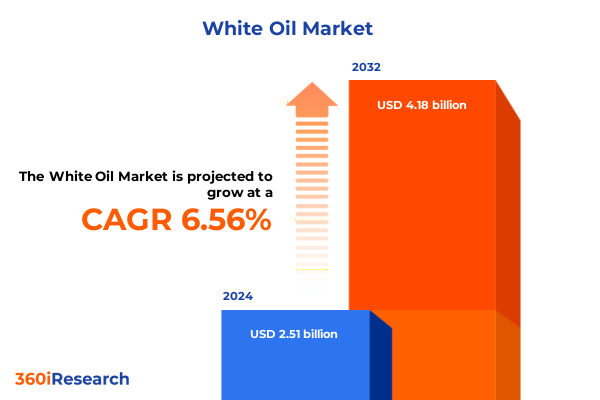

The White Oil Market size was estimated at USD 2.66 billion in 2025 and expected to reach USD 2.81 billion in 2026, at a CAGR of 6.68% to reach USD 4.18 billion by 2032.

Understanding the Evolving Dynamics of the White Oil Market Landscape and the Fundamental Forces Driving Its Growth Across Multiple Industrial Sectors

White oil, often referred to as mineral oil, stands at the crossroads of industrial functionality and consumer safety, offering unparalleled chemical stability and purity. Derived from high-purity petroleum through advanced refining processes, this colorless and odorless product has become indispensable across diverse end-use sectors. Over recent years, the demand for white oil has expanded beyond its traditional lubricant role to encompass personal care formulations, pharmaceutical excipient functions, and even food-grade applications.

The driving forces behind this evolution include heightened regulatory scrutiny, especially around product purity and safety standards. As global regulations tighten concerning contamination, manufacturers have prioritized investment in precision refining technologies to meet stringent compliance thresholds. Simultaneously, shifts in consumer preferences toward high-performance and clean-label products have reinforced white oil’s relevance in cosmetic and pharmaceutical applications. These factors have instigated a continuous cycle of innovation, pushing producers to enhance molecular uniformity while ensuring cost efficiency and supply reliability.

Moreover, the interplay of global trade dynamics and sustainability imperatives underscores the strategic importance of white oil within supply chains. With emerging economies bolstering their manufacturing capacities and Western markets focusing on higher-value formulations, industry stakeholders are presented with both geographic and functional growth vectors. As such, understanding the fundamentals of white oil’s chemical attributes, regulatory landscape, and application versatility becomes paramount for decision-makers seeking to capitalize on these diversified opportunities.

Identifying the Major Technological Shifts Operational Transformations and Sustainability Trends Redefining the Competitive White Oil Industry Landscape

The white oil market is undergoing transformative shifts propelled by technological advancements and heightened sustainability mandates. Innovations in refining techniques, such as the integration of catalytic dewaxing and hydrocracking, have significantly improved product consistency and reduced polycyclic aromatic hydrocarbon (PAH) content, thereby aligning more closely with regulatory thresholds and customer expectations.

Simultaneously, a growing emphasis on circular economy principles has prompted manufacturers to invest in solvent recovery systems and closed-loop refining solutions. These initiatives not only minimize environmental footprint but also elevate cost competitiveness by reclaiming valuable feedstocks. In parallel, bio-derived feedstocks and hybrid formulations are rapidly emerging as viable alternatives, catering to end users seeking renewable and traceable ingredients without compromising on performance.

Digital transformation also plays a pivotal role. Advanced process analytics and real-time monitoring frameworks help maintain tight viscosity and purity tolerances, enabling quicker adjustments and lower waste rates. Furthermore, the adoption of predictive maintenance empowered by IoT sensors ensures uninterrupted supply, a critical factor for end-use industries that rely on consistent lubrication and pharmaceutical-grade oil supplies.

As sustainability regulations and customer demands converge, the industry is witnessing unprecedented collaboration between refining technology providers, additive formulators, and end-use brand owners. This collective drive toward cleaner processes, coupled with data-driven operational insights, is reshaping the competitive landscape and setting new benchmarks for quality, reliability, and ecological stewardship.

Assessing the Comprehensive Impact of United States Tariff Policies Introduced in 2025 on Supply Chains Pricing Structures and Market Dynamics

In 2025, the United States implemented a series of tariff measures targeting imported white oil to bolster domestic production and address trade imbalances. These levies, ranging across different purity grades and volumes, have reshaped supply chains, compelling global suppliers and downstream consumers to recalibrate sourcing strategies.

The most immediate consequence has been an uptick in landed costs for importers, prompting multinational manufacturers to reassess their procurement portfolios. Faced with higher import expenses, several end users have explored partnerships with domestic refiners, spurring capacity expansions at local facilities. This shift not only diversifies sourcing but also mitigates exposure to fluctuating tariff regimes.

In tandem, some global suppliers have redirected export volumes to alternative markets with more favorable trade terms, such as Southeast Asia and the Middle East. This reorientation has eased pressure on regional supply but introduced greater volatility in global distribution networks. Downstream industries, notably cosmetics and pharmaceuticals, have felt margin pressures as they adapt formulations and renegotiate supplier contracts to absorb increased input costs.

Over time, the tariff environment has catalyzed a broader strategic pivot toward vertical integration and greater supply chain transparency. Companies are investing in end-to-end tracking systems to optimize import routes and ensure uninterrupted access to critical grades. As market participants adjust to this new trade landscape, the emphasis on agility and resilience has become a defining element of competitive advantage.

Delivering In-Depth Segmentation Insights Covering Application End Use Industry Grade Viscosity and Distribution Channel Nuances Driving Product Customization

A nuanced understanding of white oil segmentation reveals the intricate ways in which product differentiation drives strategic positioning. When examining applications, the cosmetics segment spans hair care, makeup and skin care, while mechanical usage encompasses gear lubrication, hydraulic fluids and metal forming, and pharmaceutical applications cover injectable, oral and topical drug formulations. Each application category demands specialized purification protocols and performance characteristics, prompting suppliers to tailor production lines accordingly.

End use industries further refine these applications, with automotive clients demanding consistent thermal stability for high-temperature environments, cosmetic brands valuing transparency and sensory neutrality, food processors requiring food-grade certifications, and pharmaceutical companies prioritizing USP-grade compliance. Plastics manufacturers, too, leverage technical grade oils as process aids in extrusion and molding, underscoring the breadth of industrial reliance on precise formulation standards.

Grade differentiation-ranging from electronic grade, with ultra-low impurity thresholds for semiconductor processes, to food grade suited for direct contact with consumables, alongside technical and USP grades-reflects the critical interplay between end-market regulations and white oil specifications. Viscosity tiers, spanning low, medium and high ranges, further influence suitability across lubrication, heat transfer and encapsulation functions, shaping inventory and distribution frameworks.

Lastly, the choice of distribution channel-whether direct sales agreements, distributor networks or online platforms-impacts lead times, service levels and cost structures. Suppliers that align their channel strategies with regional demand patterns and end-user priorities often secure stronger market footholds, demonstrating the strategic value of segmentation-driven insights.

This comprehensive research report categorizes the White Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Viscosity

- Application

- End Use Industry

- Distribution Channel

Highlighting Key Regional Demand Drivers in the Americas Europe Middle East Africa and Asia-Pacific to Inform Strategic Market Entry and Expansion Approaches

Regional dynamics play a pivotal role in shaping white oil consumption profiles and strategic market entry decisions. In the Americas, demand is anchored by a robust automotive manufacturing base and a mature personal care sector that prioritizes high-purity formulations for skin care and cosmetics. Regulatory clarity around food-grade and pharmaceutical-grade oils also supports downstream industries, enabling more streamlined product development cycles and reducing time to market.

Across Europe, Middle East & Africa, stringent environmental and safety regulations drive the adoption of advanced refining processes and encourage the shift toward low-PAH white oil grades. Many governments in these regions provide incentives for sustainable production practices, prompting suppliers to integrate greener technologies and circular approaches. Moreover, the presence of both large-scale industrial hubs and emerging markets within this vast territory creates diverse demand pockets, requiring tailored approaches for compliance, pricing and distribution.

The Asia-Pacific region emerges as the fastest-growing market segment, with expanding automotive, food processing and pharmaceutical manufacturing capacities in countries such as China and India. This growth is complemented by burgeoning consumer markets in Southeast Asia, where cosmetic brands increasingly source high-grade white oils for premium personal care offerings. Distribution strategies here often emphasize hybrid models that blend direct partnerships with digital commerce channels to capture both B2B and B2C opportunities effectively.

Understanding regional regulatory landscapes, infrastructure capabilities and evolving end-user requirements is critical for suppliers looking to optimize their investments and capture long-term growth. Customizing product portfolios and channel strategies to these geographic nuances offers a clear path to sustainable advantage.

This comprehensive research report examines key regions that drive the evolution of the White Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering the Strategic Initiatives Collaborations and Innovation Portfolios of Leading White Oil Producers Shaping the Competitive Landscape

Global white oil producers have been at the forefront of strategic initiatives to solidify their market leadership and respond to evolving customer needs. Leading oil majors have formed joint ventures with specialty chemical firms to co-develop next-generation purification catalysts and additive packages that enhance product performance. Meanwhile, companies with a strong presence in Asia have pursued capacity expansions to serve rapidly growing local markets while hedging against tariff-induced disruptions.

Some producers are integrating sustainability into their core strategies, investing in carbon-neutral manufacturing plants powered by renewable energy sources. These efforts not only reduce environmental impact but also appeal to downstream partners seeking to meet their own ESG commitments. In parallel, proprietary research centers dedicated to molecular characterization techniques enable manufacturers to offer customized white oil grades with traceable quality metrics.

Mergers and acquisitions remain a key theme, as larger players absorb regional refiners to broaden their geographic reach and streamline supply chains. Such consolidations often yield operational synergies and create multi-regional distribution platforms capable of serving diverse end industries. At the same time, smaller specialty producers differentiate through niche offerings, such as ultra-high viscosity oils for demanding mechanical applications or pharmaceutical excipients designed for biologic formulations.

Collaboration with end-user brands through co-innovation programs is also gaining momentum. By engaging directly in formulation trials and application testing, producers can fast-track product modifications and deliver value-added service models, thereby strengthening customer loyalty and driving incremental revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the White Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BP p.l.c

- Calumet Specialty Products Partners, L.P.

- Chevron Corporation

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- H&R GmbH & Co. KG

- Nynas AB

- PT Pertamina (Persero)

- Repsol S.A.

- Royal Dutch Shell plc

- TotalEnergies SE

Proposing Actionable Recommendations for Industry Leaders to Capitalize on Market Opportunities and Navigate Challenges in the Evolving White Oil Ecosystem

To navigate an increasingly complex and competitive white oil market, industry leaders should prioritize supply chain resilience by diversifying feedstock sources and establishing strategic partnerships with regional refiners. Investing in adaptive refining technologies-such as modular hydrocracking units-will enable rapid grade adjustments and lower capital expenditure risks. Furthermore, integrating advanced data analytics into operations can uncover inefficiencies, forecast maintenance needs and optimize inventory management.

Sustainability must be elevated from a compliance requirement to a growth driver. Companies should pursue renewable feedstock trials and pilot closed-loop solvent recovery systems to reduce emissions and enhance resource utilization. These initiatives can unlock new revenue streams by differentiating offerings in eco-conscious end markets such as clean-label cosmetics and organic personal care.

Digital engagement strategies are equally critical. By leveraging online platforms and e-commerce partnerships, suppliers can broaden their reach to small and medium enterprises that demand flexible purchase quantities and rapid delivery. Coupling digital storefronts with technical support and application expertise will foster deeper customer relationships and create upsell opportunities.

Finally, establishing co-innovation labs with key end-user partners accelerates product development and increases customer stickiness. By collaborating on formulation optimization and performance validation, producers can anticipate market trends, reduce time to market and capture higher margins.

Detailing the Robust Research Methodology Employed to Ensure Data Integrity and Insights Accuracy in Comprehensive White Oil Market Analysis

Our research methodology combines rigorous secondary analysis with targeted primary engagement to ensure comprehensive and validated insights. Initially, we conducted an extensive review of published literature, regulatory filings, patent databases and technical journals to map out refining technologies, purity standards and evolving regulations. This provided a foundational understanding of global white oil production and application trends.

Subsequently, we engaged directly with major producers, specialty refiners and end-user brand owners through structured interviews and surveys. These interactions yielded first-hand perspectives on supply chain strategies, pricing pressures, customization needs and sustainability initiatives. In parallel, proprietary databases tracking trade flows and tariff developments were analyzed to quantify the impact of trade policies on regional movements of white oil grades.

To ensure the integrity of our findings, we triangulated data points across multiple sources, reconciling potential discrepancies and cross-validating with expert panels. Statistical quality checks and trend analyses were performed to identify outliers and confirm consistency across reported metrics. Finally, draft insights were peer-reviewed by subject matter experts to refine interpretations and strengthen actionable takeaways.

This multilayered approach ensures that the conclusions presented are not only grounded in robust empirical evidence but also enriched by direct industry experience, delivering reliable guidance for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our White Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- White Oil Market, by Grade

- White Oil Market, by Viscosity

- White Oil Market, by Application

- White Oil Market, by End Use Industry

- White Oil Market, by Distribution Channel

- White Oil Market, by Region

- White Oil Market, by Group

- White Oil Market, by Country

- United States White Oil Market

- China White Oil Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Key Takeaways and Strategic Imperatives Derived from the Executive Analysis of the Global White Oil Market Landscape and Trends

The analysis of the white oil market reveals a dynamic interplay of technological innovation, regulatory evolution and strategic market shifts. Transformative advancements in refining and sustainability have created new performance benchmarks, while the 2025 U.S. tariff measures have underscored the importance of supply chain flexibility and regional diversification. Segmentation insights illustrate how applications, price grades, viscosity requirements and distribution channels collectively shape competitive positioning, enabling tailored offerings that meet precise end-user needs.

Regional profiles emphasize that the Americas benefit from well-established industrial ecosystems, Europe, Middle East & Africa are driven by strict regulatory standards and Asia-Pacific stands out as the fastest-growing segment with vast opportunities in automotive, personal care and pharmaceutical manufacturing. Leading companies leverage strategic collaborations, M&A activities and R&D investments to differentiate their portfolios and reinforce market presence.

For industry leaders, the path forward includes adopting agile refining solutions, advancing sustainability initiatives, embracing digital engagement channels and strengthening co-innovation with key customers. A robust, data-driven research methodology underpins these insights, combining secondary data, primary interviews and rigorous validation to deliver actionable guidance.

Ultimately, navigating the evolving white oil landscape requires balancing operational excellence with strategic foresight. By integrating these key takeaways into business planning, companies can secure competitive advantage, drive growth and adapt seamlessly to emerging market dynamics.

Engage with Associate Director of Sales Marketing Ketan Rohom to Unlock Full Access to the Comprehensive White Oil Market Intelligence

To explore the full breadth of insights, proprietary data analyses, and expert interpretations contained within this white oil market intelligence, reach out to Ketan Rohom, Associate Director of Sales Marketing. He is prepared to guide you through tailored solutions, secure your access to in-depth sections of the report, and support you in leveraging the findings to drive your strategic decisions and operational efficiencies.

- How big is the White Oil Market?

- What is the White Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?