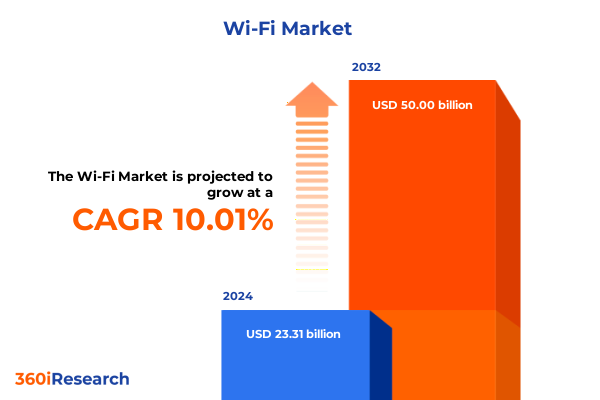

The Wi-Fi Market size was estimated at USD 25.52 billion in 2025 and expected to reach USD 27.97 billion in 2026, at a CAGR of 10.08% to reach USD 50.00 billion by 2032.

Setting the Stage for Next-Generation Wireless Connectivity by Examining the Critical Role of Wi-Fi in Modern Network Architectures

Over the past decade, Wi-Fi has evolved from a convenience feature in consumer devices to a mission-critical component of enterprise, industrial, and public-sector networks. The relentless demand for enhanced bandwidth, lower latency, and greater reliability has driven continuous innovation across standards, hardware architectures, and management platforms. As organizations pursue digital transformation initiatives, Wi-Fi infrastructure must deliver seamless experiences, enable real-time analytics, and interoperate with emerging 5G and edge computing environments to power latency-sensitive applications such as augmented reality, autonomous systems, and remote collaboration.

The proliferation of remote work models and an explosion of IoT endpoints have intensified network complexity in corporate campuses, manufacturing floors, and smart city deployments. Network architects now contend with challenges including spectrum congestion, multi-vendor interoperability, and evolving security threats from increasingly sophisticated adversaries. Meanwhile, the adoption of Wi-Fi 6E and the forthcoming Wi-Fi 7 standard promise unprecedented throughput, deterministic performance, and enhanced spectral efficiency; yet these advancements require refined planning, rigorous device certification, and advanced spectrum management tools.

In this executive summary, we provide a concise yet holistic examination of the transformative forces reshaping the Wi-Fi ecosystem. Stakeholders will gain clarity on emerging technology trends, regulatory and trade dynamics, granular segmentation perspectives, and regional nuances dictating deployment strategies. Our goal is to equip decision-makers with the insights needed to design resilient, future-ready wireless networks that align with organizational goals and deliver sustainable competitive differentiation.

Understanding How Emerging Technologies and Paradigm Shifts Are Redining the Wi-Fi Ecosystem for a Hyperconnected Future

The Wi-Fi industry is undergoing a period of rapid metamorphosis fueled by breakthroughs in protocol evolution, system intelligence, and convergence with adjacent network paradigms. The introduction of Wi-Fi 6 and 6E dramatically expanded channel availability in the 6 GHz band, while Wi-Fi 7 ushers in features like multi-link operation and enhanced multiuser scheduling to support bandwidth-hungry applications. Simultaneously, Mesh Wi-Fi architectures and Wi-Fi Direct connectivity are enabling ubiquitous coverage in challenging indoor and outdoor environments, eliminating coverage gaps without requiring extensive wired backhaul.

Concurrently, cloud–native management platforms and software-defined networking components are transforming Wi-Fi into a dynamically programmable resource. Network operators leverage centralized dashboards, AI-driven analytics, and automated self-healing mechanisms to optimize performance in real time. These capabilities facilitate rapid provisioning for events or pop-up networks, while enabling granular policy enforcement for quality of service, security compliance, and client onboarding. Furthermore, integration with multi-access edge computing frameworks ensures that latency-sensitive traffic is processed closer to the user, enhancing the viability of mission-critical applications in healthcare, manufacturing, and defense.

Environmental sustainability and energy efficiency have also emerged as transformative levers. Chipset vendors are prioritizing low-power designs that dynamically adjust transmit power and duty cycles based on usage patterns, reducing the carbon footprint of dense Wi-Fi deployments. Meanwhile, initiatives around spectrum sharing and coexistence protocols aim to maximize utilization of under-used frequencies, paving the way for greener, more adaptive wireless infrastructures.

Exploring the Broad Implications of United States Tariff Policies on the Wi-Fi Industry Supply Chain and Technology Sourcing Strategies in 2025

The implementation of new United States tariffs in early 2025 has introduced a complex web of cost pressures and strategic recalibrations across the Wi-Fi supply chain. Network equipment manufacturers now face higher import duties on critical components such as radio frequency front-end modules, advanced chipsets, and printed circuit boards. These levies have eroded traditional cost structures, compelling vendors to evaluate dual-sourcing strategies, regional manufacturing partnerships, and potential localization of assembly operations to mitigate margin compression.

Beyond component procurement, the tariffs have reshaped broader ecosystem dynamics. Original equipment manufacturers are forging deeper collaborations with contract manufacturers in non-tariff jurisdictions, accelerating the diversification of production footprints across Southeast Asia and Eastern Europe. Simultaneously, service providers are renegotiating long-term procurement contracts to include tariff-adjustment clauses, ensuring that increases in landed costs do not cascade into untenable capital expenditures. These contractual adaptations have introduced greater price transparency but also heightened the complexity of supplier management.

Despite short-term cost headwinds, the tariff environment has catalyzed innovation in product design and supply chain resilience. Companies are investing in modular hardware architectures that allow for interchangeable front-end modules sourced from alternative suppliers. At the same time, software-defined radios and field-upgradeable firmware have reduced reliance on specific hardware revisions, enabling seamless feature roll-outs without extensive hardware redesign. This strategic pivot has enhanced agility, positioning industry players to navigate ongoing geopolitical uncertainties while sustaining the cadence of Wi-Fi technology advancements.

Deriving In-Depth Insights from Multi-Dimensional Segmentation That Captures the Nuances of Offerings, Technologies, Frequencies, Deployments and End Users

The Wi-Fi market can be understood through multiple dimensions of segmentation, each revealing unique strategic priorities and competitive dynamics. From an offerings standpoint, hardware spans high-performance access points designed for enterprise and industrial applications, compact extenders that bridge coverage gaps, consumer-grade routers, and specialized wireless dongles and adapters enabling legacy devices to connect to modern networks. Complementing these devices are services encompassing installation, managed network operations, and professional consulting, while software layers include centralized network management suites that orchestrate device provisioning alongside security software that enforces compliance, intrusion detection, and threat containment.

Evaluating the landscape by technology underscores the maturation of protocols from 802.11ac, commonly known as Wi-Fi 5, to the latest iterations like Wi-Fi 6 and 6E, which unlock additional spectrum in the 6 GHz band. Looking forward, Wi-Fi 7 promises to further expand capacity and determinism, whereas Wi-Fi Direct continues to facilitate peer-to-peer connectivity in device ecosystems. Mesh networking architectures have gained traction, particularly in large venues and multi-structure campuses, due to their self-organizing topologies and superior performance under high-density usage.

Frequency band segmentation reveals distinct value propositions across the 2.4 GHz band, prized for its range; 5 GHz, valued for its balance of speed and interference mitigation; and the emergent 60 GHz millimeter-wave band, which offers gigabit-class speeds over short distances. Deployment models further diverge between cloud-based platforms that deliver rapid provisioning, centralized analytics, and over-the-air updates, and traditional on-premise architectures that prioritize data sovereignty, customization, and tight integration with legacy IT systems. Finally, end-user verticals range from heavily regulated sectors such as banking, financial services, and insurance to education, government, healthcare, hospitality, manufacturing, retail, and telecommunications, each sector imposing specific performance, reliability, and security requirements on their wireless infrastructures.

This comprehensive research report categorizes the Wi-Fi market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Technology

- Frequency Band

- Deployment

- End User

Uncovering Critical Regional Dynamics Influencing Wi-Fi Market Evolution Across the Americas, Europe, Middle East, Africa, and Asia-Pacific

Regional dynamics play a pivotal role in shaping Wi-Fi deployment strategies and vendor positioning. In the Americas, established infrastructure and high enterprise adoption have led to accelerated roll-outs of Wi-Fi 6 and 6E solutions, particularly in technology hubs and higher education campuses. The regulatory environment supports rapid spectrum allocation, while service providers differentiate through managed offerings and value-added analytics platforms. Meanwhile, the ubiquity of smart buildings and IoT initiatives in the United States and Canada underscores the demand for network solutions engineered to handle dense device ecosystems with stringent security protocols.

Europe, the Middle East, and Africa present a mosaic of regulatory standards and economic maturity levels that impact deployment timelines. Western Europe’s harmonized spectrum policies have enabled early access to 6 GHz channels, whereas certain Middle Eastern and African nations continue to refine their spectrum frameworks. Investment in public Wi-Fi infrastructure for transportation hubs and urban centers is a unifying theme, and partnerships between network equipment providers and local systems integrators have accelerated deployments in smart city projects. Vendors in this region must navigate a patchwork of compliance mandates, emphasizing modular and certification-friendly architectures to streamline product roll-out.

Asia-Pacific stands out for its rapid adoption of next-generation protocols and its status as a global manufacturing epicenter. Aggressive infrastructure investments in China, Japan, South Korea, and Southeast Asia are driving early commercial deployments of Wi-Fi 7 and large-scale mesh networks for industrial campuses. Meanwhile, regional vendors leverage proximity to component suppliers to optimize cost structures and expedite product innovation cycles. Governments across the region are also integrating wireless connectivity into flagship digital economy initiatives, further solidifying Wi-Fi as a cornerstone technology for economic transformation.

This comprehensive research report examines key regions that drive the evolution of the Wi-Fi market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Leading Enterprise Strategies and Competitive Movements by Key Companies Driving Innovation and Partnerships in the Wi-Fi Sector

A small cohort of equipment manufacturers and solution providers dominates strategic innovation and channel influence within the Wi-Fi domain. Legacy network leaders continue to expand their portfolios through targeted acquisitions, integrating specialized software firms that enhance analytics, security, and cloud-native management capabilities. These incumbents also leverage long-standing relationships with enterprise accounts to pilot advanced use cases in high-density environments, securing reference deployments that reinforce their market credibility.

At the same time, emerging challengers have disrupted conventional distribution models by embracing direct-to-customer sales and software subscription offerings. These nimble vendors prioritize user experience, delivering plug-and-play hardware complemented by intuitive mobile applications for configuration and monitoring. Their low-capex approach appeals to small and medium-sized organizations that require robust connectivity without extensive professional services engagements.

Partnership ecosystems further define competitive differentiation. Leading players collaborate with semiconductor manufacturers to co-develop proprietary chipsets optimized for AI-assisted radio resource management. Channel alliances with managed service providers have created bundled offerings that combine network deployment, 24/7 monitoring, and security threat intelligence under a unified service level agreement. This collaborative innovation continues to reshape how hardware, software, and services converge to deliver end-to-end wireless solutions across diverse industry verticals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wi-Fi market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- ASUSTeK Computer Inc.

- AT&T Inc.

- Belkin International, Inc. by Foxconn Interconnect Technology

- Broadcom Inc.

- Cambium Networks Corporation

- Charter Communications

- Cisco Systems, Inc.

- D-Link Systems, Inc.

- Deutsche Telekom AG

- Extreme Networks, Inc.

- Fortinet

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Juniper Networks, Inc.

- MikroTik

- NEC Corporation

- NETGEAR Inc.

- Nokia Corporation

- Qualcomm Incorporated.

- Ruckus Networks by ARRIS company)

- Samsung Electronics Co., Ltd.

- Senao Networks, Inc.

- Telefonaktiebolaget LM Ericsson

- TP-Link Systems Inc.

- Ubiquiti Inc.

- Verizon Communications Inc.

- Vodafone Group

- Xiaomi Corporation

- Zyxel Communications

Empowering Industry Leaders with Actionable Roadmaps to Navigate Supply Chain Challenges, Drive Innovation, and Overcome Regulatory Hurdles in Wi-Fi Networks

To navigate the complexities of today’s Wi-Fi landscape, industry leaders should consider a multi-pronged approach that balances risk mitigation with growth acceleration. First, diversifying supplier ecosystems will reduce exposure to tariff-induced cost fluctuations; establishing dual-sourcing agreements in tariff-exempt regions or developing in-country assembly capabilities can shield operations from abrupt policy changes. Concurrently, channel strategies should prioritize flexible pricing models, enabling customers to absorb incremental costs without derailing deployment timelines.

Innovation roadmaps must align with evolving use cases and regulatory requirements. Investing in field-upgradeable platforms and software-defined radio architectures will accelerate feature roll-outs and future-proof existing hardware investments. Leaders should also deepen partnerships with device manufacturers and application developers to co-create vertical-specific solutions in healthcare, hospitality, and industrial automation, thereby unlocking new revenue streams and reinforcing competitive positioning.

Finally, proactive engagement with policy makers and standards bodies will ensure that emerging requirements around spectrum sharing, cybersecurity mandates, and environmental stewardship reflect industry realities. By participating in regulatory consultations and contributing to open-source protocol initiatives, organizations can influence the trajectory of Wi-Fi advancements while demonstrating commitment to ecosystem health and sustainable growth.

Detailing the Rigorous Research Framework That Underpins Robust Data Collection, Validation Protocols, and Analytical Rigor for Credible Wi-Fi Market Insights

This analysis is grounded in a rigorous research methodology that combines comprehensive secondary review with targeted primary investigations. Publicly accessible sources, including technical standards documents, trade association whitepapers, and patent filings, established the foundational context for protocol evolutions and hardware design trends. Financial disclosures and corporate filings provided supplemental insight into strategic partnerships, mergers, and capital deployment decisions within the vendor community.

To validate and enrich secondary findings, a series of in-depth interviews was conducted with network architects, CIOs, and wireless infrastructure specialists across enterprise, education, and government sectors. These interviews probed deployment challenges, performance expectations, and procurement strategies, ensuring that the executive summary reflects practical realities in the field. Additionally, an expert panel comprising engineers from leading equipment manufacturers and independent wireless consultants reviewed preliminary conclusions, offering critical feedback on technical assumptions and market narratives.

Data triangulation techniques were applied throughout the research lifecycle to reconcile discrepancies between sources. Qualitative insights were cross-checked against objective performance benchmarks, and iterative validation workshops ensured alignment between the findings and the collective expertise of the advisory group. This multi-layered approach underpins the credibility and relevance of the insights presented here, delivering a robust analytical foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wi-Fi market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wi-Fi Market, by Offerings

- Wi-Fi Market, by Technology

- Wi-Fi Market, by Frequency Band

- Wi-Fi Market, by Deployment

- Wi-Fi Market, by End User

- Wi-Fi Market, by Region

- Wi-Fi Market, by Group

- Wi-Fi Market, by Country

- United States Wi-Fi Market

- China Wi-Fi Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Together Pivotal Findings to Deliver a Cohesive Vision of Wi-Fi Advancements, Market Drivers, and Strategic Imperatives for Stakeholders

In synthesizing these insights, several overarching themes emerge that are pivotal for stakeholders charting future Wi-Fi strategies. The relentless pace of protocol innovation necessitates flexible architectures that can accommodate rapid standard transitions without hardware overhauls. Tariff-driven cost pressures underscore the importance of supply chain diversification and localized manufacturing to preserve margin integrity and ensure uninterrupted product availability.

Segmentation analysis reveals that differentiated approaches are required across offerings, technologies, frequency bands, deployment models, and end-user verticals. Tailored solutions that align with specific performance, security, and regulatory mandates will outperform generic connectivity products. Regionally, mature markets in the Americas and EMEA demand sophisticated management and analytics functionality, while Asia-Pacific continues to lead in early adoption of bleeding-edge standards, offering fertile ground for pilot deployments and technical validation.

Finally, the competitive dynamics among incumbents and disruptors highlight the critical role of partnerships, channel innovation, and software-centric business models. Vendors that integrate advanced analytics, seamless cloud management, and strong support frameworks into their offerings are best positioned to capture growth opportunities. As enterprises, service providers, and public institutions accelerate their wireless transformation journeys, the ability to converge hardware, software, and services into cohesive, scalable solutions will define market leadership moving forward.

Seize the Opportunity to Elevate Your Strategic Positioning by Accessing the Comprehensive Wi-Fi Industry Analysis Report Through Direct Engagement

Ready to transform your organization’s wireless capabilities and secure a competitive advantage with cutting-edge insights? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to the full executive report. Engage directly to explore bespoke advisory support, customized data briefs, and exclusive briefings tailored to your strategic objectives. Contact Ketan today to unlock the comprehensive analysis and recommendations that will empower your business to lead in the rapidly evolving world of Wi-Fi connectivity.

- How big is the Wi-Fi Market?

- What is the Wi-Fi Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?