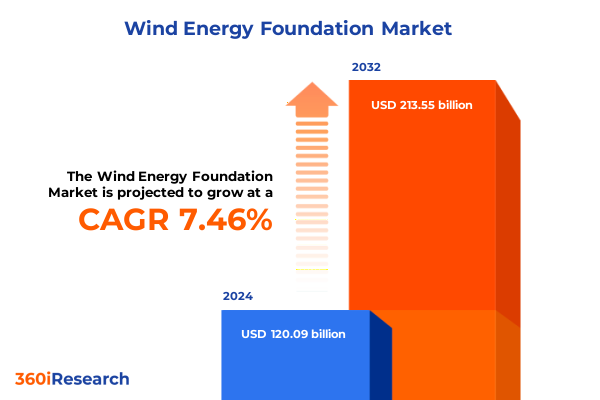

The Wind Energy Foundation Market size was estimated at USD 12.72 billion in 2025 and expected to reach USD 13.68 billion in 2026, at a CAGR of 10.54% to reach USD 25.66 billion by 2032.

Exploring the evolving dynamics of the wind energy sector amid global demands and emerging technologies shaping future opportunities

The wind energy sector stands at a critical juncture where technological innovations, policy mandates, and shifting market dynamics converge to redefine its trajectory. In an era marked by escalating climate concerns and ambitious decarbonization targets, wind power emerges as a cornerstone of sustainable energy portfolios. Rapid advances in turbine design, materials science, and digital monitoring have translated into unprecedented efficiency gains, while evolving regulatory frameworks and incentive structures continue to catalyze large-scale deployments across developed and emerging markets alike. Consequently, stakeholders must navigate an increasingly complex terrain that blends engineering breakthroughs with geopolitical considerations, financing models, and stakeholder engagement strategies.

Against this backdrop, industry participants are compelled to reevaluate traditional approaches to project development, supply chain management, and operational optimization. As capital markets seek clarity on risk–return profiles, and power purchasers demand reliable long-term agreements, the imperative for granular market intelligence has intensified. Furthermore, cross-sector collaboration between energy, infrastructure, and financial services entities is reshaping how projects are conceived, funded, and executed.

This executive summary synthesizes key insights from primary interviews, secondary research, and quantitative data analyses, offering a panoramic yet detailed perspective on the forces driving wind energy today. It lays the groundwork for understanding transformative shifts, policy implications-especially tariffs-segment-specific behaviors, regional differentiators, competitive landscapes, and practical recommendations. By aligning emerging trends with actionable strategies, this introduction sets the stage for stakeholders to capitalize on the myriad opportunities within the global wind energy ecosystem.

Uncovering the pivotal innovations and policy transformations redefining wind power deployment across diverse markets worldwide

Over the past decade, the wind energy landscape has undergone profound transformation as innovative technologies intersect with policy reforms to accelerate deployment and drive down costs. The proliferation of larger, more efficient turbines equipped with smart sensors and predictive maintenance algorithms exemplifies the technological leap forward, enabling developers to extract greater energy yields while minimizing downtime and operational expenditures. In parallel, government bodies and multilateral organizations have rolled out increasingly ambitious clean energy mandates and power purchase obligations, spurring growth across onshore and offshore segments.

Moreover, the rise of digital platforms facilitating real-time data analytics is empowering asset operators with granular visibility into performance metrics, enabling rapid decision-making and adaptive management. This digital revolution, coupled with expanding grid integration capabilities, has laid the foundation for higher penetration rates of variable renewable generation, thereby reshaping power market economics. Furthermore, the emergence of collaborative financing structures-ranging from green bonds to yieldcos-has unlocked new capital pools, offering developers enhanced flexibility to scale projects while optimizing cost of capital.

Consequently, the confluence of these innovations and policy initiatives has engendered a more resilient and agile industry capable of responding to evolving energy demands. As market participants embrace automation, advanced manufacturing techniques, and digital ecosystems, the stage is set for sustained growth and transformative change in how wind power is deployed, managed, and monetized.

Evaluating the multifaceted effects of the 2025 United States tariffs on wind energy supply chains and investment flows spanning the sector

In 2025, the United States introduced a new tariff regime targeting imported wind turbine components, aiming to bolster domestic manufacturing and create local job opportunities. While this move aligns with broader industrial policy goals, it has also generated significant ramifications across supply chains, project economics, and investment appetites. Developers now face increased procurement costs for blades, towers, and gearbox assemblies, prompting many to reassess sourcing strategies and explore alternative suppliers within North America. Consequently, some participants have accelerated partnerships with domestic fabricators, while others have revised project timelines to accommodate longer lead times.

Simultaneously, the tariff-induced cost pressures have spurred innovation in component design and materials selection. Manufacturers are exploring modular tower sections, recyclable composites, and advanced welding techniques to reduce reliance on tariffed imports. This emphasis on value engineering not only mitigates margin erosion but also positions domestic producers to capture a larger share of future orders. Furthermore, the heightened focus on local content requirements has influenced financing structures; lenders and equity partners are increasingly scrutinizing supply chain resilience and contingency plans.

Looking ahead, industry stakeholders must balance the short-term operational impacts with long-term strategic advantages. While tariffs have introduced near-term headwinds for project developers, they have also catalyzed a renaissance in domestic manufacturing capabilities and supply chain diversification. By proactively adapting procurement strategies and forging collaborative R&D agreements, market participants can navigate tariff challenges while strengthening their competitive positioning in the evolving U.S. wind sector.

Deriving actionable segmentation insights by analyzing applications, turbine orientation, installation models, and ownership frameworks in wind power

Insight into the wind energy market’s segmentation reveals nuanced behaviors and growth prospects when viewed through the lenses of application, turbine orientation, installation type, and ownership models. From an application standpoint, commercial installations-particularly within healthcare facilities, hospitality venues, and retail centers-are leveraging localized power generation to reduce operational expenditures and demonstrate sustainability commitments. Industrial consumers operating across manufacturing, mining, and oil and gas sectors are similarly deploying wind assets to underpin energy-intensive processes and meet corporate net-zero pledges. Within the residential sphere, multi-family developments increasingly adopt rooftop and community-scale turbines to diversify energy sources, while single-family homeowners explore hybrid systems that integrate wind with solar and storage. On the utility front, central generation projects continue to dominate large-scale output, even as distributed generation gains traction in grid-edge applications.

Examining turbine orientation sheds further light on strategic choices by project developers. Horizontal-axis turbines in the sub-1 MW range cater to off-grid and remote applications, whereas mid-range units between 1 and 3 MW strike a balance between capital intensity and generation efficiency for both distributed and utility-scale farms. High-capacity machines exceeding 3 MW are increasingly favored for offshore and central generation sites. Meanwhile, vertical-axis designs, once niche, are finding renewed interest in urban and hybrid system deployments owing to their compact footprint and reduced noise profile.

Turning to installation typology, grid-connected systems-spanning distributed wind arrays and sprawling utility-scale farms-remain the bedrock of new capacity additions. Off-grid solutions, including hybrid wind-diesel installations and standalone microgrids, are critical in remote or islanded contexts. Ownership structures further define market dynamics; cooperative and crowdfunding models foster community ownership initiatives, whereas corporate power purchase agreements now bifurcate into tech versus non-tech corporate offtakers. Independent power producers manage portfolios of diversified assets alongside single-asset owners, and utilities-whether investor-owned or state-run-continue to anchor the largest projects.

This comprehensive research report categorizes the Wind Energy Foundation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Turbine Orientation

- Installation Type

- Application

Highlighting regional drivers and challenges shaping wind energy trajectories across the Americas, Europe Middle East Africa, and Asia Pacific

A regional lens on the wind energy landscape uncovers distinctive drivers, barriers, and competitive dynamics across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, legacy markets in the United States and Canada are navigating tariff developments and grid modernization initiatives, while Latin American nations leverage abundant wind resources to attract foreign direct investment and diversify their energy mix. Cross-border interconnections and emerging green financing mechanisms have fostered greater collaboration between markets, accelerating capacity additions in regions that historically relied on hydropower.

Meanwhile, Europe Middle East and Africa present a mosaic of opportunity and complexity. Western European countries continue to phase out coal through ambitious offshore wind auctions and robust subsidy frameworks. Simultaneously, Gulf Cooperation Council states are piloting large-scale onshore and offshore projects as part of broader economic diversification efforts. Within sub-Saharan Africa, nascent markets are exploring hybrid microgrids incorporating wind technology to address rural electrification challenges, albeit constrained by financing gaps and grid infrastructure limitations.

Across the Asia Pacific, rapid industrialization in China and India underpins the world’s largest wind expansion pipelines, supported by domestic manufacturing capacity and localized content mandates. Southeast Asian archipelagos pursue distributed wind and hybrid installations to serve island networks, whereas Australia’s utility-scale projects tap into extensive coastal and outback wind corridors. Against this backdrop, regional alliances and supply chain hubs are emerging to streamline logistics, standardize technical requirements, and foster knowledge exchange.

This comprehensive research report examines key regions that drive the evolution of the Wind Energy Foundation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading players strategies, competitive positioning, and collaboration trends driving innovation and growth in the wind energy industry

Leading companies within the wind energy ecosystem are deploying a spectrum of strategies to bolster market presence, enhance technological capabilities, and forge synergistic partnerships. Vestas has consolidated its global leadership by investing heavily in digital twin platforms and predictive maintenance services that maximize turbine availability while reducing lifecycle costs. Siemens Gamesa continues to differentiate through tailored offshore solutions, having secured flagship contracts in key European and Asian markets. General Electric is leveraging its deep expertise in grid integration and energy storage to offer bundled renewable energy packages that appeal to corporate offtakers seeking turnkey solutions.

Chinese manufacturers, such as Goldwind and Envision, maintain aggressive expansion agendas both domestically and abroad, capitalizing on scale economies and supportive policy environments to underprice incumbents. These players are increasingly active in joint ventures and licensing agreements, transferring technology to local partners in emerging regions. Meanwhile, next-generation entrants are challenging established norms with novel turbine architectures, advanced materials, and niche service offerings that address under-served segments, such as urban hybrid systems.

Furthermore, energy transition consultancies, financial institutions, and EPC contractors are solidifying their roles as ecosystem orchestrators. Through strategic alliances, these non-manufacturer entities facilitate project development, de-risk financing, and accelerate permitting processes. By fostering cross-sector collaboration and offering integrated value propositions, they are enabling a more agile and resilient market environment where innovation can thrive.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wind Energy Foundation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bladt Industries A/S

- Blue H Engineering

- Dillinger Group

- ENERCON GmbH

- Envision Group

- Fugro

- General Electric Company

- Goldwind

- Mingyang Smart Energy Group Co., Ltd.

- MT Højgaard Holding

- Nordex SE

- Ramboll Group A/S

- Siemens AG

- Sinovel Wind Group Co., Ltd.

- Suzlon Energy Limited

- TagEnergy

- Vestas Wind System A/S

- Ørsted A/S

Outlining strategic and operational recommendations to capitalize on wind power opportunities, mitigate risks, and foster sustainable industry advancement

Industry leaders aiming to maintain a competitive edge must adopt a holistic approach that marries technological innovation with robust risk management and stakeholder alignment. First, companies should prioritize investment in advanced analytics and digital service platforms to enhance operational efficiency and asset reliability; by doing so, they can unlock new revenue streams from performance-based service contracts. Concurrently, diversifying supplier portfolios-especially in light of evolving tariff landscapes-will mitigate cost inflation and supply chain disruptions, ensuring project timelines remain on track.

Moreover, forging strategic partnerships across the value chain can accelerate technology transfer, streamline permitting processes, and expand financing options. Collaboration between OEMs, utilities, and project financiers should extend to joint R&D ventures focused on modular designs, recyclable materials, and low-noise turbine systems. Equally important is engaging proactively with policymakers and regulators to shape pragmatic incentive structures and grid interconnection standards that reflect local resource profiles and infrastructure readiness.

Finally, organizations must embed sustainability and community engagement into their core strategy. This involves incorporating social impact assessments, local content requirements, and workforce development programs into project planning phases. By aligning operational objectives with environmental and societal priorities, industry leaders can cultivate stronger public support, enhance license to operate, and future-proof their portfolios against evolving ESG imperatives.

Detailing robust research methodology integrating primary insights, secondary data reviews, and analytical techniques for credible wind energy analysis

This study leverages a mixed-methods research framework to ensure a comprehensive and credible analysis of the wind energy sector. Primary insights were gathered through in-depth interviews with industry executives, project developers, OEM representatives, and policy experts across major regions. These conversations provided granular perspectives on emerging challenges, technology priorities, and strategic imperatives. In parallel, a targeted online survey captured quantitative data on investment trends, procurement practices, and operational performance metrics from a broad sample of asset owners and service providers.

Secondary research encompassed a thorough review of regulatory filings, government publications, and technical reports from leading academic institutions. This enabled cross-validation of tariff impacts, policy shifts, and technology roadmaps. Additionally, a structured benchmarking exercise compared component costs, turbine specifications, and financing models across geographies, offering a clear understanding of competitive dynamics. Analytical techniques, including scenario modeling and sensitivity analysis, were employed to assess the implications of tariff fluctuations, supply chain disruptions, and technology adoption rates on project viability.

Finally, the research process incorporated continuous quality checks, including peer reviews by independent energy consultants and triangulation of data points across multiple sources. This rigorous approach ensures that the findings and recommendations presented herein reflect the latest market realities and offer actionable guidance for stakeholders navigating the rapidly evolving wind energy landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wind Energy Foundation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wind Energy Foundation Market, by Turbine Orientation

- Wind Energy Foundation Market, by Installation Type

- Wind Energy Foundation Market, by Application

- Wind Energy Foundation Market, by Region

- Wind Energy Foundation Market, by Group

- Wind Energy Foundation Market, by Country

- United States Wind Energy Foundation Market

- China Wind Energy Foundation Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Summarizing critical insights and future outlook to reinforce the strategic imperatives shaping the evolving wind energy sector trajectory

The findings underscore that the wind energy sector is experiencing a period of accelerated transformation, driven by technological breakthroughs, policy interventions, and evolving market structures. Tariff shifts in the United States have tested supply chain resilience, but they have also spurred domestic manufacturing innovation and strategic diversification. Segmentation analysis reveals that stakeholders must tailor solutions to the unique requirements of commercial, industrial, residential, and utility applications, as well as align turbine orientation, installation type, and ownership frameworks with localized needs.

Regionally, the Americas, Europe Middle East and Africa, and Asia Pacific each present distinct growth trajectories defined by policy environments, resource endowments, and financing landscapes. Leading companies are responding by deepening service offerings, forging alliances, and investing in digital platforms that optimize performance and drive down costs. To thrive in this dynamic context, industry participants must prioritize collaborative innovation, supply chain agility, and a commitment to sustainability that resonates with increasingly discerning investors and communities.

In conclusion, success in the evolving wind energy sector will hinge on the ability to integrate advanced technologies, navigate policy shifts, and engage stakeholders across the value chain. By adopting the actionable recommendations outlined here, organizations can position themselves to seize emerging opportunities, manage risks proactively, and contribute meaningfully to global decarbonization efforts.

Engage directly with Ketan Rohom to secure comprehensive wind energy intelligence that empowers decision making and drives strategic investments

To delve deeper into the comprehensive wind energy landscape and address specific strategic questions, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through tailored solutions that empower your organization’s decision-making process. By collaborating with Ketan, you will gain privileged access to the full suite of analysis, enabling you to align investment strategies with emerging trends and policy developments. Reach out to secure this market research report and unlock the insights necessary to drive sustainable growth and operational excellence in the wind energy sector.

- How big is the Wind Energy Foundation Market?

- What is the Wind Energy Foundation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?