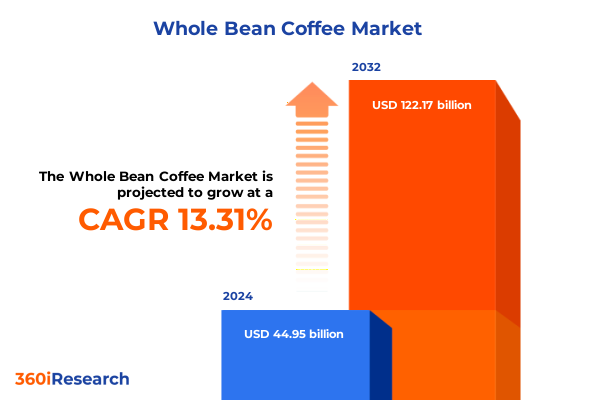

The Whole Bean Coffee Market size was estimated at USD 51.01 billion in 2025 and expected to reach USD 57.29 billion in 2026, at a CAGR of 13.28% to reach USD 122.17 billion by 2032.

Exploring the Evolution and Market Dynamics of Whole Bean Coffee in the Context of Consumer Preferences, Supply Chain Complexities, and Emerging Opportunities

The whole bean coffee market has undergone remarkable growth driven by evolving consumer preferences for freshly ground coffee at home and the increasing popularity of specialty coffee experiences. As coffee culture deepens globally, consumers demonstrate a willingness to explore single-origin beans and artisanal blends, favoring freshness, aroma, and origin transparency. Moreover, the resurgence of brewing methods such as pour-over, French press, and espresso at the consumer level has reinforced the demand for high quality whole bean varieties, elevating the role of bean provenance and post-harvest processing in purchasing decisions.

In parallel, roasters and retailers have invested in brand differentiation through storytelling around sustainable farming, direct trade relationships, and product traceability. Importantly, digital commerce platforms and subscription models have reshaped distribution, enabling smaller players to compete effectively with established brands by offering curated selections and convenience. Consequently, stakeholders throughout the value chain are increasingly prioritizing agility in sourcing, roasting, and distribution to respond to rapid shifts in consumer tastes and supply chain disruptions. This executive summary synthesizes key market dynamics, transformative shifts, the implications of United States tariff measures in 2025, segmentation deep dives, regional perspectives, leading company strategies, actionable recommendations, and research methodology. The insights presented herein equip decision-makers with a holistic understanding of current trends and strategic imperatives to navigate the whole bean coffee market’s complexities and capitalize on emerging opportunities.

Uncovering the Key Transformational Drivers Reshaping the Global Whole Bean Coffee Market Through Innovation, Sustainability, and Evolving Consumer Behaviors

In recent years, the whole bean coffee market has witnessed several transformative shifts that are reshaping its competitive landscape and value propositions. First, the sustainability imperative has moved to the forefront of consumer and corporate agendas, pushing industry stakeholders to adopt eco-friendly farming practices, invest in carbon-neutral roasting facilities, and develop recyclable or compostable packaging solutions. These environmental commitments not only address regulatory pressures but also resonate with ethically driven consumers who seek transparency about the social and ecological footprint of their coffee. At the same time, advancements in digital traceability technologies, including blockchain and QR-code enabled supply chain tracking, have empowered consumers to verify origin claims and fostered stronger trust in premium offerings.

Simultaneously, a pronounced premiumization trend has emerged, driven by specialty coffee roasters who curate limited-edition and single-origin lines that command higher price points. This has been further amplified by the surge in at-home brewing sophistication; devices such as high-precision scales, temperature-controlled pour-over kettles, and smart grinders have elevated consumer expectations for barista-level experiences at home. Moreover, health and wellness trends have influenced product innovation, with an increase in offerings featuring functional ingredients, such as adaptogenic mushrooms or MCT oil blends, catering to the lifestyle segment. Finally, the rapid expansion of direct-to-consumer and subscription models, supported by robust e-commerce platforms and data-driven personalization, has enabled roasters to build deeper customer relationships and achieve greater supply predictability. Together, these shifts underline the industry’s movement towards a more sustainable, premium, and digitally integrated future.

Assessing the Cumulative Consequences of 2025 United States Tariff Implementations on Whole Bean Coffee Import Cost Structures and Supply Chain Efficiency

As of January 1, 2025, the United States has instituted new tariff measures on green coffee bean imports, with an average duty increase of 5 percent on beans sourced from major exporting countries. This policy adjustment aims to support domestic agricultural sectors and address trade imbalances, yet it has introduced additional cost pressures across the coffee value chain. Roasters and importers have faced higher landed costs, compelling them to reassess sourcing strategies, negotiate revised contracts with exporters, and explore opportunities for tariff mitigation through trade agreements or regional origin diversification. Consequently, some market participants have shifted focus towards Central American and Ethiopian producers that benefit from favorable trade terms, while others have considered increasing direct investments in origin countries to secure preferential access.

Additionally, the cumulative effect of these tariffs has prompted a reevaluation of pricing structures and operating efficiencies. Many roasters have opted to absorb portions of the increased duties to maintain retail price stability, albeit at the expense of narrowing margins. Others have introduced tiered pricing models, leveraging premium or specialty product lines to pass through incremental costs to consumers willing to invest in higher quality or traceable offerings. Moreover, the tariff environment has accelerated innovation in blending techniques, as brands blend cost-effective robusta beans or commodity-grade arabica with signature house blends to achieve a balance between affordability and flavor complexity. Ultimately, the 2025 tariff landscape underscores the necessity for agile sourcing, sophisticated pricing strategies, and operational resilience to navigate evolving trade regulations and sustain competitive advantage.

Revealing Insights From Whole Bean Coffee Market Segmentation Across Bean Varieties, Roast Levels, Distribution Channels, Packaging Types and Pricing Tiers

Understanding the diverse segmentation dynamics of the whole bean coffee market is essential for identifying growth pockets and tailoring offerings to specific consumer segments. When considering bean types, arabica remains the dominant variety favored for its nuanced flavor profiles and perceived premium status, while robusta garners interest for its higher caffeine content and cost efficiency. Blended products, including house blends and signature blends, continue to attract a broad consumer base by offering consistent taste experiences that balance robustness and acidity. Transitioning to roast levels, the dark roast segment appeals to traditionalists seeking bold, full-bodied flavors, whereas light roasts are increasingly embraced by specialty enthusiasts drawn to origin-specific tasting notes and acidity complexity. Medium roasts bridge these profiles, catering to mainstream palates that appreciate smoother flavor characteristics.

In terms of distribution channels, supermarkets maintain their stronghold for volume-oriented purchases, offering value-driven economy and standard price tier options. Specialized retail stores provide curated experiences and expert guidance, often showcasing premium offerings in the standard and premium tiers. The online channel has surged in prominence, with brand websites facilitating direct engagement with loyal customers through subscription models, and e-commerce marketplaces expanding reach into new demographics seeking convenience and variety. Packaging innovations also influence consumer decisions; bulk pack formats continue to serve high-frequency buyers and bulk purchasers, while resealable pouches-available in flat and stand-up configurations-offer convenience and freshness preservation for everyday consumers. Vacuum packs appeal to the premium segment, delivering extended shelf life and safeguarding complex flavor profiles. Finally, across price tiers, economy offerings meet entry-level demand, standard products capture the largest consumer base through balanced quality and affordability, and premium lines command higher margins by emphasizing single-origin provenance, artisanal roasting, and sustainable credentials.

This comprehensive research report categorizes the Whole Bean Coffee market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bean Type

- Roast Level

- Packaging Type

- Price Tier

- Distribution Channel

Delving Into the Regional Dynamics Shaping the Whole Bean Coffee Market Across the Americas, Europe Middle East Africa, and Asia Pacific Growth Venues

The whole bean coffee market exhibits distinct regional dynamics that shape consumer preferences, supply infrastructures, and growth trajectories. In the Americas, North American markets-particularly the United States and Canada-continue to lead consumption volumes with strong demand for both value-oriented and premium coffee offerings. Contemporary consumers in this region demonstrate a growing appetite for specialty and single-origin beans, which has stimulated investments in artisanal roasteries and direct trade initiatives throughout Central and South America. Latin American producers, notably Brazil and Colombia, maintain their status as principal exporters, yet the rising focus on environmental certification and fair trade has elevated beans from smaller origins such as Guatemala and Honduras, widening the product portfolio available to discerning North American consumers.

Meanwhile, the Europe, Middle East & Africa region presents a heterogeneous landscape characterized by mature Western European markets where established coffee cultures prefer medium and dark roasts, coupled with emerging markets in Eastern Europe and the Middle East where coffee consumption is on an upward trajectory. European importers are notable for demanding rigorous sustainability standards and traceability, which has propelled the adoption of blockchain-enabled certification and carbon-neutral roasting processes. African markets, albeit smaller in volume, represent both significant producer and niche consumer bases, fostering local specialty scenes and innovative retail formats.

In the Asia-Pacific region, growth is driven by expanding middle-class populations in China, Southeast Asia, and India, where coffee is gaining popularity alongside traditional tea consumption. Urbanization and digital penetration have accelerated e-commerce coffee retail, while specialty coffee chains are establishing footholds in major metropolitan centers. Australian and New Zealand markets continue to set premium coffee quality benchmarks with a strong café culture influencing retail and at-home consumption. These regional dynamics underscore the importance of tailored strategies that account for local taste preferences, distribution infrastructure, and regulatory environments to capture long-term growth and optimize market penetration.

This comprehensive research report examines key regions that drive the evolution of the Whole Bean Coffee market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Whole Bean Coffee Industry Leaders and Their Strategic Initiatives, Innovations, and Collaborative Efforts Driving Market Competitiveness

The global whole bean coffee market is dominated by several established players that leverage extensive distribution networks, brand recognition, and innovation to maintain competitive positions. Among the leading companies, Starbucks has carved out a commanding presence through its vertically integrated supply chain, proprietary roasting profiles, and emphasis on sustainability initiatives such as ethically sourced arabica beans and investment in farmer support programs. Similarly, Nestlé capitalizes on its global scale by offering a broad portfolio of brands spanning economy to premium tiers, underpinned by advanced packaging technologies and widespread retail partnerships. J.M. Smucker’s portfolio of specialty coffee brands, including its high-end signature lines, emphasizes artisanal roasting and direct trade relationships, appealing to consumers seeking authentic origin narratives.

Concurrently, regional and specialty roasters are reshaping market dynamics by focusing on narrow origin sourcing, unique flavor development, and digital customer engagement. Companies such as Lavazza and Peet’s Coffee have expanded direct-to-consumer platforms featuring curated subscription services and limited-edition releases, while premium newcomers like Blue Bottle Coffee prioritize small-batch roasting, rigorous quality control, and personalized digital marketing campaigns. In parallel, fast-service chains such as Dunkin’ have enhanced their retail coffee assortments with value-driven whole bean options and collaborations that tap into mainstream consumer segments. Collectively, these industry leaders drive innovation in product development, sustainable operations, and omnichannel distribution, setting benchmarks that inform best practices and elevate consumer expectations across the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Whole Bean Coffee market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blaser Swisslube Inc.

- BP plc

- Croda International Plc

- ExxonMobil Corporation

- FUCHS Petrolub SE

- Gulf Oil Marine Ltd.

- Idemitsu Kosan Co. Ltd.

- Indian Oil Corporation Ltd.

- JXTG Nippon Oil & Energy Corporation

- Lukoil Marine Lubricants

- Morris Lubricants Ltd.

- Motul S.A.

- Petronas Lubricants International

- Phillips 66 Company

- Quepet Marine Lubricants

- Repsol S.A.

- Rymax Lubricants

- Shell plc

- Sinopec Group

- Total Marine Solutions

- TotalEnergies SE

- Valvoline Inc.

Strategic Recommendations to Navigate Whole Bean Coffee Market Challenges, Enhance Consumer Engagement, Elevate Sustainability, and Bolster Supply Chain Resilience

To capitalize on emerging trends and mitigate risks in the whole bean coffee market, industry leaders should prioritize strategic agility and consumer-centric innovation. First, roasters and retailers must deepen their commitment to sustainability by integrating circular packaging solutions, securing transparent supply chain partnerships, and certifying products through recognized environmental standards. By doing so, they reinforce brand authenticity and resonate with a growing segment of environmentally conscious consumers. Next, embracing advanced digital tools-including CRM-driven personalization, AI-powered recommendation engines, and blockchain-enabled origin verification-can facilitate stronger customer loyalty, streamlined subscription models, and enhanced operational transparency.

Furthermore, companies should continue to diversify sourcing strategies to offset tariff-induced cost pressures and geopolitical uncertainties. Establishing multi-origin procurement frameworks, pursuing preferential trade agreements, and investing in origin-country relationships can help stabilize input costs and ensure quality consistency. In parallel, roasters can optimize product portfolios by expanding premium and specialty offerings that command higher margins, while maintaining accessible economy and standard tiers to capture broader consumer segments. Operationally, investing in automated roasting lines and supply chain analytics will support efficiency gains and rapid responsiveness to demand fluctuations. Finally, collaborative initiatives across industry participants-such as shared sustainability platforms or co-branded innovation labs-can drive cross-sector learning, accelerate best-practice dissemination, and foster a resilient ecosystem capable of navigating future disruptions.

Outlining Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation to Generate Robust Whole Bean Coffee Market Insights

The insights presented in this executive summary are underpinned by a multifaceted research methodology designed to ensure rigor, reliability, and comprehensiveness. Primary research efforts included in-depth interviews with key stakeholders across the value chain, encompassing senior executives at leading roasting companies, procurement managers at importing firms, and brand strategists at specialty coffee retailers. These conversations illuminated real-time challenges related to sourcing complexities, consumer engagement strategies, and regulatory compliance in diverse operating environments. In addition, structured surveys targeting end-consumers provided quantitative data on purchase behaviors, preference drivers, and perceptions regarding sustainability and premiumization.

Complementing primary initiatives, secondary research encompassed a systematic review of industry publications, trade association reports, and scholarly articles focused on agronomic practices, tariff policies, and supply chain innovation. Data triangulation techniques were employed to cross-validate findings from disparate sources, ensuring that qualitative insights and quantitative metrics aligned consistently. Furthermore, advanced analytical tools such as competitive benchmarking, thematic content analysis, and scenario mapping were utilized to identify emerging patterns, assess strategic implications, and project potential pivot points. This rigorous approach yielded robust, actionable insights, enabling stakeholders to navigate the whole bean coffee market with confidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Whole Bean Coffee market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Whole Bean Coffee Market, by Bean Type

- Whole Bean Coffee Market, by Roast Level

- Whole Bean Coffee Market, by Packaging Type

- Whole Bean Coffee Market, by Price Tier

- Whole Bean Coffee Market, by Distribution Channel

- Whole Bean Coffee Market, by Region

- Whole Bean Coffee Market, by Group

- Whole Bean Coffee Market, by Country

- United States Whole Bean Coffee Market

- China Whole Bean Coffee Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights Emphasizing the Strategic Significance of Whole Bean Coffee Market Trends, Innovation Pathways, and Long-Term Industry Value Creation

In summary, the whole bean coffee market stands at a pivotal juncture characterized by evolving consumer preferences, disruptive sustainability imperatives, and shifting trade dynamics. The increased focus on premiumization, digital engagement, and circular economy practices reflects a broader industry transformation toward value-driven, ethically informed offerings. At the same time, recent tariff developments have underscored the importance of supply chain resilience, pricing agility, and diversified sourcing to maintain margin integrity and competitive positioning. The segmentation analysis further highlights that success hinges on a nuanced understanding of bean types, roast profiles, distribution channels, packaging innovations, and price tier strategies to address distinct consumer cohorts effectively.

Regional insights reveal that North America, Europe Middle East & Africa, and Asia-Pacific each present unique opportunities and challenges informed by local consumption patterns, regulatory regimes, and cultural coffee traditions. Leading companies continue to set benchmarks through purposeful investments in sustainability, product innovation, and omnichannel distribution, demonstrating that strategic differentiation and operational excellence are integral to growth. As the market evolves, stakeholders equipped with rigorous research insights, adaptive strategies, and collaborative mindsets will be best positioned to capitalize on emerging opportunities and safeguard against future disruptions. This executive summary serves as a strategic compass for decision-makers aiming to navigate complexity, drive innovation, and create lasting value in the global whole bean coffee ecosystem.

Empowering Stakeholders to Access In-Depth Whole Bean Coffee Market Research Insights by Engaging with Ketan Rohom for Strategic Growth, Competitive Advantage

To explore the full spectrum of insights, granular data, and strategic recommendations detailed in the comprehensive market research report, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing. By connecting with Ketan, you will gain tailored guidance on how to leverage these findings to drive your organization’s growth initiatives, optimize your product portfolio, and strengthen your competitive positioning. Reach out today to secure your copy of the report and unlock the intelligence needed to excel in the rapidly evolving whole bean coffee market.

- How big is the Whole Bean Coffee Market?

- What is the Whole Bean Coffee Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?