, challenging contract manufacturers and brand owners to hedge risks through diversified supplier portfolios and long-term purchase agreements.

The regulatory environment is equally complex, as several imported ingredient batches are now subject to enhanced customs scrutiny and extended clearance times. To mitigate the risk of disruption, stakeholders are investing in advanced trade-compliance platforms and forging strategic alliances with logistics providers. Despite short-term cost pressures, these adaptations are fostering heightened supply-chain resilience and encouraging innovation in localized whey processing capabilities, thereby laying the groundwork for a more robust domestic ecosystem.

Revealing Segmentation Insights Across Types, Forms, Applications and Distribution Channels to Unveil Strategic Opportunities in Whey Protein Ingredients

A nuanced understanding of market segmentation reveals where strategic opportunities lie across multiple dimensions. When examining product types, whey protein concentrate remains a workhorse ingredient valued for its balance of protein content and cost efficiency, while whey protein isolate commands a premium due to its high protein purity and minimal lactose content. Whey protein hydrolysate, with its rapid absorption kinetics, is increasingly incorporated into specialized formulations targeting advanced sports nutrition and clinical health applications.

Formulation trends further illustrate how product forms dictate application potential. Protein-infused bars leverage concentrated and isolate forms to deliver convenient servings, whereas liquid formats-including concentrate blends and ready-to-drink systems-cater to immediate consumption needs. Fine-tuned powder offerings, both flavored and unflavored, allow brand owners to innovate across home-mix nutrition, bakery enhancements, and functional beverage powders.

Application segmentation underscores broad usage across diverse end-markets. Animal feed applications harness whey fractions in aquaculture feed to promote growth rates and in pet food to support muscle maintenance. Dietary supplements prioritize isolates and hydrolysates for targeted wellness outcomes. In food and beverage, whey proteins enrich bakery and confectionery for improved texture, bolster beverages for protein content, and enhance dairy products with superior emulsification. Personal care formulations exploit the bioactive peptides in skincare serums and hair treatments, highlighting the versatility of whey protein ingredients.

Distribution channels chart the evolving pathways for market access. Traditional offline channels such as pharmacies, specialty stores, and supermarkets and hypermarkets continue to serve health-focused segments, while e-commerce platforms and manufacturer direct sales offer streamlined purchasing and tailored product bundles. This multifaceted segmentation landscape empowers companies to pinpoint high-growth niches and align their go-to-market strategies accordingly.

This comprehensive research report categorizes the Whey Protein Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- Distribution Channel

Mapping Regional Demand Drivers and Market Dynamics Across the Americas, EMEA and Asia-Pacific in the Evolving Whey Protein Ingredients Landscape

Regional dynamics play a pivotal role in shaping the demand and supply landscape for whey protein ingredients. In the Americas, rising health and fitness consciousness, coupled with robust sports nutrition cultures in North America and emerging wellness trends in Latin America, drive consumption of high-purity isolates and hydrolysates. Infrastructure investments by key dairy players in the region facilitate streamlined processing, while trade agreements influence the flow of imports and exports.

Across Europe, the Middle East and Africa, diverse regulatory frameworks and dietary preferences create a heterogeneous market environment. Western European markets place a premium on clean-label, organic-certified protein ingredients, whereas Middle Eastern consumers display growing appetite for functional dairy alternatives. In Africa, the burgeoning middle class and urbanization trends are gradually opening new avenues for protein-fortified foods, albeit with logistical and affordability challenges.

In the Asia-Pacific region, exponential growth is driven by increasing disposable incomes and expanding nutraceutical sectors in countries such as China, India and Australia. Manufacturers are focusing on the development of flavored powders and ready-to-consume solutions to cater to local taste profiles. At the same time, efforts to enhance cold-chain infrastructure and meet stringent quality standards are fostering collaborations between multinational producers and regional stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Whey Protein Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Competitive Positioning, and Innovation Efforts by Leading Companies Shaping the Whey Protein Ingredients Market Trajectory

Leading players in the whey protein ingredients arena are deploying strategic initiatives that underscore their competitive positioning. Major dairy cooperatives are investing in facility expansions and capacity upgrades to meet rising demand for isolates and hydrolysates, while independent specialty ingredient firms focus on niche, high-margin applications such as bioactive peptide extraction. Some firms are forging joint ventures with biotechnology startups to accelerate R&D in next-generation fractionation processes.

Innovation pipelines reflect an emphasis on sustainability, with several companies rolling out carbon-neutral production methods and implementing water-recycling technologies to minimize environmental footprint. Partnerships with research institutions are yielding proprietary blends that target specific health concerns, such as gut health and immune support, thereby creating differentiated value propositions in an increasingly crowded market.

On the commercial front, forward-looking firms are refining their digital marketing and e-commerce capabilities to engage direct-to-consumer segments. Strategic acquisitions have reinforced geographical footprints and enriched product portfolios, enabling these companies to serve a broad spectrum of industries-from pet food manufacturers to premium cosmetics brands. Together, these concerted efforts illustrate how top contenders are leveraging operational excellence, R&D prowess, and customer intimacy to shape the future of whey protein ingredients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Whey Protein Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agropur Cooperative

- Arla Foods amba

- Bongrain S.A.

- Carbery Group

- Davisco Foods International Inc.

- DMK Group

- Erie Foods International Inc.

- Fonterra Co-operative Group Limited

- FrieslandCampina

- Glanbia plc

- Grande Custom Ingredients Group

- Havero Hoogwegt Group

- Hilmar Ingredients

- Ingredia SA

- Kerry Group plc

- Lactalis Ingredients

- Land O'Lakes Inc.

- Leprino Foods Company

- Milk Specialties Global

- Murray Goulburn Co-operative Co. Limited

- Saputo Inc.

- Tatura Milk Industries Ltd.

- Volac International Ltd.

- Warrnambool Cheese and Butter Factory

Guiding Industry Leaders to Capitalize on Emerging Trends, Enhance Value Chain Efficiency and Elevate Competitive Positioning in Whey Protein

To capitalize on the momentum within the whey protein ingredients sector, industry leaders should pursue a multi-pronged strategy. First, investing in flexible processing technologies can enable rapid transition between concentrate, isolate, and hydrolysate production based on shifting market demand. Secondly, building resilient supplier networks-both domestic and international-will help mitigate the impact of trade policy fluctuations and logistical disruptions.

Furthermore, emphasizing product differentiation through patented peptide profiles and clean-label certifications can support premium pricing strategies. Collaborations with flavor houses and texturizing agents will enhance consumer appeal across bars, liquids, and powders. At the same time, optimizing value chain efficiencies-through integrated quality control platforms and real-time analytics-can drive cost reduction and ensure consistent product performance.

Finally, forging closer partnerships with brand owners in adjacent industries such as sports nutrition, functional beverages, and personal care will unlock co-development opportunities. By aligning research roadmaps with evolving consumer demands and regulatory requirements, companies can accelerate time-to-market and reinforce their leadership credentials. Adopting these targeted recommendations will position stakeholders to thrive amid competitive intensity and technological disruption.

Outlining Rigorous Research Methodology and Data Collection Framework Employed to Analyze Market Dynamics, Competitive Landscapes and Industry Trends

The research methodology underpinning this analysis integrates qualitative and quantitative approaches to ensure a holistic perspective. Initial secondary research comprised an extensive review of trade journals, technical papers, and regulatory filings to map current processing technologies, product innovations, and policy changes. This phase established the groundwork for understanding broader industry narratives and identifying key data gaps.

Subsequently, primary research was conducted via in-depth interviews with supply chain executives, R&D leaders, and sales directors across ingredient firms, contract manufacturers, and brand owners. These discussions provided granular insights into operational challenges, procurement strategies, and future roadmap priorities. Data triangulation was achieved by comparing interview findings with publicly available company reports and technical white papers.

Quantitative datasets-covering production volumes, import-export flows, and capacity expansions-were analyzed through advanced statistical models to discern trend patterns and correlations. A rigorous validation process involved peer review by subject-matter experts, ensuring that the insights presented are both reliable and actionable. This robust methodology provides a transparent framework for decision-makers to assess market dynamics and evaluate strategic options.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Whey Protein Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Whey Protein Ingredients Market, by Type

- Whey Protein Ingredients Market, by Form

- Whey Protein Ingredients Market, by Application

- Whey Protein Ingredients Market, by Distribution Channel

- Whey Protein Ingredients Market, by Region

- Whey Protein Ingredients Market, by Group

- Whey Protein Ingredients Market, by Country

- United States Whey Protein Ingredients Market

- China Whey Protein Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights to Illuminate Strategic Imperatives and Future Pathways for Stakeholders in the Whey Protein Ingredients Ecosystem

The collective insights presented underscore the dynamic evolution of whey protein ingredients from their roots in traditional dairy processing to multifaceted applications across nutrition, personal care, and animal feed. Technological advancements in fractionation and hydrolysis have expanded product possibilities, while shifting consumer behaviors and regulatory landscapes have introduced both opportunities and challenges.

Despite the headwinds posed by tariff adjustments and supply chain complexities, the sector demonstrates remarkable adaptability. Stakeholders who leverage segmentation insights-spanning type, form, application, and distribution channel-can pinpoint high-growth niches and tailor their offerings for maximal impact. Regional considerations further highlight the need for localized strategies that address unique market drivers in the Americas, EMEA and Asia-Pacific.

Looking ahead, those who invest in sustainable production methods, collaborative innovation, and resilient supply networks will be best positioned to capture emerging demand. The convergence of advanced analytics, clean-label credentials, and consumer-centric formulations signals an era of continued expansion and diversification, offering a roadmap for strategic excellence within the whey protein ingredients ecosystem.

Empowering Informed Decisions to Secure the Whey Protein Ingredients Report with Ketan Rohom for Unparalleled Market Intelligence

We invite you to elevate your strategic planning and operational execution by securing the comprehensive market research report. Engage with Ketan Rohom, Associate Director, Sales & Marketing, to discuss tailored insights and exclusive findings that can fortify your competitive edge. His expertise will guide you through the nuances of the data, ensuring that you extract maximal value from the analysis. Reach out today to acquire the definitive resource for navigating the complexities and opportunities within the whey protein ingredients sector.

- How big is the Whey Protein Ingredients Market?

- What is the Whey Protein Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?