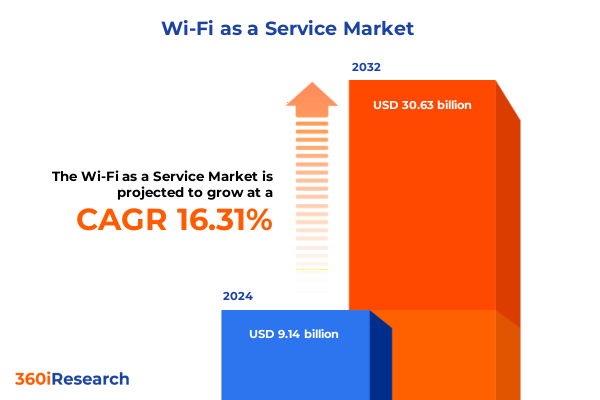

The Wi-Fi as a Service Market size was estimated at USD 10.57 billion in 2025 and expected to reach USD 12.24 billion in 2026, at a CAGR of 16.40% to reach USD 30.63 billion by 2032.

Setting the Stage for Wi-Fi as a Service by Harmonizing Enterprise Connectivity Challenges with Scalable Managed Network Expertise

Organizations today are navigating an era where seamless, secure, and scalable wireless connectivity underpins virtually every facet of daily operations, from customer engagement to critical back-office functions. Wi-Fi as a Service emerges as a compelling model to address this complexity by shifting the burden of network design, deployment, monitoring, and optimization onto specialized providers. At its core, this model liberates enterprises from the challenges of capital-intensive hardware investments and the ongoing maintenance of controllers and access points, enabling them to focus on strategic imperatives rather than network minutiae.

The shift toward subscription-based, cloud-orchestrated networking represents a fundamental evolution in how enterprises approach connectivity. By leveraging managed installation services that encompass hardware provisioning and optimized controller configurations, businesses can rapidly deploy robust wireless infrastructures that adapt dynamically to fluctuating user demands. Meanwhile, predictive analytics software overlays real-time traffic insights and security monitoring to preemptively address performance bottlenecks and threats. This Executive Summary serves as a gateway to understanding how Wi-Fi as a Service transforms traditional network paradigms into agile, intelligence-driven platforms that scale with organizational growth and technological progress.

Unleashing the Next Wave of Connectivity with Cloud-Native Architectures and AI-Driven Automation Empowering Wireless Networks

The Wi-Fi as a Service market is undergoing a transformative shift driven by the convergence of cloud-native networking architectures, artificial intelligence-powered optimization, and zero-trust security frameworks. Cloud management portals now enable centralized visibility across geographically dispersed sites, while machine learning engines continuously tune radio frequency allocations to maximize throughput and minimize interference. As these intelligent capabilities proliferate, enterprises are moving away from siloed controller appliances toward software-defined networking layers that abstract complexity and deliver policy-driven automation at scale.

Simultaneously, the integration of edge computing has accelerated, bringing analytics software closer to data sources and reducing latency for mission-critical applications such as augmented reality training in manufacturing or real-time patient monitoring in healthcare. Service providers have responded by expanding their portfolios to include security services that range from network segmentation to continuous vulnerability scanning. This orchestration of hardware, software, and security services within a unified subscription model is redefining expectations for reliability, flexibility, and cost predictability, meaning organizations must reassess legacy procurement practices in favor of collaborative, outcome-based partnerships.

Assessing the Ripple Effects of 2025 US Tariffs on Wi-Fi Hardware Costs and Supply Chain Realignment Strategies

In 2025, newly imposed US tariffs on network hardware imports have introduced pronounced cost pressures across the Wi-Fi as a Service ecosystem. Equipment manufacturers reliant on components sourced from China are facing incremental duties on access points and controller modules, driving up list prices passed through managed installation and hardware support contracts. This tariff environment has prompted many service providers to diversify their component sourcing strategies-shifting production to alternative manufacturing hubs in Southeast Asia and exploring partnerships with suppliers in Taiwan and Vietnam.

The cumulative impact of these tariffs extends beyond raw hardware costs. Installation services now carry higher labor and logistics expenses, and ongoing support and maintenance agreements are being renegotiated to account for elevated spare parts pricing. To mitigate these effects, providers are refining their subscription models, blending pay-per-use options with longer-term commitments to spread tariff-induced costs over extended service periods. At the same time, analytics and management software licensing is emerging as a high-margin offering that can cushion margin erosion in hardware-intensive portfolios, reinforcing the imperative for a balanced, service-centric value proposition.

Diving Deep into Core Market Segmentation Illuminating Components, Service Tiers, Pricing, Industry Demands, and Deployment Preferences

A nuanced understanding of market segmentation reveals the multifaceted nature of Wi-Fi as a Service offerings. At the component level, providers package access points and controllers alongside installation services that encompass comprehensive site surveys and hardware provisioning. Their managed services cover monitoring, optimization, and layered security functions, while support and maintenance agreements ensure continuous hardware support and timely software updates. Overlaying this, analytics and management software deliver real-time visibility and control across the entire network fabric.

Diverse pricing models further shape market dynamics: some enterprises favor pay-per-use structures that align expenses with actual network traffic volumes, while others opt for subscription models that guarantee predictable monthly fees essential for budgeting stability. Industry verticals drive specific needs, as financial services demand stringent encryption and segmentation, healthcare prioritizes HIPAA-compliant monitoring, and retail and hospitality seek seamless guest onboarding and location-based analytics. Organization size influences purchasing decisions, with large enterprises leveraging enterprise-grade software integrations and smaller businesses prioritizing turnkey cloud deployments. Finally, deployment preferences oscillate between fully cloud-based solutions for rapid scalability and on-premises installations for organizations with strict data sovereignty or latency requirements, highlighting the importance of flexible service architectures.

This comprehensive research report categorizes the Wi-Fi as a Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Pricing Model

- Industry Vertical

- Organization Size

- Deployment Mode

Gaining Pan-Regional Perspective by Contrasting Adoption Patterns and Drivers across Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics in Wi-Fi as a Service adoption underscore the importance of localized strategies. In the Americas, strong demand from retail chains and hospitality groups has accelerated the rollout of managed services that integrate location analytics and guest Wi-Fi monetization features. Large enterprises in North America, in particular, are gravitating toward subscription-based licensing and cloud orchestration platforms to unify network management across multiple branches.

Europe, Middle East & Africa presents a more fragmented regulatory and technological landscape. Data privacy regulations and stringent cybersecurity mandates in the European Union have driven adoption of secure network segmentation and advanced threat detection services. Meanwhile, government agencies in the Middle East are investing heavily in smart city initiatives, embedding access points within urban infrastructure. In Africa, connectivity gaps in healthcare and education sectors are spurring demand for turnkey cloud-hosted Wi-Fi packages that overcome limited local IT resources.

Asia-Pacific remains the fastest-growing region, fueled by rapid digital transformation in manufacturing and logistics, as well as high smartphone penetration rates. Enterprises in China, Japan, and South Korea have led early adoption of Wi-Fi 6E capable hardware, while emerging markets in Southeast Asia are prioritizing cloud-managed, subscription-based deployments to modernize legacy networks. This geographic diversity underscores the need for providers to align their offerings with region-specific regulatory frameworks, performance expectations, and infrastructure maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Wi-Fi as a Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Players through Their Technology Alliances Differentiation Tactics and Service Innovation in the Managed Wi-Fi Market

Leading providers in the Wi-Fi as a Service arena have distinguished themselves through strategic partnerships, technology integrations, and service innovation. Global network hardware vendors have bolstered their cloud-managed portfolio by partnering with security platform specialists, embedding advanced intrusion detection capabilities directly into managed services. Pure-play wireless specialists have responded with acquisitions of analytics software startups to enrich their dashboards with AI-driven performance insights and anomaly detection.

Differentiation strategies also reflect varied approaches to ecosystem development. Some competitors focus on open APIs and developer toolkits to enable third-party integrations with building management systems and IoT platforms, while others emphasize end-to-end vertical solutions tailored for specific industry needs, such as automated patient flow management in hospitals or contactless retail experiences. Competitive intensity has spurred innovation in service assurance offerings, with real-time SLA monitoring and predictive maintenance emerging as critical capabilities to retain high-value enterprise customers in an evolving market landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wi-Fi as a Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AccessAgility, LLC

- Adtran, Inc.

- Allied Telesis, Inc.

- AT&T Inc.

- Cambium Networks, Ltd.

- Charter Communications, Inc.

- Cisco Systems, Inc.

- Codestone Group

- CommScope, Inc.

- D-Link Corporation

- Datto, Inc.

- Dell Inc.

- Extreme Networks, Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd

- Intel Corporation

- Juniper Networks Inc.

- Nokia Corporation

- Outsource Solutions (NI) Ltd.

- Rogers Communications Inc.

- Ruijie Networks Co., Ltd.

- SecurEdge Networks, Inc.

- Singtel Mobile Singapore Pte Ltd.

- Superloop Limited

- Tata Communications Ltd

- TP-Link Corporation Limited

- Ubiquiti, Inc.

- Viasat, Inc.

- WIFIRST

Implementing a Roadmap for Success by Focusing on AI Automation Cloud Alliances Supply Chain Diversification and Vertical Solutions

To capitalize on the momentum of Wi-Fi as a Service, industry leaders should prioritize investments in AI and machine learning to automate network tuning and threat detection, thereby reducing manual intervention and improving reliability. Cultivating partnerships with leading cloud providers will expand global service reach and ensure seamless integration with broader enterprise IT ecosystems. Providers must also diversify supply chains to mitigate tariff-related cost increases on hardware components, exploring manufacturing alternatives in lower-cost regions without compromising quality or compliance.

Expanding managed service portfolios with vertical-specific solution templates-from secure remote learning networks for educational institutions to compliance-focused deployments for financial services-will enhance go-to-market differentiation. Flexible pricing structures that blend pay-per-use and subscription models can address diverse buyer preferences, while embedding network analytics within mobile applications will empower IT leaders to monitor performance on the go. Finally, developing a service blueprint for Wi-Fi 7 readiness, including automation scripts and pilot test labs, will position providers at the forefront of next-generation wireless innovation.

Ensuring Rigor and Reliability through Multimodal Interviews Data Triangulation and Expert Validation underpinning the Connectivity Market Analysis

This analysis employed a rigorous, multi-tiered research methodology to ensure reliability and depth. Primary data was gathered through structured interviews with CIOs, network architects, and IT directors across diverse industry verticals, complemented by surveys of managed service providers to capture frontline perspectives on deployment challenges and service evolution. Secondary research involved a comprehensive review of vendor white papers, regulatory filings, and publicly available technical benchmarks to validate service capabilities and performance claims.

Quantitative insights were derived by synthesizing provider-reported deployment metrics and anonymized usage data from live environments, while qualitative findings emerged from in-depth case studies illustrating real-world implementations. Triangulation methods ensured consistency across data sources, and an expert advisory review panel, comprising former network engineers and industry consultants, vetted the final conclusions. This robust approach provides stakeholders with confidence in the strategic recommendations and segmentation insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wi-Fi as a Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wi-Fi as a Service Market, by Component

- Wi-Fi as a Service Market, by Pricing Model

- Wi-Fi as a Service Market, by Industry Vertical

- Wi-Fi as a Service Market, by Organization Size

- Wi-Fi as a Service Market, by Deployment Mode

- Wi-Fi as a Service Market, by Region

- Wi-Fi as a Service Market, by Group

- Wi-Fi as a Service Market, by Country

- United States Wi-Fi as a Service Market

- China Wi-Fi as a Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Reinforcing Connectivity Imperatives by Highlighting the Strategic Role of Managed Wi-Fi in Future-Proofing Enterprise Networks

As enterprise networks evolve to support digital transformation initiatives, Wi-Fi as a Service stands out as a pivotal enabler of agility, security, and user experience excellence. By offloading infrastructure management to specialized providers, organizations can redeploy internal IT resources toward innovation projects that drive revenue growth and competitive differentiation. The convergence of cloud orchestration, AI-driven analytics, and flexible pricing models creates an environment where connectivity is no longer a static utility but a strategic asset.

Looking ahead, service providers that master the interplay between hardware, software, and comprehensive support will capture the lion’s share of growth opportunities. Success will hinge on the ability to anticipate emerging requirements-such as ultra-low-latency applications for augmented reality and massive device densities fueled by IoT-and to deliver seamless upgrades through continuous software enhancements. In summary, Wi-Fi as a Service offers a future-proof blueprint for enterprise connectivity, empowering organizations to navigate uncertainty with confidence and scale their digital ambitions.

Unlock Comprehensive Market Insights for Wi-Fi as a Service by Connecting with Ketan Rohom for Expert Guidance and Customized Solutions

To gain an in-depth understanding of the rapidly evolving Wi-Fi as a Service landscape and secure a competitive edge, industry stakeholders are encouraged to connect with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the comprehensive market research report. His expertise ensures you’ll receive tailored insights, strategic recommendations, and actionable data to inform your network modernization initiatives. Reach out directly to explore licensing options, discuss enterprise deployments, and unlock the insights needed to drive sustainable growth through advanced connectivity solutions.

- How big is the Wi-Fi as a Service Market?

- What is the Wi-Fi as a Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?