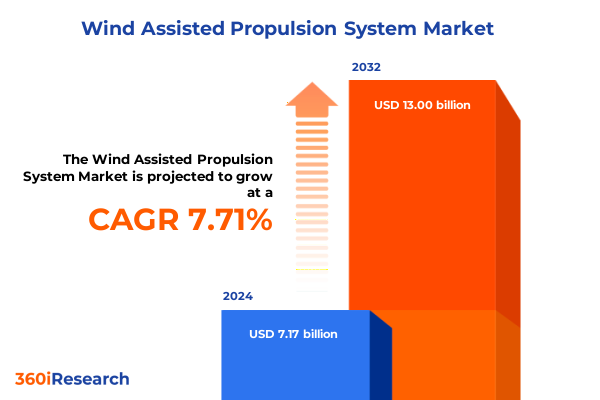

The Wind Assisted Propulsion System Market size was estimated at USD 7.70 billion in 2025 and expected to reach USD 8.26 billion in 2026, at a CAGR of 7.77% to reach USD 13.00 billion by 2032.

Unveiling the Strategic Imperative for Wind-Assisted Propulsion as a Transformative Force in Maritime Decarbonization and Operational Excellence

The maritime industry stands at a pivotal crossroads as global imperatives for decarbonization and fuel efficiency converge. Historically reliant on heavy fuel oil, merchant shipping accounts for nearly 3 percent of worldwide greenhouse gas emissions, a figure that threatens to climb absent transformative interventions. Concurrently, volatile bunker prices and tightening environmental regulations have elevated cost pressures and operational risks. In this context, wind-assisted propulsion has emerged from niche experimentation to become a mainstream supplement for vessel operators seeking both carbon reduction and cost optimization. Innovations that once existed on the periphery of maritime engineering are now central to strategic fleet decisions, signaling a fundamental shift in how ships harness renewable energy.

Over the past decade, a wave of pilot installations and demonstration voyages has validated the effectiveness of diverse wind technologies-ranging from rigid wing sails and kite nets to rotating cylinders and hull-mounted vanes. Recent studies have shown that suitably configured systems can deliver up to 40 percent reductions in fuel consumption under favorable wind conditions, yielding significant emissions and expense savings while maintaining operational schedules. Moreover, the rapid uptick in retrofits for both large bulk carriers and smaller service vessels underscores an industry-wide acknowledgement of wind’s role in comprehensive decarbonization strategies. As vessel operators and technology providers deepen collaboration, wind-assisted propulsion is poised to redefine energy efficiency standards across global shipping corridors.

Examining the Converging Technological, Regulatory, and Market Dynamics Driving Rapid Adoption of Wind-Assisted Propulsion Systems Globally

The landscape of maritime transport is undergoing a metamorphosis driven by interlocking technological, regulatory, and market forces. On the regulatory front, the International Maritime Organization’s escalating emissions targets and the European Union’s integration of shipping into its Emissions Trading System have created a compliance imperative. FuelEU Maritime rules, slated to introduce carbon intensity benchmarks by 2025, further compel carriers to explore renewable energy integrations. At the same time, major ports are launching green corridor initiatives, incentivizing low-carbon voyages and establishing preferential berthing for vessels with alternative propulsion systems. These policy shifts, coupled with looming global carbon pricing frameworks, are forging an environment where wind-assisted solutions are not merely optional but essential for long-term viability.

Technological innovation is advancing at an unprecedented pace. High-aspect-ratio wing sails, inspired by competitive yacht design, are being adapted for commercial carriers to withstand harsh sea conditions while delivering measurable performance gains. Rotor sails, drawing upon Magnus effect principles, have demonstrated reliable thrust contributions even in moderate wind environments. Kite systems, once hampered by control complexity, now benefit from automated flight algorithms and real-time meteorological integration. Simultaneously, digital twin platforms enable operators to simulate system performance and optimize routing based on wind forecasts. Against a backdrop of escalating fuel costs and growing investor scrutiny on ESG metrics, these converging trends are redefining how shipping enterprises configure and manage their fleets.

Assessing the Multifaceted Consequences of 2025 U.S. Tariff Measures on Wind-Assisted Propulsion System Manufacturing Supply Chains and Deployment Costs

Throughout 2025, newly enacted U.S. tariffs on imported steel and aluminum have reverberated across the wind-assisted propulsion supply chain, elevating manufacturing and retrofit expenses. Components such as aluminum masts and high-strength steel frames-critical to rigid wing sails and rotor sail assemblies-now carry additional duties of up to 25 percent, a change that has compelled system producers to reassess production footprints and sourcing strategies. According to industry analyses, the cumulative cost implications of these trade measures have been felt not only in raw material procurement but also in downstream assembly and shipyard operations as labor and logistics margins adjust to offset higher input prices.

For many technology providers, the tariffs have catalyzed a shift toward localized manufacturing within North America. Some producers are expanding partnerships with U.S. fabrication facilities to minimize duty burdens, while others are negotiating long-term steel supply contracts to lock in more favorable rates. Retrofitting wind-assisted equipment is particularly sensitive to these cost fluctuations, as existing vessels demand custom-engineered modules and support structures. Operators are now weighing the economics of fleet-wide retrofit programs against single-vessel conversions, with some electing to delay installations until tariff reviews potentially reduce financial headwinds.

Beyond immediate cost pressures, the trade measures have broader strategic implications for the pace of wind-assisted adoption. While the U.S. market remains attractive due to extensive transoceanic routes and regulatory incentives, the rate of newbuild integrations could decelerate as stakeholders seek clarity on future trade policy. Simultaneously, exporters of propulsion modules are exploring regional hubs in Mexico and Canada to leverage North American supply chains under USMCA provisions. These adjustments underscore the adaptive capacity of the sector but also highlight the nuanced interplay between trade policy and maritime decarbonization commitments.

Illuminating Critical Insights Across Technology Types, Vessel Classes, Installation Models, and End-User Verticals Shaping Market Trajectories

Adoption patterns in the wind-assisted propulsion arena reveal a mosaic of opportunities and challenges contingent on technology, vessel class, installation approach, and end-user profile. Hull vane solutions, featuring streamlined appendages affixed to existing hull forms, are often favored for smaller vessels and coastal operators given their lower installation footprint and moderate performance gains. Kite rigs, harnessing high-altitude winds via automated flight control, have found a niche on larger bulk carriers where deck space and flight clearance permit expansive operation. Rotor sail configurations, employing vertical cylinders that generate lift through rotation, cater to medium-sized vessels seeking reliable thrust across varying wind speeds. Meanwhile, turbosail systems, an evolution of classic rigid sail frameworks augmented by exhaust heat recovery, are emerging for specialized applications where integration with engine systems enhances overall efficiency.

The choice between newbuild integration and retrofit deployment further shapes strategic considerations. New construction allows designers to embed wind-assist hardware into hull architecture from inception, optimizing weight distribution and hydrodynamic balance. In contrast, retrofit programs-whether fleet-wide or targeting individual flagship vessels-offer operators the flexibility to pilot technologies and calibrate return on investment before committing broadly. Commercial shipping lines, including both bulk and container carriers, are often the first movers in retrofit trials, leveraging scale advantages to negotiate favorable equipment rates. Government fleets, comprising naval auxiliaries and research platforms, tend to prioritize reliability and system redundancy, selecting technologies with rigorous certification histories. Private vessel owners, particularly luxury cruise lines and yacht operators, view wind-assist solutions as brand differentiators, aligning high-profile installations with environmental stewardship commitments. This segmentation underscores the importance of customized system design and deployment strategies that reflect the diverse needs of each market segment.

This comprehensive research report categorizes the Wind Assisted Propulsion System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Vessel Size

- Installation

- End-User

Mapping Diverse Regional Dynamics and Adoption Patterns for Wind-Assisted Propulsion Technologies Across the Americas, EMEA, and Asia-Pacific Corridors

Regional dynamics in wind-assisted propulsion adoption vary markedly across the Americas, Europe, Middle East & Africa, and Asia-Pacific corridors, each influenced by distinct regulatory ecosystems, port infrastructure, and maritime trade flows. In North America, enhanced federal and state incentives for alternative energy uptake have made retrofit programs attractive to major bulk and tanker operators, while coastal shipping routes benefit from pilot grants tied to emissions reduction targets. Latin American ports, though less mature in programmatic incentives, are increasingly receptive to demonstration projects as part of broader sustainability agendas.

Within Europe, Middle East & Africa, stringent carbon regulations under the EU Emissions Trading System and the FuelEU Maritime initiative have galvanized carriers to incorporate wind-assist solutions, positioning Rotterdam, Hamburg, and Mediterranean gateways as innovation hubs. Shipowners operating in Gulf ports face rising environmental levies, prompting interest in carbon-saving technologies that also mitigate charter party risks under evolving ESG frameworks. Across Africa, select transshipment centers are exploring wind propulsion as a means to differentiate services and align with green shipping corridors.

The Asia-Pacific region, encompassing major shipbuilding nations and trade giants, exhibits a dual trajectory. China, Japan, and South Korea are investing heavily in indigenous wind-assist research and establishing pilot corridors between key ports such as Shanghai and Singapore. Meanwhile, operators in the Indo-Pacific archipelago, facing higher fuel prices and logistical challenges, view retrofit solutions as both cost-effective and climate-responsive. These regional contrasts underscore how local policy, economic incentives, and infrastructural readiness drive the uptake and maturation of wind-assisted propulsion technologies across global maritime networks.

This comprehensive research report examines key regions that drive the evolution of the Wind Assisted Propulsion System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players’ Strategies, Collaborations, and Innovation Pipelines in the Wind-Assisted Propulsion Sector

The competitive landscape of wind-assisted propulsion is defined by a constellation of specialized technology innovators and large-scale engineering firms. Norsepower, a pioneer in rotor sail manufacturing, has recently inaugurated the world’s first dedicated facility for high-volume production of spinning cylinder units, consolidating its leadership in the sector. BAR Technologies, drawing on America’s Cup foiling expertise, secured full certification for its WindWings solution in mid-2023 and has since expanded its global team to meet rising demand, undertaking installations on Newcastlemax carriers and securing multi-vessel contracts. Eco Marine Power, with its modular energy management platform, achieved the milestone sale of its 100th VentoFoil unit in early 2025, demonstrating sustained commercial traction and diversified application across bulk, tanker, and RoRo vessels.

Additional entrants such as Airseas, a spin-off of aerospace innovators, are advancing kite rig technology by integrating machine-learning algorithms for optimized flight patterns. Marine classification societies and shipyards are actively partnering with these providers to develop standardized installation processes and safety protocols. Across the value chain, strategic alliances between propulsion specialists and major shipowners are accelerating deployment timelines and driving iterative improvements in system reliability. While competition is intensifying, collaboration on interoperability standards and joint pilot programs is equally prominent, reflecting a consensus that collective progress in wind-assist innovation will ultimately benefit the broader maritime decarbonization agenda.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wind Assisted Propulsion System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AIRSEAS, SAS by Kawasaki Kisen Kaisha, Ltd.

- Anemoi Marine Technologies Ltd.

- Bar Technologies Ltd.

- Becker Marine Systems GmbH

- Blue Planet Shipping Ltd.

- BOUND 4 BLUE, S.L.

- BOUND 4 BLUE, S.L.

- Damen Shipyards Group

- Eco Marine Power Co., Ltd.

- Econowind

- Fraunhofer CML

- GT Green Technologies Ltd

- Maersk Line A/S

- MAN Energy Solutions

- Mitsui O.S.K. Lines, Ltd.

- Nayam Wings Ltd

- Norsepower Oy Ltd.

- OceanWings SAS

- Rolls-Royce plc

- Skysails GmbH & Co. KG

- Smart Green Shipping Alliance Ltd.

- Windship Technology Ltd.

- Wärtsilä Corporation

- Yara International ASA

Outlining Targeted Strategic Initiatives and Operational Tactics for Industry Leaders to Accelerate Wind-Assisted Propulsion Integration and Value Capture

Industry leaders seeking to capitalize on wind-assisted propulsion must adopt a proactive, integrated approach that aligns technology trials with broader sustainability targets. First, establishing cross-functional task forces that bring together operations, engineering, and ESG teams will ensure comprehensive evaluation of system performance, from fuel savings to carbon reporting impacts. Pilot installations should be strategically distributed across vessel classes and trade routes to capture data on diverse wind profiles and operational conditions, creating a robust performance database for decision analytics.

Second, forging strategic partnerships with technology providers and classification societies will accelerate certification cycles and reduce time to implementation. Co-development agreements can unlock opportunities for customization and knowledge transfer, while joint investment in regional service hubs will bolster post-installation support. Additionally, integrating wind-assist planning into existing voyage optimization and digital twin platforms will harmonize propulsion assets with routing software, maximizing thrust contributions without compromising schedule reliability. Finally, supply chain resilience must be reinforced through dual-sourcing strategies and localized fabrication partnerships to mitigate geopolitical and tariff-related disruptions. By embedding these actions into fleet decarbonization roadmaps, industry leaders can transform wind-assisted propulsion from experimental pilots into scalable components of tomorrow’s low-carbon fleet.

Detailing a Robust Multimethod Research Framework Combining Qualitative and Quantitative Approaches for Wind-Assisted Propulsion Market Analysis

This analysis draws upon a robust multimethod research framework to ensure comprehensive coverage and analytical rigor. Primary data were collected through in-depth interviews with C-suite executives and technical directors from leading shipping lines, classification societies, and component manufacturers. These qualitative insights were complemented by a systematic review of regulatory documents, including International Maritime Organization resolutions and regional incentive program materials, to contextualize policy drivers.

Secondary research encompassed an exhaustive examination of peer-reviewed journal articles, whitepapers from maritime consultancies, and recent press releases detailing pilot project outcomes. Case studies of retrofit and newbuild installations were benchmarked using vessel performance data, voyage logs, and shipyard maintenance reports. In parallel, supply chain risk assessments were conducted via trade policy analysis, incorporating tariff schedules and import-export data to map material flow vulnerabilities. This triangulation of qualitative and quantitative methods ensures that the findings presented herein are grounded in both empirical evidence and strategic foresight, offering decision-makers a nuanced understanding of wind-assisted propulsion market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wind Assisted Propulsion System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wind Assisted Propulsion System Market, by Technology Type

- Wind Assisted Propulsion System Market, by Vessel Size

- Wind Assisted Propulsion System Market, by Installation

- Wind Assisted Propulsion System Market, by End-User

- Wind Assisted Propulsion System Market, by Region

- Wind Assisted Propulsion System Market, by Group

- Wind Assisted Propulsion System Market, by Country

- United States Wind Assisted Propulsion System Market

- China Wind Assisted Propulsion System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Illuminate the Future Pathway for Wind-Assisted Propulsion Adoption and Maritime Decarbonization Momentum

The convergence of decarbonization imperatives, technological maturation, and evolving market incentives has elevated wind-assisted propulsion from experimental novelty to strategic necessity within the maritime sector. As regulatory frameworks tighten and stakeholders demand measurable emissions reductions, vessel operators are integrating diverse wind technologies to complement alternative fuels and energy efficiency measures. The 2025 U.S. tariff environment underscores the importance of adaptable supply chain strategies, driving greater localization and collaboration across the value chain.

Segmentation insights reveal that adoption trajectories are influenced by technology viability, vessel profiles, installation approaches, and end-user mandates. Regional dynamics further differentiate market readiness, with incentive structures in the Americas, EMEA, and Asia-Pacific shaping deployment patterns. Leading companies are scaling production, securing certifications, and forging alliances that will accelerate system availability and reduce total cost of ownership. Going forward, embedding wind-assist objectives into fleet modernization plans-and aligning them with digital optimization platforms-will be critical for capturing full operational and environmental benefits. Cumulatively, the strategic integration of wind-assisted propulsion represents a cornerstone of maritime decarbonization, positioning early adopters for competitive advantage and sustainable growth.

Engage with Ketan Rohom Today to Secure Comprehensive Wind-Assisted Propulsion Market Intelligence and Drive Strategic Decision-Making

For decision-makers seeking to deepen their understanding of wind-assisted propulsion's strategic potential and operational pathways, a tailored consultation awaits. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how comprehensive market intelligence can inform your capital investment, technology adoption, and partnership strategies. Through a personalized briefing, you will gain clarity on competitive positioning, supply chain optimization, and emerging regulatory incentives. Don’t miss this opportunity to leverage specialized insights that will accelerate your organization’s decarbonization roadmap and unlock new revenue streams. Contact Ketan Rohom today to secure your market research report and chart the course for sustainable maritime leadership.

- How big is the Wind Assisted Propulsion System Market?

- What is the Wind Assisted Propulsion System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?