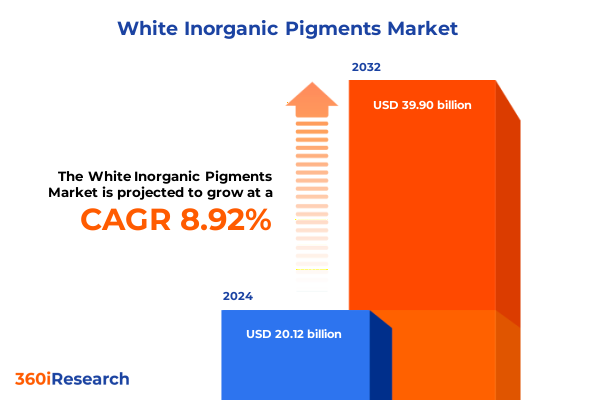

The White Inorganic Pigments Market size was estimated at USD 21.83 billion in 2025 and expected to reach USD 23.69 billion in 2026, at a CAGR of 8.99% to reach USD 39.90 billion by 2032.

A Strategic Overview of White Inorganic Pigments Highlighting Key Industry Drivers Technological Trends and Emerging Market Dynamics

The white inorganic pigment sector has evolved into a foundational component of modern manufacturing and design, underpinning applications from architectural coatings to high-performance ceramics. As global industries intensify their focus on material innovation and environmental compliance, white pigments have demonstrated remarkable versatility and stability. This introduction sets the stage for a deeper exploration of the market’s defining attributes, framing the strategic influences that are reshaping supply chains, production processes, and end-user applications.

Through an integrated lens, this section illuminates the driving forces behind the sector’s expansion, highlighting technological advancements in pigment synthesis alongside emerging sustainability imperatives. In particular, the increasing demand for high-opacity, UV-resistant materials has accelerated research into novel formulations and purity enhancements. By understanding these core dynamics, decision-makers can better appreciate both the opportunities and challenges that accompany the pursuit of performance excellence and regulatory alignment in white inorganic pigments.

Exploring Pivotal Industry Transformations Driven by Sustainable Innovations Shifting Value Chains and Novel Material Technologies

In recent years, the white inorganic pigment landscape has undergone transformative shifts driven by the convergence of regulatory pressures and technological innovation. Stricter environmental standards have prompted companies to reevaluate traditional manufacturing processes, investing heavily in cleaner production methods that reduce emissions and energy consumption. Concurrently, advances in nanotechnology and surface functionalization have unlocked new avenues for enhancing opacity, weather resistance, and dispersibility, positioning white pigments as critical enablers of next-generation coatings and composite materials.

Moreover, the value chain has experienced notable realignment as strategic partnerships emerge between chemical producers, equipment suppliers, and end users. This collaborative trend fosters a deeper integration of research and development efforts, accelerating the commercialization of specialty grades that meet exacting performance requirements. As a result, stakeholders are better equipped to respond to shifting consumer preferences for eco-friendly products while capitalizing on novel material properties that drive differentiation in competitive markets.

Assessing the Comprehensive Effects of 2025 US Tariff Policies on Supply Chains Cost Structures and Global Competitiveness in the White Pigment Sector

The imposition of new US tariff policies in 2025 has introduced significant complexities into the white inorganic pigment supply chain, affecting cost structures, sourcing strategies, and international trade flows. By increasing duties on select raw materials and intermediate products, manufacturers have encountered elevated input costs that reverberate throughout their downstream operations. This policy shift has compelled many organizations to reevaluate their procurement networks and explore alternative suppliers in regions with more favorable trade arrangements.

In response, forward-looking companies are investing in localized production capabilities and backward integration to mitigate tariff exposure and enhance supply chain resilience. These strategic moves not only reduce vulnerability to future policy fluctuations but also improve control over quality and logistics. As the industry adapts, the cumulative impact of tariff adjustments underscores the importance of agile operational frameworks and diversified sourcing strategies to maintain competitive positioning in a rapidly evolving global market.

Unveiling Critical Market Insights Through Detailed Segmentation Across Pigment Types Applications End-User Industries Physical Forms and Product Grades

A nuanced understanding of segment-level performance is essential for capitalizing on growth opportunities within the white inorganic pigment market. When examining pigment types, distinctions among antimony oxide, titanium dioxide, zinc oxide, and zinc sulfide reveal differentiated applications and margin profiles. Titanium dioxide, in particular, merits special attention as its anatase and rutile forms exhibit unique optical properties tailored to high-opacity coatings and specialized industrial uses.

Similarly, application-based segmentation highlights the critical roles that coatings and paints, construction materials, inks and printing, paper and packaging, and plastics play in driving volume demand. Within coatings and paints, the segmentation into architectural, automotive, industrial, and powder coatings underscores the diverse performance requirements across interior, exterior, and specialty formulations. The plastics segment further refines opportunity spaces among polyethylene, polypropylene, and polyvinyl chloride, each demanding tailored pigment dispersions for optimized color consistency and stability.

End-user industry insights provide additional clarity: automotive sectors rely on both aftermarket and OEM channels for maintenance and factory-finished components, while construction, consumer goods, electrical and electronics, and textiles each impose unique criteria for durability, heat resistance, and regulatory compliance. The electrical and electronics subsegment of ceramics and photovoltaics underscores emerging demand for white pigments that facilitate energy capture and device insulation.

Beyond application and end-user divisions, the physical form of pigments-whether dispersion, granules, or powder-impacts handling, mixing behavior, and formulation ease. Equally important is product grade differentiation: food grade, industrial grade, pharmaceutical grade, and solar grade classifications ensure that purity, particle size distribution, and trace metal content align with stringent safety and performance standards. Together, these segmentation layers provide a comprehensive blueprint for targeted product development and go-to-market strategies.

This comprehensive research report categorizes the White Inorganic Pigments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pigment Type

- Physical Form

- Product Grade

- Application

- End-User Industry

Delivering Targeted Regional Perspectives Highlighting the Americas EMEA and Asia-Pacific Markets within the White Inorganic Pigment Landscape

Regional dynamics within the white inorganic pigment landscape reveal differentiated growth trajectories shaped by local demand drivers, regulatory frameworks, and supply chain efficiencies. In the Americas, strong infrastructure investment and a mature coatings sector create favorable conditions for high-purity titanium dioxide and specialty zinc oxide products. North American manufacturers benefit from established raw material sources while responding to sustainability mandates that emphasize reduced carbon footprints and circular economy principles.

Over in Europe, the Middle East, and Africa, a complex interplay of environmental regulations and construction booms sustains robust demand for versatile white pigments. The region’s tightening chemical safety standards encourages the adoption of advanced pigment formulations that minimize heavy metal content and enhance recyclability. Conversely, in parts of the Middle East and Africa, expanding industrialization and urbanization drive baseline volume growth for standard-grade pigments.

Asia-Pacific remains a focal point for capacity expansion, underpinned by aggressive manufacturing and infrastructure projects. Rapidly growing economies in China, India, and Southeast Asia are investing heavily in paint and plastics production, elevating the consumption of dispersion and powder forms of white pigments. Concurrently, government initiatives aimed at boosting renewable energy deployment bolster the solar grade segment, with titanium dioxide playing a critical role in reflective coatings for photovoltaic installations.

This comprehensive research report examines key regions that drive the evolution of the White Inorganic Pigments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Innovations Collaborations and Strategic Initiatives Shaping the Competitive Landscape of White Inorganic Pigments

An evaluation of key players reveals an increasingly competitive arena where strategic investments, innovative product launches, and collaborative ventures define market leadership. Companies that prioritize vertical integration-securing raw material mines and establishing in-house processing facilities-demonstrate improved cost control and quality assurance, positioning themselves advantageously amid tariff-induced uncertainties.

Strategic collaborations between pigment producers and research institutions have accelerated the commercialization of functionalized surface treatments, enabling enhanced dispersibility and reduced energy consumption during manufacturing. Additionally, mergers and acquisitions among mid-tier suppliers are reshaping the competitive map, facilitating geographic expansion and portfolio diversification.

Leading stakeholders are also differentiating through sustainability credentials, securing eco-label certifications and committing to carbon-neutral production targets. In doing so, these companies cater to end users who prioritize green building materials and low-VOC coatings. The convergence of financial discipline, technological innovation, and environmental stewardship underscores the evolving playbook for companies seeking to maintain or elevate their market positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the White Inorganic Pigments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altana AG

- BASF SE

- Cabot Corporation

- Clariant AG

- Cristal Global

- DIC Corporation

- Ferro Corporation

- Heubach GmbH

- Huntsman Corporation

- Ishihara Sangyo Kaisha, Ltd.

- KRONOS Worldwide, Inc.

- LANXESS AG

- Lomon Billions Group

- Sudarshan Chemical Industries Ltd.

- Tayca Corporation

- The Chemours Company

- Tronox Holdings plc

- Venator Materials PLC

Strategic Action Steps for Industry Leaders to Capitalize on Innovation Trends Optimize Supply Chains and Enhance Sustainable Practices

To navigate the evolving white inorganic pigment landscape successfully, industry leaders should consider several strategic priorities. First, investing in R&D collaborations that focus on advanced surface treatments and nanoparticle stabilization can unlock performance enhancements that differentiate products in competitive end markets. Such innovation partnerships not only accelerate time-to-market but also distribute development risk across multiple stakeholders.

Second, optimizing supply chains by establishing regional production hubs and forging strategic alliances with raw material suppliers can mitigate tariff impacts and logistical bottlenecks. By adopting lean manufacturing principles and leveraging digital supply chain monitoring tools, companies can improve operational agility and cost efficiency.

Third, embedding sustainability at the core of product development ensures compliance with emerging environmental regulations while resonating with customers who demand eco-conscious solutions. Companies that implement closed-loop water systems, renewable energy integration, and waste valorization practices will be better positioned to meet stringent ESG criteria and capture premium pricing tiers.

Finally, cultivating a customer-centric approach-supported by tailored technical service offerings and digital engagement platforms-enhances adoption rates and fosters long-term partnerships. Personalized training programs and data-driven formulation support can elevate brand loyalty and create barriers to entry for new competitors.

Outlining a Robust Methodological Framework Ensuring Rigorous Data Collection Analysis and Validation for White Pigment Market Research

The research methodology underpinning this analysis combines primary and secondary data sources with rigorous validation and cross-referencing procedures. Primary research entailed in-depth interviews with executives, technical specialists, and procurement managers across multiple regions to capture nuanced perspectives on market drivers, technology adoption, and regulatory impacts. Secondary research involved comprehensive reviews of industry publications, patent databases, and regulatory filings to contextualize findings within broader macroeconomic and environmental trends.

Quantitative data collection was executed using structured surveys targeting defined segments, ensuring demographic and geographic representation aligned with the market’s diverse composition. Qualitative insights were enriched through case studies of leading manufacturers, enabling a deeper understanding of best practices in process optimization and sustainability management. All data points were subjected to triangulation, with cross-validation against independent third-party data repositories and trade association statistics to minimize bias and enhance reliability.

This methodological framework ensures that conclusions and recommendations are grounded in robust, multi-dimensional evidence, providing stakeholders with confidence in the strategic insights and actionable guidance derived from this study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our White Inorganic Pigments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- White Inorganic Pigments Market, by Pigment Type

- White Inorganic Pigments Market, by Physical Form

- White Inorganic Pigments Market, by Product Grade

- White Inorganic Pigments Market, by Application

- White Inorganic Pigments Market, by End-User Industry

- White Inorganic Pigments Market, by Region

- White Inorganic Pigments Market, by Group

- White Inorganic Pigments Market, by Country

- United States White Inorganic Pigments Market

- China White Inorganic Pigments Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings Reinforcing the Strategic Value and Long-Term Implications of White Inorganic Pigment Advancements

In synthesizing the findings, several overarching themes emerge that underscore the strategic value of white inorganic pigments. Technological advancements in surface modification and nanoscale engineering are redefining product capabilities, fostering applications in high-performance coatings, energy technologies, and specialty plastics. At the same time, policy shifts-particularly new tariff structures and environmental regulations-underscore the necessity of agile operational strategies and diversified sourcing networks.

Moreover, segmentation analysis illuminates the multifaceted nature of demand drivers across pigment types, applications, end-user industries, physical forms, and product grades, guiding targeted investment and product development decisions. Regional insights further refine the strategic roadmap, revealing distinct growth pockets and regulatory nuances in the Americas, EMEA, and Asia-Pacific. Finally, the competitive landscape analysis highlights the imperative for companies to combine innovation, vertical integration, and sustainability credentials to maintain market leadership.

Collectively, these insights establish a cohesive narrative that equips decision-makers with a clear understanding of current dynamics and future opportunities. Through this comprehensive exploration, industry participants can formulate robust strategies that align with technological trends, regulatory frameworks, and customer expectations, thereby driving long-term value creation.

Engage with Ketan Rohom to Access the Comprehensive White Inorganic Pigment Report Equipping Your Team with Strategic Insights and Exclusive Market Analysis

To gain a competitive edge and secure unparalleled strategic guidance, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) today. Our comprehensive white inorganic pigment market research report synthesizes critical insights, advanced segmentation analyses, and forward-focused recommendations. By connecting with Ketan, your team can access proprietary data visualizations, gain exclusive perspectives on tariff dynamics and regional variations, and benefit from tailored consultation on harnessing emerging material technologies. Don’t miss the opportunity to transform your decision-making process and drive innovation; engage with Ketan Rohom now to secure your copy of this essential report.

- How big is the White Inorganic Pigments Market?

- What is the White Inorganic Pigments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?