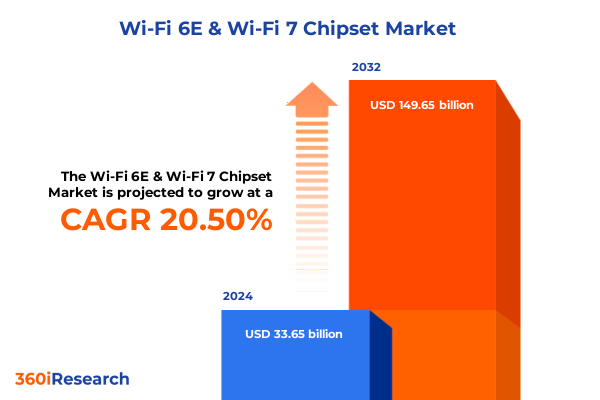

The Wi-Fi 6E & Wi-Fi 7 Chipset Market size was estimated at USD 40.50 billion in 2025 and expected to reach USD 48.75 billion in 2026, at a CAGR of 20.52% to reach USD 149.65 billion by 2032.

Unveiling the Future of Wireless Connectivity Through the Latest Wi-Fi 6E and Wi-Fi 7 Chipsets Revolutionizing Network Performance Across All Industries

The arrival of Wi-Fi 6E and the imminent rollout of Wi-Fi 7 mark a pivotal evolution in wireless networking, reshaping the way devices connect and communicate in today’s hyper-connected world. Beyond mere incremental improvements, these standards introduce fundamentally new capabilities-such as the exploitation of the 6 GHz band in Wi-Fi 6E and ultra-wide 320 MHz channels with Multi-Link Operation in Wi-Fi 7-that redefine expectations for speed, capacity, and latency. As enterprises and service providers alike confront ever-growing demands for bandwidth in applications ranging from immersive collaboration to industrial automation, the advanced features of these chipsets promise to alleviate longstanding congestion issues and deliver transformative user experiences.

Moreover, the integration of high-order modulation schemes like 4096-QAM and expanded spatial streams positions Wi-Fi 7 to exceed theoretical throughput thresholds of 40 Gbps, while the tri-band design of Wi-Fi 6E solutions enables seamless coexistence across 2.4, 5, and 6 GHz frequencies. These developments not only catalyze novel use cases in AR/VR, cloud gaming, and telemedicine but also drive secure, high-bandwidth connectivity within next-generation vehicles. Early chipset announcements from leading semiconductor vendors demonstrate the industry’s commitment to supporting these features in both consumer and mission-critical segments.

How Technological Breakthroughs and Emerging Use Cases Are Dramatically Transforming the Wi-Fi 6E and Wi-Fi 7 Chipset Ecosystem to Meet Next-Gen Demands

As organizations accelerate digital transformation, the adoption of Wi-Fi 6E in enterprise and campus environments has gained significant traction. Recent market analyses indicate that Wi-Fi 6E deployments grew by double-digit percentages in the first quarter of 2023, accounting for over 10 percent of enterprise access point revenues and underscoring a rapid shift toward the 6 GHz band for high-density applications. This expansion reflects an imperative to support bandwidth-intensive workflows, from high-definition video conferencing to large-scale IoT device aggregation.

Concurrently, the automotive sector is integrating advanced wireless connectivity solutions to underpin software-defined vehicles. Automakers are embedding Wi-Fi 6E modules to facilitate high-speed telematics, over-the-air updates, and in-vehicle infotainment streaming, leveraging extended spectrum channels to transfer terabytes of sensor data with minimal latency. The move toward secure, concurrent multi-band links addresses both performance and safety requirements in modern vehicles.

On the horizon, Wi-Fi 7 is ushering in new benchmarks for low-latency communication and ultra-reliable links, particularly within smart factories and critical healthcare applications. Time-Sensitive Networking features under development promise latency below 5 ms, enabling deterministic performance critical for robotics coordination and remote diagnostics in telemedicine. As standards bodies finalize the 802.11be amendment, early adopter ecosystems are already testing these capabilities in pilot deployments, signaling a shift toward mission-critical wireless infrastructures.

Analyzing the Cumulative Operational and Economic Effects of 2025 United States Tariffs on Wi-Fi 6E and Wi-Fi 7 Chipset Supply Chains Reveals Critical Strategic Imperatives

The imposition of elevated tariffs on imported electronics in 2025 has intensified cost pressures across the Wi-Fi chipset supply chain. Although semiconductors in their raw form received certain exemptions, finished products containing these chips-such as access points and client devices-are subject to levies reaching up to 25 percent. These measures have driven up component costs, requiring manufacturers to absorb higher input prices or pass them through to end users, thereby affecting affordability in consumer and commercial segments.

Economic modeling suggests that sustained tariffs at 25 percent could reduce U.S. GDP growth by up to 0.76 percent over a decade, while average household technology budgets may shrink due to elevated device prices. For chipset producers, profit margins are under scrutiny as finance teams weigh the trade-off between localized manufacturing investments and the premium tariffs add to offshore production. This dynamic is reshaping strategic decisions across the semiconductor ecosystem.

In response, industry participants are accelerating supply chain diversification, forging partnerships with domestic foundries under the CHIPS Act incentives and exploring tariff-free assembly jurisdictions. While re-shoring efforts promise long-term resilience, the transition introduces lead-time challenges, capital outlays for new fabs, and an intricate balancing act between cost, capacity, and regulatory compliance. The cumulative impact of these tariffs underscores the urgency for agile sourcing strategies in a rapidly evolving geopolitical landscape.

Key Insights into Application, End User, Chipset Type, and Distribution Channel Segments Driving the Wi-Fi 6E and Wi-Fi 7 Chipset Market Dynamics

A closer look at application segments reveals that the automotive industry’s demand for high-throughput connectivity, particularly in advanced driver-assistance systems and premium in-vehicle infotainment, is accelerating the integration of Wi-Fi 6E and forthcoming Wi-Fi 7 solutions into next-generation vehicles. Consumer electronics brands are leveraging smart home devices, smartphones, tablets, and wearables to capitalize on tri-band performance, enabling seamless streaming and device synchronization in residential environments. The enterprise infrastructure landscape is likewise evolving as access points, routers, and managed switches transition to new chipset generations to support dense user populations and latency-sensitive services. In parallel, medical imaging suites and telemedicine platforms are embracing secure, high-bandwidth wireless links to facilitate real-time diagnostics and remote patient monitoring, while industrial automation relies on robust connections for process control, collaborative robotics, and distributed sensor networks.

When examining end user categories, commercial segments such as hospitality, office campuses, and retail outlets prioritize scalable wireless architectures to enhance customer experiences and operational efficiency. Industrial sectors in energy, utilities, and manufacturing are investing in resilient connectivity to drive predictive maintenance and smart grid applications. Residential deployments, spanning multi-dwelling units and single-family homes, are increasingly outfitted with advanced router platforms that support the expanded 6 GHz band, reflecting homeowner demand for streaming, gaming, and remote work capabilities.

Differentiation by chipset type underscores a competitive landscape of combo solutions that integrate Wi-Fi, Bluetooth, and other radios for space- and cost-sensitive applications, discrete chips optimized for peak performance in enterprise class equipment, and system-on-chip architectures designed for power-efficient consumer devices. Meanwhile, distribution channels split between traditional offline partnerships with value-added resellers and fast-growing online marketplaces, each driving distinct go-to-market strategies and margin structures.

This comprehensive research report categorizes the Wi-Fi 6E & Wi-Fi 7 Chipset market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chipset Type

- Application

- End User

- Distribution Channel

Crucial Regional Dynamics Shaping the Adoption and Growth of Wi-Fi 6E and Wi-Fi 7 Chipsets Across the Americas, EMEA, and Asia-Pacific Markets

In the Americas, robust enterprise budgets and early regulatory approval for the entire 6 GHz band have made the United States and Canada laboratories for large-scale Wi-Fi 6E rollouts in campuses, airports, and smart cities. Latin America follows with government-backed spectrum releases and rising connectivity investments in urban centers, fueling pilot programs for Wi-Fi 7 in major metropolitan areas. The region’s emphasis on public infrastructure has positioned it at the forefront of use cases that demand both high capacity and mobility.

Europe, Middle East & Africa features a mosaic of regulatory frameworks, with countries like Germany and the UK enabling the lower 6 GHz band for indoor Wi-Fi 6E, while others await final harmonization on the upper spectrum. Telecom operators and regulators are debating shared-access models to accommodate both licensed mobile services and unlicensed Wi-Fi, driving collaborative spectrum policy dialogues. Regional equipment providers are adapting product portfolios to comply with national requirements while advancing Wi-Fi 7 pilot trials in dense urban environments.

Asia-Pacific remains the world’s semiconductor manufacturing heartland and a hotbed for consumer adoption. South Korea, China, and Japan have allocated broad swaths of 6 GHz spectrum for unlicensed use, catalyzing rapid integration of Wi-Fi 6E chipsets into smartphones, routers, and enterprise gear. Southeast Asian markets such as Singapore, Thailand, and the Philippines have also greenlit indoor implementations, laying groundwork for coordinated Wi-Fi 7 trials that will test Multi-Link Operation and ultra-low latency services.

This comprehensive research report examines key regions that drive the evolution of the Wi-Fi 6E & Wi-Fi 7 Chipset market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Chipset Manufacturers Driving Innovation in Wi-Fi 6E and Wi-Fi 7 Technology Through Strategic Alliances and Product Launches

Qualcomm has emerged as an early leader in the transition to Wi-Fi 7, with its FastConnect 7800 and Networking Pro Series platforms already featured in over 350 design wins across client, gateway, and enterprise products. By leveraging AI-optimized algorithms for Multi-Link Operation and advanced beamforming, Qualcomm’s chipset roadmap underscores a strategic focus on high-density and low-latency applications.

Broadcom continues to solidify its market position with the BCM4389 and other Wi-Fi 6E-certified chips, delivering simultaneous tri-band performance and enhanced security features. Its close partnerships with leading router and AP manufacturers ensure that Broadcom solutions remain prevalent in both consumer and service provider networks worldwide.

MediaTek has gained momentum by offering cost-effective Wi-Fi 6E reference platforms and enabling rapid time-to-market for both access point and client-side implementations. Its collaboration with global hardware OEMs on test bed devices highlights a strategy centered on broad ecosystem compatibility and developer support.

Other notable contributors include ON Semiconductor’s QCS-AX2 family for enterprise access points, NXP’s automotive-qualified AW693 solution for secure in-vehicle connectivity, and emerging offerings from Intel and Marvell that promise to expand the Wi-Fi 7 landscape in 2025 and beyond. Each organization’s unique portfolio reflects targeted investments in key verticals-ranging from automotive to industrial automation-that will shape the competitive hierarchy in the coming years.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wi-Fi 6E & Wi-Fi 7 Chipset market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Broadcom Inc.

- Huawei Technologies Co., Ltd.

- Infineon Technologies AG

- Intel Corporation

- Marvell Technology Group Ltd.

- MaxLinear, Inc.

- MediaTek Inc.

- Microchip Technology Incorporated

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Peraso Technologies Inc.

- Qorvo, Inc.

- Qualcomm Incorporated

- Realtek Semiconductor Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Silicon Laboratories Inc.

- Skyworks Solutions, Inc.

- STMicroelectronics N.V.

- Synaptics Incorporated

- Texas Instruments Incorporated

Strategic Action Steps for Industry Leaders to Capitalize on the Emerging Wi-Fi 6E and Wi-Fi 7 Wave and Future-Proof Their Connectivity Solutions

Industry leaders should prioritize accelerating research and development efforts on Wi-Fi 7 features such as Multi-Link Operation, 4096-QAM, and Time-Sensitive Networking to differentiate their chipset roadmaps and capture early mindshare in high-value segments like smart factories and augmented reality experiences. Incorporating AI-driven signal optimization can further enhance real-world performance and power efficiency.

Given the ongoing tariff environment, companies must balance near-term cost pressures by diversifying supply chains and forging partnerships with domestic assembly and testing facilities. Leveraging CHIPS Act incentives and exploring alliances with local foundries will mitigate tariff exposure and strengthen long-term resilience against geopolitical shocks.

Stakeholders should engage proactively with regulatory bodies to advocate for harmonized 6 GHz spectrum policies that support both unlicensed Wi-Fi and emerging licensed use cases. Participating in standard-setting forums and sharing deployment data can help accelerate approvals for upper 6 GHz allocations globally, unlocking new capacity for next-generation wireless applications.

To optimize go-to-market strategies, chipset vendors and OEMs should develop tailored value propositions across both offline distribution networks and rapidly expanding online channels. Prioritizing comprehensive reference designs, developer kits, and localized sales support will ensure that partners and end users can swiftly integrate and deploy advanced Wi-Fi capabilities.

Overview of Research Methodologies Combining Primary and Secondary Data to Deliver In-Depth Wi-Fi 6E and Wi-Fi 7 Chipset Market Analysis

This analysis is grounded in a multi-stage research approach combining rigorous secondary research of regulatory filings, industry white papers, technical standards, and publicly available financial disclosures with primary interviews of chipset architects, device OEM executives, and network solution providers. Insights were triangulated against syndicated industry data and benchmarked through expert panels to ensure alignment with real-world deployment experiences.

Quantitative data points were validated through cross-referencing vendor announcements, certification records from the Wi-Fi Alliance, and regional spectrum allocation databases. Qualitative perspectives were captured via structured discussions with wireless infrastructure consultants and system integrators across target verticals, providing a holistic understanding of market drivers and barriers.

The segmentation framework reflects a careful assessment of application, end user, chipset type, and channel variables, informed by interviews with leading automotive, healthcare, and enterprise stakeholders. Regional analyses were supplemented by regulatory agency reports and industry association briefings to map spectrum availability and adoption trajectories.

All primary and secondary inputs were synthesized through an iterative review process involving subject matter experts to reconcile divergent viewpoints and refine strategic recommendations. Research limitations include the ongoing evolution of Wi-Fi 7 standards and pending tariff rulings, which will be monitored for subsequent updates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wi-Fi 6E & Wi-Fi 7 Chipset market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wi-Fi 6E & Wi-Fi 7 Chipset Market, by Chipset Type

- Wi-Fi 6E & Wi-Fi 7 Chipset Market, by Application

- Wi-Fi 6E & Wi-Fi 7 Chipset Market, by End User

- Wi-Fi 6E & Wi-Fi 7 Chipset Market, by Distribution Channel

- Wi-Fi 6E & Wi-Fi 7 Chipset Market, by Region

- Wi-Fi 6E & Wi-Fi 7 Chipset Market, by Group

- Wi-Fi 6E & Wi-Fi 7 Chipset Market, by Country

- United States Wi-Fi 6E & Wi-Fi 7 Chipset Market

- China Wi-Fi 6E & Wi-Fi 7 Chipset Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Reflections on the Transformative Potential of Wi-Fi 6E and Wi-Fi 7 Chipsets for Next-Generation Wireless Ecosystems

The convergence of technological innovation, regulatory evolution, and strategic industry collaboration positions Wi-Fi 6E and Wi-Fi 7 as catalysts for next-generation wireless ecosystems. These chipsets are set to empower a diverse array of use cases-from immersive enterprise collaboration and autonomous vehicle connectivity to precision healthcare diagnostics and fully automated manufacturing environments-by delivering unprecedented speed, capacity, and reliability. As the market matures, chipset vendors and system integrators that embrace advanced modulation, multi-band operation, and AI-driven optimization will distinguish themselves in high-value segments where performance and determinism are non-negotiable.

Ultimately, the ongoing shifts in spectrum policy, supply chain paradigms, and go-to-market dynamics underscore the importance of agility and foresight. Organizations that proactively engage with regulatory stakeholders, invest in resilient manufacturing partnerships, and tailor their product portfolios to specific vertical demands will be best positioned to navigate the complex landscape and unlock the full potential of Wi-Fi 6E and Wi-Fi 7 chipsets. The insights presented herein serve as a strategic blueprint for decision-makers seeking to harness the transformative power of these groundbreaking wireless technologies.

Unlock Actionable Insights and Drive Your Wireless Strategy with a Comprehensive Wi-Fi 6E and Wi-Fi 7 Chipset Market Research Report Delivered by Ketan Rohom

To access detailed analyses, competitive benchmarking, and forward-looking insights on the Wi-Fi 6E and Wi-Fi 7 chipset landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the report’s comprehensive findings, customized market breakdowns, and strategic implications tailored to your business needs. Leverage his deep expertise to secure the actionable intelligence required for making informed investment, product development, and partnership decisions. Contact Ketan today to unlock the full potential of this in-depth market research report and stay ahead in the rapidly evolving wireless connectivity market.

- How big is the Wi-Fi 6E & Wi-Fi 7 Chipset Market?

- What is the Wi-Fi 6E & Wi-Fi 7 Chipset Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?